Hong Kong's Monetary Future: CBDC, Stablecoins and Tokenized Deposits

Hong Kong will get to the future even faster than Singapore.

Hong Kong embraces a digital currency future to guarantee its role as Asia’s premier financial center!

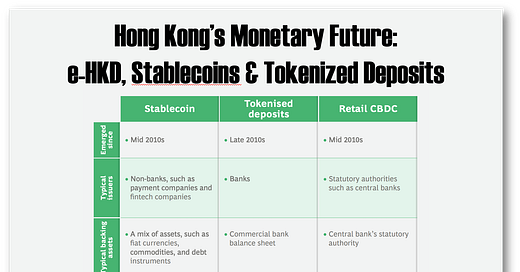

What makes Hong Kong’s efforts so special is that they promote Stablecoins, CBDC, Tokenized Deposits, and even Crypto.

Hong Kong has wisely taken an agnostic position toward digital currency, saying, “If you can pay with it, we’ll take it!”

And why not? CBDCs won’t be the only game in town, even if they are likely the biggest.

Hong Kong can’t fail. With the tie-up between Hong Kong and China CBDCs, it’s clear that Hong Kong will be a global digital currency leader in no time!

👉TAKEAWAYS

Hong Kong is racing toward a digital future that has:

🔹 Near-instant payment.

Immutable distributed ledgers reduce the need for time-consuming reconciliation between multiple parties and provide trusted bookkeeping for instant payments, especially for cross-border transactions.

🔹 Atomic settlement with tokenised assets.

Tokenised assets can be traded and settled on the immutable distributed ledgers against emerging digital mediums of exchange to reduce settlement and counterparty

🔹 Programmable features.

Money can be encoded with flexible business logic and stay effective across multiple money operators to stipulate conditions for usage (e.g., transfer destination, timing)

🔹 Operation via transparent protocols.

Money and assets can be operated with a high level of transparency, with immutable smart contracts governing business and operational logic.

🔹 Connection with virtual assets (or "crypto-assets")/Web3 economy.

Emerging digital mediums of exchange can work effectively with different types of tokens on public blockchains without fiat on-ramp and off-ramp processes.

🔹 The economic benefit.

These features will result in more competitive financing rates, better access to financing and faster loan disbursement.

The innovations that will come out of Hong Kong’s plunge into digital assets will be game-changers. What many are missing is that these new means of payment will fundamentally change not just payment but the underlying business process related to the payments.

👊STRAIGHT TALK👊

Hong Kong and Singapore are Asia’s leading financial centers and like the Yin and Yang symbol ☯ are locked in an eternal struggle to outdo each other!

Both are undoubtedly fintech powerhouses, but Hong Kong will take the lead in digital payment.

The reason is clear: China’s digital yuan will create a regional CBDC trading zone in Asia and boost Hong Kong into first place.

Hong Kong will also transition its own trade with China to the e-HKD, giving it a massive advantage. It also hosts “mBridge,” the world’s first CBDC exchange.

These two factors will give Hong Kong an edge over Singapore in the digital payments race. Note I said edge; it is a tight race. Singapore is also preparing to use e-CNY and has built its own CBDC transfer system.

With China behind it, Hong Kong will be driven to use CBDC and all other forms of money to attain instant payment and programmable money.

To show you how big this opportunity is, the Greater Bay Area’s foreign trade, including Hong Kong and Macau, accounts for 5% of global trade volume, or around $2.5 trillion!

The work is already underway with Ant Group to build a blockchain bill of lading system that uses e-HKD. (here)

You have to give Hong Kong credit for seeing the future and embracing it.

Hong Kong’s lead in all digital currencies, including crypto, will solidify its role as a financial center well into the next century.

Thoughts?

Thank you to all my subscribers who have been sharing Cashless! You are now the No. 1 driver of subscriptions, and prove that word of mouth still works better than X!

Join the community by subscribing! You’ll be glad you did!