INNOVATION SPECIAL: ARK's TOP 14 Big Ideas, China a Bigger Innovator Than the US; Fintech and a Multipolar Currency World; China's Banks Innovate or Die

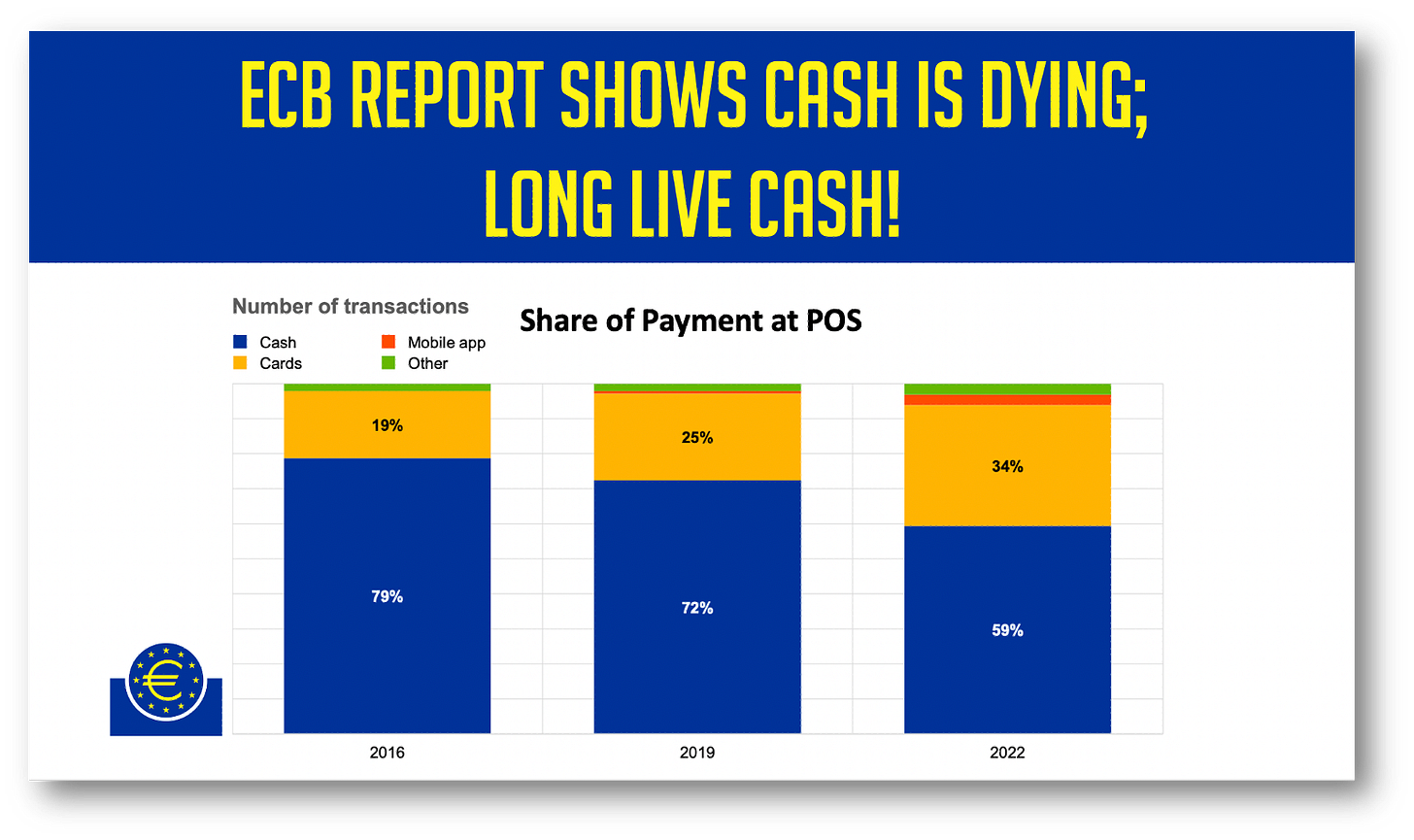

The ECB shows that cash is dying; LONG LIVE CASH!

Five stories show how innovation is changing our world!

1. ARK’s Top 14 Big Ideas: BUYER BEWARE

2. China Overtakes the US in Innovation

3. Top 5 Trends in our new multipolar currency world brought by fintech

4. China’s Banks Innovate or Die!

5. EU Cash Use is dying; LONG LIVE CASH!

Dall-e’s view of a multipolar currency world as the dollar goes up in flames.

I am proud to be the No. 4 global fintech influencer on the prestigious Onalytica influencer list. I got there by writing solid articles that people like you want to read. If you want crystal clear hype-free discussion on all CBDCs, fintech, crypto, and China’s tech scene, this is the place. All of my writing is backed up by my curation of the best educational PDFs in the business. Subscribe, and you’ll be glad you did!

1. ARK’s Top 14 Big Ideas: BUYER BEWARE

ARK Invest’s 12 BIG IDEAS for 2023 is FANTASTIC, but buyer beware!

ARK’s report does something no other does, it is visionary in showing how the 12 big ideas are interconnected! Instead of looking at tech, for example, digital wallets, in isolation, ARK distinguishes itself by showing how things like AI and wallets interconnect!

Download: here

ARK Invest needs little introduction as founder Cathie Wood became the “high priestess” for the high-tech boom. Still, ARK's ETFs falling 70% hit hard with assets under management falling by $50bn!

WARNING: ARK is selling itself and its funds, so this is a sales document! Enjoy its vision of the future, but beware that some of the numbers seem a bit exaggerated, like a used car salesperson's!

I break down only the report’s fintech topics into the good, bad, and ugly!

🟢 The good:

Digital Wallets: I LOVE ARK’s coverage! They absolutely get the disruptive power of digital wallets and do a fabulous job of showing their importance in our future. ARK's global view is second to none, and recent moves by Twitter into payments and banks in the US to build new wallets are clear indicators of how important this sector will be. Wallets will “cut out the middlemen!”

Public blockchain & Smart Contracts: Ignore the sh*tcoins and crypto insanity, public blockchain is real and a positive development that will gain traction. That incumbent banks are building on Ethereum shows that it shouldn’t be dismissed. A public blockchain is a specialized tool, perhaps not for everything, but it has great potential.

🟡 The bad:

Bitcoin: ARK’s overall view is that bitcoin is going to the moon! Sorry, I don’t buy that, even if I don’t predict or wish for its demise. It is impossible to ignore the regulatory tidal wave that is about to hit bitcoin. If ARK is so smart, why don’t they see this coming? ARK also promotes BTC’s use in financial inclusion, ignoring UNDP and other warnings.

🔴 The ugly:

DeFi and Smart Contracts: ARK wrote one of the worst sentences ever: “DeFi lending protocols functioned as designed.” Are you kidding me? ARK needs to read the BIS’s detailed account of how DeFi contributed to the crypto crash! DeFi was hacked for over $3.2 bn in 2022! Everything is fine? Shame on ARK for saying that DeFi lending promotes inclusion. DeFi lending REQUIRES collateral that the excluded don’t have!

Takeaways:

The interconnectivity that ARK shows is visionary!

ARK views the future through “rose-colored glasses!”

Beware. Like a used car salesperson, ARK is inflating the car's value.

The future is coming faster than you think!

2. China Overtakes the US in Innovation

🔥CHINA SURPASSES THE US IN “ABSOLUTE” INNOVATION.🔥

The US-based ITIF drops a BOMB: In 2020, China’s innovation and advanced-industry capabilities increased to 139 percent of the US’s in absolute terms, increasing from 78% in 2010!

Download: here

Ringing the alarm that the US’s innovation capabilities are faltering and China is overtaking the US has become almost a ritual for me. This report is probably the most alarming yet, and its title: "Wake up, America," says it all.

What readers may be thinking….

The response from readers on this topic are now predictable:

1) China “can’t innovate and only copies,”

2) I am a communist,

3) a growing majority tell me I’m right.

Here are my responses to all three groups in advance:

1️⃣ "China can’t innovate and only copies," the ITIF wrote the best sentences I ever read on this:

“Many U.S. elites comfort themselves with the narrative that China, at least under the leadership of Xi Jinping, cannot truly innovate and that the U.S. therefore has little to worry about. But this view is premised on too-narrow a view of innovation, largely one referring to the development of science-based, new-to-the-world products. Not only is this definition too narrow for assessing advanced-industry strength, but it is also not clear that this still even rings true given China’s recent gains in areas such as space exploration, genomics, AI, and quantum computing.”

2️⃣ "I am a communist:"

Thirteen years in China have not made me a “collaborator.” It did make the study of innovation in China far more than an academic pursuit. I live it daily and see its impact first-hand. When an innovator with a book on innovation that lives in China tells you that they are “winning” I would hope that this would be seen as a “canary in a coal mine,” not someone with a political agenda.

One thing I did learn is that smart people get China wrong because of the media. The Western media's barrage of sensational articles proclaiming China's imminent doom makes understanding China nearly impossible.

3️⃣ "I am right."

Thanks, but this doesn’t mean Chinese world domination. When innovation is measured “proportionally,” accounting for the size of the economy and population, China still lags behind the US at 75%, up from 58% in 2010.

So it's still "game-on," though China will likely catch the US in the next decade.

The problem is that in "geopolitical conflicts—military or civilian—it is total, not proportional, innovation that is likely the determining factor.”

Takeaways:

Will the US "Wake UP?"

No, it will not. The US hasn’t mustered the profound commitment required to remain the top innovator.

This is a competition for high-value-added industries, which, once lost, can't be recovered.

Bans and blocks impacting China's tech are not the same as competing!

China is challenged by low efficiency and is not guaranteed to win.

3. Top 5 Trends in our new multipolar currency world

The TOP 5 trends to watch as we switch to a multipolar currency world.

Our monetary system is changing, and this will likely be the biggest story of 2023. I intend to cover it regularly this year because it is so critically important.

Download: here

To explain this transition to multipolarity, I present an excellent paper from Credit Suisse and five examples from the recent news that prove this trend is real and unfolding before our eyes.

There will be no dollar collapse or sudden shock. This will be an imperceptible yet inexorable move to alternative currencies using fintech, including CBDCs, that are being built now.

Fintech, as I said two years ago, is now a pawn on the geopolitical chess board. The transformation to currency multipolarity fintech will bring will be slow, which is why many will miss it or deny its existence.

From Credit Suisse:

"We see a new – or rather adapted – more multipolar system resulting from three drivers:

🔹first, the trend increase in bilateral trade among many countries, which allows for returns to scale in the use of their respective currencies rather than the US dollar;

🔹second, the deepening of local capital markets in emerging markets; and,

🔹third, efforts (especially by leading emerging markets) to develop mutual insurance schemes against shocks resulting from shifts in US monetary policy."

The top five trends to follow:

1️⃣ China’s push for the petroyuan:

Saudi Arabia is now “open to trade in currencies other than the USD” while China is pushing for yuan acceptance. This will happen in 2023.

2️⃣ Brazil and Argentina’s common currency:

Both are friends of the US but share a desire to expand bilateral trade and decrease costs. Who can blame them?

3️⃣ Iran and Russia:

This is the “pariahs club!” The two rogue nations just linked banking systems, and to overcome mutual currency distrust, are working on a gold stablecoin.

4️⃣ India and Pakistan use yuan for Russian oil:

India is a US “friend” that is purchasing oil from Russia in CNY and wants to use its rupee in UAE trade. Is India a bad country? Pakistan now also plans to buy Russian oil in CNY.

5️⃣ BRICS+ reserve currency and CBDC:

BRICS proposed a new joint currency basket though I expect this project to take a while. But watch as Egypt joined BRICS and Indonesia is applying! Also, watch carefully as this year, China, India, Russia, and Brazil will all launch CBDCs!

Takeaways:

-The dollar isn't dead, but it is wounded.

-Should you worry? NO! Should you be aware and prepare? YES!

-Multipolarity is a slow process, and many will point to USD usage figures and deny it exists.

-Fintech is making de-dollarization possible.

-De-dollarization is simply insurance against sanctions.

4. China’s Banks Innovate or Die!

The top 3 things Chinese consumers want from their banks have lessons for the West.

I don't believe that “what happens in China stays in China! This great report on China banks by Bain & Company shows what consumers want from the banks after they’ve used super-apps.

It’s very simple in China, banks either innovate or die! Banks in China have been disrupted more by digital competitors than anywhere else in the world!

Download: here

Bankers from the West could also learn from this report as their Chinese colleagues are years ahead of the West in fighting digital challengers!

The top three things Chinese bank customers want:

1️⃣ An Omnichannel experience…. yes people still want branches!

Surprisingly, China banks are showing us that -despite- digital payment disruption by super apps WeChat and Alipay, most incumbent banks are well-liked by their customers!

China’s banks have a “Net Promoter Score” of 55% meaning most customers would recommend their bank. NPS scores are rising and appear to follow banks’ improving digital capabilities.

Banks can't rival the functionality of super apps but can rival their ease of use and expand services. My bank app does more and more every year!

Chinese still want nice branches! Mine is always empty now, so I am surprised by this finding, but I guess for some, it’s a deciding factor.

2️⃣ Super app functionality, not gamification

Unsurprisingly, users want their bank apps to do more, and the push for banks to challenge the superapps is real.

Without payments, this would be impossible, but now with the onset of the digital yuan as a national payment system, some banks may just rise to the challenge!

Unsurprisingly bank users want rewards or loyalty points for their patronage. Why not? Coupled with digital yuan use this could be a killer combo!

Where I think there is a real lesson for the West is with gamification. Chinese consumers haven’t taken to gamification, chat, or discussion functions, which some Chinese banks tried. Perhaps gamification is overrated?

3️⃣ Digital and HUMAN Wealth Services

The part that strikes me most about this is that wealth management is still such an emotionally charged decision that humans are still necessary. Robo-advisors in the West also found this out.

The inability to reach humans or having to switch to a different channel are killers with wealth products. Unsurprisingly, chatbots really fail in this use case!

Takeaways:

Chinese banks need to deliver ever-increasing functionality in their apps to compete with super apps. Other bells and whistles don't matter.

Personal services still matter in Wealth management, and gamification seems overrated.

The e-CNY may allow some banks to edge ever closer to offering super app levels of convenience.5. EU Cash Use is dying; LONG LIVE CASH!

The ECB’s “SPACE” report with FABULOUS graphs shows that the payment attitudes of EU citizens are changing fast!

5. EU Cash Use is dying; LONG LIVE CASH!

The ECB’s “SPACE” report with FABULOUS graphs shows that the payment attitudes of EU citizens are changing fast! Cash is on its way out.

While cash is still the most frequently used way to pay at 59% of transactions in 2022, its use plummeted 20 points from 79% in 2016 and 13 points from 72% in 2019. Download the ECB report: here

Long Live Cash

Many readers will be expecting the author of a book titled “Cashless” to be gleeful with these results. I'm neutral, as I see this as a natural evolution of payment.

In fact, I will hopefully surprise you all by focusing on why we will NEED cash for a long time to come.

If that sounds like a conflicted point of view, it isn’t, and it mirrors the sentiments of many EU consumers:

“60% of consumers considered the option to pay with cash to be important or very important. …. This contrasts with self-reported preferences for cash or cashless; 55% say they prefer cashless means of payments (up from 49% in 2019), while 22% prefer cash and 23% have no clear preference.”

So people want the convenience of going cashless while retaining the ability to use cash if they please!

Interestingly, this desire to keep cash even exists in the EU's leading cashless countries: Luxembourg, Netherlands, and Finland, where only 39%, 21%, and 19% of transactions are cash.

Why keep cash?

From a user perspective, the main reasons are:

(i) cash is considered to make one more aware of one’s own expenses;

(ii) cash is perceived as anonymous (and therefore protects privacy);

(iii) cash transactions are perceived to be immediately settled.

Now let's talk about anonymity which has become a much bigger topic due to big tech and digital surveillance. According to the survey, “anonymity has acquired a more prominent role in respondents’ opinions, rising from 13% in 2016 to over 40% in 2022.”

So let's face it, it isn't just drug dealers and thieves who love cash's anonymity, and that isn't going to change anytime soon. In fact, it is going to grow!

No surprise that cards trump cash for convenience, and a relatively large majority (62%) saw the key advantage as being that they don’t have to carry much cash with them.

So, long-term going cashless will win, but the opportunity to use cash should always be maintained.

Takeaways:

Long live cash!

Cash must be kept for many years to come with anonymity and privacy on everyone’s mind.

Cashless is simply easier, and long-term convenience will win.

See how deep the “cashless” rabbit hole goes!

My work is entirely supported by reader gratitude, so if you enjoyed this newsletter, please do both of us a favor and subscribe or share it with someone. You can also follow me on Twitter, or Linkedin for more. If you want to learn more about Innovation Labs or China’s CBDC, check out my website richturrin.com which is full of videos, interviews, and articles. The best way to make sure you see the stuff I publish is to subscribe to the mailing list here on Substack, which will get you an email notification for everything I post.

Everyone, including platforms that disagree with me, has my permission to republish, use or translate any part of this work or anything else I’ve written (except my books) with credit given to me and this site (richturrin.substack.com) free of charge. For more info on who I am, what I do, and where I’m going, check out richturrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is number 4 on Onalytica's prestigious Top 50 Fintech Influencer list and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon:

Cashless: HERE

Innovation Lab Excellence: HERE