India's UPI Digital Payments A Beacon for Asia and the Pacific

The Asian Development Bank Wants to Leverage UPI's Lessons

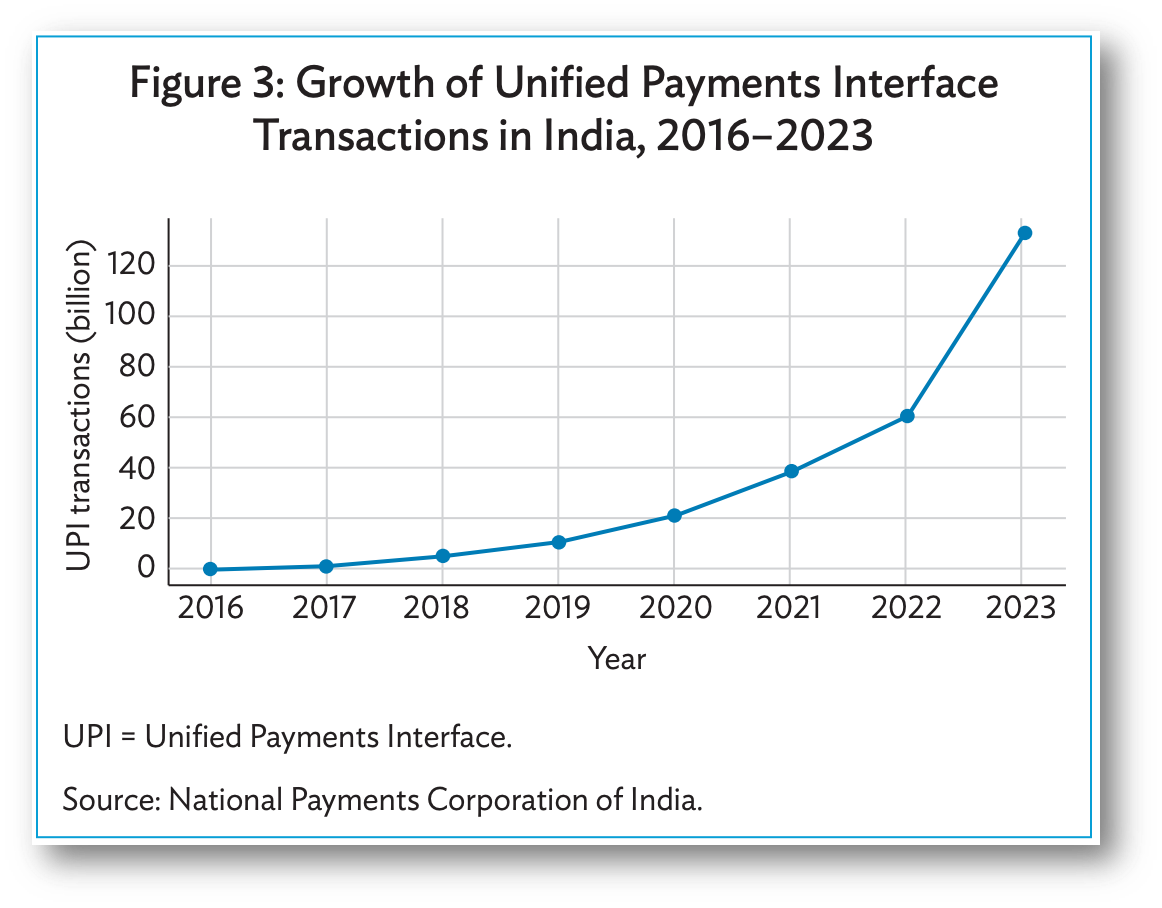

The Asian Development Bank (ADB) highlights India’s remarkable success in digital payments and makes it clear that UP is a model for Asia and the Pacific.

Go UPI, go!

The ADB in its own words:

By leveraging the lessons learned from UPI, other countries in Asia and the Pacific can accelerate their digital transformation and achieve the goal of financial inclusion for all.

Let’s look at what makes UPI so successful in the takeaways:

👉TAKEAWAYS

The ADB notes these key points made UPI a success: (With my commentary)

🔹The importance of government leadership and support in creating an enabling environment for digital payments.

Note that India’s visionary approach to payments as “digital public infrastructure” is what made UPI possible. Digital payment was seen as a service for the entire nation! The government actually showed leadership that other nations should emulate.

🔹 The need for a standardized and interoperable payment system to enable seamless transactions across different banks and payment providers.

INTEROPERABILITY! This is why, even as a fan of China’s payment systems, I feel that UPI is superior! China has the “walled garden” problem where payments are not universally accepted. This is a major driver for the new digital yuan!

🔹 The importance of educating consumers and merchants about the benefits and security of digital payments.

This is universal and was a major issue in China in the early days of digital payment. In China, much of this education was conducted by the payment sales people! So yes, education is key, whether public or private.

🔹 The need to invest in digital infrastructure, such as broadband internet and smartphones, to enable wider adoption of digital payments.

Digital infrastructure is never perfect, and offline payments are key to the adoption of both the digital yuan and rupee CBDCs! Offline is key because, in developing nations, infrastructure fails.

👊STRAIGHT TALK👊

Nothing makes me happier than seeing India’s UPI and the “India Stack” of “Digital Public Infrastructure” get a boost!

The ADB does a great job of highlighting UPI’s structure and the National Payment Corporation (NPCI), the real-time payment system UPI is based on.

The Indian government structured NPCI as a public-private partnership where banks and the government collaborate on NPCI.

This is key because NPCI is not optional; it is a nationwide system that connects all financial institutions. By forging a partnership, all stakeholders’ interests could be considered.

But wait for it…… the NPCI is structured as a not-for-profit! So, one thing that the nation’s banks likely don’t like is that UPI’s success hasn’t resulted in great riches.

NPCI is envisioned as “Digital Public Infrastructure” like bridges and roads, and this is exactly what developing Asia and the Pacific need more of!

Thoughts?