Global Risks: Fintech Doesn't Live in a Vacuum

Big risks are on the horizon, no one will escape, but fintech may help.

Global Risks abound; this isn’t new, but what is increasingly evident is that the outlook is deteriorating and that no one will escape unscathed. Living standards and development will be challenged on a global scale.

I am often asked why I write about global risks and geopolitics and don’t just stick to CBDCs. The reason is clear: fintech and CBDCs don't exist in a vacuum.

Fintech certainly isn’t immune, and while it will certainly be impacted, it also may offer solutions like green financing and carbon trading.

That’s why I think this report is so important: the more we know about the future, the more we can prepare and be ready for it! Hopefully, fintech can do some good!

👉TAKEAWAYS

Global risks ranked by severity over the next two years:

Misinformation and disinformation

As polarization grows and technological risks remain unchecked, ‘truth’ will come under pressure.

Extreme weather events

Environmental risks could hit the point of no return.

Societal polarization

Divisive factors such as political polarization and economic hardship are diminishing trust and a sense of shared values.

Cyber insecurity

Simmering geopolitical tensions combined with technology will drive new security risks.

Interstate armed conflict

With multiple wars underway does this need explaining?

Lack of economic opportunity

Persistent poverty, income and wealth inequality; and unequal access to educational, technological and economic opportunities.

Inflation

The potential for broad sections of the population being unable to maintain current lifestyle with declining purchasing power.

Involuntary migration

Forced movement or displacement across or within borders is linked to virtually all the other ten risks. Any of the other nine can trigger this.

Economic downturn

Near-zero or slow global growth lasting for several years or a global contraction

Pollution

As communities become unlivable, ecosystem collapse may contribute to involuntary migration.

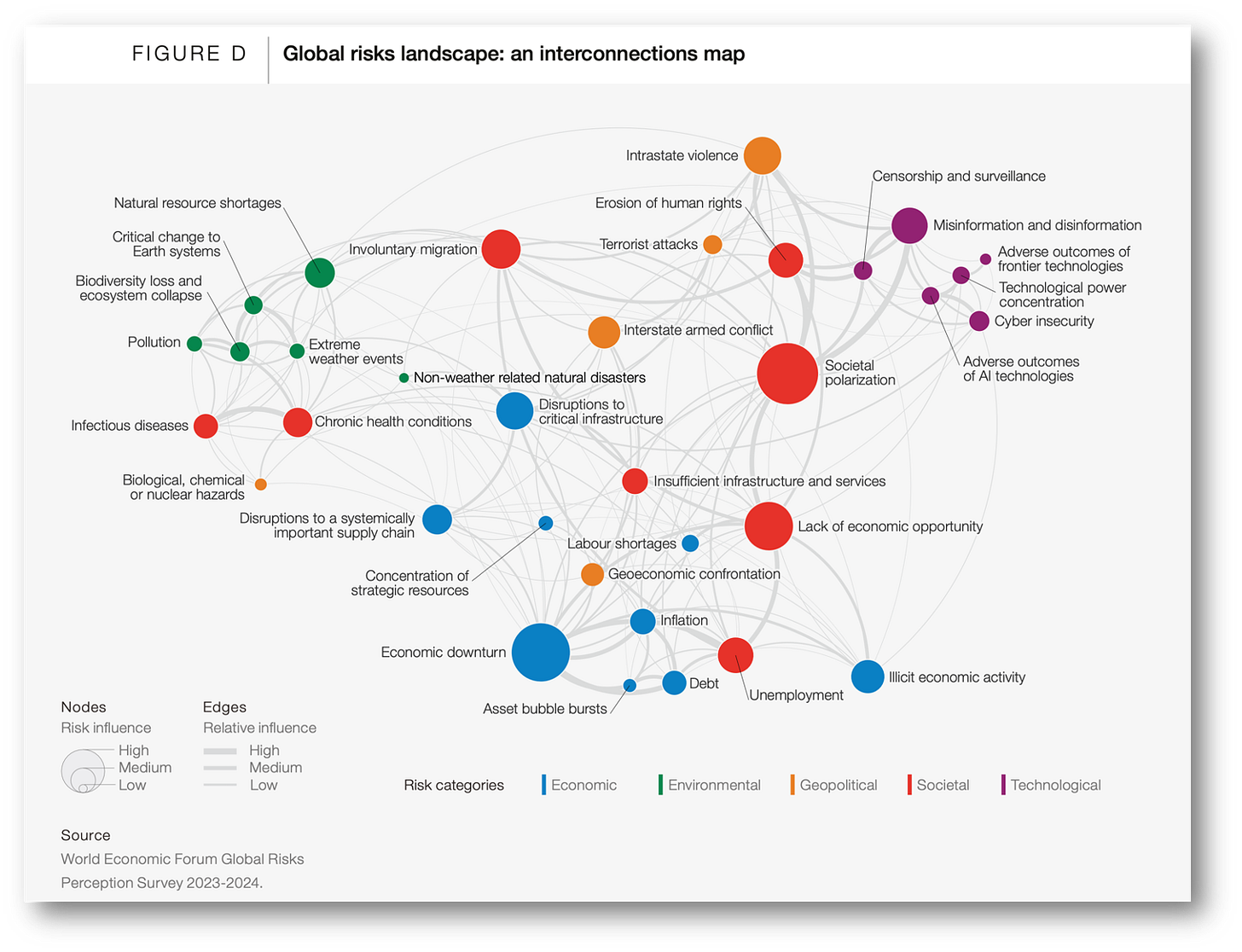

The interconnectivity of global risks is why the term “polycrisis” has come into vogue. Many of the problems are connected, happening at the same time, and can’t be solved individually. For an example, look at how societal polarization and misinformation are connected.

👊STRAIGHT TALK👊

If you aren’t scared when you read this list of risks, you should be.

None of us should crawl under a rock but instead try to understand how these risks will impact our business and personal lives.

As for fintech I think that it will have a clear role to play in three key areas:

Climate: Green bonds, carbon trading, ESG, all of these are fintech’s future. How much longer will we be solving the problem of cross-border cash transfers? What problem does fintech solve next?

Economic downturn: I know some readers may be offended but Universal Basic Income (UBI) is coming and fintech will have a big role to play. Don’t like UBI? I get it, but compared to social upheaval, it’s cheap at any price.

Pollution: Fintech must be put to use to create a pricing and trading system for “economic externalities.” In the past the environment had no value so was squandered, fintech can help value and protect the environment.

Cyber insecurity: Here, too, digital wallets, digital IDs, and other security systems for cash transfer can help.

These risks are fintech’s future and I hope that our discipline can play an active role in reducing them!

Thoughts?

Subscribing is free!

The button says pledge, but Substack adds that not me.

Don’t be afraid to click!