Real-Time Payments: Banks’ New Opportunity, Not a Threat

Banks are like a deer trapped in the headlights incabable of action.

Real-time payments are exploding globally, and while banks should see them as an opportunity for broader open finance initiatives, the grim reality is that most are still frozen in fear.

Real-time payments combined with open finance will allow banks to release innovations that unlock customer value. The trick is that to unlock this value, banks have to engage in innovation, which has never been their strong suit.

Sadly, many banks are still stuck on real-time payments' impact on their card business revenue, not the opportunity.

👉TAKEAWAYS

The cashless tsunami:

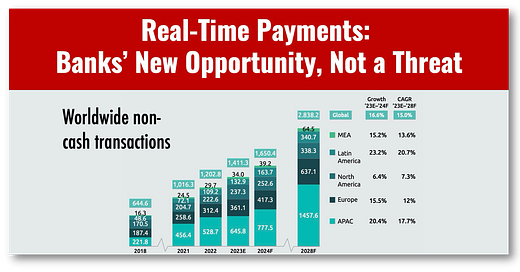

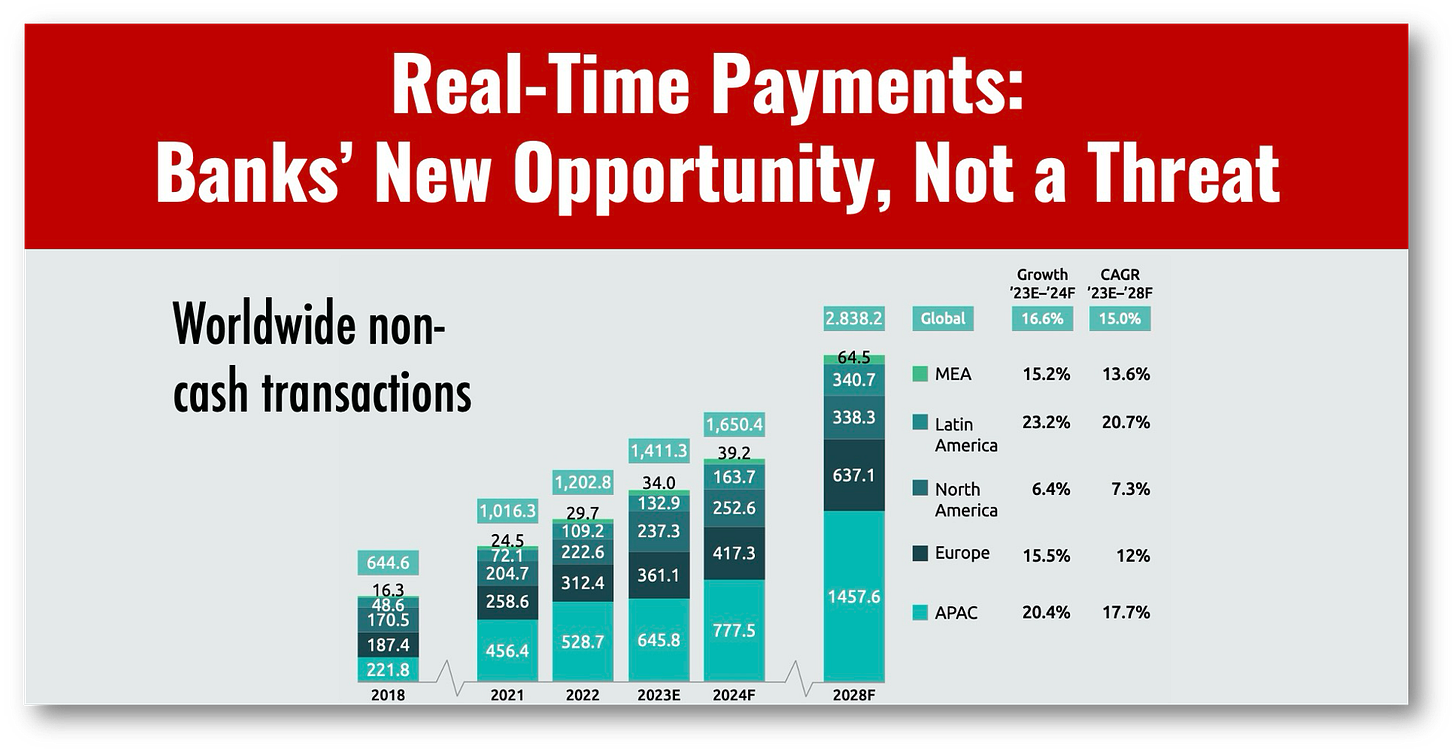

🔹 In 2023, non-cash transaction volumes worldwide reached nearly 1,411 billion. Forecasts indicate transaction growth to around 2,838 billion by 2028 – for 15% compound annual growth (2023 - 2028) (Figure 1).

🔹 The Asia-Pacific (APAC) region is leading the charge with a staggering 17.7% projected annual growth, solidifying its position as the fast growing geography for non-cash transactions. In 2024, APAC exhibited one of the high year-on-year (YoY) growth at 20.4%, illustrating the ongoing digital shift in the payment landscape.

🔹 Europe's non-cash transactions reached 361 billion in 2023, with a 15.5% YoY increase in 2024 and a projected 12% compound annual growth (CAGR) from 2023 to 2028.

🔹 North America saw around 237 billion in non-cash transactions, a 6.4% YoY increase, in 2024 with a projected CAGR of 7.3% from 2023 to 2028.

🔹 Latin America reached nearly 133 billion in non-cash transactions, a 23.2% YoY growth spike in 2024, with a projected 20.7% CAGR (2023 to 2028).

🔹 The Middle East and Africa (MEA) reached 34 billion non-cash transactions, a more than 15.2% YoY increase, and we expect similar compound growth by 2028.

🔹 Open finance is set to reshape financial services, with 400 million users by 2027 in the open banking framework. This shift enables personalized financial products and empowers consumers.

👊STRAIGHT TALK👊

Banks are, in fact, like the proverbial "deer caught in the headlights.” They clearly see that payments are changing the world but are blinded and incapable of action. Like the deer they are at real risk of getting hit.

Here’s how bad it is for open finance initiatives:

“Among payment executives interviewed as part of the World Payments Report 2025, 39% said their bank is in the planning phase, conducting impact assessments; another 23% of banks were deemed to be hesitant as they await further regulatory clarity. Meanwhile, only 21% of providers have begun installing the necessary technology, and only 17% are at an advanced stage, piloting or launching open finance products.”

Is anyone surprised banks are once again failing at innovation?

Thoughts?

You made it this far, so subscribe! Here are the six benefits waiting for you when you subscribe:

Save time: Get the expert insights on Central Bank Digital Currencies (CBDC), AI, Payments, and Financial Inclusion that you need to stay ahead of the curve, all delivered directly to your inbox weekly;

Know the future and profit: Get real payback from a unique point of view directly from Asia that focuses on how the region is “leapfrogging” the West and showing you the future;

Be prepared: CBDCs are no longer theoretical but coming soon, so keep up with the latest developments on the digital euro, yuan, sterling and dollar;

Manage your personal AI risk: Don’t be disrupted; be the disruptor. In-depth analysis of how our AI revolution impacts finance so that you can be in front of this great transformation, not behind it;

Stay objective, avoid hype: My writing doesn’t follow corporate diktats. It’s a message that doesn’t conform with mainstream media and is gritty, practical, hype-free, and, on occasion, controversial;

Stay safe: My writing is trusted by nearly 60,000 executives, innovators, investors, policymakers, journalists, academics, and open-minded crypto hodlers daily.

Readers like you make my work possible! Subscribing is free, but I am honored when readers opt for a paid subscription to recognize my high-quality writing and help keep it flowing. Thank you!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!