Navigating the Future of Banking: How Tokenization Drives Institutional DeFi

Tokenization comes first, banks shouldn't put the cart before the horse.

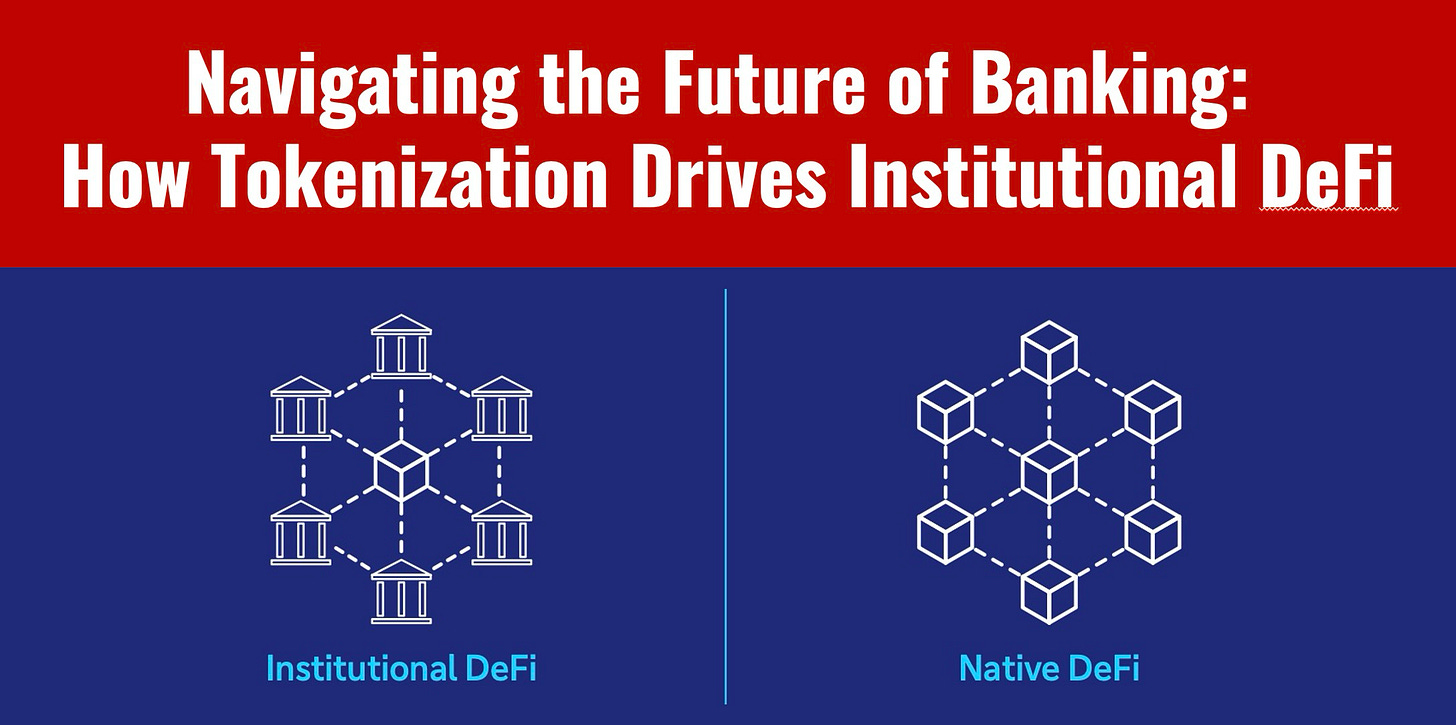

Institutional DeFi is coming and will be a natural step following the broader adoption of tokenized assets.

It’s easy to get confused between DeFi and tokenization, as both buzzwords compete for banks’ attention. However, as of late, tokenization is clearly winning the battle.

Frankly, that’s good and shows banks are not putting the cart before the horse. Banks need tokenized assets before they launch their DeFi programs.

Institutional DeFi will only take hold once banks have regulated assets, even though it likely could work tomorrow with crypto, stablecoins and existing digital assets, but banks won’t take the risk.

It's important to understand that Institutional DeFi is not the same as crypto DeFi. It will likely take place on private blockchain networks run by banks, with transactions between regulated entities.

The report shows three great use cases, which are fine but miss the most obvious use case I cover below

👉TAKEAWAYS

Potential use cases:

Interoperability,

Smart-contract based bridges that connect different blockchains to allow interoperability and avoid fragmentation by choice of blockchains. Linking public, public permissioned and private networks to minimise fragmentation while allowing a high degree of access and participation.

Refinancing tokenised financial instruments with stablecoin

DeFI systems can also be utilised for traditional industry's financing, albeit not at scale just yet. For example, security tokens representing some real-world financial instruments can be placed into a smart contract "vault" as collaterals against stablecoins that are then received and converted into fiat currency.

Tokenised fund in asset management

Distribution of the tokenised fund units or tokens can occur over the blockchain for direct accessibility by suitably qualified investors, with Investor records first maintained on-chain while smart contract based facilities allow faster or near-instantaneous subscription and redemptions using regulated stablecoins. As a further step, the tokenised fund unit, which represents hiqh-quality liquid traditional financial instruments, can act as collateral.

👊STRAIGHT TALK👊

The use cases covered in the report are fine but miss the reality that the first tokenized asset that banks will work with is likely money.

Whether the DeFi system works with stablecoins or CBDCs will be decided in the future, but this is likely to be the defining use of this Institutional DeFi technology.

And why not?

DeFi made its name in the crypto world through exchanges with pre-programmed rules that allowed for the immediate conversion of one crypto to another, why not do the same with digital money?

The market for a DeFi foreign exchange is massive, and banks will welcome the day when these markets never sleep.

The paper makes a case for public blockchain to become the de-facto utility platform for banking. I disagree.

I can’t see bank risk managers allowing major transaction portals to reside on decentralized networks. JP Morgan agrees, and its Onyx network, while Ethereum-based, is private.

Banks aren’t putting the cart before the horse. They’ll go for institutional DeFi, but only after banks have tokenized regulated assets.

Thoughts?

More on DeFi here:

Permissioned DeFi for cross-border transfers is coming, but wholesale CBDC and Deposit Tokens will be first to market.

Permissioned DeFi is fabulous tech, its adoption will depend on who runs the blockchain network. The full article from BCG can be viewed: here

You made it all the way down here! Subscribe now, these six benefits are waiting for you:

Don’t get left behind: Get the expert insights on Central Bank Digital Currencies (CBDC), AI, Payments, and Financial Inclusion, that you need to stay ahead of the curve, all delivered directly to your inbox weekly;

See the future: Profit from a unique point of view directly from Asia that focuses on how the region is “leapfrogging” the West and showing us the future;

Be independent: My message doesn’t follow corporate diktats it’s a message that’s often controversial and does not conform with mainstream outlets;

Be prepared: CBDCs are no longer theoretical but coming soon, so keep up with the latest developments on the digital euro, yuan, sterling and dollar;

Understand AI: In-depth analysis of how our AI revolution impacts finance and will change how we interact with financial services.

Trust: My writing is trusted by over 50,000 executives, innovators, investors, policymakers, journalists, academics, and open-minded crypto hodlers daily

Subscribing is free, but I am honored by readers volunteering to opt for a paid subscription to recognize my high-quality writing. Thank you!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!