Russian sanctions aren’t working. Where is the “shock and awe” we were promised?

Heavy sanctions haven't stopped the fighting or weakened Putin's grip on power.

Thomas Lea's The Two-Thousand Yard Stare, 1944. A striking image of combat fatigue that captures how we all likely feel over the daily horror of the Ukraine-Russia War.

On the first anniversary of the Russian-Ukraine war, we have to look objectively at the role of sanctions. My article is based on a great read from Peter Rutland that can be found on either of these links ( here and here) and supplemental readings. Rutland shows the four main factors that made sanctions far less effective than initially conceived.

While sanctions have certainly impacted the Russian economy, they certainly haven’t ended the conflict or brought down the government in Moscow. Granted, these outcomes were never realistic. Sanctions rarely do either and have a “success rate” ranging between 13% and 35%, depending on the analyst’s view of success.

Author’s note: I know this is a sensitive topic. Frankly, I am torn on publishing this as I know that reactions to sanctions vary and this is a polarizing topic. I also freely admit that at this late stage, I am ill-equipped to offer solutions. That doesn’t, however, preclude me from objectively observing what’s happening.

The sanctions do send a clear message to Russia that the world will not sit idly by while they invade Ukraine and that there will be consequences. They are also signal of unity with Ukraine. Some will also argue that they need more time to bite. I do not view this as likely, as the ability to evade sanctions is growing daily.

The original article posits four main reasons for Russia’s ability to resist sanctions. Two of these four I will not cover in detail as they are less financial in nature. They are:

Russia’s unique ability to endure sanctions acquired from existing Crimean invasion sanctions in 2014;

the nature of Russia’s dictatorship and oligarchs, which enhances Russia’s sanctions resilience.

In place of these two sections, I have added two new factors that are having an impact on sanctions, the influence of China, CBDCs, and whether or not our expectations are realistic.

Factors impacting Russian Sanctions

1. Energy sales continue

Despite sanctions, Russia is still earning some $800mn daily from energy sales, more than enough to offset the $300mn spent daily to fight the war. And before blaming India, Turkey, and China for their oil purchases of $18bn, $20bn, and $50bn, look first to the EU, which purchased some $125bn in oil and gas since the start of the invasion.

Fossil fuel imports during the first 100 days of the invasion.

Source: CREA

The good news is that EU purchases from Russia are falling. Still, of course, the price that the EU is paying for energy is increasing as global energy prices remain high, which offsets any loss of revenue to Russia. This is why the concept of sanctions “backfiring” on the imposing countries is real and severe.

2. Non-aligned nations.

The 49 nations sanctioning Russia account for 60% of the world’s economy, leaving the remaining 40% still doing business with the pariah state. Many of these nations, including India, Turkey, and China, view this conflict differently. In addition, poor countries like Pakistan don’t have the luxury of saying no to discounted Russian oil prices.

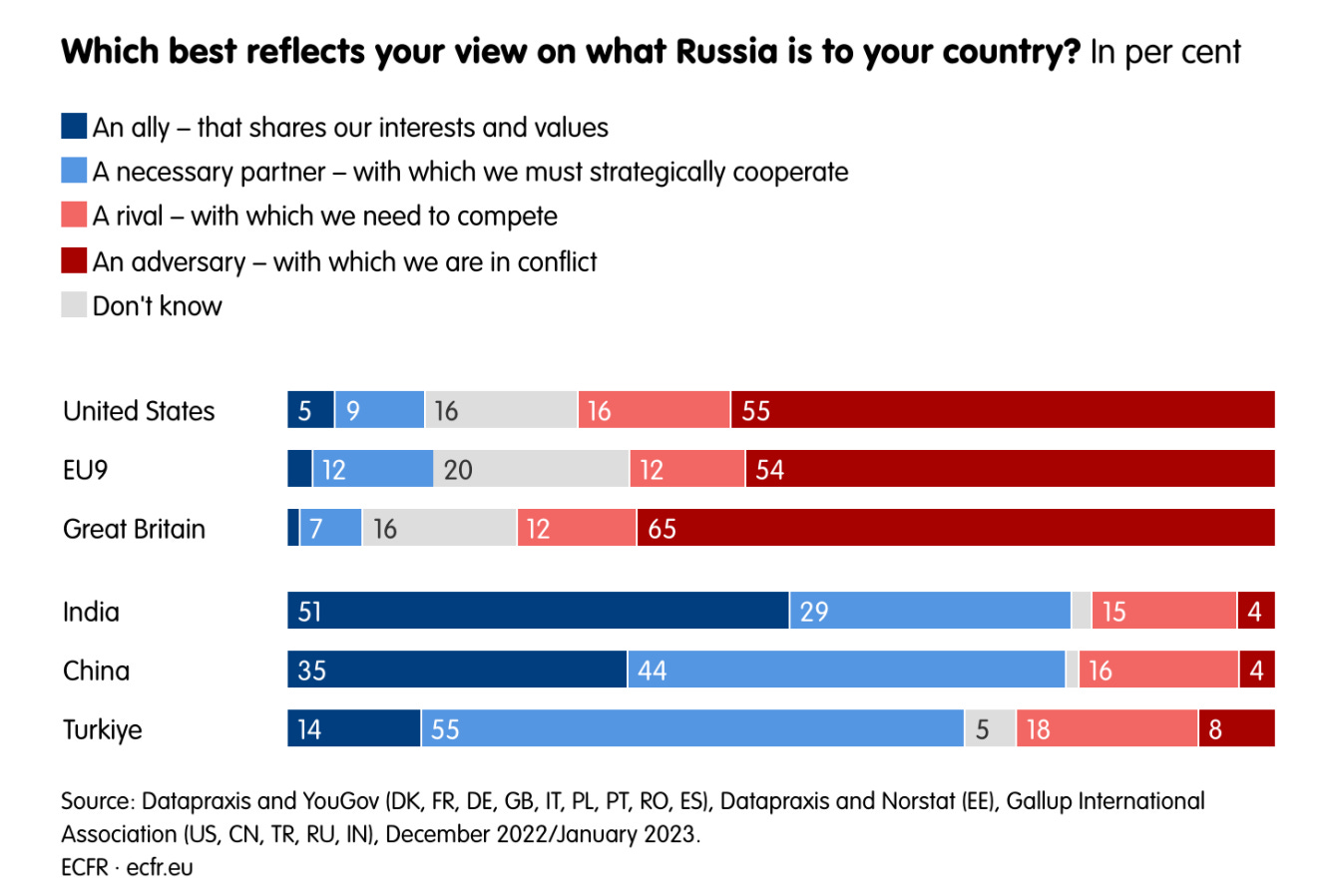

Russia’s War is viewed very differently across the world. This report shows how NATO member Turkiye and US ally India view the conflict differently.

Source: European Council on Foreign Relations, United West, Divided from the Rest: Global Public Opinion One Year into Russia’s War on Ukraine

Full Report: here

3. China trade is not Russia’s savior

The Carnegie Endowment covered China’s increased trade with Russia in great detail. (here and here) It is no secret that China and Russia have professed a deep friendship and are both fans of de-dollarization. Still, the yuan is no replacement for the dollar and euro, which comprise the majority of Russia’s foreign currency use.

The article states that while Russia’s trade value in yuan skyrocketed from 0.4% to 14%, mostly in Chinese goods exported to Russia, the yuan is no savior for Russia. These trade amounts do not make up for the 34% drop in dollar and euro use in Russia, which accounted for 52% of Russia’s total. Analysis shows that Russia’s reliance on China is generating further Russian instability as it increases its dependent on China’s managed ruble exchange rates and policy decisions.

China’s support for Russia has limits. Recent press releases from Beijing have made it abundantly clear that China is increasingly frustrated with Russia. The removal of “without limits” from China’s statement on its friendship with Russia was telling. Whether China’s 12-point peace proposal launched hours ago can help is unknown. Whether or not we like China, we should all hope China can help starts peace talks. (Author’s note: The China peace proposal’s 3rd point requires an end to sanctions. This makes the proposal a “non-starter” in the eyes of the West.)

4. Russia’s CBDC is coming

Many of you must have been wondering when I’d get to this. Russia’s CBDC program is going into a pilot phase in April. Russia made CBDC development a priority and is rushing the product to market. It will likely be yet another source of sanction leakage.

Russia’s CBDC will not be alone. India, China, and Brazil will all have late-stage CBDCs in 2023, and CBDC transfers between these nations will likely be trialed. In the case of China, which is already trading with Russia, it’s hard to see how CBDC will add significant volumes to what already exists. India, however, is a more interesting use case as it already has more limited transactions in rupees with Russia, which appear more limited to large companies. CBDC might be a way to broaden trade between SMEs.

What is clear, and in my view unfortunate, is that one of the first uses for cross-border CBDC transfer may be for sanctions violations or in a grey area. Note the US has not condemned India’s Russian oil purchases.

5. Sanctions take time

They do, and there is no doubt that Russia’s economy has been severely impacted. Still, the ability to evade sanctions grows with each passing day. Reports of Russian tankers transferring oil cargos mid-ocean and Russia increasing its gold production show that sanctions avoidance has become the norm and, for some, a profitable business. This is especially true when energy is in such high demand. Iran’s black-market oil sales show how this is done and prove that waiting is not always the answer.

The bigger question of whether more time is required for Russian sanctions to work can, in part, be answered by a classic paper by the Peterson institute (here). The author outlines five required conditions that made past US sanctions effective.

Reading this list carefully, you will see that Russian sanctions are virtually in direct opposition to each of these five conditions, which makes their likelihood of failure, even if given more time, likely:

The goal is relatively modest. This also lessens the importance of multilateral cooperation, which often is difficult to obtain.

The target country is much smaller than the country imposing sanctions, economically weak, and politically unstable. (The average sanctioner's economy was 187 times larger than that of the average target.)

The sanctioner and target are friendly toward one another prior to the imposition of sanctions and conduct substantial trade. The sanctioner accounted for 28 percent of the average target's trade in success cases but only 19 percent in failures.

The sanctions are imposed quickly and decisively to maximize impact. The average cost to the target as a percentage of GNP in success cases was 2.4 percent and 1 percent in failures.

The sanctioning country avoids high costs to itself.

If not sanctions then what?

At least a partial answer to this comes from US Statesman Richard N. Haas’ classic paper “Economic Sanctions: Too Much of a Bad Thing.” Haas suggests: “The principal alternative to economic sanctions, however, is best described as conditional engagement, i.e., a mix of narrow sanctions and political and economic interactions that are limited and made conditional on specified behavioral changes.”

It is impossible to envision that the West will roll back any sanctions to use Haas’ more limited engagement. While these measures are too late to be used now, Haas at least gives us some answer as to how sanctions might be more limited in the future. His paper also suggests that adding “shock and awe” sanctions, with profound global impact, on top of the many existing sanctions on Russia would not prevent further conflict. His comment is prophetic: “More generally, sanctions can have the perverse effect of bolstering authoritarian, statist societies.” We can also not expect these sanctions to remain indefinitely: “Sanctions fatigue tends to settle in over time and international compliance tends to diminish.”

Source: Castellum.AI

Conclusions

The daily nightmare of Russia’s invasion of Ukraine impacts us all, and I am sure many of us wish we could go back in time to avert tragedy.

Sanctions’ impact on Russia’s ability to wage war is limited. While they were sold as a knockout blow to Russia’s war machine, they were not. Russia’s war machine marches on, and Putin’s grip on power seems unchanged. Yes, the nation is under stress, but for Russia, this is not a new condition.

The global human toll of these sanctions is rising and, to a large degree, backfiring on the countries imposing them. Disruptions across many different markets where Russia remains a significant supplier of energy, raw materials, and food have created a global division between nations. Those supporting sanctions on one side and those who either view the conflict differently or cannot afford to support them on the other. As a result, de-dollarization is now in the news daily, and it saddens me that CBDC’s first cross-border use may be in sanctions avoidance.

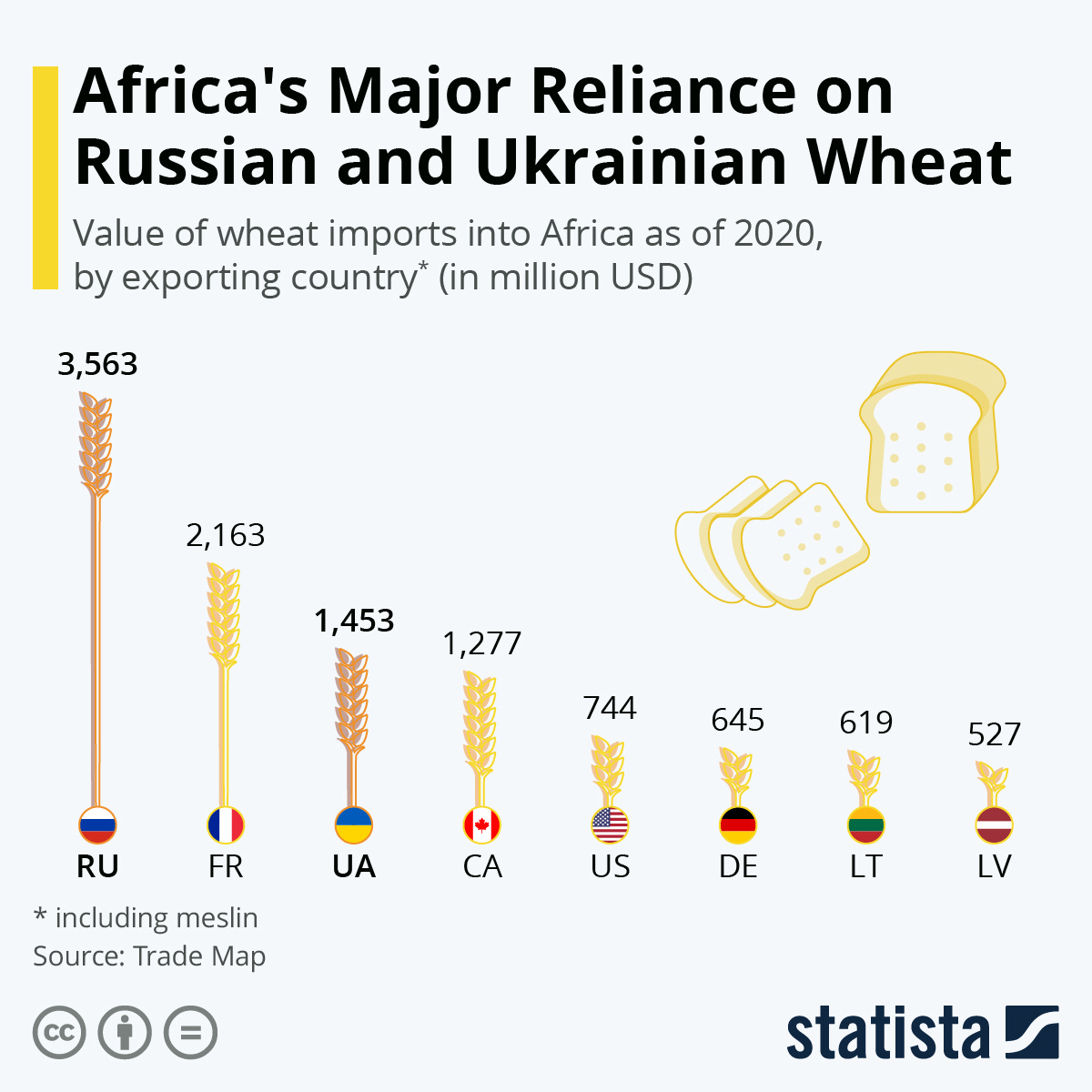

Russia is critical to Africa’s food security—one of many examples where “Global South” nations cannot afford to be trapped between sanctions.

Source: Statista

For now, the sanctions will remain, but the question is, for how much longer? It’s clear to me that they are not achieving their objective. Sanctions are leaky vessels, and as we already see, the existing sanctions have sprung leaks in many places. I expect that in the coming year, we will see not just leaks but gushing flows. What then?

Final “mic drop” moment from Kishore Mahbubani

See how deep the “cashless” rabbit hole goes!

My work is entirely supported by reader gratitude, so if you enjoyed this newsletter, please do both of us a favor and subscribe or share it with someone. You can also follow me on Twitter, or Linkedin for more. If you want to learn more about Innovation Labs or China’s CBDC, check out my website richturrin.com which is full of videos, interviews, and articles. The best way to make sure you see the stuff I publish is to subscribe to the mailing list here on Substack, which will get you an email notification for everything I post.

Everyone, including platforms that disagree with me, has my permission to republish, use or translate any part of this work or anything else I’ve written (except my books) with credit given to me and this site (richturrin.substack.com) free of charge. For more info on who I am, what I do, and where I’m going, check out richturrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is number 4 on Onalytica's prestigious Top 50 Fintech Influencer list and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon:

Cashless: HERE

Innovation Lab Excellence: HERE

This is a war against dollar.