Shanghai lockdown first day out!, Digital Dollar the Good the Bad and the Ugly, DeFi and TradFi will work together, SE Asia digital payment and Digital Yuan App Ban!

The American Banker’s Assoc. and stablecoin Circle shoot at the digital dollar and miss!

This week:

1. Shanghai lockdown winds down, first day out in 55 days!

2. Digital Dollar: Good Bad and the Ugly! (SPECIAL ARTICLE)

3. OECD on how DeFi and Tradfi will work together

4. SE Asia is digital payment’s “field of dreams”

5. US digital yuan app store ban does nothing!

1. Shanghai lockdown winds down, first day out in 55 days!

The first day out of our apartment complex after 55 days as Shanghai lockdown is slowly winding down!

Our first steps out of our apartment complex in 55 days! What a relief! Streets are empty!

The best we can all hope for is that the lockdown helps buy time for Shanghai’s elderly, who are most vulnerable to the virus. The inevitability of Omicron seems clear. Perhaps in the coming months, Shanghai and China can use the time gained to better prepare for what is to come, and it will save lives. That is my only hope.

People are resilient and life goes on!

That there was a cost to the economy is clear, I wrote about this last week. Is it a fair trade-off? Probably, given that 1.4 bn people are affected, but I consent it’s not black and white. It’s easy to second guess or critique lockdowns from afar. I lived through it and think it’s best to let history be the judge.

The unsung heroes of lockdown! Look how much he has on one scooter!

For the moment, rather than debate the efficacy of lockdown, I just want to share my joy that it is nearing its end. However, I still don’t think things will be back to normal for quite a while.

2. Digital Dollar Comments: Good Bad and the Ugly!

SPECIAL ARTICLE!

Link to article here! Or click on picture.

Friends this was such an important read it became an article here on substack all its own!

What you will learn:

How the American Banker’s Asociation fabricated numbers that show how the digital dollar will collapse the banking system! Shame on them!

Why Stablecoin Circle, is going for a power grab and also has it out for the digital dollar.

Why I like stablecoins but think they are all inferior to CBDCs.

Why one crypto company told the truth about how a digital dollar will help with financial inclusion.

3. OECD on how DeFi and Tradfi will work together

Despite the crypto and DeFi meltdowns I still see a future where DeFi and Traditional Finance (TradFi) will work together to make regulated markets more efficient! Remember the old adage: "don't throw the baby out with the bathwater!”

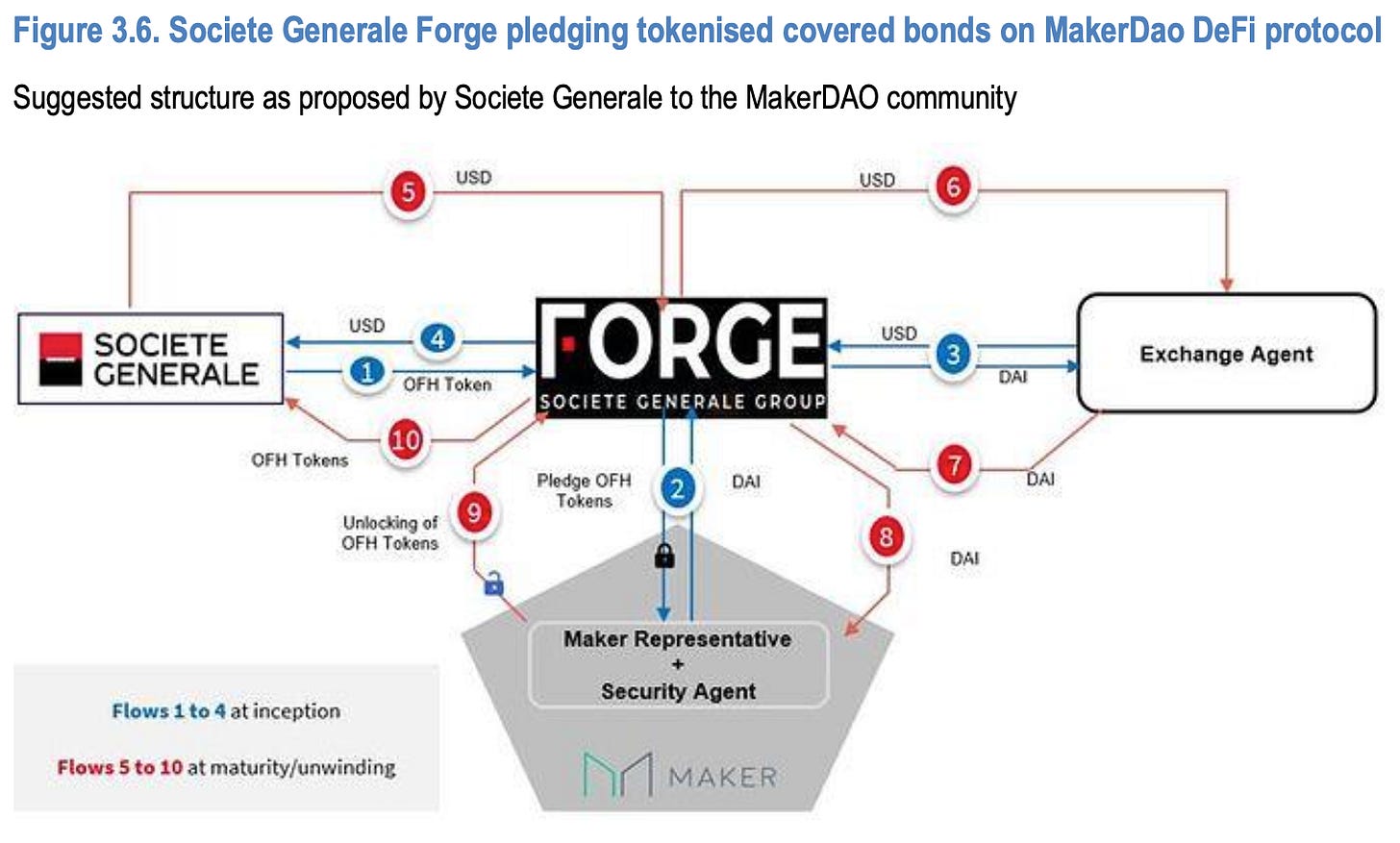

Here SocGen shows how DeFi can be used in the Repo market. JP Morgan and BNP Paribas are also cooperating on a similar blockchain based system that has carried some $300bn in intraday repo FT article here.

Download this great OECD report: Here

As a proponent of CBDCs I encourage you to check out page 46 section 3.2.4:

“Interconnectivity between DeFi and traditional finance can also involve the integration of DeFi protocols in CBDC pilots and the possible future use of CBDCs in DeFi protocols in the place of stablecoins. CBDCs could be used instead of stablecoins, both as collateral pledged in DeFi protocols and for exchange purposes.”

Just as CBDCs have coopted crypto technology, much to the chagrin of crypto fans, you can certainly expect DeFi to be equally coopted!

I’m going to call it "CenFi” for centralized finance. It will have KYC, AML, smart contracts, and the capabilities we associate with DeFi and banks today, like loans or savings. Why not?

Neobanks watch out!

I understand if some of you find it hard to see beyond the sewer that is the DeFi market today, I get it, it's bad!

Still, we can take the good from DeFi and put it to work to make our future financial system more efficient.

4. SE Asia is digital payment’s “field of dreams”

Southeast Asia is digital payment’s “field of dreams” both for operators who see the market potential and the users craving inclusion who see these services as aspirational.

Two papers combined tonight, first an interesting interview by McKinsey with the CEO of Grab, MoMo, and Mynt (GCash) and the WEF’s take on SE Asia fresh off the Davos conference.

Download: Here

First, let’s look at SE Asia by the numbers because they are astounding and show why there is no time to waste:

🔹 Six in ten people are unbanked, and only about 17 percent of transactions are cashless;

🔹 600 million young emerging consumers or about half of Southeast Asia’s population is under the age of 30 and tech-savvy;

🔹 75% of the population owns a mobile phone, while credit card ownership is negligible;

🔹 70% of the Southeast Asian workforce are informal workers who remain financially underserved;

🔹 69% of the national labour force in Southeast Asian economies are micro, small and medium enterprises (MSMEs);

🔹 60% of surveyed MSMEs were unable to get a loan when they needed financing.

Westerners from advanced economies don’t quite get how mobile payment services are received in SE Asia or China.

The most common question I get about this is always whether Asian markets are more open to innovation?

They are, but this misses the underlying reason why. Poorer populations are less interested in innovation and more interested in embracing access to a life that they’ve been denied. Digital is aspirational, and it is the pursuit of this better life that drives acceptance of innovation, not the other way around.

Mobile wallets aren’t perfect and the CEOs interviewed acknowledge a need for financial education. Excessive loans and the wallet operator’s search for unicorn-sized profits are also acknowledged problems.

Still, it’s fascinating to see how technology undeniably “Made in China” is changing the region and bettering lives for many!

5. US digital yuan app store ban does nothing!

The proposed digital yuan app store ban in the US will achieve absolutely nothing let me explain why!

The intent of the proposed act is to prohibit all apps with the digital yuan in the USA. There is one thing they don’t get! China doesn’t want US users!

Well, that didn’t take long! The digital yuan isn’t even fully launched in China and Senators Rubio, Cotton and Braun are proposing the “Defending Americans from Authoritarian Digital Currencies Act”

As I predicted in my book Cashless the US will enact sweeping digital yuan bans, and this is just the first!

The new act would make it impossible to host an app on a US app store that supports or enables transactions using the digital yuan.

Why this is COMPLETELY meaningless and doesn’t even impact WeChat or Alipay!

The problem with the act is that it isn’t the apps themselves that enable digital yuan use! Instead, it is the digital wallet that enables you to use it on your app and for that you need a China 🇨🇳 mobile number! Once again the US shows it doesn’t understand how the digital yuan works!

Take Alipay for example. You could download the English International version of the Alipay app, the one I use, and still not be able to use the digital yuan. Without the official digital yuan wallet, it simply won’t work.

Alipay is not unto itself a digital yuan wallet, it is tied to your wallet and to get a wallet you need a Chinese phone number! No e-CNY wallets will work on US phones!

Is the US likely to say that Alipay could “enable” digital yuan use? How? If the digital yuan wallet only works on a Chinese mobile number how can the apps enable digital yuan use?

Does this shut down the digital yuan in the US? Not in the least! Chinese digital yuan users with Chinese bank accounts will simply keep a Chinese phone with a Chinese app store on their phone while in the US.

Take me for example, I live in China but keep a US phone that I use to pay bills in the US. So Chinese users could pay digital yuan in the US while keeping it entirely on Chinese bank accounts. No one can stop that!

China doesn’t want US users! To use the digital yuan you need a digital wallet and no one in the US is going to get one for a long time!

One other thing is very important to remember. Because the e-CNY is central bank-issued it will need the approval of local central banks to be used in a foreign country. It isn’t crypto!

So take Kenya a China-friendly BRI country as an example. To use e-CNY in trade the PBOC will have to work out a deal for access with the Central Bank of Kenya for use.

I get that the Senators don’t want the digital yuan used in the US, the good news is that China agrees! Maybe one of the few things China and the US can agree on.

Again the Senators don’t understand that e-CNY isn’t like crypto!

So who will this impact? No one!

The Senators will, however, get to say that they are “tough on China!”

Thanks for reading

Be in control of your future, subscribe!

More of my writing, podcasts, and media appearances here on RichTurrin.com

Contact me: https://richturrin.com/contact/

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is an Onalytica Top 100 Fintech Influencer and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon: