How AI Transforms Payments: Not What You Expect

AI reshapes access to payment rails, not the rails themselves.

This is my daily post. I write daily but send my newsletter to your email only on Sundays. Go HERE to see my past newsletters.

HAND-CURATED FOR YOU

Stripe presents a solid report on how AI is changing payments, showing how all that is old is new again.

Many expect AI to revolutionize payments with GenAI, but most of the AI in this report is machine learning (ML), which has been used for these applications for years and is now being marketed as “new.”

Regardless of the type of AI, the hard reality is that AI will change how we access payments, but not change the rails themselves.

If your bank has absurd fees for payments or takes too long to send the money, AI isn’t going to help.

These issues are generally determined by the “payment rails,” whether they are card-based, SWIFT, or, in the near future, stablecoins.

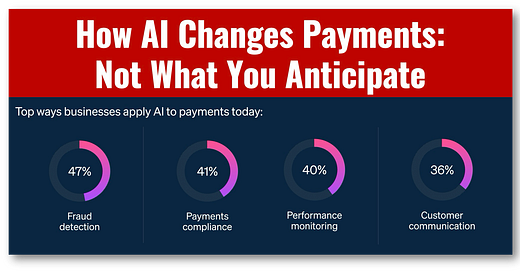

AI is crucial in payments, and Stripe’s survey of 2,000 business leaders reveals the top applications: fraud detection, payments compliance, performance monitoring, and, unsurprisingly, customer communication.

While these are all great uses for AI note that none touch the payment rails, they could be implemented as readily on a card network as a stablecoin payments system.

Another thing to note is that although they can substantially improve payment performance, three out of four aren’t new to anyone in the payments business and are based on machine learning, which has been used in fraud prevention since the early 1990s.

That AI is getting smarter is fundamentally good, but I sold these systems when at IBM, and they are hardly news to anyone working in the payments industry.

Payment compliance is another significant application of AI, as global regulations increasingly require businesses to authenticate payments to prevent fraud. Here, too, the use of AI is significant, but not a new development.

Performance monitoring? ML again, and an even older use case!

Customer communication is perhaps the newest AI use case in the group and is unquestionably big. A world where I talk to my GenAI agent and tell it to send money is certainly revolutionary and is coming soon!

This is where the personalization is most likely to happen, and of the four big investments, it is the most “fresh.”

My goal is not to belittle AI advances. These systems are continually improving and will ultimately make payments more efficient for us all.

However, they are not “new” applications of AI so much as existing ML systems that have quietly done this work for years.

Yet the desire for AI miracles has us reselling these ML systems as new, simply to demonstrate that everything old can be repackaged as new again.

👉Optimizing Payments

🔹 Optimize checkout experiences

Analyze factors such as customer characteristics, device types, location data, and transaction details to create personalized experiences that drive higher conversion.

🔹 Simplify authentication compliance

Evaluate transaction risk factors and selectively apply security measures to minimize customer friction while ensuring regulatory compliance.

🔹 Reduce fraud

Detect subtle patterns and anomalies across hundreds of signals that indicate fraudulent activity, continually learning and adapting to new threats

🔹 Boost authorization rates

Determine optimal routing, formatting, and messaging—and strategically retry declined payments.

🔹 Prevent and manage disputes

Identify risky transactions for refunds before disputes happen, and automatically respond with the right evidence when they do.