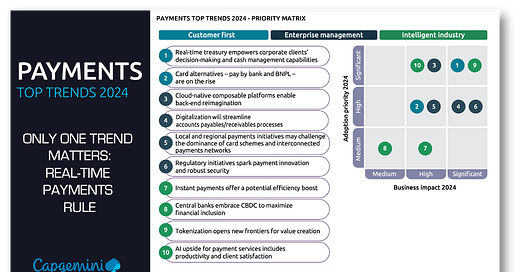

Payments Top Trends for 2024: Real-time Rules

Real-time payments are the only trend that matters.

Capgemini does a great job of laying out ten payment trends for 2024, but in the end, only one matters: real-time payments.

Whether these payments are mobile, stablecoin, CBDC, or deposit tokens is immaterial; the only thing that matters is that they are immediate, and no one waits.

That’s why five of the ten trends are all about real-time payments!

👉TAKEAWAYS (My 5 real-time favorites)

TREND 1: Real-time treasury empowers clients’ decision-making and cash management capabilities

So, if you ever need a driver for real-time payments, look to companies that want to increase efficiency through real-time treasury and reconciliation. That companies want real-time will be key to its swift adoption as they can leverage everyone from regulators to payment companies to get what they want.

TREND 5: Local and regional payments initiatives may challenge the dominance of card schemes and interconnected payments networks

Today I opened my HSBC Singapore mobile app and noticed two new buttons one for sending money to India’s UPI and the other to Thailand’s PromptPay. For thousands of immigrant workers living in Singapore, sending money home without usurious remittance charges has just become a reality. And this is just the beginning in Asia all networks will be connected. Give it 2-3 more years.

TREND 7: Instant payments offer a potential efficiency boost

Is it really news that 365/24/7 instant payment is more efficient? If the world learned anything from WeChat and Alipay, this was it! So far, some 79 countries have real-time payment networks, and the graph of volume (below) shows a solid 12% CAGR.

TREND 8: Central banks embrace CBDC to maximize financial inclusion

CBDCs are coming, but what is increasingly evident, particularly in Asia, is that interconnected mobile networks will beat CBDC to the punch for connecting nations. Still, given the limit of smaller amounts transferred on mobile networks, CBDCs will still have an important role to play. Look for offline CBDC transfers to be a game-changer for financial inclusion.

TREND 9: Tokenization opens new frontiers for value creation

Tokenization is really a wildcard. As though mobile payments and CBDC weren’t enough we’re now looking at bank tokenized deposits as another potential transfer system as well as other tokenized assets. Tokenization is still a few years off.

Instant payments are growing at 12% per year globally. Growth in Africa and Asia is far greater.

👊STRAIGHT TALK👊

Payments are going real-time and the transition will happen faster than most people think.

This may seem an unusual prophecy to people from the West who haven’t experienced the amazing transition to real-time payments that those in the East have.

Many in the West think that credit cards’ hold on payments will be eternal, but it won’t. Just a few years ago, it was equally unthinkable that credit cards’ lock on personal credit could be challenged, but BNPL is doing just that! (see trend 2).

What we think of as unthinkable or impossible often isn’t. The reality is that the experience for most users in using real-time mobile payment is superior to cards, and when merchants discover that they can reduce merchant fees, they’ll flock to it.

What is apparent is that how we get real-time payments is irrelevant. The technology behind it is only of interest to geeks like me (us).

What matters more is that real-time is adopted as soon as possible to reduce costs and increase economic growth.

Subscribing is free!

The button says pledge, but Substack adds that, not me.

Don’t be afraid to click!