Metaverse and crypto crime has anyone thought this through? CBDCs the holy grail for cross border transfers while crypto never ceases to amaze

Free book: “Big Data and Artificial Intelligence in Digital Finance”

Holiday edition so please be forgiving of the editing and graphics:

1. The Metaverse and crypto crime has anyone thought this through?

2. ECB thinks CBDCs could be the holy grail for cross-border transfers

3. Crypto never ceases to amaze

4. Free book: “Big Data and Artificial Intelligence in Digital Finance”

5. Holiday pics from China’s mountains in Sichuan

1. The Metaverse and crypto crime has anyone thought this through?

The Metaverse, crypto, and crime, why have so few really thought this through beyond the hype?

Three main stories today make me wonder if the metaverse is going to be the crypto haven that crypto proponents envision:

1️⃣ The Future of Financial Crime in the Metaverse (PDF)

This report by Elliptic does a fabulous job of outlining our new world of financial crime on the Metaverse. Far from being a place of peace and universal harmony we can expect that human nature will prevail to make it a place where money laundering, wash trading, scams, terrorism funding, code exploits, illegal shops, and sex crimes will be the norm.

Thinking that these “facts of life” will suddenly disappear is delusional. But still many hold on to the dream.

Download the report: here

2️⃣ Metaverse and systemic risks

A blog post by The Bank of England also asks fundamental questions about the metaverse’s impact to the financial system. Stating: “The importance of cryptoassets in the open-metaverse means that if an open and decentralized metaverse grows, existing risks from cryptoassets may scale to have systemic financial stability consequences.” Unsurprisingly the BOE believes that: “An important step is therefore for regulators to address risks from cryptoassets’ use in the metaverse before they reach systemic status.”

Clear enough? (https://bit.ly/3dqS8a4)

3️⃣ Tornado Cash’s $7bn in laundered money

In March the Tornado Cash CEO told Bloomberg it would be “technically impossible” for sanctions to be enforced against decentralized protocols.

Famous last words!

With all US citizens and entities banned from using its services, its website and email down, Tornado coin (TORN) down 95%, stablecoin Circle banning transactions with the site, and its open source code pulled off Github it would seem the US gov’t, like them or not, has done a good job of sanctioning them.

With the sanctions on Tornado, it's clear that the metaverse will not be a cash transfer “free for all” and that the metaverse will also be subject to similar scrutiny. (https://bit.ly/3JMzWUG)

Takeaway

Crime doesn’t pay, and the metaverse and its cousin Web 3 are by no means doomed. Both have great potential to be transformative technologies, but what is clear is that no gov’t is going to allow cash transfer without oversite. So why keep up the false advertising?

It won’t be enough for crypto users to “pinkie swear” that they will pay taxes and not participate in unlawful activities. Could it be that CBDCs, which get no love from crypto circles, just might be a perfect solution for the metaverse?

This matters if you use public services, pay your taxes, and believe that gov't has a role to play in limiting criminal activity in real and virtual worlds.

2. ECB thinks CBDCs could be the holy grail for cross-border transfers

Who can resist the reference to Monty Python? Link to the ECB report: here

The ECB thinks CBDCs have the best chances of being the holy grail of cross-border payments, while Bitcoin fails and stablecoins are met with skepticism.

What is the "holy grail":

The holy grail of cross-border payments is a solution that allows cross-border payments to be

(1) immediate,

(2) cheap,

(3) universal, in the sense of covering ideally every addressable party in the world, and

(4) settled in a secure settlement medium, such as central bank money (crypto fans will not be amused by this obvious bias!)

CBDC is the winner:

The review of various visions as to how to achieve the holy grail suggests that Bitcoin is the least credible; stablecoins, traditional correspondent banking, and cross-border Fintechs take an intermediary place, but may all contribute to improvement over the next years.

From a public policy perspective, stablecoins appear somewhat more problematic than the other two options as they aim at deep closed-loop solutions, market power, and fragmentation.

Two solutions – the interlinking of domestic instant payment systems and future CBDCs, both with a competitive FX conversion layer (Note: these are the BIS mCBDC and Partior projects)– may have the highest potential to deliver the holy grail for larger cross-border payment corridors as they combine

(i) technical feasibility;

(ii) relative simplicity in their architecture; and

(iii) maintaining a competitive and open architecture by avoiding the dominance of a small number of market participants who would eventually exploit their market power.

Unsurprisingly the ECB likes the BIS's cross-border solutions!

As to the ECBs concerns about stablecoin's ability to create walled gardens, I believe that following China's experience with WeChat and Alipay these concerns are justifiable but need not preclude their use.

I think that the ECB is being overly harsh with its take on stablecoins and that they have an important role to play in providing CBDCs with a competitor!

CBDC should compete with stablecoins in the cross-border transfer market to enhance innovation and ensure the lowest pricing.

As I like to say: "stablecoins will help keep CBDCs honest." Even if I believe them to be an inferior means of payment when compared to CBDCs.

3. Crypto never ceases to amaze

Warhol in Astonishment, Hyung Koo Kang, 2010

Crypto just never ceases to amaze, three articles that caught my eye while on holiday show that “fake it till you make it” is the norm.

1) Solana: “fake it till you make it!”

Great read by David Morris at CoinDesk on how Solana faked its numbers! What never ceases to amuse me about crypto is that for all of the talk about being free of gov’t oversight it is precisely the lack of oversight that causes it to suffer the most. It’s not just me saying this, a host of crypto visionaries like Vitalik Buterin and MIchael Saylor are all calling for regulation to reign in the abuse.

Solana setting up fake Twitter accounts and double or triple counting dollar flows on the network is a must-read. What makes it so amazing is how easy it was and how even the slightest bit of oversight would have uncovered the deception.

Thoughts:

i) Why are crypto fans so gullible? Why do they believe everything they see on Twitter?

ii) Calls for self-regulation are not going to stop the outright deceptions of Solana and Terra-Luna

iii) What role should the crypto media have played in questioning Solana’s explosive growth?

2) Bridges to nowhere

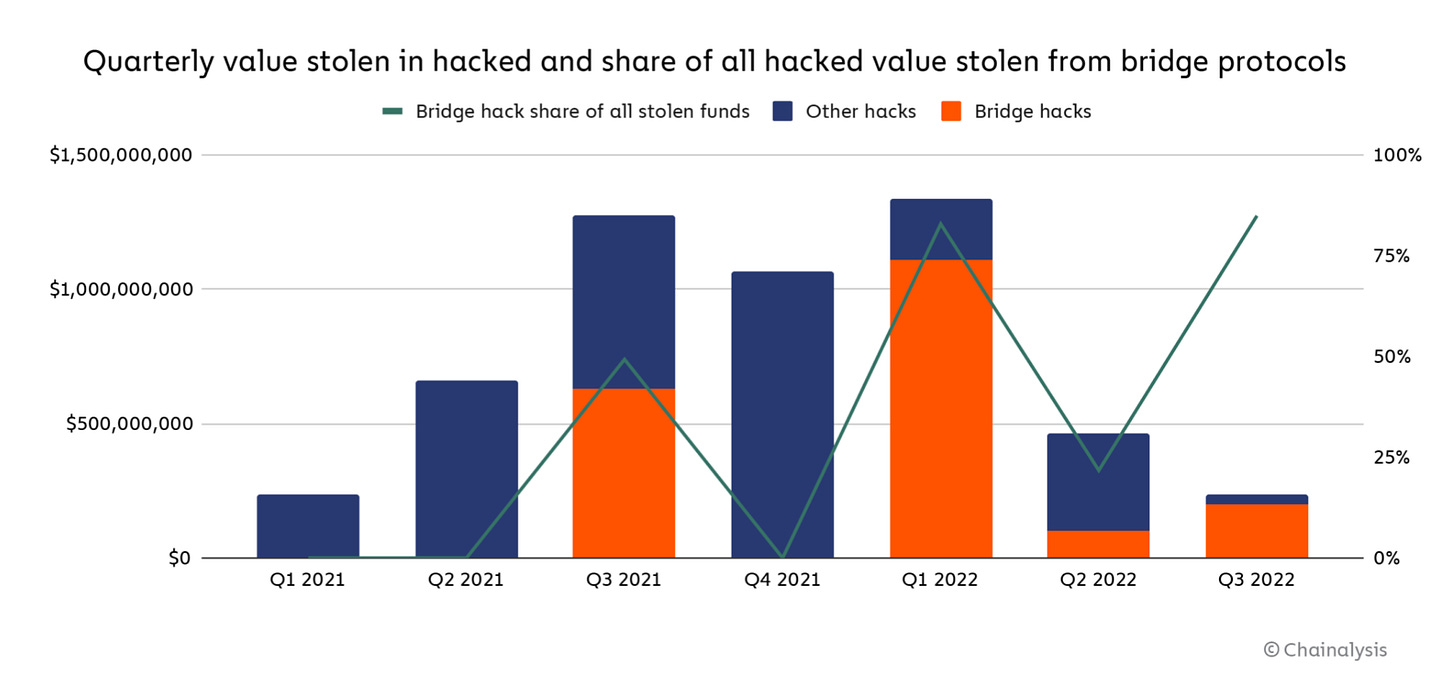

Chainalysis estimates that $2B was stolen from cross-chain bridge hacks this year. And with an additional $190 mn from the Nomad hack the numbers just keep going up giving a black eye to DeFi and the entire bridge system.

Chainalysis estimates that $2 billion in cryptocurrency has been stolen across 13 separate cross-chain bridge hacks, the majority of which was stolen this year. Attacks on bridges account for 69% of total funds stolen in 2022 so far.

Thoughts:

i) Is this really the financial system of the future?

ii) Web3 and the metaverse are supposed to be built on these bridges. Do you have any faith this will work?

iii) A few months back Fed CBDC proponent suggested that in lieu of bridges crypto could use CBDC as a stable intermediary, do you think anyone in crypto will listen, or will the madness continue?

3) Ethereum miners want to keep their hand in the till

Ethereum mining is a $19bn fraud-filled industry that simply doesn’t want to go away with the switch to energy-efficient "proof of stake" Ether 2.0. Unsurprisingly they aren’t going to go away quietly with “the merge” and will work with other protocols to keep their mining equipment going. https://yhoo.it/3bCKGrY

What this means:

i) Ether 2.0 energy savings will be overstated if the miners simply switch to other protocols.

ii) Ether 2.0 is no done deal, though I genuinely want it to succeed.

iii) Miners are not nice guys, in fact, I think they’re crooks. They’ve had their hand in the till for a long time and want to keep it there as outlined by the BIS here, (https://bit.ly/3zIYVDJ) and new research here (https://bit.ly/3vSFTcP)

4. Free book: “Big Data and Artificial Intelligence in Digital Finance”

Please note that this book is “open access” meaning that it is not copywrited material. As a fellow author I am sensitive to this as both of my books have been stolen and placed on pirate book sites! Download: here

“Big Data and Artificial Intelligence in Digital Finance” is a fabulous new “open access” book by John Soldatos and Dimosthenis Kyriazis that focuses on “Increasing Personalization and Trust in Digital Finance using Big Data and AI.”

This book is comprised of chapters written by collaborating authors, all are different and you will find that the technical level varies. Some chapters are clearly written for data experts, and I encourage readers to skim through the chapters to find material that is written at a level that suits them.

5. Holiday pics from China’s mountains in Sichuan

I couldn’t resist throwing in a few holiday pics from the mountains of Sichuan. Nature in China is something that most don’t think of but it’s absolutely gorgeous, though I confess hard to access when compared to trips to Shanghai or Beijing.

More of my writing, podcasts, and media appearances here on RichTurrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is an Onalytica Top 100 Fintech Influencer and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my best sellers on Amazon: