Instant Cross-Border Mobile Payments are Becoming a Reality in SE Asia

The BIS's Project Nexus is a success with more nations onboarding soon!

Simple is always best, and one way to get immediate cross-border payments is to connect Asia’s wildly successful QR-based instant payment systems (IPS).

The problem is that connecting IPSs is anything but simple, and that’s where the BIS’s Project Nexus and its standardized approach will help.

Southeast Asia is a hotspot for these bilateral linkages, with 13 person-to-merchant (P2M) QR payment linkages and four person-to-person (P2P) payment linkages as of May 2024.

Bilateral links are great, but they are expensive to build, and Nexus promises to make it far easier with the rollout of its “comprehensive blueprint.”

So, while IPS networks between Singapore and Malaysia, Indonesia, Thailand, and the Philippines were connected bilaterally, the remaining six cross-nation connections will likely be made through Nexus.

The rationale is clear: SE Asia wants to grow, and with SMEs a dominant force in their economies, mobile payments are simply practical.

And the next step is mind-blowingly large: connecting them all to India’s UPI!

👉TAKEAWAYS

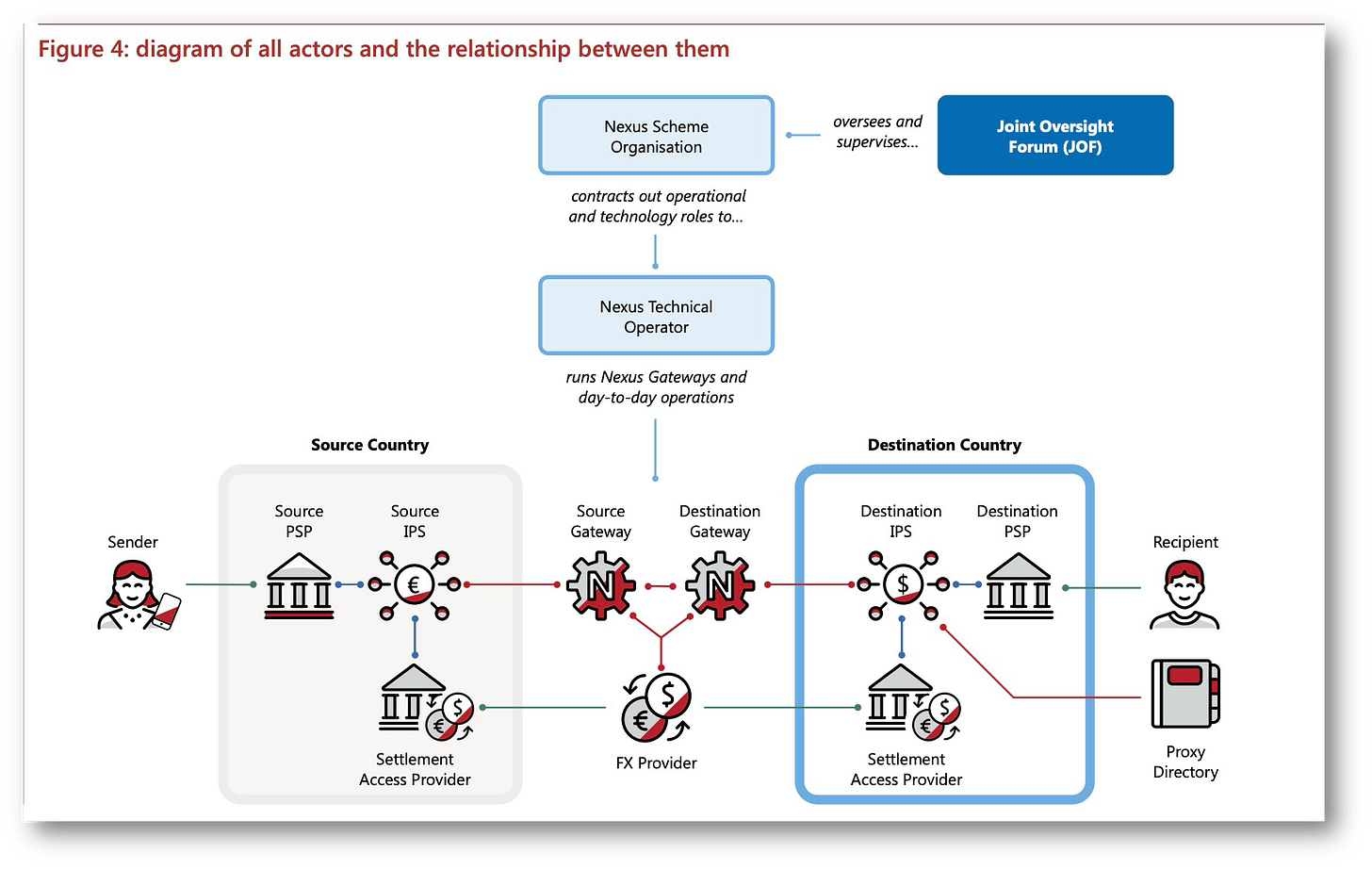

Improving cross-border payments: Nexus aims to improve the speed, cost, transparency, and access to cross-border payments. Nexus aims to enable cross-border payments that reach their destination in 60 seconds or less

Linking IPS multilateral: Some countries already link their IPS, but the slow and complex process makes scaling challenging. Bilateral links (unlike nexus) are only commercially viable for connecting close trading partners.

Standardizing the scheme: Nexus eases IPS interlinking by standardizing the way that IPS connect to each other.

Speed: Nexus will enable cross-border payments in seconds, 24/7/365, as most IPS process domestic payments within 30 seconds.

Cost: Nexus payments should fall within the G20 and UN SDG target of costing the Sender less than 3% of the value of the payment.

Access: Nexus provides access to cross-border payments to any bank or non-bank PSPs that are eligible to join their domestic IPS.

Transparency: Nexus gives the Sender transparency about how much it will cost them to pay a specific amount to the Recipient

👊STRAIGHT TALK👊

Nexus isn’t just for SE Asia, with some 70 nations using IPSs there is a lot of room for growth in cross-border mobile payments.

The next step for Project Nexus is truly remarkable and I’ll reproduce it in full:

”Phase four will see Bank Negara Malaysia, Bangko Sentral ng Pilipinas, the Monetary Authority of Singapore, the Bank of Thailand and domestic IPS operators – who worked together in phase three – joined by the Reserve Bank of India, expanding the potential user base to India's Unified Payments Interface (UPI), the world's largest IPS.”

So India’s UPI the world's largest IPS will be connected with most of SE Asia which means that roughly 25% of the world’s population will have cross-border instant payments!

If that isn’t mind-blowing, what is?

And once again this fintech revolution is brought to you by Asia!

What do you think?

Join our community by subscribing. You’ll be joining an exciting journey down the rabbit hole to our shared digital future—and you’ll be glad you did!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!