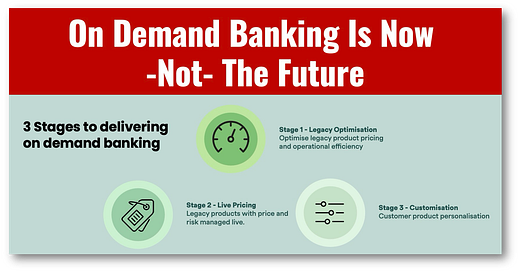

On Demand Banking Is Now -Not- The Future

Customers are tired of waiting for the bank to get back to you

This is my daily post. I write daily, but send my newsletter to your email only on Sundays. Go HERE to see my past newsletters.

HAND-CURATED FOR YOU

With all the talk of AI and agentic services for banking, there is little recognition of the end goal: "on demand” banking.

On demand means digital banking products and services available 24/7, with banks ready to give you the price when you want it.

That’s the “end-game” of all the digitalization that is sweeping the banking world. The provision of banking services on the spot, not “one-size-fits-all” products, but personalized products built with customer input.

Alipay made the first online, digitally underwritten loans back in 2016. While they were simple, cookie-cutter loans, that was a decade ago. By now, Western banks should be ready to provide digital services for more complicated products, but where are they?

The reality is that between AI, credit ratings, open banking APIs, and big data, there isn’t much that the bank doesn’t know about you. Most banking products, like home or car loans, are simple to price and have limited options.

The irony is that banks that lack the vision to pursue on-demand banking are losing out. Estimates are that early adoption banks can attract a 30% higher volume of business at ~12bps wider margins.

This isn’t some pipe dream for a distant future, it’s now.

If banks don’t understand that this is where their fancy new GenAI systems are taking them, they are more clueless than I thought.

👉On Demand Banking Benefits:

➢ Customers can pick their loan:

🔹 How long to borrow or save for. Getting a lower interest rate than on the market today or one that best suits their needs.

🔹 When to fix the interest rate. Getting a new opportunity to see interest rates not on the market today.

🔹 A product that reflects how much they want to borrow. Getting an interest rate that reflects their specific risk (LTV) profile.

➢ Banks also gain:

🔹 Growing market share as live pricing results in a higher probability of being the best lending or saving rate on the market at the same or wider margin.

🔹 Reducing interest rate risk due to the removal of the necessity to provide a fixed customer price for several weeks.

🔹 Wider margins due to selling bespoke products and an ability to increase margins when input costs (wholesale interest rates) move in the bank’s favour.

🔹 Lower operating costs through automation and better management of operational underwriting capacity.

🔹 Lower regulatory risk as customers get the loan they need with greater transparency.