Stablecoin Redemptions: When ‘Democratized Finance’ Means Retail Carries the Losses

And the GENIUS Act doesn't help!

This is my daily post. I write daily but send my newsletter to your email only on Sundays. Go HERE to see my past newsletters.

With stablecoins, “the devil is in the details,” and if you think that everyone will be treated equally, when you try to get your money back, you’re in for a big surprise!

MIT’s Digital Currency Initiative published a blog about stablecoin redemptions that will likely turn your stomach and change your perspectives on fairness.

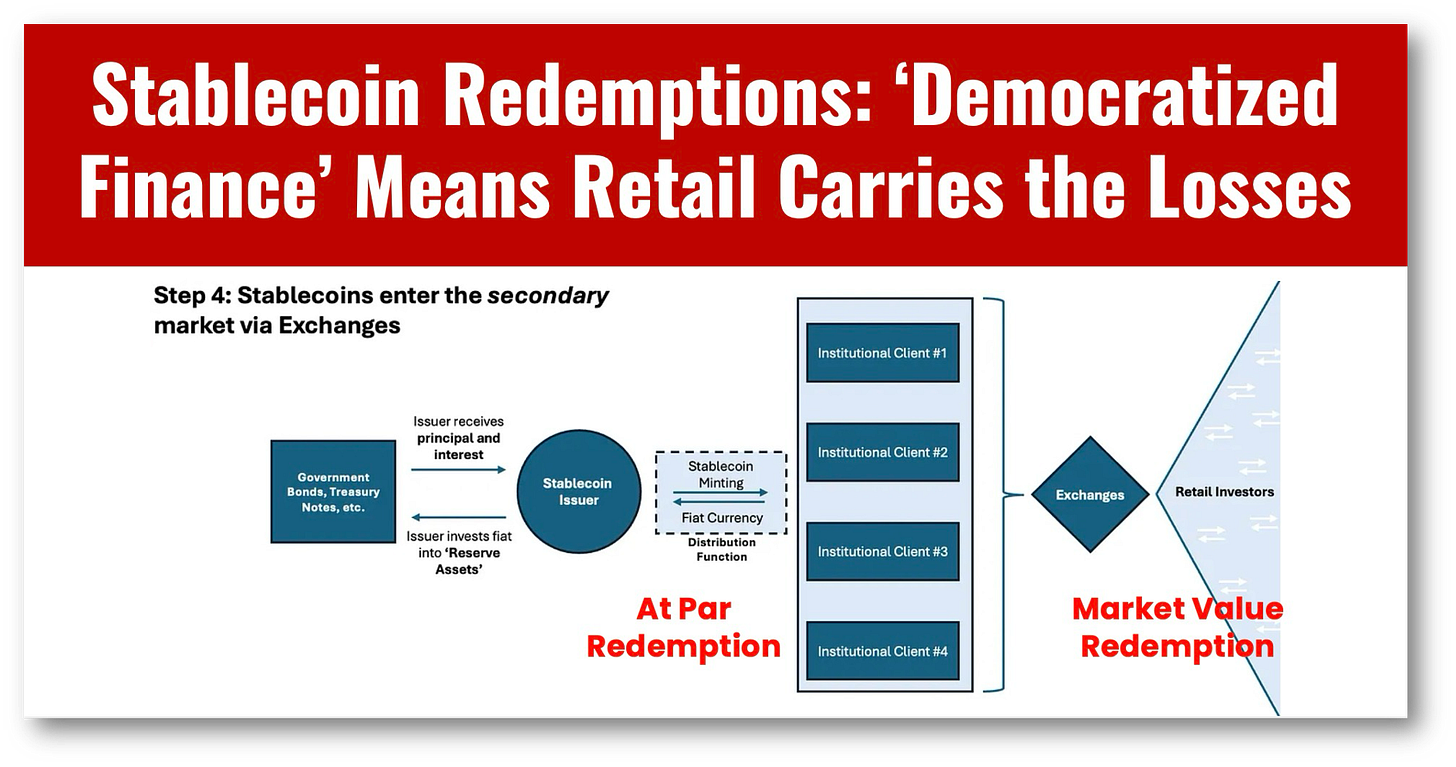

The article looks back on Circle’s depeg during the Silicon Valley Bank Collapse of 2023 and found that all stablecoin holders were not paid back equally.

Large institutional investors with direct accounts with Circle were paid back “at par” meaning at 1:1 with the value of the stablecoins held.

Meanwhile, smaller stablecoin holders had to redeem on secondary markets where prices for Circle coin dipped to $0.87.

As usual, it is the little guy who takes the losses, and stablecoins, despite all the talk of democratization, have done nothing but privatize gains and democratize the losses.

Retail Stablecoin Users Lose, Institutional Users Gain

Let’s wind back the clock to March of 2023, when Silicon Valley Bank (SVB) collapsed. Circle had deposits of roughly $3.3 bn of its total $40bn in assets, roughly 8% of the total, in the bank.

Circle’s USDC coin “depegged,” dipping as low as $0.87 on exchanges, far below the $0.92 that the coin should have been worth if only 8% of its assets were impaired.

The first lesson in this story is that market sentiment matters more than the numbers when things go wrong!

When SVB was bailed out by the US government, the coin regained its dollar peg; however, any retail transaction prior to this was done at market rates well below the dollar peg.

Thanks to blockchain analysis, remember the blockchain never forgets, institutional clients redeemed at least $2 bn during the crisis via a process called burning.

Burning allowed institutional clients to give their coins back to Circle, who destroyed the coins and paid them at 1:1 for their coins.

So let me make this clear, the only thing that was democratized when Circle depegged where the losses to retail investors! Institutional users cashed out at par.

Now, who were the institutions? While many large users had accounts with Circle, one group was the major crypto exchanges.

So a retail customer could cash in a USDC coin at an exchange and get $0.87, while the exchange could take the same coin and get $1.00 for it.

Are you amused?

The Genius Act Will Not Prevent This!

Interestingly, the Genius Act is unclear on who is considered eligible for at par redemption. Which is why it’s not too genius.

This isn’t new and is a major oversight. The State of New York’s DFS rules do cover retail investors for at-par redemptions of state-regulated stablecoins, requiring 1:1 reserve backing and timely redemption (within two business days, net of fees).

And that’s not all, stablecoin laws in the EU, Hong Kong, Singapore, and the UAE all have direct retail redemptions with specific timelines! Why should this be unclear in the US, which seeks to become the crypto capital of the world?

Hype versus Reality

Once again, we see how we need to look deeper than the stablecoin hype. What appears clear is that with stablecoins, a system is being promoted that only protects institutional buyers at the expense of retail users.

Understand that this runs contrary to the propaganda found in every pro-stablecoin publication all of which tout stablecoin’s benefits for “the little guy.”

Fintech and most certainly crypto preach moral superiority over incumbent banks, and this shows why it is not justified.

Stablecoin depegs will not be rare. Thirty-seven US banks failed in the last decade, all of which were under more rigorous regulations than stablecoins. Given that stablecoins will be issued under state laws with varying degrees of enforcement, it’s just a matter of time before retail holders are burned.

During this coming depeg, be prepared for the cries from retail users that their peg broke, while institutional users quietly cash out and put it in the bank without losing a penny.

Only then will this topic get the attention it deserves.

HAND-CURATED FOR YOU

👉Read more about the SVB Bank failure in my articles:

1. SVB the first digitally fueled bank run

2. SVB: a bailout by any other name

3. Tech will learn nothing from the SVB failure