NEOBANKS AND CBDCs IN THE NEWS: AI & Neobanks perfect together or throwing clients to the dogs with chatbots? CBDCs: 24 in use in 10 years, What we learnt, Cybersecurity

NEOBANKS

1. Neobanks and AI perfect together?

2. Chatbots could throw neobank customers to the dogs!

THE BIS PUTS CBDCS IN THE NEWS!

3. CBDCs: 24 in use within 10 years?

4. CBDCs: What have we learnt?

5. CBDC cybersecurity learning from DeFi’s hacks.

Today’s artwork: I just couldn’t resist using Dall-E to see exactly what a bank customer being thrown to the dogs would look like! Now we all know!

Back in Shanghai, and as you can see, the length of the newsletter is back up to “normal.” Not sure tonight’s editing will be much better than my holiday editions.

I am proud to be the No. 4 global fintech influencer on the prestigious Onalytica influencer list. I got there by writing solid articles that people like you want to read. This is the place if you want crystal clear, hype-free discussion on all CBDCs, fintech, crypto, and China’s tech scene. All my writing is backed up by my curation of the very best educational PDFs in the business. Subscribe, and you’ll be glad you did!

NEOBANKS

A double header! McKinsey claims AI will be neobanks’ savior, while the Consumer Finance Protection Bureau clarifies that chatbots will have to become much smarter to save them!

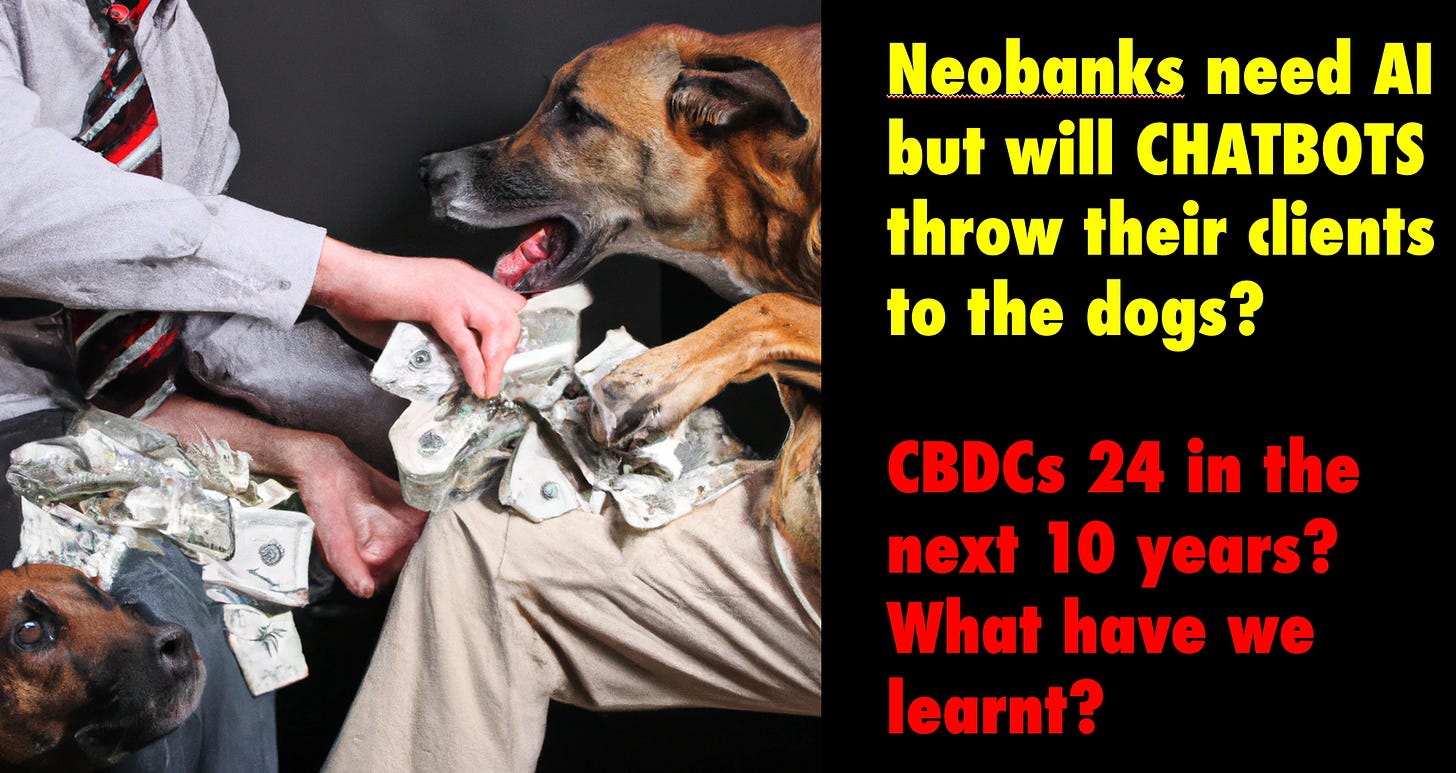

1. Neobanks and AI perfect together?

Neobanks and AI a match made in heaven if the neobanks aren’t already on the highway to hell.

See the full report: here

Mckinsey weighs in on neobanks and makes it clear that, whether profitable or not, they are disrupting the global financial services industry. Who can dispute this?

Love them or hate them, all eyes are on neobanks to see what they’ll do next, and with AI in the news, you can bet that it's the next big thing for neobanks!

Neobanks have been in the news for all the wrong reasons. Most of their valuations have collapsed due to “shifting investor perceptions on the neobanks’ valuation drivers,” and their profitability is, with some exceptions, nothing short of abysmal.

Still, with over 400 launches of licensed neobanks in the last decade, they aren’t going anywhere. With incumbent banks and big tech digital platforms now launching neobanks, it’s clear that the pool of competitors is bigger and deeper than ever.

This brings us to AI, which McKinsey considers vital to neobanks' strategy:

“The real challenge for neobanks today is how to strengthen that competitive advantage by capturing a higher share of consumers’ wallets and generate material profits. The answer, to a large degree, lies in embedding data and AI capabilities extensively across all aspects of neobanks’ operations.”

So there you have it, the magical connection with AI that will “increase the odds” of success for neobanks.

👉If it sounds weak, facile, or improbable, you’re right, it is. Neobanks will likely be early AI adopters, but if they are on the “highway to hell” with no profits all of the AI in the world won’t save them. 👈

Neobank’s best-differentiating characteristics are speed to market and customer focus, which will make setting-up AI the ultimate “Hail Mary” play for many neobanks.

AI adoption will likely save some neobanks and, in the process, teach incumbents "how it's done! Not all.

Love 'em or hate 'em, neobanks are still the ones to follow!

Thoughts?

👉Takeaways:

—Neobanks aren’t going away and are perfect platforms for AI adoption

—AI is hardly a winning neobank strategy. Adding chatbots might save a few, but not all.

—Some neobanks are on “the highway to profitless hell,” and AI can't save them no matter how good.

—Love ‘em or hate ‘em, neobanks are still the ones to watch.

—Can AI help them pull a rabbit out of their hat?

Hey you, yeah you! Subscribe!

I know you want to…..

2. Chatbots could throw neobank customers to the dogs!

Chatbots unleashed are already throwing bank customers to the dogs! Will it get even worse?

Download: here

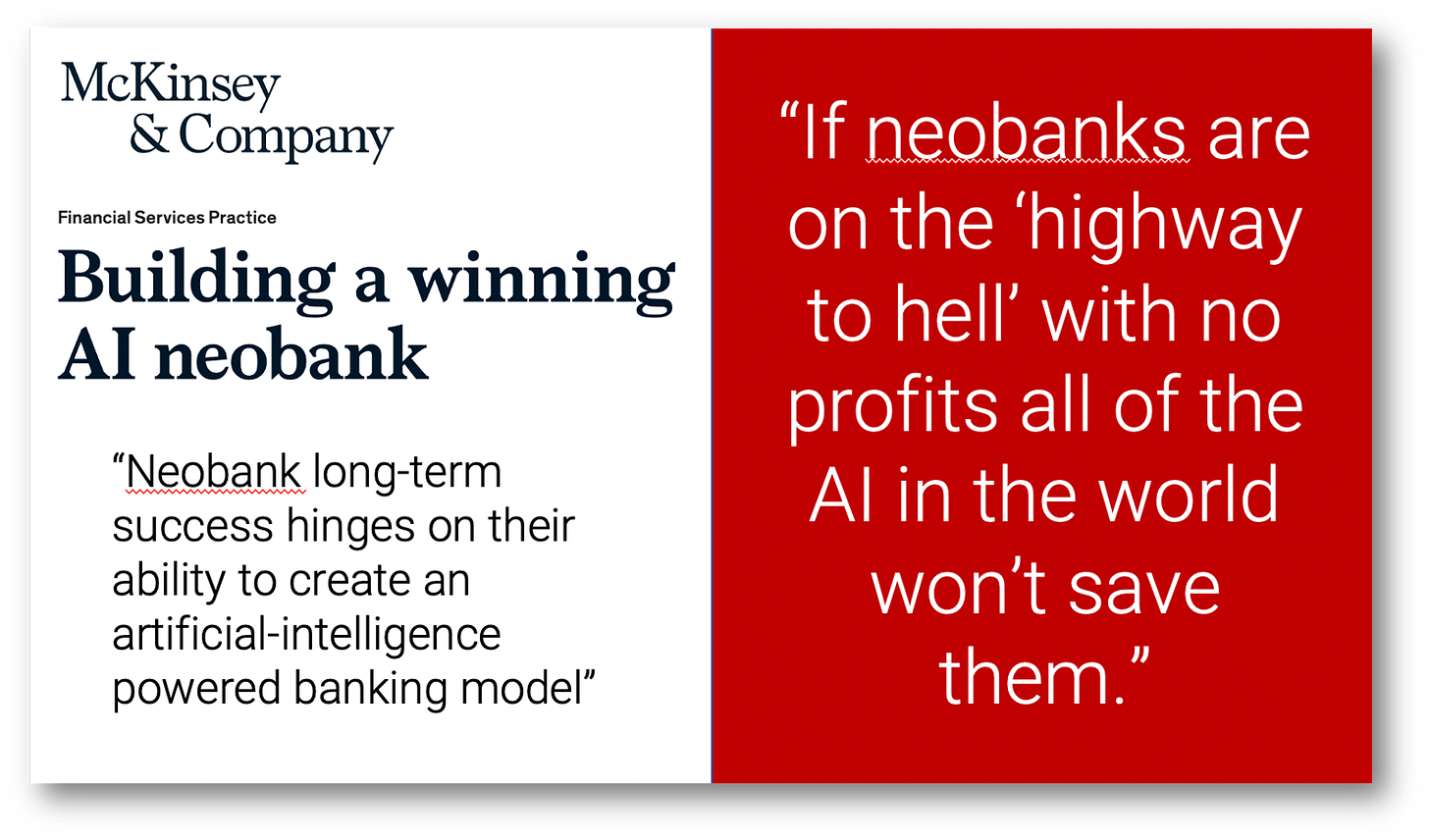

The Consumer Finance Protection Bureau (CFPB) looked at US bank customer service chatbots and found that the norm was:

❌“wasted time, feeling stuck and frustrated, receiving inaccurate information, and paying more in junk fees.”❌

This does not bode well for banks' use of chatbot technology, and they risk “violating legal obligations, eroding customer trust, and causing consumer harm.”

Chatbots are everywhere

🟢 To show how pervasive chatbots are, the CFPB claims that a full 37% of the US population engaged with a bank’s chatbot in 2022, and all of the US top 10 banks have them deployed at scale.

While ChatGPT and the latest generation of chatbots promise more detailed and natural customer service, much will depend on how they are deployed. Will they simply be better at generating more “junk fees?”

My experience

🟠 Perhaps your experience was like mine using DBS Singapore’s chatbot a few months back. I was elated when it did a few credit card services perfectly, was unsurprised when it had no idea what I wanted on other inquiries, then shocked when it tried to upsell me on bank services.

Causing harm

🔴 The CFPB makes it clear that chatbots “risk harming people:”

“Providing inaccurate information regarding a consumer financial product or service, for example, could be catastrophic. It could lead to the assessment of inappropriate fees, which in turn could lead to worse outcomes such as default, resulting in the customer selecting an inferior option or consumer financial product, or other harms.”

The CFPB is correct in its assessment and the seriousness of the situation. The potential for harm is real and will worsen as chatbots become more pervasive.

In 2018 in one of my first LinkedIn articles on Chatbots I wrote something that still rings true today:

"Take pity on the customers who find themselves in chatbot hell by providing an escape route to human intervention –before they start to hate the chatbot."

Thoughts?

👉Takeaways:

—The CFPB shows that chatbots are not excelling at replacing human customer service.

—Newer generations of chatbots may be smarter, but that intelligence may be put to work upselling clients.

—I like chatbots, provided I know that human intervention is readily available. Sadly this is increasingly unlikely.

Subscibe! It’s the best way for you to stay up-to-date!

THE BIS PUTS CBDCS IN THE NEWS!

No less than three fabulous CBDC publications by the BIS this week as they review where they’re going, what their research thought them and how to make them secure!

3. CBDCs: 24 in use within 10 years?

CBDCs may be used by 24 Countries within 10 years, and the world will change.

Download: here

Let’s talk candidly about the future for a moment. We’re in the middle of a pervasive societal digital transformation with the daily news of breathtaking advances in AI, making the prospect of a digital cash revolution seem tame by comparison.

✅ Our world is fundamentally changing.

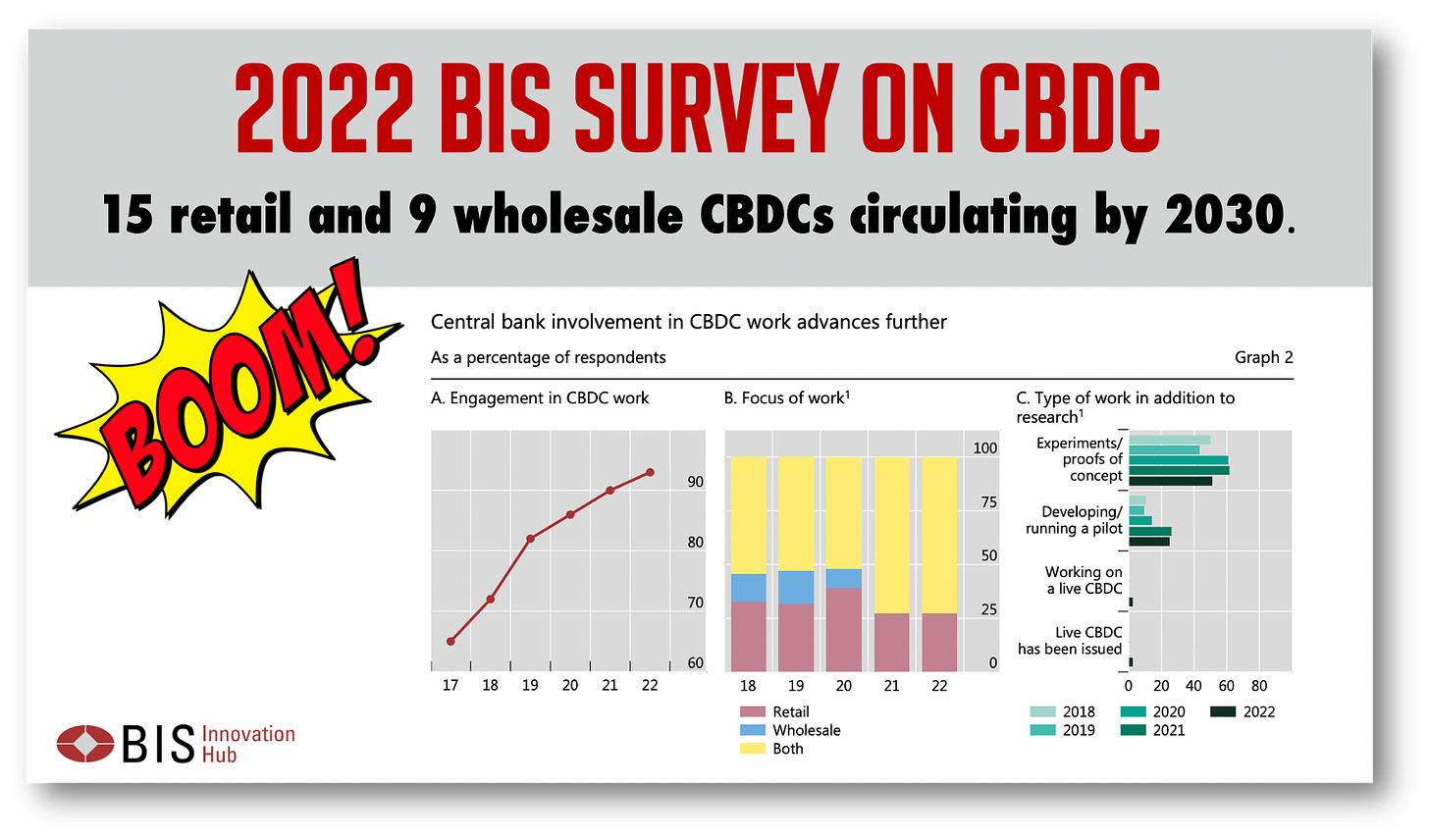

The BIS makes this very clear. With 93% of 86 central banks surveyed in 2022, engaged in CBDC work, the status quo in payments is over.

The survey represents 94% of global economic output and 82% of the world’s population. So no nation will avoid the changes to the payment systems that are to come.

✅ Emerging markets in the lead

Notably, with CBDCs, emerging markets are in the lead, with 28 respondents in advanced economies and 58 in emerging and developing markets (EMDEs).

This is driven primarily by the hope for greater inclusion and increased efficiency in domestic payments, which EMDEs desperately lack.

✅ CBDC, fast payments or both?

Graph 6, pg 8, shows that most central banks see the benefits of having both a fast payment system AND CBDC. Showing how it’s not one or the other but both. This is fundamentally good for consumers. The more convenient payment options you have, the better, and the lower the fees will be.

✅ One change to note:

This year’s survey makes it clear that developed economies are not looking to influence monetary policy with CBDC (graph 4, pg 6).

That is a clear signal that central banks have intend to keep cash around, as you can’t manage policy unless everyone is holding CBDC. Using CBDC to manage monetary policy was always more academic than practical.

❌ Fear merchants

Throughout these changes, there will be those that profit from selling fear. Generative AI is unquestionably the best example. No sooner did GenAI hit the news stream this year than the predictions of humanity's demise started. It’s an industry. Fear sells.

So too, with CBDC. The cries that gov’t is coming for your money are in the news daily. Most misrepresent the state of CBDC design and don’t care. Stoking fear through clickbait headlines is a business, but the world still changes.

Thoughts?

Takeaways:

—CBDCs are coming, no nation will be untouched.

—Emerging markets will lead the transition.

—Don't like CBDC? Use fast payments or cash. Choice is good.

—There will be geopolitical changes to match, the BIS doesn’t touch on this, but they are coming.

Reverse psychology? Don’t subscribe and miss out!

4. CBDCs: What have we learnt?

What have we LEARNT about CBDCs? Easy, they are desirable, viable and feasible!

Download: here

The BIS is on a roll with a GREAT paper that examines their CBDC research and tries to tease out what they’ve learned.

I'll make it easy for you. CBDCs work! That isn't to say they're ready to go tomorrow, they aren't, but they will be soon.

To break their assessment down, the BIS looks at three specific types of CBDC and assesses desirability, viability, and feasibility for each.

1️⃣ Wholesale domestic CBDC:

↳Desirability: As financial institutions and market infrastructures move towards tokenised securities introducing a wCBDC will be a core competency.

↳Feasibility: Two POCs called “Project Helvetia” settled tokenised assets in central bank money and were shown to be feasible in a near-live setting.

↳Viability: That the SNB is taking forward the Helvetia investigation shows that the project is viable.

2️⃣ Retail domestic CBDC

↳Desirability: Here proponents and opponents are fiercely divided. Proponents point to the benefits: financial inclusion, cross-border payments, payment efficiency, safety and innovation. Opponents point to fears of a surveillance state. You pick!

↳Feasibility: The BIS hasn’t built an rCBDC but has assembled and tested the pieces through projects Aurum, Sela, Rosalind, Polaris, and Tourbillon. The pieces work but must be aggregated to build an rCBDC.

↳Viability: So far, with only 4 rCBDCs issued and major pilots in India and China, there is no consensus on viability. What we do know is that fast payment systems are very successful.

3️⃣ Cross-border CBDC

↳Desirability: "Better and cheaper cross-border transactions are universally desirable."

↳Feasibility: The BIS concluded 5 POCs: Jura, Dunbar, mBridge, Icebreaker, and Mariana. Every experiment showed that a multiple-wCBDC platform is operationally

feasible.

↳Viability: Although systems with multiple CBDCs are technically feasible, further work is needed on policy, legal and regulatory, governance, and economic issues.

Thoughts?

👉Takeaways:

— In all cases, CBDC outcomes are desirable, which is why central banks pursue them!

—The technology can deliver and is feasible, but legal and regulatory issues remain daunting.

—Many of the BIS’s projects are viewed as viable and taken over by the sponsoring central bank.

—What the projects are worth in dollars is anyone’s guess!

Hey, if you made it this far, you owe it to yourself to click subscribe!

5. CBDC cybersecurity learning from DeFi’s hacks.

Download: here

CBDC cybersecurity is critical so the BIS turns to the experts, DeFi, to learn what NOT to do.

I would be lying if I told you that CBDCs won’t be hacked! They will, and the hackers will include everyone from pros like state-sponsored attackers and professionally organized crime syndicates to your neighborhood teenager.

If we learned anything from DeFi, it’s that everyone is going to take a crack at your network.

The BIS gets that central banks aren’t used to “developing and updating mass market products and serving retail consumers” and provides Polaris as a matrix of best practice protocols.

The Polaris framework "addresses CBDC cybersecurity concerns with a CBDC-focused framework that leverages existing industry standards and guidelines, providing a seven-step model for secure and resilient CBDC systems."

CBDCs have another problem that DeFi does not. The potential for attacks with CBDCs is much broader than within DeFi, which has the dubious distinction of being widely hacked.

CBDCs will be built into IoT devices like consumer smartphones, smart TVs, and wearables up to industrial components. Each with unique security issues making security a bear!

🔥Should this scare you?

Not at all!

There are already examples of payment networks like India’s UPI and China’s WeChat and Alipay that operate in populace tech-savvy nations with low amounts of hacking. CBDC will be no different!

An unhackable CBDC is not realistic, but minimal hacking is attainable. We accept this trade-off with card networks daily.

Polaris’ seven steps:

1️⃣ Prepare

Assess central bank readiness for implementing and operating a secure and resilient CBDC system.

2️⃣ Identify

Identify the information assets, systems, and networks used for CBDC systems and external dependencies that must be protected.

3️⃣ Protect

Objectives to protect the CBDC system against and mitigate the impact of security and resilience incidents.

4️⃣ Detect

Incidents should be expected to happen.

5️⃣ Respond

Central banks should have a dedicated incident response team with clear roles and responsibilities.

6️⃣ Recover

This step is about restoring impacted services to normal operations.

7️⃣ Adapt

Adjust CBDC operational parameters.

Thoughts?

Takeaways:

—It’s not if CBDC networks will be hacked, but when.

—BIS 7-step model will help but not avoid hacking.

—CBDC builders should take inspiration from India and China whose payment networks have minimal hacking.

—State-sponsored attacks are what worry me the most!

Subscribing is the only logical course of action.

And share with your colleagues because:

"The needs of the many outweigh the needs of the few or the one."

Subscribed

My work is entirely supported by reader gratitude, so if you enjoyed this newsletter, please do both of us a favor and subscribe or share it with someone. You can also follow me on Twitter or Linkedin for more. The best way to ensure you see the stuff I publish is to subscribe to the mailing list here on Substack, which will get you an email notification for everything I post.

Everyone, including platforms that disagree with me, has my permission to republish, use or translate any part of this work or anything else I’ve written (except my books) with credit given to me and this site (richturrin.substack.com) free of charge. For more info on who I am, what I do, and where I’m going, check out richturrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is number 4 on Onalytica's prestigious Top 50 Fintech Influencer list and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon:

Cashless: HERE

Innovation Lab Excellence: HERE