Macro Trends: Digital Transformation🔹Financial Inclusion🔹India's Rise🔹Polycrisis🔹Sanctions

A look at Macro trends impacting fintech and our world.

1. Digital Transformation

2. Financial Inclusion

3. India’s moment to shine

4. Polycrisis why we’re in one

5. Sanction’s Human Toll

Today’s artwork: “Warrior,” Jean-Michel Basquiat, 1982

Painted in 1982 at the height of Basquiat’s artistic power, Warrior – made with acrylic and spray paint on a wood panel – depicts a powerful warrior wielding a silver sword. Its Christ-like, gladiatorial figure is a crucial subject extensively explored by the artist in numerous sketches prior to this work. Warrior can be interpreted as a semi-autobiographical work championing his creative vision as a black artist.

Hey, it was a great week. I just scored eighth on the “Adorsys” ranking of fintech influencers! I am honored whenever my work is noticed, and a big thank you to Adorsys!

I am also proud to be the No. 4 global fintech influencer on the prestigious Onalytica influencer list. I got there by writing solid articles that people like you want to read.

If you want crystal clear, hype-free discussion on CBDCs, fintech, AI, crypto, and China’s tech scene, this is the place.

If you’ve already subscribed, you have my heartfelt thanks! For those considering, “just do it, subscribe.” You’ll be glad you did! If you like what you’re reading, please SHARE IT!

1. Digital Transformation

Read: here

How to pull off digital transformations in Financial Services with real examples.

Digital transformation is the macro trend of our times, and we'll look at it in concrete terms with Mckinsey case studies of successful transformations!

SPOILER ALERT: McKinsey is honest and makes it clear that transformation isn’t easy, even for those who have succeeded!

Here are a few highlights from the studies from DBS, BCP, Allianz, and Kiwi Bank:

🔹 Make the change stick through leadership and culture:

To generate traction and spread the culture change, BCP was utterly disciplined in its implementation. To make sure there was no backsliding, BCP put in place a dedicated leadership team focused solely on the transformation, ensured C-suite buy-in on the changes, and set up new reporting structure.

🔹 Don’t let perfect be the enemy of good:

Waiting too long to make decisions hampers solution deployment, organizational learning, and value delivery. Kiwibank’s approach of deploying solutions rapidly, improving them iteratively, and being guided by a clear from-and-to target state.

🔹 Upskilling current talent is equally important as bringing new talent (similar finding at Kiwi bank):

BCP learned that it needs to not only bring new tech talent for growth but also upskill its current talent on new ways of working and latest technologies to deliver product and services faster.

🔹Eliminate historical silos between functions to build cross-functional agile teams:

As DBS looked to scale its capabilities and solutions, it defined an operating model built around platforms, a variation on a products and platforms operating model, which DBS adapted to its own context.

🔹 Fully leverage the power of Data and AI:

DBS’s emphasis on embedding AI has ensured that digital touches every part of the bank. It utilizes AI to deliver 45 million hyper-personalized nudges to customers.....Additionally, AI and analytics facilitated end-to-end money laundering surveillance and supported HR in employee retention.

Thoughts?

🔺Please leave a comment, repost♻️ and like! One comment equals 10 likes, and it takes only 3 reader comments to boost this post 50%.

👉TAKEAWAYS:

—Digital transformation is the macro trend of our times

—Does the topic make you feel uncomfortable?

—How to transform is hotly debated, but there are no fast rules.

—Transformation is an existential battle between institutional momentum and digital efficiency.

Just do it!

2. Financial Inclusion

Financial Inclusion isn't just providing access, but ensuring the vulnerable aren't robbed!

One and a half billion living in emerging markets are financially excluded, a big number but not the whole story. Even wealthy countries have problems, as a 2021 FDIC survey shows. In the world's wealthiest nation, 19.6% of Americans, 24.6 M, were under and unbanked! A divisive social problem.

McKinsey does a great job explaining inclusion, a key MACRO TREND for this week's series, but they left something out!

McKinsey left out that just being connected to the financial system isn’t inclusion! Financial inclusion means ensuring that vulnerable populations are connected to a financial system that doesn’t rob them!

Two concrete examples show how important this is:

❌ China's P2P loans:

China got financial inclusion through WeChat and Alipay in 2014, and they performed miracles! In 2017 China had the world’s largest unbanked population at 225 M; by 2021, there were roughly 70 M!

However, in the early days of the payment platforms, they gave people access to fraudulent peer-to-peer (P2P) lending and borrowing apps, resulting in US$ 115 bn in losses.

Many newly included people, all of whom grew up in a trusting state-run economy, had access to a corrupt system that was an unmitigated disaster!

The pattern was repeated in India and Kenya!

❌ Terra/Luna:

Crypto is often seen as a way of bringing inclusion to the developing world, and the $40bn Terra/Luna debacle proves that “quality counts.”

Chainalyis crypto adoption index for 2020 shows emerging markets in 8 of the top 10 nations, all of which had citizens suffering debilitating losses.

✅ When we look back at fintech in 50 years, its greatest legacy will likely be inclusion. How we do it is immaterial; that we do it is imperative.

✅ Financial inclusion is more than just having a bank account or mobile payment. It must include giving the most vulnerable access to a financial system that isn’t stacked against them!

Thoughts?

👉TAKEAWAYS:

—Financial inclusion is a positive macro trend and fintech's greatest gift.

—Connecting the vulnerable to safe financial systems is key.

—Is giving someone a credit card with a 36% annual rate, the US’s highest, inclusion?

—Inclusion's contribution to social stability is critical!

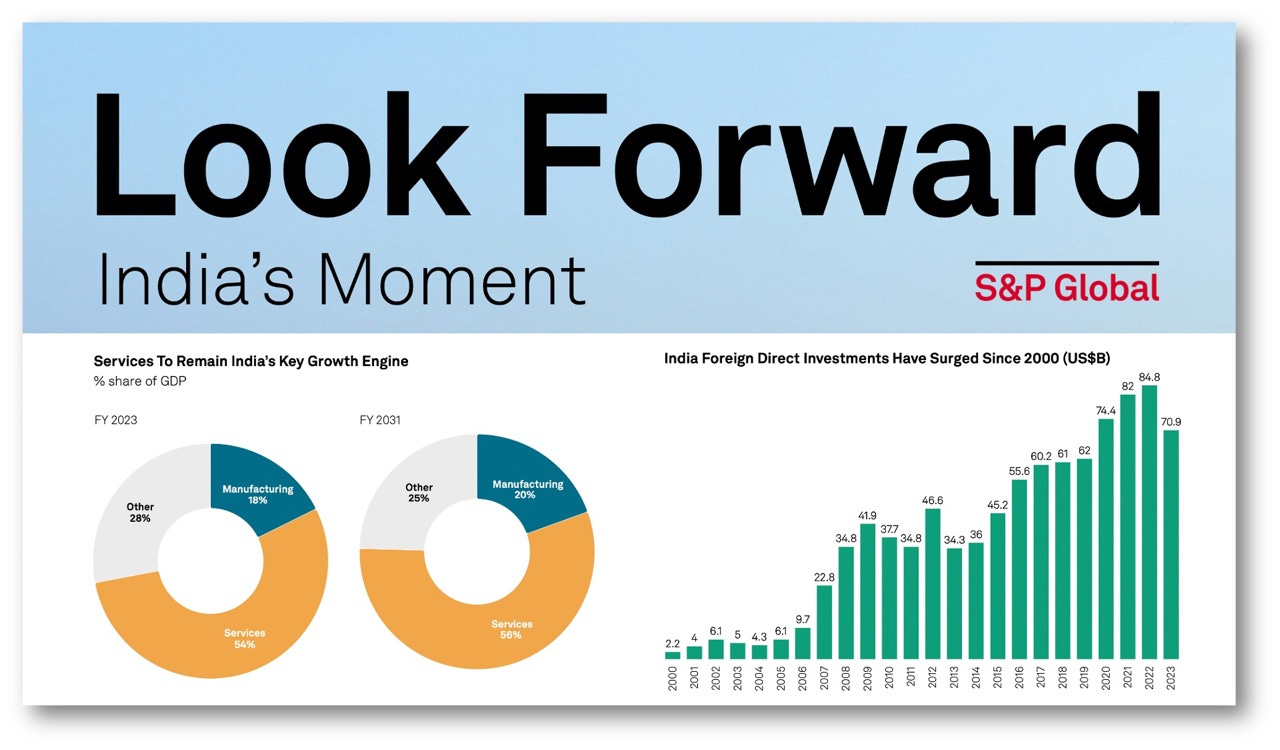

3. India’s moment to shine

This is India’s moment to shine as the pivot to Asia accelerates

India is today’s macro topic! With 1.4 bn inhabitants, 7% GDP growth, record foreign direct investment flows of $84bn, and a consumer market that will double in the next 8 years.

No one can ignore a rising India with growth that will accelerate the world’s pivot to Asia as an economic powerhouse.

S&P provides a great read on India, addressing the challenges of providing quality growth to the world's most populace nation.

Highlights from selected chapters:

✅ High and stable growth:

The macro challenge for India in the upcoming decade is to turn traditionally uneven growth into a high and stable trend. Success will ultimately depend on India’s ability to reap its demographic dividend; increase labor force participation, including upskilling; boost private investment, with structural reforms in land, logistics and labor; and increase competitiveness, driven by foreign direct investment.

✅ Demographic dividend:

India’s short-term economic growth will stand on the shoulders of its 678.6 million strong labor force. The nation’s ambitions to become a global manufacturing hub are closely linked to its ability to upskill workers.

Low skill levels make India’s value added per person employed low, even relative to SE Asian neighbors. Getting more women to enter the workforce will be pivotal for future growth, as only 24% were participating in 2022

✅ Energy transition:

Any path to global net-zero emissions will have to travel through India due to the country’s energy use, which doubled between 2000 and 2020. Consumption per capita is still 1/10th of the US.

✅ Made in India:

India seeks to raise manufacturing to 25% of GDP from 17.7% by 2025. [Due in part to China derisking.]

Developing a strong logistics framework is key to transforming India from a services-dominated economy into a manufacturing-dominant one.

❌ Climate Risks:

A stunning 94% of the GDP and 89% of the population will be impacted by climate change.

Thoughts?

👉TAKEAWAYS:

—India’s growth is a macro trend that cannot be ignored and supports a global economic pivot to Asia.

—Low worker skills and poor logistics are major issues.

—Foxcon closing its chip project shows bumps in the road.

—Foreign investment is pouring in with China de-risking.

4. Polycrisis why we’re in one

Welcome to the Great Unraveling: Polycrisis, what it is, and why we’re in one.

This week we are focusing on macro trends changing our world, some scary, some hopeful.

I aim to step back and see how and where technologies fit in the bigger picture. Today the scariest macro trend of all is a polycrisis and what the Post Carbon Institute refers to as “The Great Unraveling.”

So what is a Polycrisis?

“A global polycrisis occurs when crises in multiple global systems become causally entangled in ways that significantly degrade humanity’s prospects."

So what caused our current polycrisis?

1️⃣ Environmental Unravelling:

This is a big topic, and while Global Warming is top of the list, it isn’t the only environmental issue we’re facing. Biodiversity, soil loss, water scarcity, pollution, and resource depletion all work together. Interlinked, they combine to create a situation where the best we can do is cure small-scale symptoms rather than the illness.

“It is misleading to think of the problems abovementioned problems as isolated glitches in an otherwise functional and sustainable system of humans interacting with nature. They are, rather, indications of systemic failure.”

2️⃣ Social Unraveling:

Poverty and inequality are the primary drivers of social unraveling but are only two among many problems. Add to this racism, authoritarianism, scarcity, and technological change, unraveling the threads that bind us.

"Unfortunately, the general view remains that these are all isolated problems that will be overcome in due course. There is as yet little recognition that these challenges are systemic, entrenched, and interrelated."

3️⃣ What can we do?

"In general, an overarching goal of personal action should be to build resilience—the capacity of a system to encounter disruption and still maintain its basic structure and functions." Resilience means being able to adapt to short-term disruption and long-term change.

Resilience helps maintain social cohesion within societies and peaceful relations during crises to implement the key changes required for collective behavior.

Thoughts?

👉TAKEAWAYS:

—We are in a polycrisis of interwoven social and environmental problems.

—All is not lost, but resilience is required.

—Technology can unify people increasing resilience to polycrisis.

—Does your tech do that?

5. Sanction’s Human Toll

Sanctions aren’t bloodless, and their human toll is shocking.

A shocking 27% of nations and 29% of global GDP is now under US, EU or UN sanctions compared to 4% of nations and less than 4% of GDP in the 60’s.

These are shocking numbers, so much so that this week as I focus on Macro Trends, I’m including sanctions.

Regular readers will know that I always write about sanctions in connection with CBDC, and de-dollarization, two of my favorite topics.

The reality is that I tend to look at sanctions in sterile economic terms and see them as a driver for fintech to either bypass or enforce them. This paper by the Center for Economic and Policy Research puts them in a light that makes them anything but sterile or bloodless.

The paper reviews research on the human impact of sanctions against Iran, Afghanistan, and Venezuela. (If you read nothing else, check out Appendix 1, pg 89)

Some may say that these are bad countries that deserve sanctions. The problem with this is that research shows that economic sanctions are associated with declines in living standards that severely impact the most vulnerable groups in targets.

Sanctions impact the vulnerable, who are the least likely to have an impact on bringing the desired changes sought by the sanctions. Sanctions carpet bomb the wrong target.

Sanctions' impact on life expectancy should give us all pause:

❌UN sanctions: a decrease in life expectancy of 1.2 years for men and 1.4 years for women. US sanctions: 0.4 years for men and 0.5 years for women.

❌A decline in average life expectancy of 0.3 years.

❌Sanctions during pregnancy lead to a decrease of 0.07 stan. dev. in a child’s weight.

❌Under five mortality: a 1 stan. dev. increase in costs leads to a 4 % increase in mortality, while US sanctions lead to a 35% increase.

❌Increased HIV infection rate of children by 2.5% and an increase in AIDS related deaths by 1%

✅ Targeting individuals or institutions rather than entire nations may be a partial solution but increases evasion.

👉TAKEAWAYS:

—Sanctions are a macro trend that will continue despite the human toll.

—Increased mortality rates mean sanctions aren't clean.

—Ironically, fintech is being used to avoid or enforce sanctions.

—I understand that this is heavy reading, but it humanizes sanctions impacts and shows that they are far from “clean.”

My work is entirely supported by reader gratitude, so if you enjoyed this newsletter, please do both of us a favor and subscribe or share it with someone. You can also follow me on Twitter or Linkedin for more.

Everyone, including platforms that disagree with me, has my permission to republish, use or translate any part of this work or anything else I’ve written here on Substack with credit given to me and this site (richturrin.substack.com) For more info on who I am, what I do, and where I’m going, check out richturrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is number 4 on Onalytica's prestigious Top 50 Fintech Influencer list and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon:

Cashless: HERE

Innovation Lab Excellence: HERE