Get Set For A Roaring 2025: "Seize The AI Opportunity"

UBS is bullish on 2025, but be wary of trade wars, tariffs and real wars.

UBS is calling for roaring markets in 2025 with its year-end report, which predicts a booming year for equities, gold, and, of course, AI.

UBS goes as far as to tell investors “to seize the AI opportunity,” as AI is the “investment opportunity of the decade.” Time will tell! UBS suggests AI-linked semiconductors and US megacaps. (see pg 30) with 25% of an equity portfolio exposed to the sector!

As if its bullish call for AI weren’t enough, UBS expects the S&P 500 to reach 6,600 by the end of 2025, around 10% higher than today’s levels.

Meanwhile, Asia is split. China is potentially at risk from the US’s Trump tariffs, and UBS is calling for a slight drop in GDP. However, those same tariffs, or the lack thereof, will bolster India’s and Indonesia's high GDP growth.

The EU is at risk of a global trade war. It is sobering, but the reality is that the EU is also exposed to China tariffs. With this, the expectation is weaker earnings growth than the rest of the world.

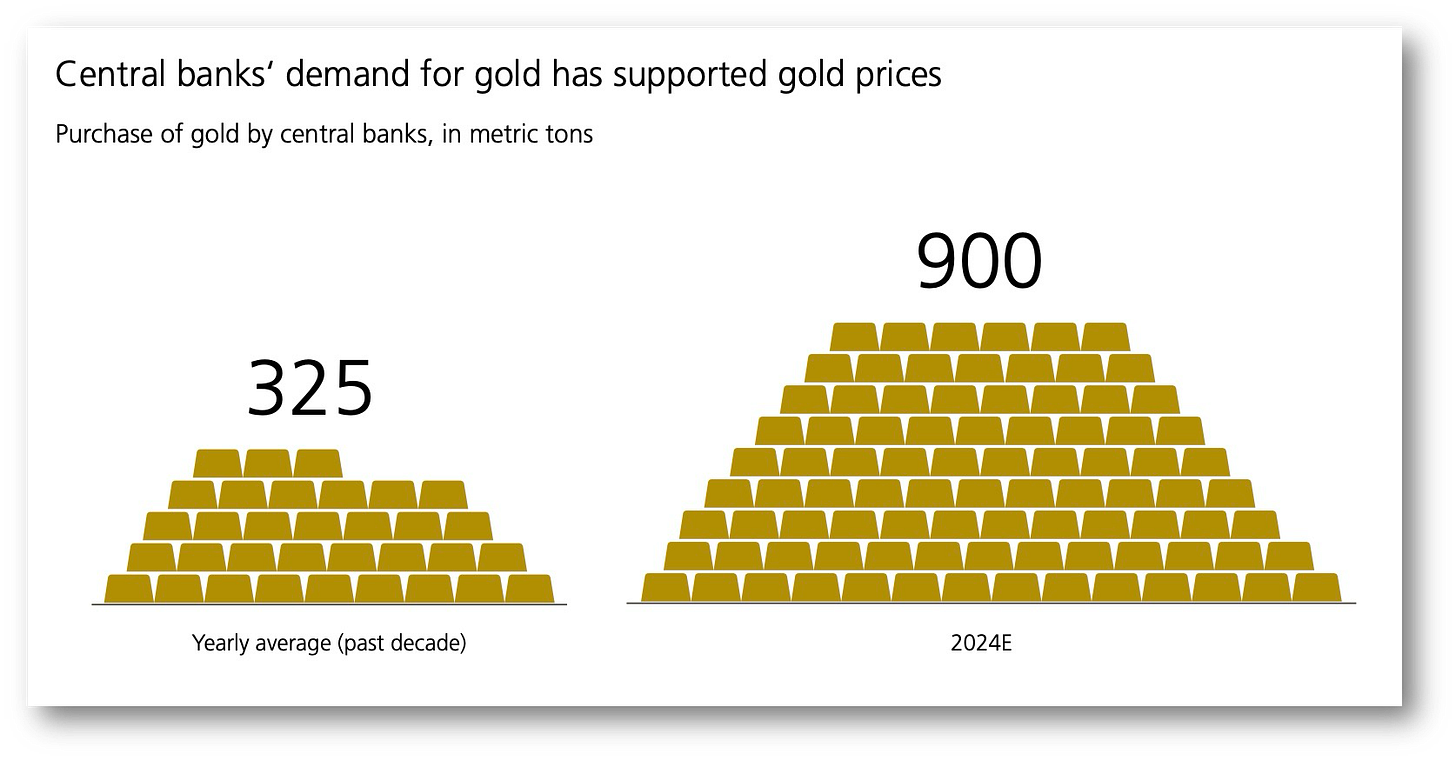

The de-dollarization trend among central banks and private asset managers will continue (pg 37), fueling heavy buying of gold. UBS is calling for new gold highs! Next time you read that de-dollarization isn’t happening, ask UBS.

👊STRAIGHT TALK👊

To put this all in perspective and balance UBS’s optimism, we are witnessing two wars and the prospects of intense trade disruption through tariffs. UBS may be positive, but for many, the outlook is anything but roaring. I’m glad UBS is so positive, but I think this just shows how markets are disconnected from reality.

👉TAKEAWAYS

Growth

We anticipated a deceleration in growth for 2024, but expected the economy to avoid a recession. Growth exceeded expectations. Developed economies are on track to grow by 1.7% in 2024 versus our estimate of 1.1%, with US economic outperformance a key driver. Emerging market growth also looks set to modestly exceed our forecasts (4.4% versus 3.9% expected).

Inflation and rates

We anticipated 50 basis points of rate cuts from the Federal Reserve in 2024. The Fed has already cut rates by 75bps, and we think another 25bp rate cut is possible before the end of 2024.

Bonds

Stronger economic growth data and anticipation of higher inflation under a new US administration supported yields later in the year, pushing them up to 4.4% at the time of writing. Investment grade bonds have returned near 3% year-to-date.

Equities

We expected positive returns for stocks in 2024 and advocated a focus on quality companies, including those in the technology sector. The MSCI AC World Quality and MSCI AC World Technology indices are up by 18% and 27.3%, respectively, this year.

Currencies

Our message in currencies last year was to “trade the range.” We expected EURUSD to trade between 1.00 and 1.12 and USDCHF to trade between 0.85 and 0.94. Those ranges have held through the year, with EURUSD currently trading near the middle of this range, close to where it was 12 months ago.

Commodities

We expected gold to break new record highs, forecasting it to rise to USD 2,150/oz (from USD 1,950/oz at the time of writing). It overshot our initial expectations, closing as high as USD 2,790/oz in October. Oil helped hedge geopolitical risks in the first half of the year but ultimately fell short of our expectations of USD 90-100/bbl, with Brent crude trading at USD 71/bbl at the time of writing.

Please share on Substack with a restack!

Readers like you make my work possible! Please buy me a coffee or consider a paid subscription to support my work. Thank you!

Sponsor Cashless and reach a targeted audience of over 55,000 fintech and CBDC aficionados who would love to know more about what you do!