Smart Use of AI in Payments, or Playing it Safe?

Agents will bring sci-fi-like innovation to payments.

This is my daily post. I write daily but send my newsletter to your email only on Sundays. Go HERE to see my past newsletters.

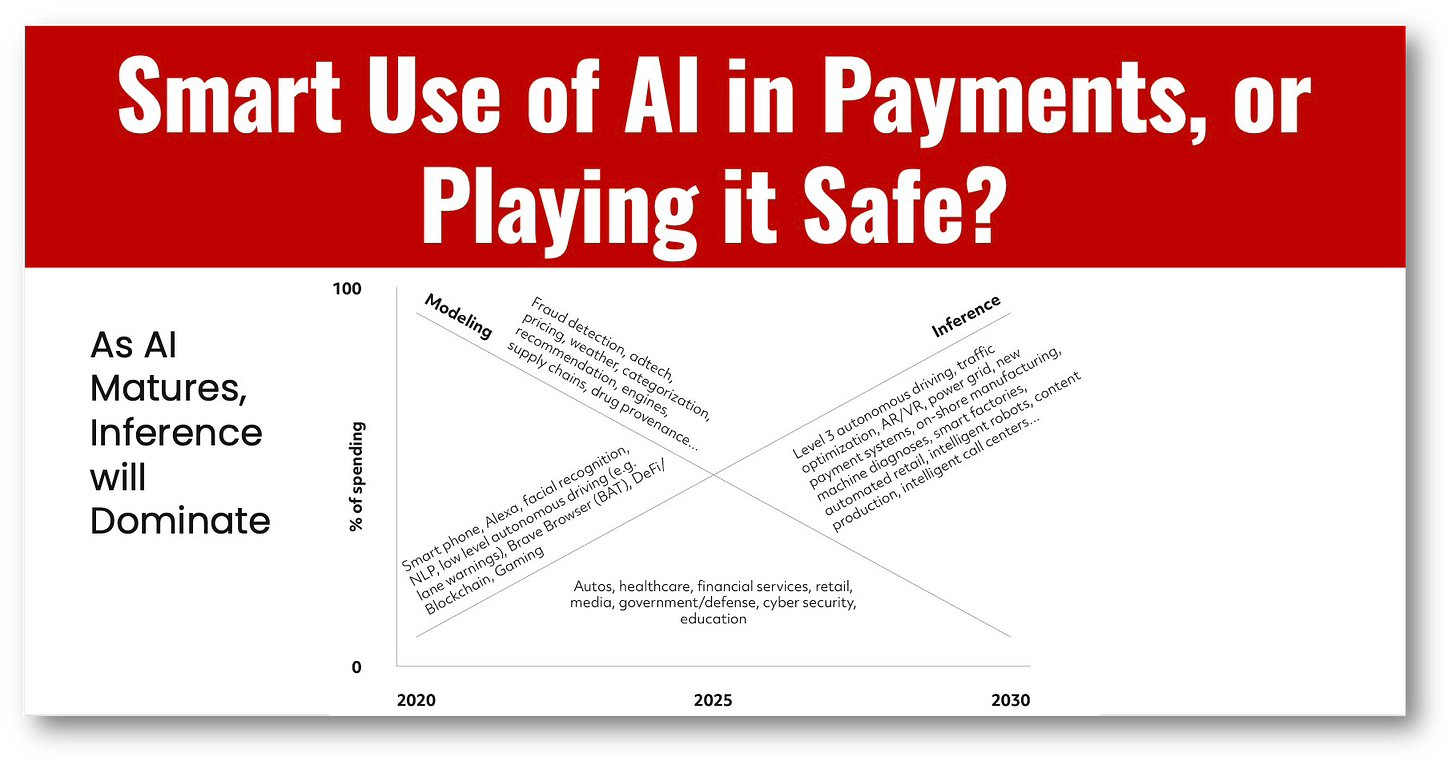

AI in payments is a big topic, and while the race to adopt AI is on, the problem remains finding “the smart use cases” that will not become “expensive distractions.”

The Payments Association Guide to AI tries to look at the “smart use cases”, including credit scoring, fraud, compliance, KYC, & AML, chatbots, and blockchain.

Smart use cases for sure, and there is much work to be done to adopt AI in each, but the Payments Association is playing it safe and not “thinking big.”

I consider their list as simply a starting point for AI in payments, and we should expect more from AI in the future, which is a bit more science fiction-like.

What about AI agents that act on our behalf to determine what is the optimal payment method whenever we make online purchases?

Cards, stablecoins, or CBDC, which gets me the best price?

Or payments that disappear as a personal AI agent analyzes each payment request and, if required, sends it to the user for approval for that “human in the loop” experience.

I expect AI to bring us a seamless payment experience.

I look forward to seeing the results from some of the “expensive distractions,” because that’s where the future is taking us.

👉Drivers for AI in Payments

🔹 Boosting revenues through increased personalisation of services to customers and employees.

One of the most powerful enablers of a strong customer experience is personalisation. By leveraging different types of AI, companies can unlock insights into consumer behaviour. This allows for tailor-made decision-making and the ability to offer what a customer wants and needs at the point when they need it.

🔹 Lowering costs through efficiencies generated by higher automation, reduce error rates and improve resource utilisation.

Better processes and efficiency also contribute to customer-centricity – increasingly so as banking and investment products have become largely commoditised. AI-powered analytics can improve how these services are delivered, providing differentiation and contributing to a competitive edge by enhancing customer experiences. More than 50% of 2,056 recently-surveyed IT and line of business decision- makers and influencers say that customer experience is their leading driver for AI adoption.

🔹 Uncovering new and previously unrealised opportunities.

The improved ability to process and generate insights from vast troves of data, according to a study involving over 25 use cases.

🔹 Driving growth by reducing risk and optimising processes to drive down costs.

This is especially true for anything that is volume- based and reliant on speed and accuracy, such as payments processing or regulation.

🔹 Satisfying the regulator.

Regulators the world over require auditable processes and decisioning, and AI can help payments firms provide this in a cost-effective, non-manual way.

🔹 Faster computing power.

Although the historical annual improvement of about 40% in central processing unit (CPU) performance in computing is slowing, the combination of CPUs packaged with alternative processors is improving at a rate of more than 100% per annum. Although ‘Moore’s Law’ is no longer strictly true, computing power is still growing exponentially every year, allowing AI to utilize faster and cheaper computing capacities.

HAND CURATED FOR YOU

🚀 Every week I scan thousands of articles to find only the best and most valuable for you. Subscribe to get my expertly curated news straight to your inbox each week. Free is good but paid is better.