Report Reveals Companies "Not Rushing Into AI" as Markets Panic

A new survey shows AI is coming, but not as fast as valuations imply.

If yesterday’s market crash weren’t enough to feed fears that AI-driven gains are overhyped, here’s another statistic from this fabulous MIT and Boomi report that will certainly help with more perspective:

“Nearly all organizations (98%) say they are willing to forgo being the first to use AI if that ensures they deliver it safely and securely.”

Companies are not rushing into using AI; they are terrified of getting it wrong. The biggest hold-up in AI implementation isn’t legacy systems or a lack of funding but pure risk management.

Can you blame companies?

This doesn’t mean that the AI revolution isn’t coming, just that it won’t come fast enough to support the insane valuations of AI stocks.

Corporations are making massive investments in AI, and the money is flowing, but the hype has made people far too overexcited over fast AI money.

👉TAKEAWAYS

🔹 Companies are not rushing into AI. Nearly all organizations (98%) say they are willing to forgo being the first to use AI if that ensures they deliver it safely and securely. Governance, security, and privacy are the biggest brake on the speed of AI deployment, cited by 45% of respondents (and a full 65% of respondents from the largest companies).

🔹 AI ambitions are substantial, but few have scaled beyond pilots. Fully 95% of companies surveyed are already using AI and 99% expect to in the future. But few organizations have graduated beyond pilot projects: 76% have deployed AI in just one to three use cases.

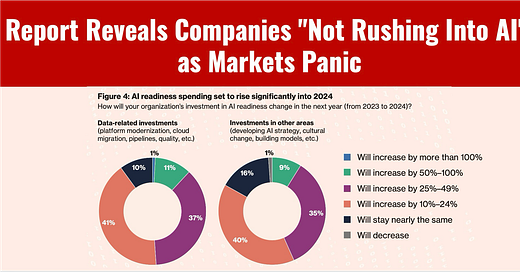

🔹 AI readiness spending is slated to rise significantly. Overall, AI spending in 2022 and 2023 was modest or flat for most companies, with only one in four increasing their spending by more than a quarter. That is set to change in 2024, with nine in ten respondents expecting to increase AI spending on data readiness

🔹 Data liquidity is one of the most important attributes for AI deployment. The ability to seamlessly access, combine, and analyze data from various sources enables firms to extract relevant information and apply it effectively to specific business scenarios.

🔹 Data quality is a major limitation for AI deployment. Half of respondents cite data quality as the most limiting data issue in deployment. This is especially true for larger firms with more data and substantial investments in legacy IT infrastructure.

👊STRAIGHT TALK👊

AI will change the world, and we should all not doubt this.

What is in doubt are stratospheric valuations for tech companies with massive long-term capital expenditures for data centers that don’t have the revenue to support them.

Yes, corporations are spending big on AI, but as the survey reveals, the problem is that all of AI’s risk falls onto the company implementing the AI system. This makes them naturally conservative and in no rush to deploy an AI that could potentially cause severe damage.

This is in addition to the top three AI deployment problems that are slowing AI implementation: data quality, data infrastructure and data integration.

Meanwhile, big tech and many management consultants, all of whom profit from AI preach what I can only describe as a “false gospel” of instant and effortless AI transformation.

If only this were true.

AI is coming, just not as fast as predicted.

Did you make it this far? There are even more benefits waiting for you when you subscribe.

Don’t get left behind: Get the expert insights on Central Bank Digital Currencies (CBDC), AI, Payments, and Financial Inclusion, that you need to stay ahead of the curve, all delivered directly to your inbox weekly;

See the future: Profit from a unique point of view directly from Asia that focuses on how the region is “leapfrogging” the West and showing us the future.

Be independent: My message doesn’t follow corporate diktats it’s a message that’s often controversial and does not conform with mainstream outlets;

Be prepared: CBDCs are no longer theoretical but coming soon, so keep up with the latest developments on the digital euro, yuan, sterling and dollar;

Understand AI: In-depth analysis of how our AI revolution impacts finance and will change how we interact with financial services.

Trust: My writing is trusted by over 50,000 executives, innovators, investors, policymakers, journalists, academics, and open-minded crypto hodlers daily

Subscribing is free, but I am honored by readers volunteering to opt for a paid subscription to recognize my high-quality writing. Thank you!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!