(Part 1 of 2) India's UPI Revolution: DPI is the Future of Inclusion

Digital public infrastructure (DPI) makes big strides in financial inclusion

This is my daily post. I write daily but send my newsletter to your email only on Sundays. Go HERE to see my past newsletters.

HAND-CURATED FOR YOU

This is one of the best reports I’ve ever seen on financial inclusion. It compares India’s success with that of China and Brazil and asks what more can be done.

For context, understand that India’s use of digital public infrastructure (DPI) has already brought financial inclusion to an astounding 490 million people.

This is the first installment of a two-part story. Part two (HERE) discusses the World Bank’s highly favorable evaluation of DPI’s public benefit brought by its “inclusion first” mandate.

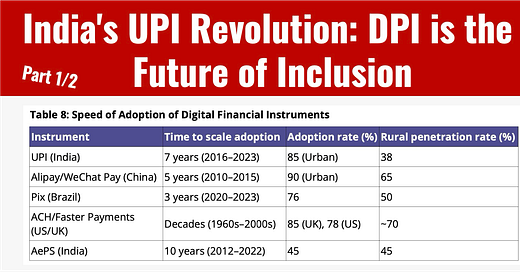

This is the first report I’ve ever seen that tries to gain insight by comparing India’s UPI system with Brazil’s PIX and China’s Alipay. These comparisons are fascinating, and readers should check out the charts showing how these three digital payment success stories achieved dramatic improvements in inclusion.

The report shows that AI may play a big role within DPI, with broad use cases ranging from improving biometric accuracy while onboarding clients to AI credit scoring and AI customer service chatbots. But challenges remain.

The use of AI in credit would seem straightforward. Alipay’s use of AI in credit is documented to have resulted in a 40% increase in loan disbursements, and similar systems in Brazil used with PIX had an 18% higher loan approval rate.

These figures sound encouraging, but studies in India indicate that 30% of AI-based lending decisions in India exhibit bias, disproportionately affecting women and rural borrowers.

Surprised? AI isn’t magic and brings human and data biases along for the ride.

DPI is a key technology for financial inclusion, and we should expect it to be a feature in both developed and developing economies.

If we’re brave enough to follow, India has given the world a blueprint for DPI.

👉Recommendations for Financial Inclusion

🔹 Privacy and Security by Design in DPIs: Implement privacy-enhancing technologies such as differential privacy and secure multiparty computation. Establish data protection standards aligned with global frameworks.

🔹 Enhancing Regulatory Supervision Through AI in Regtech: Leverage AI to proactively detect fraud and automate compliance processes. Develop capacity-building programs for regulators to strengthen oversight.

🔹 Fraud Reduction Through Information Sharing: Foster inter-institutional data-sharing partnerships to detect fraud patterns and implement real-time grievance redressal systems.

🔹 Inclusion of Non-Financial Market Participants: Extend access to microfinance and digital tools for non-banking stakeholders, including informal sector participants and promote gender-focused financial inclusion initiatives.

🔹 AI Guidance for Fintech Based on First Principles: Mandate transparency in AI models to eliminate biases in credit scoring and underwriting. Establish ethics frameworks for AI deployment in financial systems.

🔹 Expanding and Capacitating Self-Regulatory Organisations (SROs): Enable SROs to monitor digital lending practices and ensure fair play in emerging technologies.

🔹 Personalised Digital Financial Literacy: Launch targeted literacy programmes for rural and marginalised populations and develop user-centric tools to simplify onboarding and engagement.

🔹 Building Offline Payment Use Cases: Invest in offline-capable payment systems like UPI 123 to reach connectivity-deprived regions. Integrate payment solutions with welfare schemes to drive adoption.

🔹 Scaled Integration of Neo-Banking: Promote interoperability between neo-banks and traditional financial systems while supporting smaller financial institutions in adopting digital banking practices.

🔹 Data Classification: Establish common classification frameworks to enhance AI transparency, interoperability and inclusivity. Encourage global data-sharing collaborations.

🔹 Shared Responsibility Models and Liability Regimes: Define clear liability standards for stakeholders in the digital financial ecosystem. Promote partnerships between private entities and regulators to share compliance responsibilities.