Generative AI’s $4 tn impact; We need digital ID now; Regulated Liability Networks or CBDC?

Shouldn't digital payment be a "public good" as it is now with cash?

1. Generative AI’s $4 tn impact

2. We need digital ID now not later

3. Regulated Liability Networks or CBDC?

Today’s art: A dramatic evening sky over the harbor in Rovinj or Rovigno, Croatia. St. Euphemia, on the hill, is a Baroque church in the heart of the historic town center. The town is tied historically to the Venetian Republic, and the local food and culture still have strong ties to the region.

Italian edition newsletter, please forgive any errors in editing.

1. Generative AI’s $4 tn impact

Generative AI’s $4 tn impact shows that the AI disruption predicted in SciFi movies is finally here.

Report available from Mckinsey: here

McKinsey produces its “big numbers report" for Generative AI (GenAI) and predicts an astounding $4.4 trillion potential productivity boost!

I say “big numbers report" sarcastically because McKinsey is famed for using big numbers to incentivize clients to use its services.

Whether McKinsey’s numbers are believable is a worthy debate, but what is undebatable is that the GenAI disruption is happening now.

McKinsey’s 7 key insights:

Generative AI’s impact on productivity could add trillions of dollars in value to the global economy. Our latest research estimates that generative AI could add the equivalent of $2.6 trillion to $4.4 trillion annually. UK GDP in 2021 was $3.1 trillion.

About 75% of the value that generative AI use cases could deliver falls across four areas: Customer operations, marketing and sales, software engineering, and R&D.

Generative AI will have a significant impact across all industry sectors. Banking, high-tech, and life sciences are among the industries that could see the biggest impact as a percentage of their revenues from generative AI.

🔥Across the banking industry, for example, the technology could deliver value equal to an additional $200 bn to $340 bn annually if the use cases were fully implemented.🔥

Generative AI has the potential to change the anatomy of work, augmenting the capabilities of individual workers by automating some of their individual activities. GenAI can potentially automate work activities that absorb 60 to 70% of employees’ time today.

The pace of workforce transformation is likely to accelerate, given increases in the potential for technical automation. Half of today’s work activities could be automated between 2030 and 2060, with a midpoint in 2045.

Generative AI can substantially increase labor productivity across the economy, but that will require investments to support workers as they shift work activities or change jobs. Generative AI could enable labor productivity growth of 0.1 to 0.6 percent annually through 2040.

The era of generative AI is just beginning. Excitement over this technology is palpable, and early pilots are compelling. But fully realizing the technology’s benefits will take time with significant challenges.

Thoughts?

Takeaways:

—McKinsey’s big numbers reports always need to be taken “with a grain of salt” but GenAI is big.

—The SciFi moment where AI disrupts everything predicted for so long is now.

—Learning about GenAI is important, do it now!

—Surviving GenAI disruption will be a challenge for many. This cartoon from Tom Fishburn “the Marketoonist” entitled “AI Productivity” says it best.

AI Productivity

Hey you, yeah you! Subscribe!

You’ll be glad you did!

2. We need digital ID now, not later

We need decentralized digital IDs now; they are the future and not the theft of freedom by "Davos man."

Download: here

The WEF does a great job of tackling the issues surrounding decentralized digital ID (DID) and shows how it will have an important role to play in our future.

DIDs are a polarizing topic, with calls to resist them the norm. I fully expect to read comments that “Davos Man” will “take away our freedom” with this article.

Meanwhile, US ID fraud cost $56bn in 2021, so DIDs are infinitely practical in increasingly digital societies. Worldwide roughly 850 mn people lack legal identification, making it difficult or impossible for them to engage with society fully.

So advanced societies view DID as a Davos Man plot, while developing nations desperately need it to provide services to their populations. See the problem?

Centralized or gov’t IDs have existed for ages but may limit user control and create centralization risk, as well as the potential for surveillance and liability. This is why decentralized IDs with privacy that you control are so powerful.

🔹 What is Decentralized ID?

DID systems use cryptography, digital wallets, and related technologies to enable multiple entities to contribute credentials and empower individuals to manage their data. Properly implemented, decentralized ID could enhance privacy, control, efficiency and effectiveness.

Decentralized ID attempts to strike a balance between two paths: to protect individual privacy and control while facilitating compliant access to goods and services.

Efforts are already being made to scale decentralized ID. The European Digital Identity initiative, for example, will offer a personal digital wallet for EU citizens, residents, and businesses to gain access to public and private EU services.

🔹 Barriers to implementation

There are a host of barriers to DID implementation. A lack of widely agreed-upon technologies, standards, and proposals limits the reach of these systems. The absence of enabling policy and regulation may curtail their efficacy.

🔹 TradFi and Crypto

The two biggest non-governmental stakeholders for DID are crypto and TradFi, as both desperately need DID to tackle KYC. Still, despite their shared interest, there is a lack of industry support for partnerships. Sad but true.

Thoughts?

Takeaways:

—DID will be seen by some as a Davos Man plot but are critical infrastructure for all rich and poor societies.

—The cost of ID theft should be a driver for DID development.

—TradFi and crypto worlds share a common interest in DID development.

—Kudos to the EU's DID program!

Reverse psychology:

Whatever you do DON’T subscribe, you’ll enjoy missing this fabulous commentary and terrific PDFs!

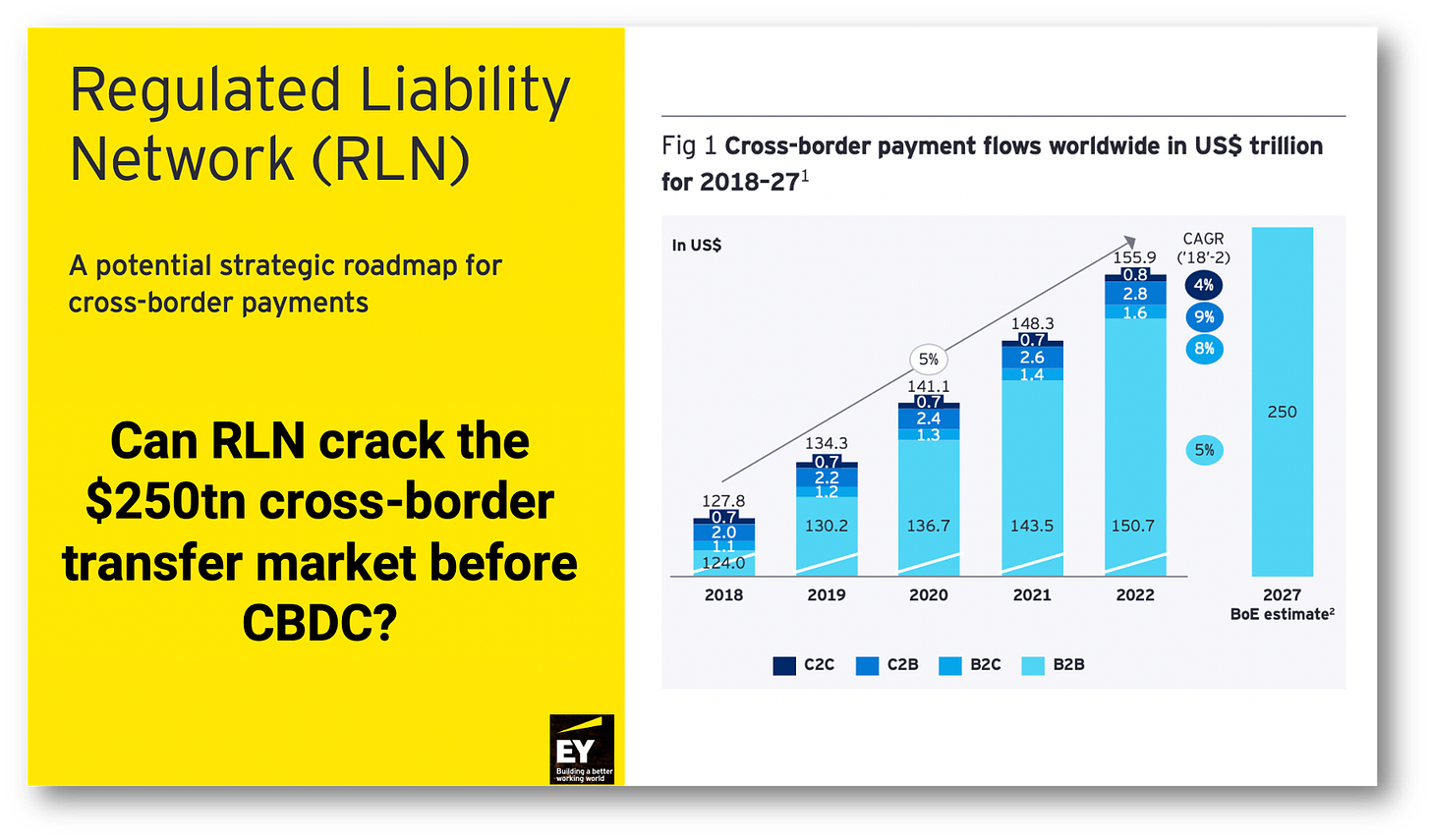

3. Regulated Liability Networks or CBDC?

Regulated liability networks are banks’ answer to CBDC but fall far short of being a “Public Good.”

Download: here

EY’s report of Regulated Liability Networks (RLN) is a fabulous read that portends a future of tokenized liabilities sailing across borders, something we should all look forward to.

RLNs are not a “public good”

I like RLNs but see them as key financial infrastructure that should be built “in addition to” and not “in lieu of” CBDC and stablecoins.

What RLNs are not is Payments as a Public Good. Without CBDC or other payment infrastructures, society will be forever tied to bank transfers and fees.

In economics, a public good refers to a commodity or service made available to all members of society. Typically, these services are administered by governments and paid for collectively through taxation.

A great example of a public good is cash! Cash can be used free of charge and is not controlled by a private company with economic interests. Cash is public infrastructure.

So why shouldn’t electronic cash be treated similarly?

Society cannot afford to give banks a lock on cash transfers and, with recent high-profile bank failures, will create a less "resilient" network than CBDCs with a gov't guarantee.

🔹EY sees the following RLN advantages:

• Participants tokenize their liabilities in their partitions in real-time on a shared ledger as fungible digital assets tokens. They can be exchanged at par value and settled through central bank money

• The RLN enables real-time 24x7 transfer and settlement of liabilities.

• Minting, burning, and transfer of liabilities work across the end-to-end process.

• The RLN can be integrated in the existing ecosystem without replacing existing players but interoperating with them.

• The RLN avoids the fragmentation caused by the development of individual “bank coins.”

🔹Here’s what I see as missing:

• Payments should be made publicly available to all citizens

• The impact of SVB-style bank failures

• RLNs do not “disintermediate" payment but “reintermediate” payments by replacing cash and further banks lock on society.

• How much will banks charge for the privilege, and should banks control that price?

Thoughts?

Takeaways:

—I look forward to RLN networks as a part of wholesale payment infrastructure that includes CBDC and stablecoins.

—RLNs are NOT payment as a public good. Citizens should demand this.

—Giving banks a lock on digital payments is a gift society cannot afford.

—RLNs focus payments into the banking system and decrease overall payment system resilience.

Subscribing is the only logical course of action.

And share on Twitter because:

"The needs of the many outweigh the needs of the few or the one."

My work is entirely supported by reader gratitude, so if you enjoyed this newsletter, please do both of us a favor and subscribe or share it with someone. You can also follow me on Twitter or Linkedin for more. The best way to ensure you see the stuff I publish is to subscribe to the mailing list here on Substack, which will get you an email notification for everything I post.

Everyone, including platforms that disagree with me, has my permission to republish, use or translate any part of this work or anything else I’ve written (except my books) with credit given to me and this site (richturrin.substack.com) free of charge. For more info on who I am, what I do, and where I’m going, check out richturrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is number 4 on Onalytica's prestigious Top 50 Fintech Influencer list and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon:

Cashless: HERE

Innovation Lab Excellence: HERE

Share