Is Financial Fragmentation A $6.5 Trn GDP Threat?

Or is this a ruse to perpetuate SWIFT's monopoly on financial transfers?

SWIFT and the Economist look at financial fragmentation and see a future fraught with a potential $6.5 trn in global GDP decline. I see a ruse to maintain the status quo in payments.

The report defines financial fragmentation as— “a reduction in international financial integration and the disruption of cross-border payments, credit, and investment that ultimately reduces cross-border capital flows—threatens to untie the complex linkages that drive employment, business growth and countries’ development.”

While the definition of fragmentation doesn’t explicitly state this, any fragmentation can be seen as an assault on SWIFT’s near monopoly on cross-border payments.

This is precisely what alternative payment systems of any kind, whether CBDC, stablecoins, or tokenized deposits, are designed to do.

That’s why I find it so difficult to accept the results of this report.

SWIFT and the Economist are making the self-serving argument that any fragmentation will result in a decline in Global GDP and employment.

Is this realistic or a ruse to maintain SWIFT’s lock on global payments?

Fragmentation Examples

Current examples of fragmentation not included in the report would seem to refute the report’s contentions.

The easiest example is trade conducted on China’s CIPS transfer system, which perfectly fits the definition of “fragmentation.”

It would be hard to show that trade with Brazil and Indonesia, two CIPS users among many, would result in lower GDP or employment in any countries involved.

The biggest argument against the report is that a nation’s decision to use non-dollar assets or transact on a SWIFT alternative is driven by the calculation that it will save money on the transaction.

This is particularly true right now when the dollar is expensive to buy. How exactly will getting a cheaper deal in cross-border trade and transfers reduce GDP?

Still, the report is valuable as SWIFT acknowledges that a transition to a multipolar currency world is underway, a future it doesn’t like, and you can smell the fear.

👉Model Findings:

🔹 Fragmentation harms cross-border capital flows, such as foreign direct investment (FDI), which support consumption, investment financing, risk diversification, and resource allocation.

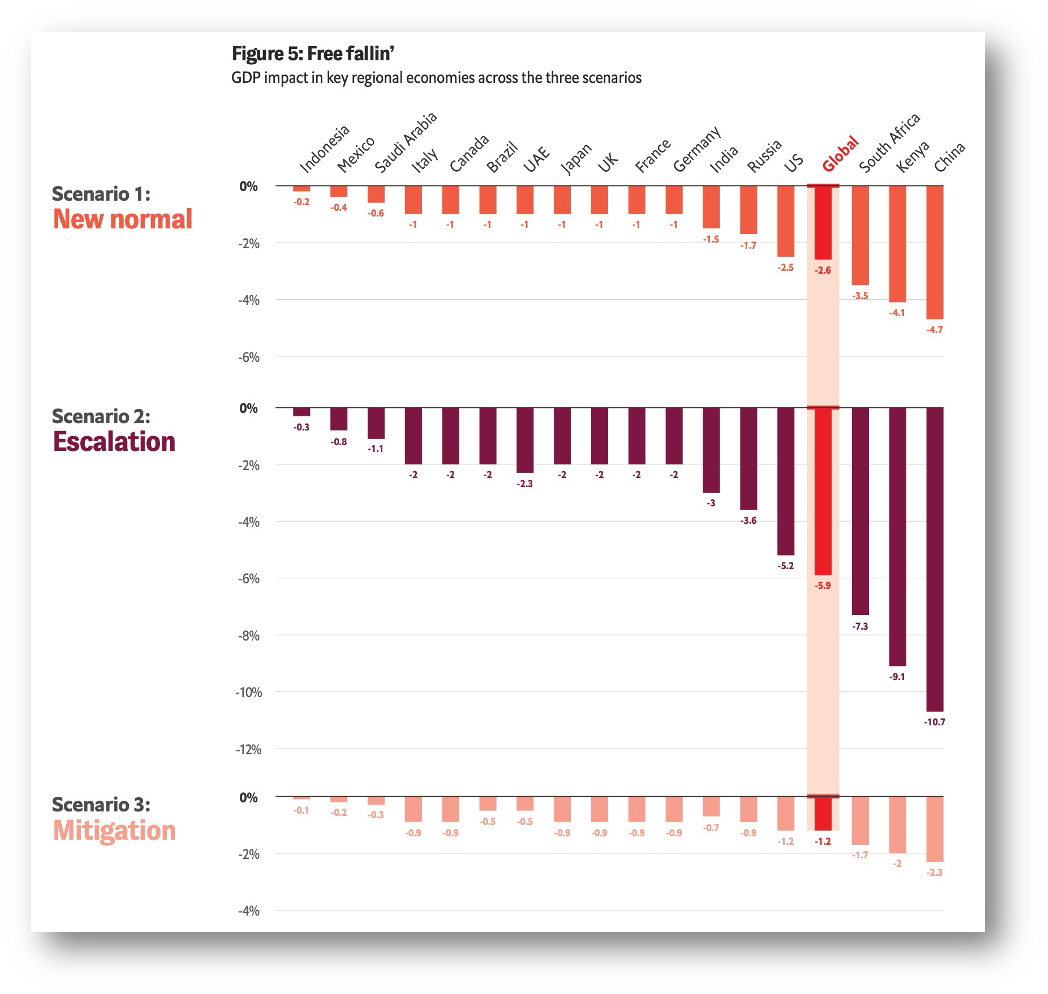

🔹 The worst-case scenario in the decline of cross-border capital flows would see GDP roughly 6% lower and nearly 280 million fewer jobs.

🔹 Ensuring that these scenarios do not come to pass means not just taking steps to reverse fragmentation, but also putting in place safeguards that ameliorate fragmentation’s worst effects.

♦ The report is inconclusive as to how fragmentation can be reversed when nations participate in fragmenting the financial flows after calculating that it is in their best interest!

♦ Emerging economies have long looked askance at financial weaponization through sanctions enforced by SWIFT, the acceleration of which in recent years has further prompted many economies to explore alternative capital markets, currencies, or financial infrastructures.

If you know someone who would like this newsletter, please share it with them and help grow our community of Asia, CBDC, and AI champions!

Readers like you make my work possible! Please buy me a coffee or consider a paid subscription to support my work. If neither is possible, please share my writing with a colleague!

Sponsor Cashless and reach a targeted audience of over 55,000 fintech and CBDC aficionados who would love to know more about what you do!