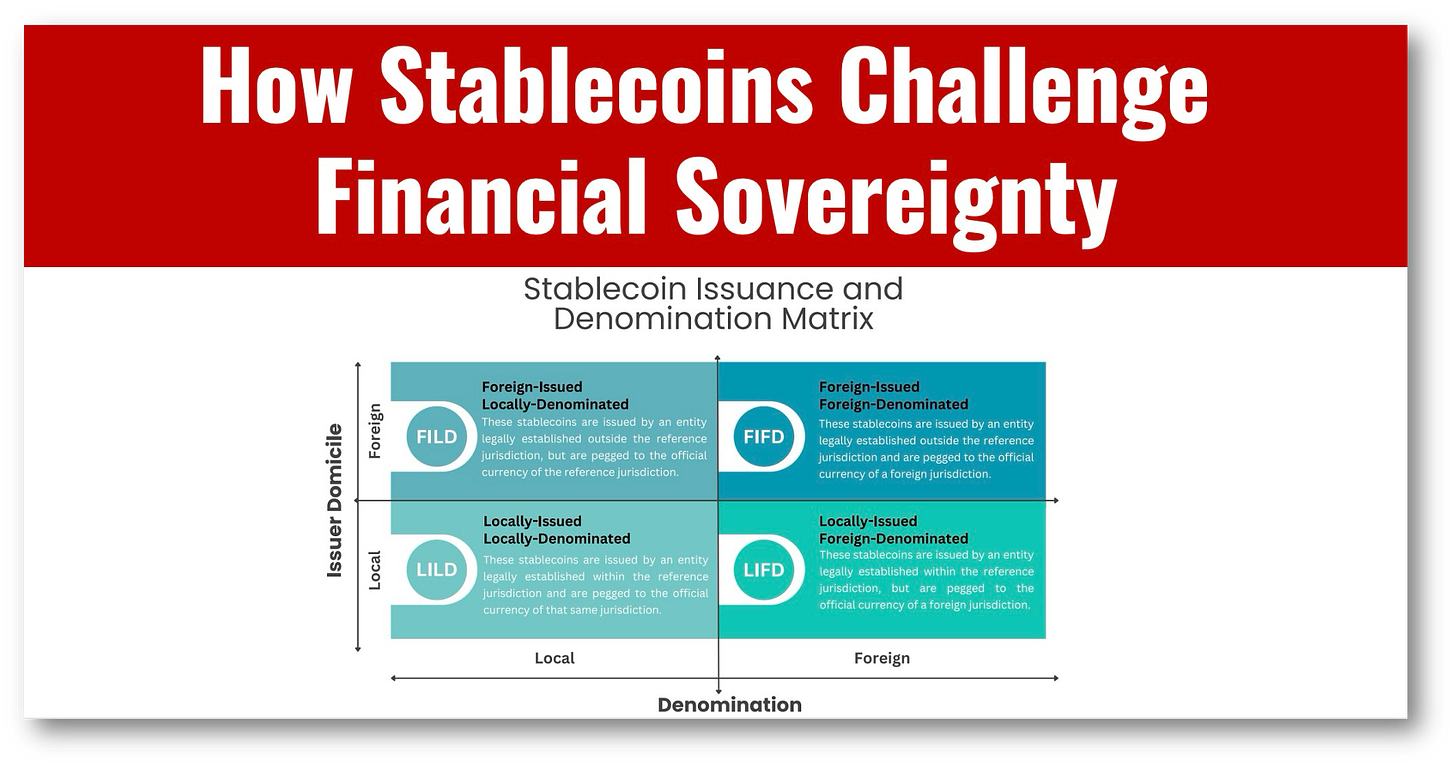

How Stablecoins Challenge Financial Sovereignty

Will stablecoins create a two-tier cash transfer system?

This is my daily post. I write daily, but send my newsletter to your email only on Sundays. Go HERE to see my past newsletters.

This is a special post for premium subscribers. I invite you to “go premium” so you don’t miss out on this and the insightful “Hot Topics” section I put into every weekly newsletter!

Keep reading with a 7-day free trial

Subscribe to Cashless: Fintech, CBDC and AI at the speed of Asia to keep reading this post and get 7 days of free access to the full post archives.