India the model for digital payments🔷IMF on Generative AI risks in finance🔷 The Future of Money🔷 Tech strategy? What tech strategy!😱

Banksy's love is in the air show

1. India is the model for digital payments

2. IMF speaks out on Generative AI risks

3. The Future of Money

4. 79% of companies don’t have a tech strategy!

Today’s artwork: Banksy, Love Is In The Air, 2003

‘If you want to say something and have people listen,

then you have to wear a mask’

Love Is In The Air, also known as Flower Thrower or LIITA, depicts a young man, dressed as a militant, wearing a backwards baseball cap and a bandana to mask the lower half of his face. He is caught in the middle of throwing a bouquet of flowers as if it were a grenade or Molotov cocktail. Despite the apparent aggression in his posture, the figure is getting ready to launch a universal symbol of love and peace as opposed to a weapon.

1. India is a model for digital payments

India is a MODEL for digital payment with UPI but is STILL BUILDING a CBDC; read why!

If you want to see the future of payments, go to India. Three critical components make India a payments leader that sets the example for the rest of the world: UPI, CBDC or the digital rupee, and Aadhaar digital ID

▶UPI: A retail real time gross settlement system. UPI revolutionized payments in India by providing accessible digital transfers to all. UPI clocked over 74.05 billion transactions in volume and INR 126 trillion of value. So it's big, real big.

▶Digital rupee: This is the new CBDC project that has both wholesale and retail CBDCs. The goal is to use CBDCs for inclusion, offline transfers, boost payment innovation, curb money laundering, promote a cashless economy, simplify securities settlement, and reduce operating costs.

▶Aadhaar: Is India’s digital ID (DID) program and is a model in providing DID to India’s 1.4bn inhabitants. The key for our purposes is that Aadhaar DID is used for KYC onboarding on both UPI and eRupee!

But the question remains: Why build a digital rupee if UPI works so well?

Here’s your answer:

1️⃣ Form of payment:

UPI is a payment system that transfers balances, while the e-rupee is sovereign paper currency converted to digital currency.

2️⃣ Dependency

💥UPI REQUIRES A BANK ACCOUNT! UPI transfers balances. E-rupee is independent of bank account, which is critical for inclusion. 💥

3️⃣ Settlement

UPI is nearly instant for users but interbank settlements happen on a deferred net basis. E-rupee has no settlement! Nothing else needs to happen once a token is transferred between digital wallets. The token is the money and is independent of accounts!

4️⃣ Anonymity

UPI transactions are all recorded by banks, while for e-rupee, no data is captured on transactions from one wallet to another below INR 50,000.

5️⃣Liability

UPI liabilities are with the bank, e-rupee with the central bank

So the e-rupee makes sense even with UPI!

Thoughts?

👉TAKEAWAYS:

—India is a model for advanced payments that the world should copy.

—Even with a successful UPI system, India is building a CBDC.

—Reviewing the differences shows why e-rupee is superior to UPI.

—Both will coexist and give India one of the world’s most advanced payment systems.

2. IMF speaks out on Generative AI risks

IMF: Generative AI is transformative but has “inherent risks” and “approach with caution!”

The IMF counters GenAI hype with a warning of the real risks inherent to the technology that are simply ignored with all the hype. Astute readers were waiting for this to happen, I certainly was!

While the IMF acknowledges that GenAI has “great promise,” it advises looking at the risks wisely!

🚨THE RISKS:

🔷 Data Privacy

AI/ML systems raise several well-known privacy concerns: data leakages from the training data sets, the capacity to unmask anonymized data through inferences, and AI/ML “remembering” information about individuals in the training data set after the data are used and discarded.

🔷 Embedded Bias

An important challenge for AI systems is embedded bias—systematically and unfairly discriminating against certain individuals or groups of individuals in favor of others.

🔷 Robustness

Robust AI performance is rapidly becoming an important issue for safeguarding financial stability. AI/ML models face a challenging task when previously reliable signals become unreliable, leading to a loss in prediction accuracy.

🔷 Synthetic Data

GenAI could impart some of its risks (for example, bias accuracy) to the generated synthetic data.

🔷 Explainability

🔥Financial institutions must be able to explain their decisions and actions internally and to external stakeholders, including prudential supervisors. The breadth and diversity of the data used by GenAI— which are at the core of its utility—make it exceedingly difficult to map GenAI’s output to the data, including in the extreme case of hallucination.🔥

🔷 Cybersecurity

GenAI poses significant new challenges to the cybersecurity landscape. GenAI models could be vulnerable to data poisoning, input attacks, and jailbreaking attacks.

🔷 Financial Stability

AI/ML may also automate and accelerate the procyclicality of financial conditions. AI/ML could also quickly amplify and spread the shock throughout the financial system.

How do you feel about GenAI now?

Thoughts?

👉TAKEAWAYS:

—Gen AI is transformative financial technology but has real risks.

—Hype has reduced attention to risk, a major problem!

—Lack of explainability is a huge problem in finance: "Why didn't I get a loan?"

—Do you remember algorithmic flash crashes? Gen AI crashes may be worse!

3. The Future of Money

The Future of Money in three parts!

This is a special three-part series covering the changes occurring to money, which, in my view, are part of a natural “evolution" in a new age of technology. Expecting credit cards to represent evolution's peak is irrational and expensive.

In a LinkedIn first, I’m covering this topic in three parts because I had three great PDFs that are all related.

🔷PART 1: Barclay’s: Money in the Age of Tech.

Barclay’s Rise team looks at the future of money and calls it “one of the most exciting periods in the history of finance and money.” This is likely true, and the team does a great job of talking about how the nature of money is changing rapidly through CBDC, Stablecoins and the Metaverse.

Barclay’s section on stablecoins is a GREAT read. Barclays makes the case for regulated stablecoins which is now without question their evolutionary path. In Part 3 below I include Singapore’s new regulatory approach to stablecoins.

🔷PART 2 Mckinsey: Tokenization

Mckinsey’s paper on Tokenization is a great read and supplements Barclay’s paper above. Regular readers know well that Bank Deposit Tokens are a likely contender to replace or supplement CBDCs.

The concept of tokenizing bank deposits and transferring them between institutions on secure wholesale blockchains is an attractive alternative to CBDCs that banks fundamentally dislike!

McKinsey covers how to tokenize in the most general context and it's a great read!

🔷PART 3: MAS Stablecoins

Singapore’s new stablecoin regulatory approach shows that stablecoins are coming! Their approach is a model of simplicity and should be copied by other nations.

SPOILER: The same grade of AML/KYC that banks use is required, so some crypto fans will not be pleased.

For nations like the US, where retail CBDCs are not in development, regulated stablecoins will likely make a positive impact.

GO DIRECTLY to the final two pages for a great summary chart of the regulations!

Thoughts?

👉TAKEAWAYS:

—The future of money is changing quickly; these three reports show how it's happening faster than most think.

—Tokenization without crypto is a key technique for money and capital markets.

—Stablecoins will be regulated, and Singapore is showing a path.

—I look forward to using stablecoins alongside CBDCs!

4. 79% of companies don’t have a tech strategy!

MONEY TALKS: Building tech into corporate strategies produces ROI growth, yet 79% of companies don’t!

Can you believe that at a time when technology is changing our planet, only 21% of companies integrate tech into their business strategies meaningfully? Better put 79% of companies are clueless!

Accenture does a fabulous job showing that money talks and tech strategies make money!

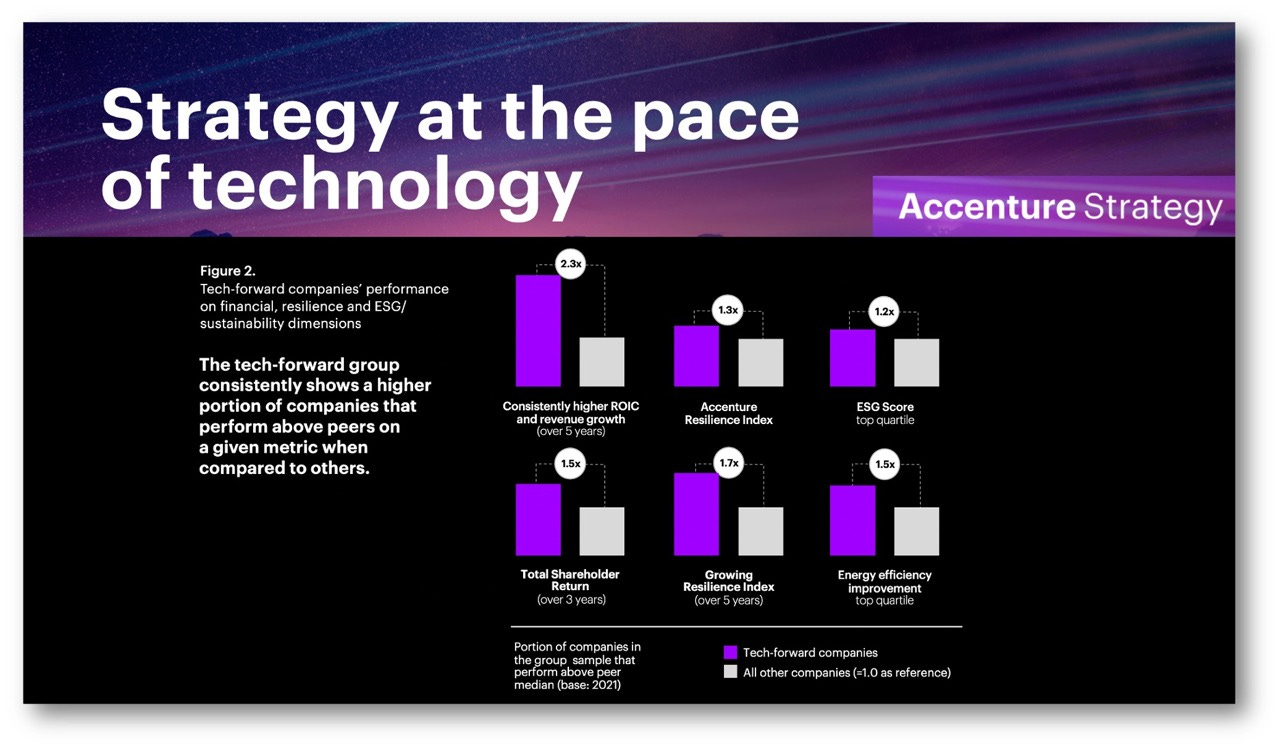

A two-year study looking at 1,600 companies across nine countries and 18 industries nails it by showing that companies that are “tech-forward,” by using tech in their strategies and C-suite, are pulling away from their peers!

🔷 MONEY TALKS: Tech-forward companies over 5 years left competitors in the dust:

✅ Were 2.3X more likely to outperform peers in terms of revenue growth and return on invested capital (ROIC).

✅ Represent a higher proportion 1.3X of resilient companies

✅ Performed better on ESG by 1.2X

✅ Post covid, tech forward companies are STILL pulling away and their lead is growing!

✅ Of 16 industries in the study HALF had less than 20% of their industry classified as tech-forward. Stunning!

🔷 So what makes a tech-forward company? Accenture uses two primary criteria:

1️⃣ On C-suite dynamics, leading companies have closed the tech-fluency gap, and raised the bar for senior tech executives.

They’re laser-focused on using tech to grow and innovate and are better at capitalizing on ongoing technology efforts to inform strategy development. This means that the C-suite and top managers are trained and support technology within their companies.

2️⃣ On strategy dynamics, tech-forward companies have accelerated strategy cycle times and learned to allocate resources more flexibly than others.

Tech-forward companies have brought modern agile IT practices to strategy development by testing strategies through experimentation and rapid sprints. Who'd have guessed that Agile, once the domain of tech geeks would make it in the boardroom, but it did!

My work is entirely supported by reader gratitude, so if you enjoyed this newsletter, please do both of us a favor and subscribe or share it with someone. You can also follow me on Twitter or Linkedin for more.

Everyone, including platforms that disagree with me, has my permission to republish, use or translate any part of this work or anything else I’ve written here on Substack with credit given to me and this site (richturrin.substack.com) For more info on who I am, what I do, and where I’m going, check out richturrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is number 4 on Onalytica's prestigious Top 50 Fintech Influencer list and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon:

Cashless: HERE

Innovation Lab Excellence: HERE

"UPI transactions are all recorded by banks, while for e-rupee, no data is captured on transactions from one wallet to another below INR 50,000"

So if I want to bribe a corrupt politician in India, then my bot has to send 10 transfers of 49,999? Sounds good.