Mojaloop: Digital Payments For Everyone Through Digital Public Infrastructure

Mojaloop is open source and brings digital sovereignty over payment systems.

Mojaloop isn’t just talking about financial inclusion but actually doing it with projects in Mexico, the Philippines, Rwanda, and the COMESA region.

In this “inaugural report,” Mojaloop explains what it does and why you need to know about it!

Majaloop brings financial inclusion by providing “digital public infrastructure” at scale.

Similar to UPI, it is a real-time payment switch that allows private sector service providers to provide instant payment clearing.

In short, banks can build instant payment systems on top of “Mojaloop Hub”, just like banks in India built instant payment systems on top of UPI.

But the real magic of Majaloop is that developing nations can own their national payment infrastructure!!

The software is open source (free) and originally developed with funding from The Bill & Melinda Gates Foundation.

👉TAKEAWAYS

🔹 Mojaloop ticks all of the boxes: financial inclusion, open-source, digital public infrastructure, public good, and free or near-free payments!

🔹 National Mojaloop deployments in progress in Rwanda, Mexico, and the Philippines and a regional deployment across the Common Market for Eastern and Southern Africa (COMESA)

🔹 The launch of the Mojaloop Accelerator Program, a program designed to build the skills and capacity of local system integrator teams

🔹 Active Proofs of Concept (POC) and implementations underway in five countries

🔹 The establishment of the Mojaloop Foundation Product Council as well as new engineering and go-to-market teams

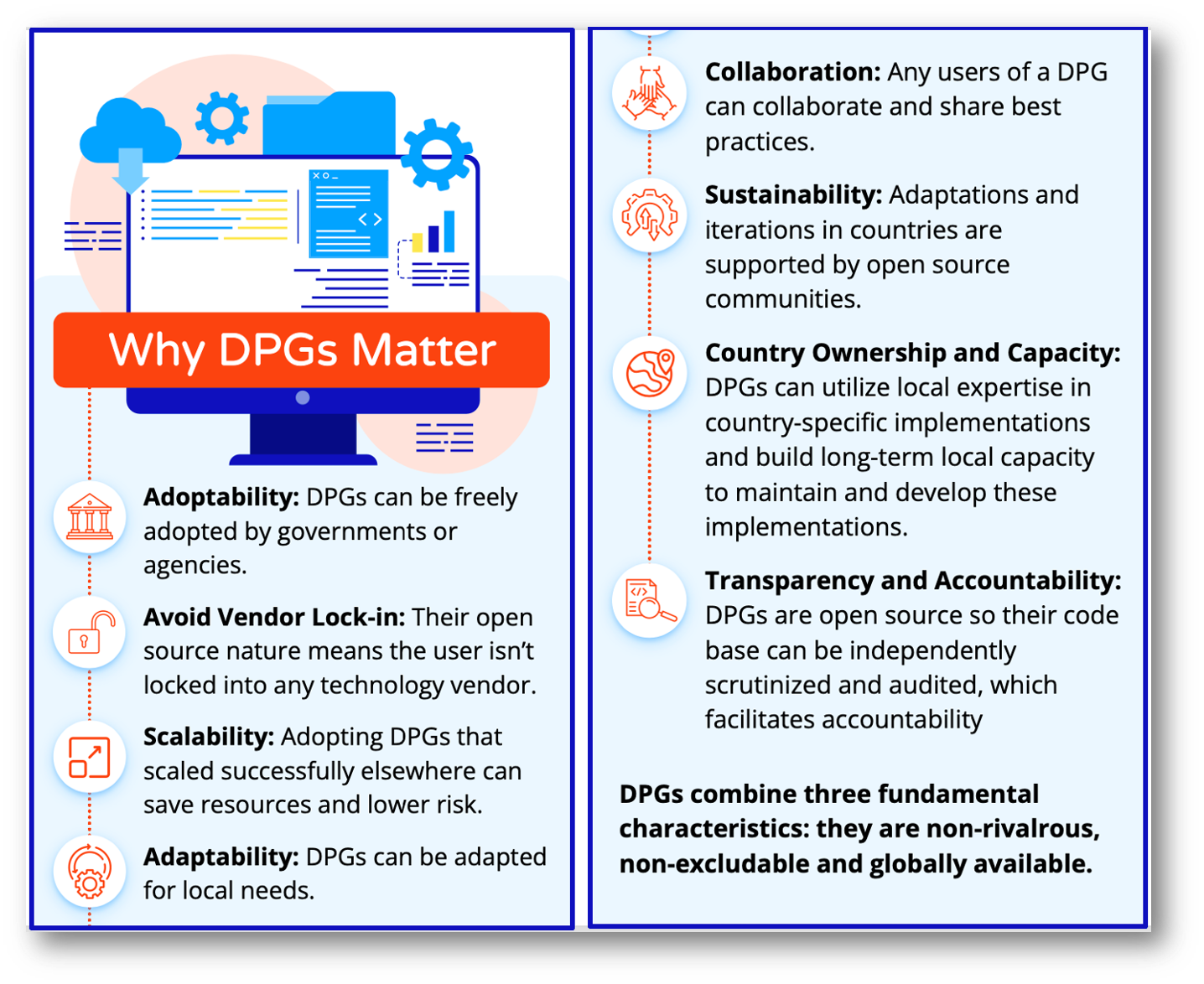

Digital Public Goods (DPGs) are “open-source software, open standards, open data, open AI systems, and open content collections that adhere to privacy and other applicable laws and best practices, do no harm, and help attain...Sustainable Development Goals (SDGs).”

👊STRAIGHT TALK👊

Digital Public Infrastructure through free, open-source software like Mojaloop is the key to financial inclusion in the developing world.

When discussing digital payments and financial inclusion, the conversation always turns to which Silicon Valley-funded payment company will become a unicorn in Africa.

Sadly, there is less talk about the government systems required to bring Real-Time Payment to life!

Digital public infrastructure plays a key role in this, and the success of payment systems in India and China proves that public infrastructure has a key role.

Majaloop gives developing nations digital sovereignty over their digital payment systems, this can’t be emphasized enough.

This is not Visa or Mastercard coming in and providing better card access over which the state has no control over data or sanctions.

These systems belong to the nation using them and are, at their core, designed to protect citizens and the state from foreign intervention.

Majaloop is important, and we'll hear more about their system being adopted soon!

Thoughts?