Retail Banking Top Trends 2024: Digital is King

Given the bank failures of 2023, this year has got to be better than last!

Given the bank failures and interest rate rises of 2023, it’s a good bet that 2024 will be a better year for banks. That is, however, a very low bar to clear!

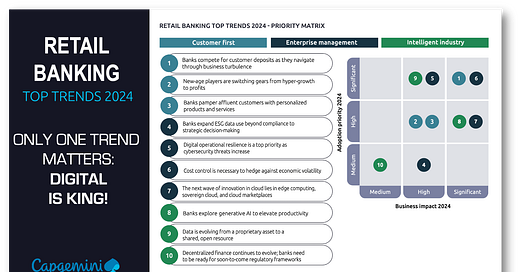

Capgemini does a great job of breaking down banks’ 2024 priorities into three major trends: Customer first, Enterprised management and Intelligent industry.

While these may sound like the bank is going off in three separate directions, they aren’t. Virtually every one of the ten trends has a digital component.

If I were CapGemini, I would say that in 2024, “Digital is King.”

👉TAKEAWAYS (my comments in brief for all 10)

Banks compete for customer deposits as they navigate through business turbulence

Unless banks resort to giving away free toasters again, they only have two significant offerings: interest rates and service. Service is now a digital product, as branches get cut, and increasing rates lowers profit. So digital is the only play.

New-age players are switching gears from hyper-growth to profits

Neo or challenger banks need to make money fast. This we know, but as they are already digitally sophisticated what more can they offer clients? Can you believe Revolut is considering opening branches in France!

Banks pamper affluent customers with personalized products and services

This is significant. As GenAI makes customer service more digital and less human this just might be a money maker!

Banks expand ESG data use beyond compliance to strategic decision-making

I hope they do! Green products and services are particularly important for younger clients.

Digital operational resilience is a top priority as cybersecurity threats increase

Not having your systems crash like DBS’s in 2023 or having them hacked is no joke. No surprise that these expenses will ramp up with digital offering density.

Cost control is necessary to hedge against economic volatility

No surprise here but controlling costs means further digitization.

The next wave of innovation in cloud lies in edge computing, sovereign cloud, and cloud marketplaces

Is there anyone reading who is at all surprised by this? Sovereign cloud is a stretch for most banks. (see below)

Banks explore generative Al to elevate productivity

Again no surprise! Please don’t expect me to write even more about GenAI!

Data is evolving from a proprietary asset to a shared, open resource

Everyone talks about personalization but without data banks aren’t going to get much more personal than the aforementioned toaster. We’ve been waiting for years for this but banks are still slow.

Decentralized finance continues to evolve; banks need to be ready for soon-to-come regulatory frameworks

I think that DeFi is coming but it will be bigger in 2025. It’s still very new and its’s a stretch for all but the most sophisticated banks.

Sovereign cloud isn’t new, I was trying to sell it when I worked at IBM some 6 years ago. It’s a real stretch asking an IT department to run their own cloud. While it has benefits it also puts far more risk onto the bank’s shoulders.

👊STRAIGHT TALK👊

For most banks, 2024 should be infinitely better than 2023, which had six noteworthy bank failures! That’s good news for banks, but their next challenge is on the digital frontier, which is central to the year’s top trends.

Banks are facing a digital arms race, and it's already clear that large, digitally sophisticated banks will be the winners. They’ve invested in digital for years and already have experienced in-house know-how to launch cutting-edge systems.

Then there are all of the other banks, the vast majority, who haven’t spent heavily on digital and muddle through providing clients with digital services. For historical reasons, I have an account with a small bank like this, and they are so digitally challenged it’s sad. What future will they have?

I don’t think they have a future. In 2024 we will start to see the digital have-not banks start to look for mergers with more sophisticated players. The problem is that the investment in time and money to improve their digital services won’t pay off when compared to an immediate sale.

The trend I’m looking for in 2024 that Capgemini missed is digital have-not banks will start to “throw in the towel” and sell.

Thoughts?

Subscribing is free!

The button says pledge, but Substack adds that, not me.

Don’t be afraid to click!