Global Payments are a $2.2 tn cash cow for banks🤑 CBDC and financial inclusion💸 Cross-border regulatory friction❌

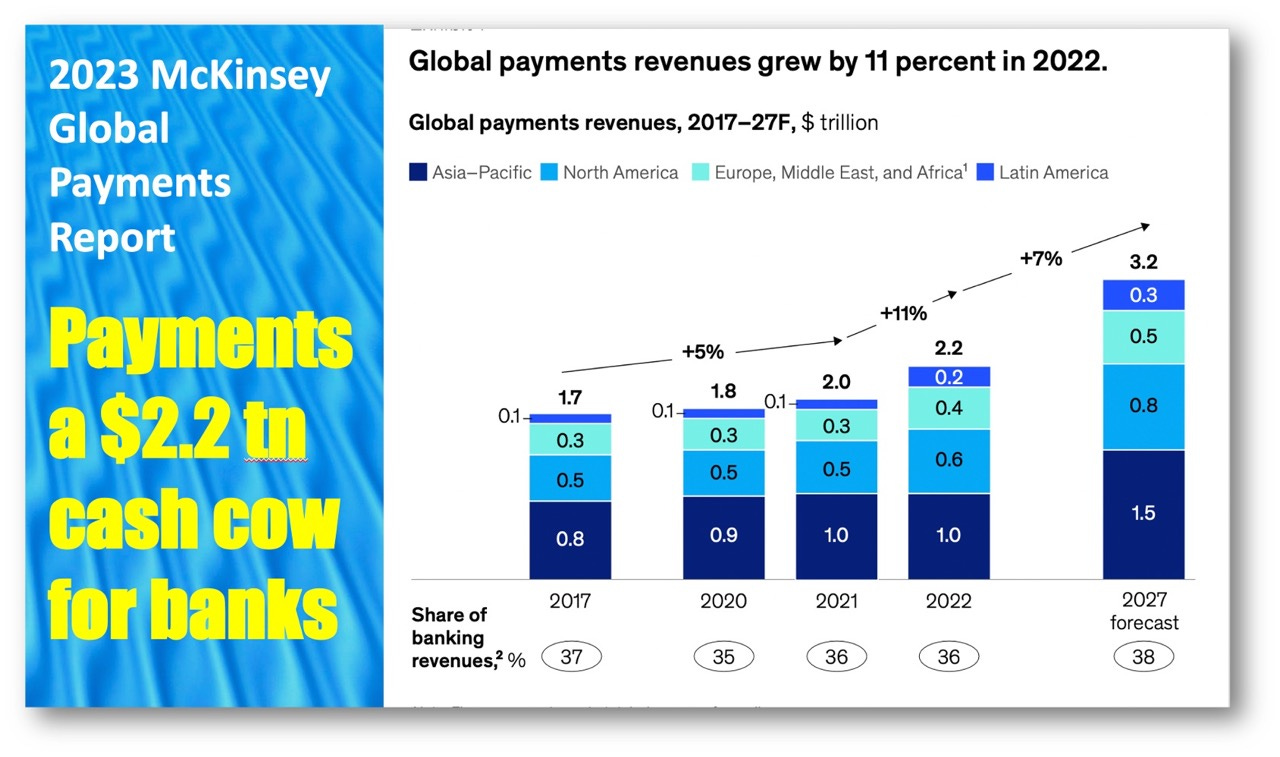

1. McKinsey Global Payment Report: a $2.2 trillion cash cow for banks

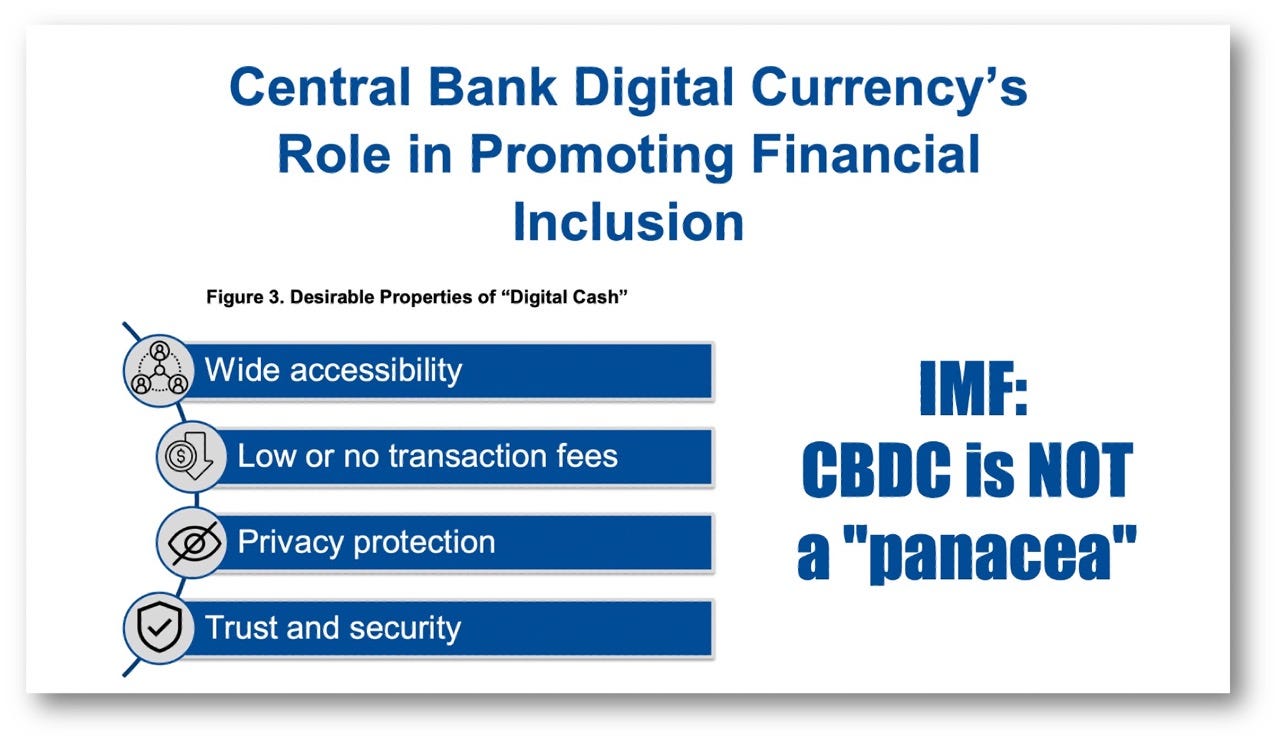

2. IMF: CBDC and financial inclusion

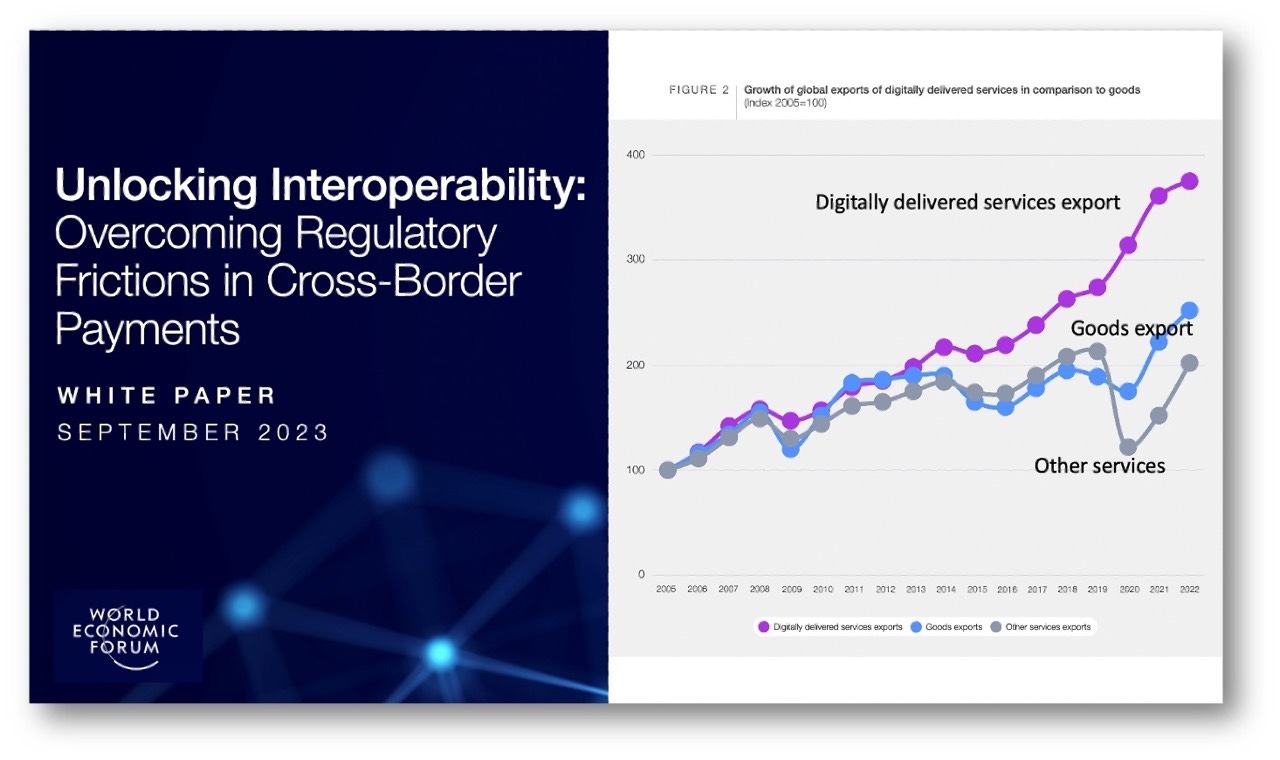

3. WEF: Cross-border regulatory friction

Today’s art: Juvenile Frogfish, Richard Turrin, Siladen Island, Indonesia 2023

Note grains of sand on its back. Total length 4 mm.

Frogfish are amongst underwater photographers’ favorite “critters” to look for underwater. They are so well camouflaged and adapted to their immediate surroundings that they are rarely detected. Often called grotesque, frogfish were declared “The spawn of Satan” by the mayor of Bitung, Indonesia.

Frogfish (Frog fish, frogfishes) are very misunderstood and very little is known about this unique underwater lie-in-wait predator. The hairy frogfish, Antennarius striatus, is a special type of frogfish that is one of the most popular subjects for underwater photographers.

1. McKinsey Global Payment Report: a $2.2 trillion cash cow for banks

Mckinsey talks bank payment revenue and why it’s a cash cow that needs to be slain!

👉TAKEAWAYS: My contrarian perspective after the ❌

✅ Global payments revenue grew by double digits for the second year in a row.

❌ This is more than $2.2 trillion, an all-time high representing a global tax on society. For North America 2.2% of GDP!

❌ At more than 37% of bank revenue, high payment fees are a cash cow!

✅ Sustained growth in India, fueled by cash displacement, moved it into the top five countries for payments revenues.

❌ Cash transaction fell by 7% in India based on UPI’s digital payments, which grew 10x over the past 5 years and is projected to grow at roughly 35 %/yr. Given India's switch to digital and CBDC how much longer will “cash-rich, high-friction pockets” exist?

✅ For the first time in several years, interest-based revenue contributed nearly half of revenue growth.

❌ Half of 2022’s revenue growth came from rising interest rates, exclipsing fees as the main source of growth. Banks are profiting from the holding time of your money due to high rates and shows why CBDC and instant payments are a necessity.

✅ Cash usage declined by nearly four percentage points globally in 2022. Over the past five years, the growth rate for electronic transactions has been nearly triple the overall growth in payments revenue.

❌ The question remains why are we still paying banks for transfers when immediate low cost RTGS fast payments and CBDC are a reality?

👊STRAIGHT TALK👊

The real question is why are banks getting a $2.2 trillion dollar gift that makes up 37% of their revenue? Who thought this system was a good idea?

This is why CBDC and real-time payment systems are taking off globally. No one has any affection for a system that has embedded high costs, and this is clearly a long-term strategic problem for bank payments.

Interestingly McKinsey seems to ignore this transition. It makes no reference to CBDC and RTGS's impact on bank payment revenue. It is as though McKinsey believes the high cost payment model will live forever. It won’t.

All of us are fed up with the cost of payments, and disruption is coming for banks in this sector no matter how much AI McKinsey tells them to use!

Blunt enough?

2. IMF: CBDC and financial inclusion

The IMF talks “Finanial Inclusion” and CBDC is NOT a "panacea" but is a great tool among many!

👉TAKEAWAYS:

🔷"Financial inclusion is a key policy objective that central banks, especially those in emerging and low-income countries, are considering for retail CBDC." That said, it is only a single piece of a larger puzzle for inclusion and must not be over-hyped!

🔷 Most financially excluded households rely on cash for payments, which marginalizes them from the formal economy.

🔷 If properly designed to address the barriers to financial inclusion, CBDCs have the opportunity to gain acceptance by the financially excluded for digital payments.

🔷 CBDC, once adopted by the financially excluded, can then serve as an entry point to the broader formal financial system.

🔷 Complementary policies for “digital inclusion” can help maximize the potential of a well-designed CBDC to improve financial inclusion.

🔷 Overall, CBDC is 🔥not a panacea🔥 to financial inclusion, and additional experience is needed to fully understand its potential impact.

🔷 CBDC has unique properties and may offer additional features that other solutions may not provide.

🔷 CBDC’s key features include:

1. Can be used without a bank account.

2. No required minimum balances.

3. Formal identification could potentially not be required for small transactions.

4. Offline functionality.

5. Operates on feature phones (non-smartphones) and even stored-value cards.

6. Simple and intuitive user interface/user experience (UI/UX) and easy to use.

7. Nationwide acceptance.

None of this GUARANTEES acceptance but the ability to use all of these features, especially nationwide acceptance, should be a “tipping point” for inclusion.

👊STRAIGHT TALK👊

CBDC’s role in financial inclusion will be significant. But it is important not to OVERHYPE its capabilities. In economies where digital connectivity and digital literacy is high, take South East Asia as an example; CBDC just may work wonders to take nations beyond the gains already made by digital wallets.

Look also to China for guidance. Despite the success of Alipay and WeChat Pay, an estimated 20% of the population is still unbanked. The goal of CBDC is clear for China: bring that 20% into the digital world by making digital payment even easier through offline payments and payments without a phone.

In other regions like sub-Saharan Africa, where digital services are limited and digital literacy is low, promoting CBDC as the ultimate solution to inclusion will be hard. Yes, it can help, but seeing it as a magical means of creating broad-based inclusion is a push or perhaps hype. Closing the digital cultural gap will not be done overnight.

CBDC should be part of a gov’t’s financial inclusion program but it must be recognized that it is only one part of a multifaceted problem that needs to be solved!

So, enough hype, let’s get down to work!

3. WEF: Cross-border regulatory friction

The WEF focusing on regulatory "cross-border payments interoperability" is like the sound of a single hand trying to clap in vain!

“Overcoming regulatory frictions to unlock interoperability is becoming increasingly crucial to ensure progress is made in building a cross-border payment system suitable for today’s digital economy and trade.“

The WEF is correct, but at a time of war, sanctions, and banks’ fee gouging, it’s hard to see governments holding hands and singing Kumbaya!

👉TAKEAWAYS:

WEF suggestions:

🔷 Make improving cross-border payment interoperability a key objective:

Boost cross-border payment interoperability by establishing clear governmental directives with a global perspective, crafting a holistic national interoperability policy.

🔷 Strengthen regulatory cooperation for cross-border payments:

This recommendation aims to improve cross-border payments by enhancing regulatory cooperation.

🔷 Modernize regulatory frameworks:

Modernize regulatory frameworks for cross-border payments by adopting a hybrid approach to regulation and removing regulatory hurdles to accessing domestic payment systems.

🔷 Encourage public-private partnerships (PPPs):

Encourage greater collaboration between regulators and industry stakeholders, including payment service providers (PSPs), technology companies and industry associations, to foster PPPs.

❌ So many other factors raise the cost of cross-border payments that it is hard to see “regulatory interoperability” as anything other than the nice use of a buzzword.

👊STRAIGHT TALK👊

So I must ask why the word “SANCTIONS” does not even appear in this report. It is easy because the authors know full well that they are impossible to overcome.

So in effect, they are proposing “regulatory interoperability” for the roughly 70% of the world that is worried about cross-border costs, not the 30% who have no, or highly limited access, to cross-border payments at any price!

I don’t actually disagree with the WEF and its suggestions. They are valid and would undoubtedly help reduce costs. They are just far too limited.

They seem academic and dodge the real issues. That’s why I call this report the sound of a single hand clapping.

Without the other crucial issues of sanctions, war, and banks’ fee gouging their clients being dealt with, they won’t produce the desired effect.

Perhaps before governments sing Kumbaya on cross-border payment “regulatory interoperability,” they should look to the shocking 27% of nations and 29% of global GDP now under US, EU, or UN sanctions.

What “regulatory interoperability” are sanctioned nations offered? Or is it just the 71% of global GDP whose cross-border transfer costs matter?

Is that 👊STRAIGHT enough TALK👊 for you?

My work is entirely supported by reader gratitude. My newsletter is 100% free, so if you enjoyed this newsletter, please do both of us a favor and subscribe or share it with someone. You can also follow me on Twitter or Linkedin for more. For more about what I do and my media appearances, check out richturrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is number 4 on Onalytica's prestigious Top 50 Fintech Influencer list and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon:

Cashless: HERE

Innovation Lab Excellence: HERE

I, being a superficial reader of this topic, prefer the new format. ;-)