Profit Surge: Digital Banking’s 2X Impact on Revenue!

The gap between banking's digital haves and have-nots expands

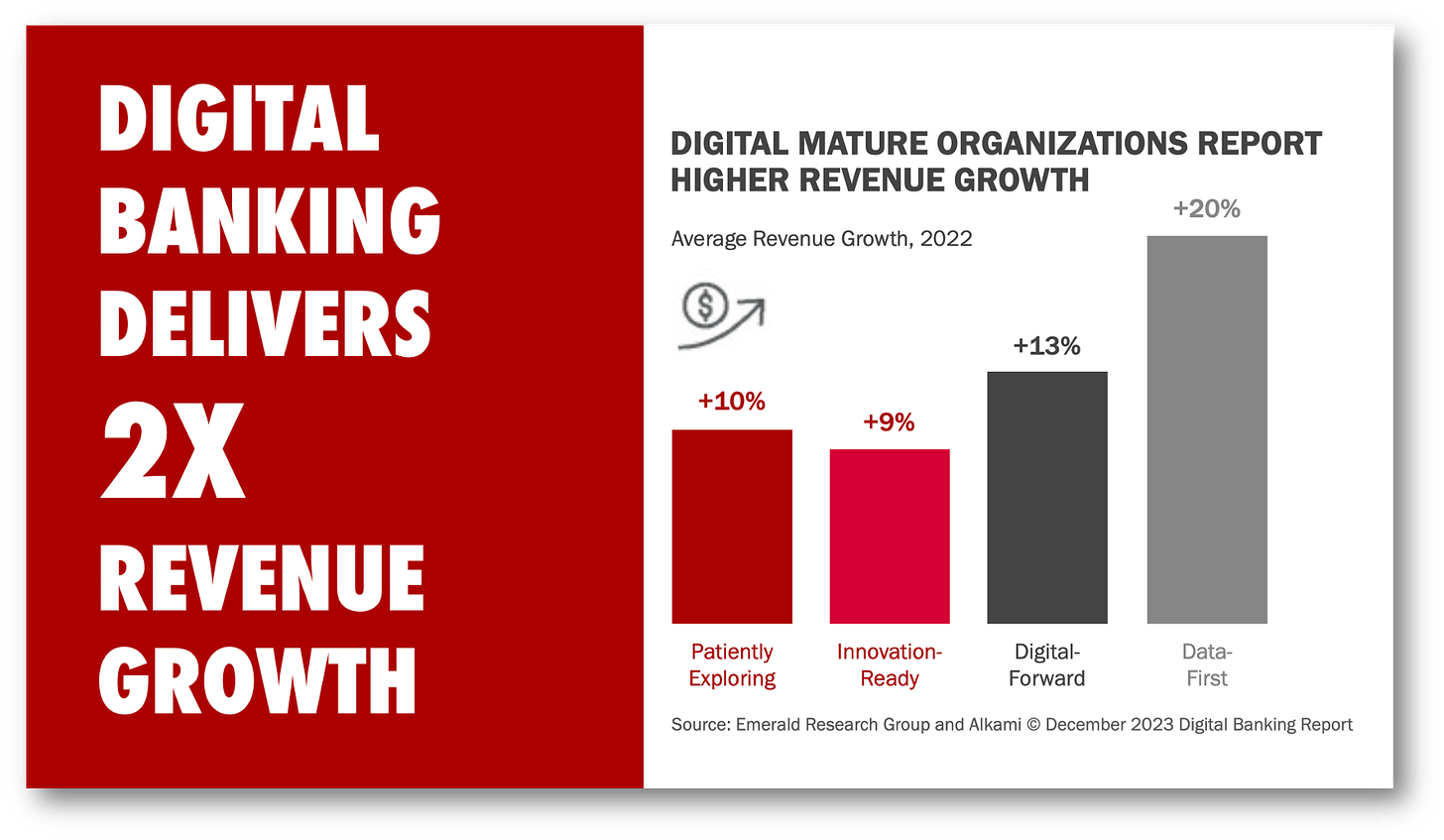

The Digital Banking Report by Alkani shows that digital banking isn’t just a passing fad with digitally advanced banks showing two times the revenue growth of digital laggards.

These results beg the important question: “Why are 53% of banks in the digital laggards groups?”

👉TAKEAWAYS:

🔹Digital maturity is linked to revenue growth, with the most advanced institutions reporting up to twice the annual revenue growth as the least advanced.

🔹The Four Groups in Digital maturity can be broken into 4 groups:

Patiently Exploring (14%) Primarily smaller institutions that place emphasis on interaction rather than technology. They bet on people over tech, a big mistake!

Innovation-Ready (39%) – Mostly mid-sized organizations, that bet on USER EXPERIENCE over advanced functionality, as though UX can solve all problems.

Digital-Forward (38%) – Can be any size, this group bets on tech, automation, and speedy account opening.

DATA-FIRST (9%) – Larger, full-service institutions that are laser-focused on data-driven decision-making over intuition and see tech as a major advantage.

🔹Organization size does not solely determine digital maturity. One-quarter of financial institutions excelling digitally have less than $500 million in assets. In contrast, more than one in seven of the least digitally mature institutions have more than $5 billion in assets. (see below)

🔹While digital account opening is offered by the majority of the most advanced institutions, only one-quarter of them provide a 5-minute online account opening experience for new customers or members and half are struggling to automate critical back-office processes.

Size Does Not Determine Digital Maturity

“While many of the less digitally mature organizations are from smaller asset sized institutions, it’s worth noting that digital banking sophistication is not solely determined by size. One-quarter of organizations excelling digitally have less than $500M in assets.”

👊STRAIGHT TALK👊

The concept of emphasizing digital in banking is hardly new, nor is the fact that advanced digital banks are revenue leaders.

So once more, I am stunned to find that of the four digital groups represented, 53% of banks remain in the bottom two classifications, which brand them as digital laggards.

What on earth are they thinking?

The most obvious excuse for some is that their banks are small and can’t afford digital.

That sounds good, but this excuse no longer holds water given the findings in the report that size is not the determining characteristic of digital maturity.

It also doesn’t hold up when you take a look at the extensive digital banking offerings targeted explicitly at smaller institutions.

So what exactly is holding up these laggards?

In the end, the only answer is a lack of vision in the leadership team. After a decade of “digital transformation” 53% of bank leaders still don’t get it.

This is inexcusable, and boards need to take a hard look at retiring many top banking CEOs.

What are your thoughts on early bank CEO retirement?

Leave a comment!

A big thank you to all my subscribers! I appreciate your notes telling me how much you enjoy reading the Cashless newsletter.

Join them by subscribing! You’ll be glad you did!