State of AI and defining responsible AI; The future of payments; what's holding up the metaverse?

FITCH DOWNGRADES US DEBT TO AA+

1. State of AI in 2023: Gen AI’s breakout

2. Responsible AI puts people and the planet first

3. GenZ will decide the future of payments

4. What’s holding up the $5trn metaverse?

5. The US DOWNGRADE!

Today’s artwork: Beethoven Frieze: "The Hostile Powers," Gustav Klimt, 1901

Who can resist a painting of a Typhoeus! Klimt’s frieze takes its theme from Richard Wagner’s interpretation of Beethoven’s Ninth Symphony and depicts humankind’s search for happiness.

In the scene, humanity must face the dangers and temptations of the “Hostile Forces” in the form of a Typhoeus, a hybrid monster with shaggy fur, blue wings, and a snake-like body accompanied by Sickness, Madness, and Death on the left and Lasciviousness, Wantonness, and Intemperance on the right!

Klimt’s vision seems perfectly modern, as today, humanity faces “hostile forces” in the form of misuse of technology. The very concept that we need to teach our technology ethics shows the problem.

Not shown in this view is a floating Genie, which represents humankind's wishes and desires to overcome these “hostile forces." Let’s hope that with technology, the Genie can beat the Typhoeus!

Hey, it was a great week. I just scored eighth on the “Adorsys” ranking of fintech influencers! I am honored whenever my work is noticed, and a big thank you to Adorsys!

I am also proud to be the No. 4 global fintech influencer on the prestigious Onalytica influencer list. I got there by writing solid articles that people like you want to read.

If you want crystal clear, hype-free discussion on CBDCs, fintech, AI, crypto, and China’s tech scene, this is the place.

If you’ve already subscribed, you have my heartfelt thanks! For those considering, “just do it, subscribe.” You’ll be glad you did! If you like what you’re reading, please SHARE IT!

1. State of AI in 2023: Gen AI’s breakout

Read: here

The state of AI in 2023, or why only Generative AI matters for AI surveys!

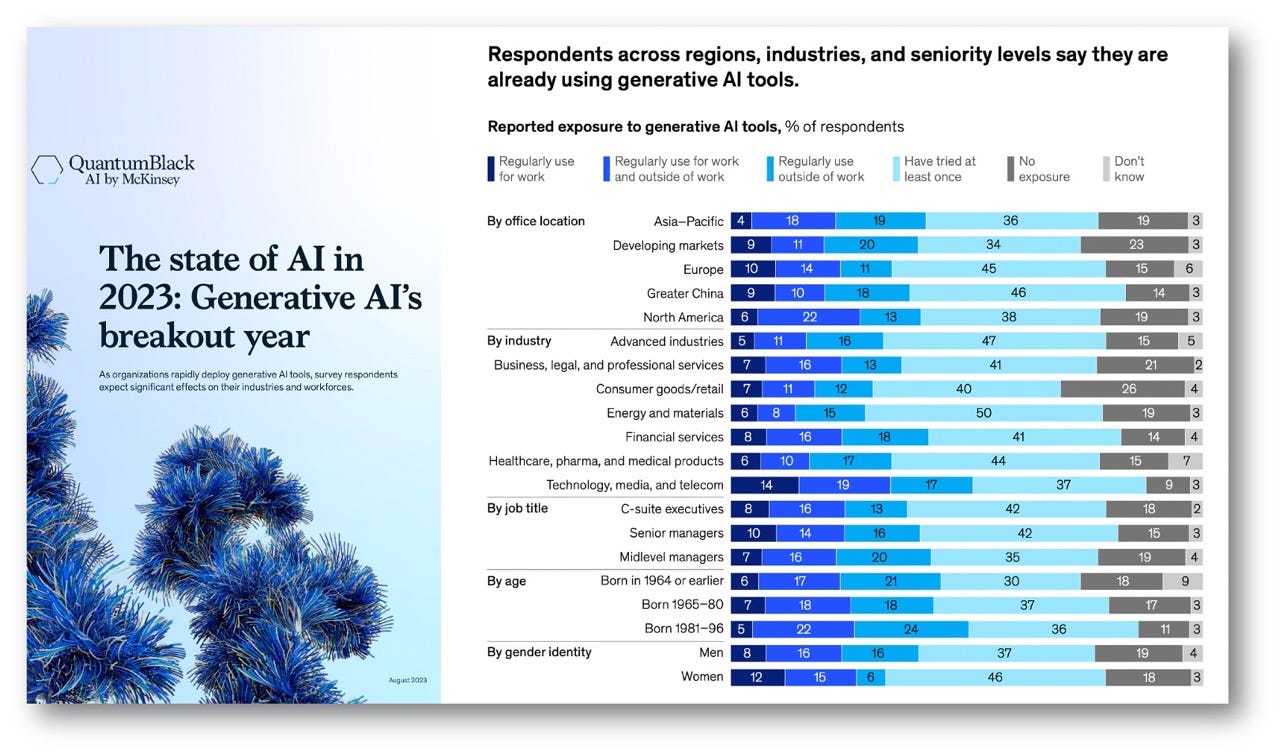

McKinsey wants to know the state of AI in 2023 and worked with its AI arm to survey 1684 participants across continents, industries, and ages to figure out who is using AI and what they’re doing with it!

One thing is that AI is more than a passing fad. It's here to stay, with 40% of respondents saying they are increasing AI investments!

Let’s take a look at the survey:

🔹 Who?

First, a surprise! Regular AI users were well represented from young to old, with little usage variation across age groups.

That sounds good, but if you don't know or have no exposure to AI you're more likely to be born before 1964 like me! A full 27% of these "elders" are clueless, a 13-point gap with the youngest group! They will get fired.

Interestingly, the variation in c-suite, senior and midlevel managers was slight, with all using AI at roughly equal amounts.

🔹 Where?

The US slams the competition in AI use and surpasses last-place finisher China by a 9-point margin! This makes sense because the GenAI craze hasn’t reached China yet as it has in the West. No 2 is the EU which is just behind the US.

🔹 What?

If you’re afraid AI will take over marketing and sales you’re right it will and probably drive us all nuts!

The No. 1, 2 & 3 uses are all marketing, sales, product development, and services. So get ready to be flooded by AI everywhere you consume.

❌This is where the survey results fall short. More complex non-GenAI use cases will be very specific to the company, take longer, and not turn up in these survey results. What everyone is working on is somewhat meaningless. What matters most is who uses AI, generative or not, to build the biggest disruptor!

🔹 What if?

What if AI gives the wrong darned answer? This is the no. 1 risk, and I'm not surprised, are you? Just wait for some new chatbot to start spewing offensive content!

Cybersecurity and IP infringement took the second and third spots for AI risk. IP lawsuits are going to be huge.

Thoughts?

👉TAKEAWAYS:

—AI isn't a passing fad, and the money is pouring in.

—Age matters, and older employees, my generation, will be lost!

—Be afraid. AI is going to pound us senseless with marketing and sales in about 9 months.

—AI risks are the problem.

2. Responsible AI puts people and the planet first

Download: here

Responsible AI prioritizes PEOPLE and PLANET, but AI METRICS prioritize the bottom line.

IEEE’s paper on responsible AI is a model for all businesses to follow. Still, while this paper is prescient in seeing AI’s bigger role in society, most companies will look to “the bottom line” first.

Bank of America as example

Am I too jaundiced or cynical? I don’t think so, so let's look at the headlines of an interview with Bank of America’s CEO as an example:

“AI virtual financial assistant has logged 1.5B customer interactions since 2018 launch: Moynihan” The conversation goes on to tout BoA’s AI, Erica, and its 10 million hours of conversations. Moynihan added at the end: “So people can use it and they like it.”

Erica is undoubtedly a fine AI and BoA a leader among its peers, but look how the hours and customer interactions are well-quantified metrics, but people’s acceptance far less so. “People like it,” is that a metric?

What metrics you use matter

IEEE cuts to the heart of this issue by asking: "What are the metrics of success for Responsible AI?”

👉“Suppose you are not using metrics to measure the effects of your product, service, or system on the planet or people. In that case, the risks and rewards you are measuring will primarily focus on KPIs relating to economics and growth. If your risk does not include how ecological systems could be damaged or human mental health may be at risk for your product, you guarantee ‘unintended consequences.’“👈

This is why BoA’s statistics on interactions and millions of hours are far less meaningful than they are made out to be.

Only when BoA and others get the metrics right and start measuring and considering “human needs and the long-term impact on the future of society” will we get the AI we deserve.

IEEE nails it: “What you measure is what matters to you. But this is only partly true since people and their mental health matter whether or not society has prioritized those factors.”

Call me a cynic, but my take is that most companies will only measure their AI's bottom line, which scares me.

Thoughts?

👉TAKEAWAYS:

—Ethical AI prioritizes people and the planet, which may conflict with profit.

—We deserve ethical AI and will need better metrics to define success.

— AI success metrics must be based on increasing a customer’s long-term flourishing

3. GenZ will decide the future of payments

Download: here

Millennials and Gen Z are the future of payments while boomers are still writing checks!

We all know that there is a generational component to payments, and American Banker shows just how big and amusing a gap there is between young and old.

Frankly, it is shockingly large, and as a boomer, my generation is being left behind writing checks!

But before we make fun of boomers, and I assure you we will, remember that they hold half of the US’s $140 tn in wealth. On average, boomers are worth well over 10x GenZ and roughly 4x Millenials. So does a boomer using a credit card rather than a digital wallet matter?

Still, these findings are important because, despite Boomer’s ability to pay, eclipsing younger generations, how we pay in the future will be dictated by Millenials and Gen Z.

Boomers are the punch line for virtually every finding in this report so enjoy!

✅ At least half of Gen Z and millennial respondents have made a digital P2P payment and used a digital wallet for an in-store payment or an online purchase. Compare these numbers to a third of boomers making P2P payments and digital wallet online payments, and 💥 one in 10 using a digital wallet for in-store payments.💥

✅ Gen Z has higher ownership rates of debit cards than boomers, and is twice as likely to have used a buy now, pay later (BNPL) service. 💥In contrast, boomers are twice as likely to own a credit card and three times as likely to use paper checks and have a retail store card compared to Gen Z.💥

✅ Twice as many Gen Z and millennials acquired wearable payment devices in the past year and four times as many have used them for in-store payments versus boomers. Three-quarters-plus of Gen Z and millennials see themselves as leaders or early majority technology adopters, compared with just one-third of boomers.

✅ Two-thirds (65%) of Gen Z consumers report an increase in online shopping, compared to just 31% of boomers.

✅ Credit cards dominate in-store and online purchases for boomers, which makes sense, since 98% of boomer-owned cards have rewards.

Thoughts?

👉TAKEAWAYS:

—Gen Z and Millenials will determine how we pay as boomers fade into retirement.

—Gen Xers are not trendsetters and are well behind millennials

—Millenials are the biggest crypto users eclipsing even Gen Z.

4. What’s holding up the $5trn metaverse?

Download: here

What’s holding up the US$5trn metaverse?

The Economist Impact group does a great job of doing away with metaverse hype and takes a very practical look at what we must overcome to get to the US$5trn prize!

We all know that the metaverse can potentially disrupt the world on a scale that may match or surpass the internet. The promise of immersive experiences makes it not just a place to view but a place to experience.

It's exciting, and I want it, and I’m sure you do too! Unfortunately, our enthusiasm also develops hype!

The Economist lays out three big challenges to scaling the metaverse:

1️⃣ Market Barriers

→Lack of interoperability:

The internet achieved ubiquity because common standards were created and implemented to ensure that different technical components seamlessly interact and function. Aligning on similar technical standards for the metaverse will require multi-stakeholder collaboration.

→Policy and regulation fostering innovation and safeguarding trust:

Here there is a recognized need for government regulatory action, which some decentralization purists will dislike!

2️⃣ Organization Barriers

→Low concurrent user ceilings discourage users:

Metaverse platform developers must enable more users to participate in virtual environments. Right now, environments have limited participants.

→Relatively long technology development timelines.

Metaverse breakthroughs depend on progress made across the technology ecosystem (e.g., infrastructure, streaming, graphics processing, headset size, hand detection and eye-tracking technologies).

3️⃣ Consumer Barriers

→ High-priced headsets:

With high prices, AR/VR headsets are currently out of reach for many consumers worldwide.

→Significant technical requirements and bulky products impact UX:

Consumer units with lower graphical capability, battery capacity, and interoperability are detrimental to UX, as is their bulk.

→Trust privacy and security concerns

Many do not trust companies with personal data generated in the metaverse. This distrust is focused on big tech and social media companies.

Thoughts?

👉TAKEAWAYS:

—The Metaverse is big, and it's coming.

—How long it takes is not just limited by technology.

—Lack of consensus on a definition is a problem.

—Look for not just one metaverse but many!

5. The US DOWNGRADE!

My PDF of the Fitch downgrade and the Congressional Budget Offices charts

Fitch rating agency DOWNGRADES US credit from AAA to AA+ based on an “erosion of governance”

And there you have it. The US just got pushed out of the AAA club by Fitch. If that wasn’t bad enough, it got thrown out not just due to fiscal deterioration and high debt but the ultimate insult "an erosion of governance.”,

Markets shrugged off the news, so it doesn't mean much but establishes a downward trend. This isn't the US's first downgrade and follows Standard & Poors in 2011. Of the big 3, only Moody’s maintains the US's AAA rating.

The downgrade delivers a scathing rebuke of Washington's debt ceiling showdowns that leave the world wondering if the US will default on its debt.

Who’d have guessed they are so toxic? (sarcasm)

Fitch is brutal:

🔹Erosion of Governance:

In Fitch's view, there has been a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters, notwithstanding the June bipartisan agreement to suspend the debt limit until January 2025. The repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management.

🔹Rising General Government Deficits:

We expect the general government deficit to rise to 🔥 6.3% of GDP in 2023, from 3.7% in 2022, 🔥 reflecting cyclically weaker federal revenues, new spending initiatives and a higher interest burden.

To add visuals to the sobering assessments in Fitch's report, I’ve included graphs from the Congressional Budget Office which show a bleak picture.

In the CBO’s words, “net interest outlays are a major contributor to the growth of total deficits.” The CBO shows how by 2033 roughly half of the US's deficit will be interest!

If that isn’t downgrade-worthy, what is?

🔹"Exceptional strengths" support the US's rating:

"Critically, the U.S. dollar is the world's preeminent reserve currency, which gives the government extraordinary financing flexibility."

This is certainly an ironic statement, given that dedollarization is now in the news daily. While this is unquestionably true today, in future years, when the debt service becomes even harder to manage, there is no guarantee that this will be true.

Fitch’s long-term outlook isn’t good, and business as usual has got to end.

Thoughts?

👉TAKEAWAYS:

—Debt ceiling standoffs and “deterioration in governance” are making US debt more risky.

—Downgrades will make debt even more expensive to pay off a vicious cycle.

—The cycle of debt and poor governance won’t end until something breaks, and by then, it’s too late.

“Subscribe and prosper,”

And share with your colleagues so they do not invite danger with “insufficient facts.”

My work is entirely supported by reader gratitude, so if you enjoyed this newsletter, please do both of us a favor and subscribe or share it with someone. You can also follow me on Twitter or Linkedin for more. The best way to ensure you see the stuff I publish is to subscribe to the mailing list here on Substack, which will get you an email notification for everything I post.

Everyone, including platforms that disagree with me, has my permission to republish, use or translate any part of this work or anything else I’ve written (except my books) with credit given to me and this site (richturrin.substack.com) free of charge. For more info on who I am, what I do, and where I’m going, check out richturrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is number 4 on Onalytica's prestigious Top 50 Fintech Influencer list and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon:

Cashless: HERE

Innovation Lab Excellence: HERE