Stablecoins: Clean Up or Miss Out on the Future

I love stablecoins but they need a big clean-up to be taken seriously

This is my daily post. I write daily but send my newsletter to your email only on Sundays. Go HERE to see my past newsletters.

HAND CURATED FOR YOU

Stablecoins are in the news daily and are seen as everything from a private sector alternative to CBDC to a means of promoting dollar dominance. While they have great potential, unless they clean up their act, they aren’t going anywhere.

After Trump banned a US CBDC, stablecoins became the only form of digital dollar that US citizens could use for retail payments. Purists may mention the possibility of banks developing retail tokenized bank deposits but that is unlikely. That’s one reason stablecoins are in the news and why all eyes are upon them.

That puts a lot of pressure on stablecoins to deliver on their often miraculous claims of financial inclusion, helping dollar hegemony, and disrupting cross-border transfers. However, until US regulations become clear, none of this will happen, and we will all be waiting in limbo. The reason is that stablecoins are not decentralized and follow the US government’s orders, much like a US CBDC, but most don’t like to admit this.

Stablecoins are subject to US government bans and sanctions, as seen when both Tether and Circle pay freeze accounts at the behest of the US government. Tether even boasts of its partnership with the FBI, OFAC and Secret Service. HERE

This means that I don't expect any of these miracles to materialize until the US releases definitive regulations on stablecoin usage. Only then will the rules of the game be set, and existing players forced to conform.

Meanwhile, the stablecoin market won’t be left to the current crop of crypto issuers. Standard Chartered bank in Hong Kong and the Bank of America in the US are in the process of launching their stablecoins, showing how they are going mainstream.

The participation of incumbent banks also guarantees that the days of lax AML/KYC for stablecoins are over.

1% Illicit Use Shows Clean up Required

For all of the good stablecoins can potentially do, they need to clean up their act as they’ve been called out as criminals, “go-to” currency.

Last year, the United Nations Office of Drugs and Crime (UNODC) reported that Tether, on the TRON blockchain, had become a preferred vehicle for cyber fraud, money laundering, and illegal gambling. In fact, it is so popular that it has reduced illicit transfers in Bitcoin. HERE

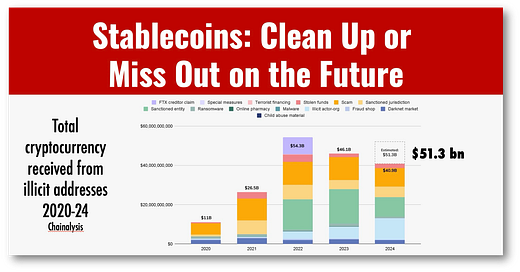

Chainalysis reported an estimated $51bn in criminal activity with stablecoins in 2024 and claimed that this is only 0.14% of the total on-chain transaction volume. That sounds good, but it contradicts the UN and others who bemoan their considerable use in crime.

The reality is that Chainalysis tracks illicit transactions against highly inflated overall stablecoin transaction volumes. This reduces the criminal activity in their statistics, while the real numbers are far higher.

Interestingly, Visa can help us better understand the actual stablecoin volumes. Visa adjusts stablecoin transactions volumes to adjust for “inorganic activity from bots and other artificially inflationary pressure.”

Visa’s adjusted stablecoin transaction value for 2024 is $5.8 trillion instead of $29.6 trillion, as commonly touted in the crypto press. (Visa: HERE and my article HERE) Visa estimates that stablecoin transaction volumes are inflated by about 80% in 2024.

Using Chainalysis’s $51bn in illicit activity, we can see that roughly 1% of stablecoin use supports illicit activity when using the adjusted volumes.

Surprised? You should be and it shows why stablecoins need a clean-up!

Regulatory Solution

While the above figures are only an estimate, they show clearly how much work there is to be done cleaning up stablecoins.

When US regulations affect stablecoins, bank-grade KYC and AML will be implemented. The idea that the US government will allow USD stablecoins to circulate with KYC and AML, which are inferior to banks, would undermine the entire US financial system.

This will eliminate any regulatory arbitrage stablecoins may have and reduce the number of illicit transactions. However, it could also very well crimp their use in crypto transactions, where their transfers remain a mystery. The US government does not like mysteries related to dollar use.

Even when regulated, stablecoins will likely maintain a cost and timing advantage over traditional SWIFT transfers. This will be hard to beat and a major driver for adoption. Stablecoins will force banks into uncomfortable decisions, such as whether stablecoin pricing should undercut their existing payment fee structure. It will also force existing stablecoin issuers to bear the cost of implementing new bank-grade KYC/AML systems. That is why, in the end, only the market can judge whether stablecoins’ benefits warrant increased use once they are regulated.

My bet is on stablecoins becoming critical financial infrastructure, but watch as incumbent banks get in the business challenging crypto “incumbents” like Tether and Circle Pay. Why wouldn’t they?

More of my articles on stablecoins: