Genuine Asian Bank Superapps are Far From Inevitable, and Most Will Fail

Big Tech dominates Asia's superapps because building one is anything but "easy."

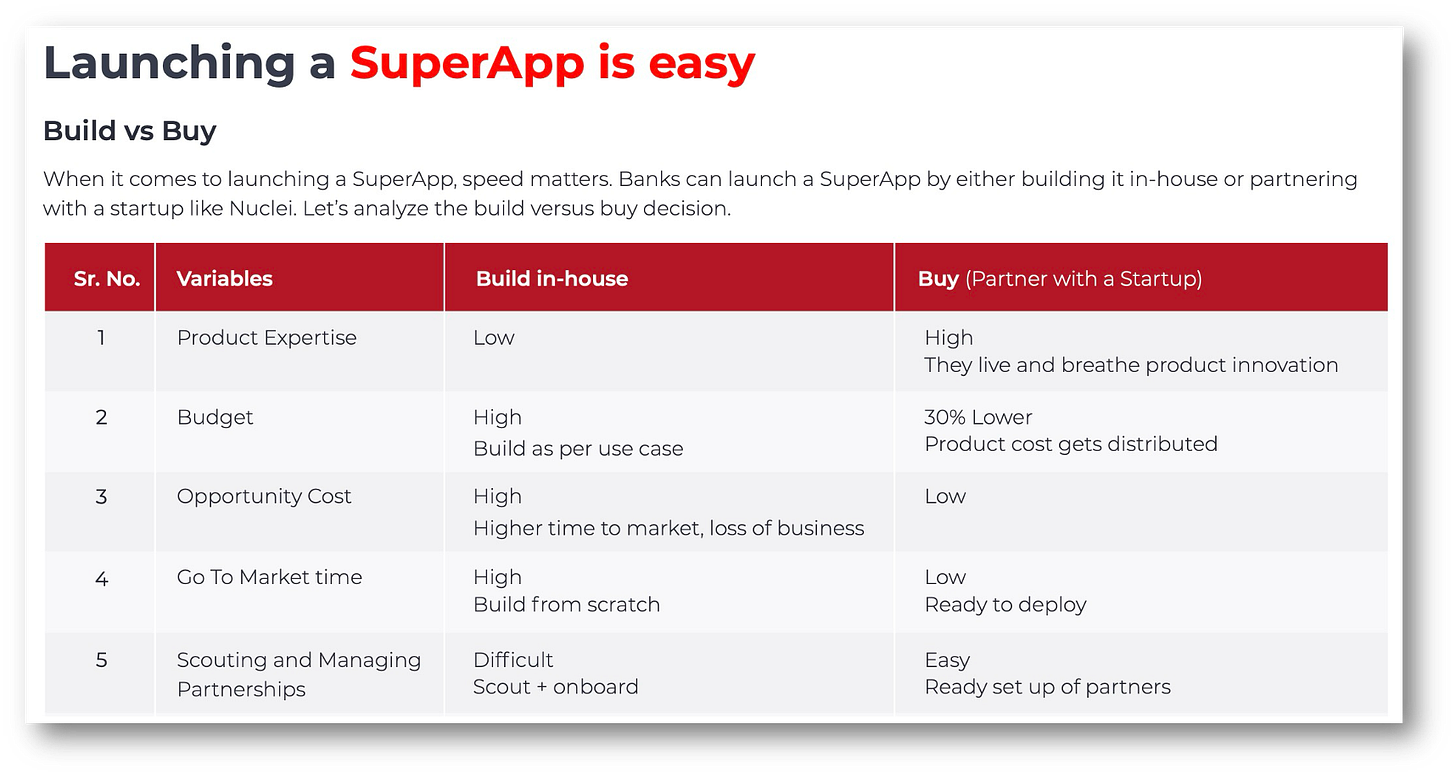

Bank superapps are anything but “inevitable,” and any report that says “Launching a SuperApp is easy” deserves to be called out as total BS!

There is nothing inevitable about bank superapps!

Yes, there will be digitally sophisticated banks that make their apps far more useful, but being “super” as defined by real superapps in Asia will elude them.

Banks would have to pull off a complex feat of public acceptance and digital mastery, which is anything but inevitable and beyond the capabilities even of more digitally sophisticated neobanks.

Calling it “easy” is such a gross over-simplification of this formidable task that I think it is negligent by the authors!

👉TAKEAWAYS

Types of superapps:

🔹Redirection: This method redirects the users to the website of the relevant merchant. But the experience is poor. The SuperApp has no control over payments, and does not have any user information once they leave the platform. However, go-to-market is fast and cost effective.

❌ This is NOT a superapp! Redirection will never be super!

🔹Mini Apps: It is a hybrid approach where the user is shifted to the merchants’ platform within the SuperApp platform. User data is shared across the platforms and the payment mechanism is integrated in the mini app as well.

✅ This is the only way to be super, but this goes against bank DNA which seeks to control access to their platform. WeChat and Alipay opened their platform to EVERYONE, can you see a bank doing that?

🔹Native Environment: There is no redirection. All journeys are built by the platform. Information exchange between platform and merchant happens via APIs. Customer experience is great, but it increases the app’s size, time to market, and costs comparatively.

❌ Impossible to manage! There is no way to pull this off for the masses of businesses required to make the app super!

Easy? Are you kidding me? This is the most absurd statement I’ve ever seen. Getting mass acceptance of an app is tremendously difficult! Ask anyone in the tech business. Meanwhile this report suggests digitally unsophisticated banks supposed to pull this off and that its “easy.”

👊STRAIGHT TALK👊

“Banks have a competitive advantage when entering the SuperApp space because of their long-standing trust and existing customer base.”

No banks do not have an advantage! One look at Asia’s superapps shows that it is big tech that conquered the superapp space, NOT the banks.

Banks do have customer trust, I agree, but they do it with a closed ecosystem, which is the very opposite of the open ecosystem required by superapps.

The definitive superapps are open ecosystems that allow 3rd party players onto the app, which goes against every shred of bank DNA, which prefers a closed ecosystem of highly trusted partners.

The entire reason Alipay, WeChat and Grab in Asia became super was that you could find the service you needed, no matter how small, on the app without going elsewhere.

I would like to give you two examples: My yoga studio had its class booking app on WeChat, as did my local parking garage. The app handled even the smaller details of my life.

Can you see a bank app doing this? Could they be bothered to deal with small businesses at that level of granularity? No way, no how!

While bank apps may certainly become more useful, they will likely fall far short of “super.”

Building a superapp is easy?

I’m calling BS on this report and hope banks aren’t stupid enough to believe them!

You made it this far, so subscribe! Here are the six benefits waiting for you when you subscribe:

Save time: Get the expert insights on Central Bank Digital Currencies (CBDC), AI, Payments, and Financial Inclusion that you need to stay ahead of the curve, all delivered directly to your inbox weekly;

Know the future and profit: Get real payback from a unique point of view directly from Asia that focuses on how the region is “leapfrogging” the West and showing you the future;

Be prepared: CBDCs are no longer theoretical but coming soon, so keep up with the latest developments on the digital euro, yuan, sterling and dollar;

Manage your personal AI risk: Don’t be disrupted; be the disruptor. In-depth analysis of how our AI revolution impacts finance so that you can be in front of this great transformation, not behind it;

Stay objective, avoid hype: My writing doesn’t follow corporate diktats. It’s a message that doesn’t conform with mainstream media and is gritty, practical, hype-free, and, on occasion, controversial;

Stay safe: My writing is trusted by nearly 60,000 executives, innovators, investors, policymakers, journalists, academics, and open-minded crypto hodlers daily.

Readers like you make my work possible! Subscribing is free, but I am honored when readers opt for a paid subscription to recognize my high-quality writing and help keep it flowing. Thank you!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!

Fully agree Open interoperable super Apps do not fit Banks usual culture