SWIFT and BIS CBDC TRANSFERS; CHINA'S TECH AND APPROACH TO DIGITAL , CAN THE WEST COMPETE? USDC DEPEGS SHOWING WHY WE NEED CBDC!

What a blowout week!

CBDC

1. Retail CBDC Cross-Border Transfers

2. SWIFT connects CBDCs

3. USDC shows why we need CBDC!

CHINA

4. China leading in 37 of 44 “critical technologies”

5. China’s worldbeating whole nation approach to digital

BANKS

6. Banks NOT digital ecosystem players

Artwork: A surrealist work by Joan Miro. I was unable to find the details of this work but the central figure looks as we all might feel following a very busy week in fintech and China tech news!

I am proud to be the No. 4 global fintech influencer on the prestigious Onalytica influencer list. I got there by writing solid articles that people like you want to read. If you want crystal clear hype-free discussion on all CBDCs, fintech, crypto, and China’s tech scene, this is the place. All my writing is backed up by curating the best educational PDFs. Subscribe, and you’ll be glad you did!

1. Retail CBDC Cross-Border Transfers

The BIS's "Project Icebreaker" sets the standard for retail CBDC cross-border payments!

Download: here

“Project Icebreaker” is a model for our retail CBDC cross-border payment future. It allows ANY CBDC design to connect and banks to maintain their critical role as foreign exchange (FX) liquidity providers.

Project Icebreaker pulls off a nice trick in that it allows for retail CBDC transfers without requiring different nations' CBDCs to talk to one another or transfer CBDC!

“In the Icebreaker model, a cross-border transaction is broken up into two domestic payments, one in each domestic system. An rCBDC, therefore, never leaves its own domestic system. This is because FX providers buy one currency in one system and sell the other currency in the other system. An FX provider, therefore, holds rCBDC supporting wallets in two or more systems.”

Icebreaker has three principal components:

1️⃣ The icebreaker hub:

Icebreaker is a hub and spoke, meaning that it can route payment messages (not CBDCs) between connected CBDC systems. Individual CBDC systems need only connect to the platform and do not have to make direct connections with each other. These connections are technically challenging, given the many different CBDC designs.

Icebreaker's other role is to provide a database of FX rates and match the best rates to the requested transfers. This removes high fees.

2️⃣ FX providers (banks):

Banks will play an important role, as they do now, in providing “liquidity” for FX transactions. They will offer rates that are matched to trades on the platform. Banks must also maintain CBDC accounts in nations where they provide FX cross-pairs.

3️⃣ Retail CBDCs.

Here is where Icebreaker shines! It allows central banks almost full autonomy when designing their domestic rCBDC systems. They can connect with virtually any design!

This is critical because CBDC interoperability is very difficult to achieve, given the different design standards in trial. Icebreaker and its cousin in Hong Kong, mCBDC, are platforms that impose few technical constraints on CBDCs that use them!

For the record, -some- nations' CBDCs will be interoperable with high-level commercial and central bank FX support. For everyone else, Icebreaker is a godsend! I also expect to see other solutions once CBDCs launch!

Takeaways:

—Icebreaker is another BIS masterpiece that shows how, once again, the BIS is building our future.

—The ability to connect any CBDC and use bank liquidity is key!

—Icebreaker will provide interconnectivity for many CBDCs that are not interoperable or have low liquidity.

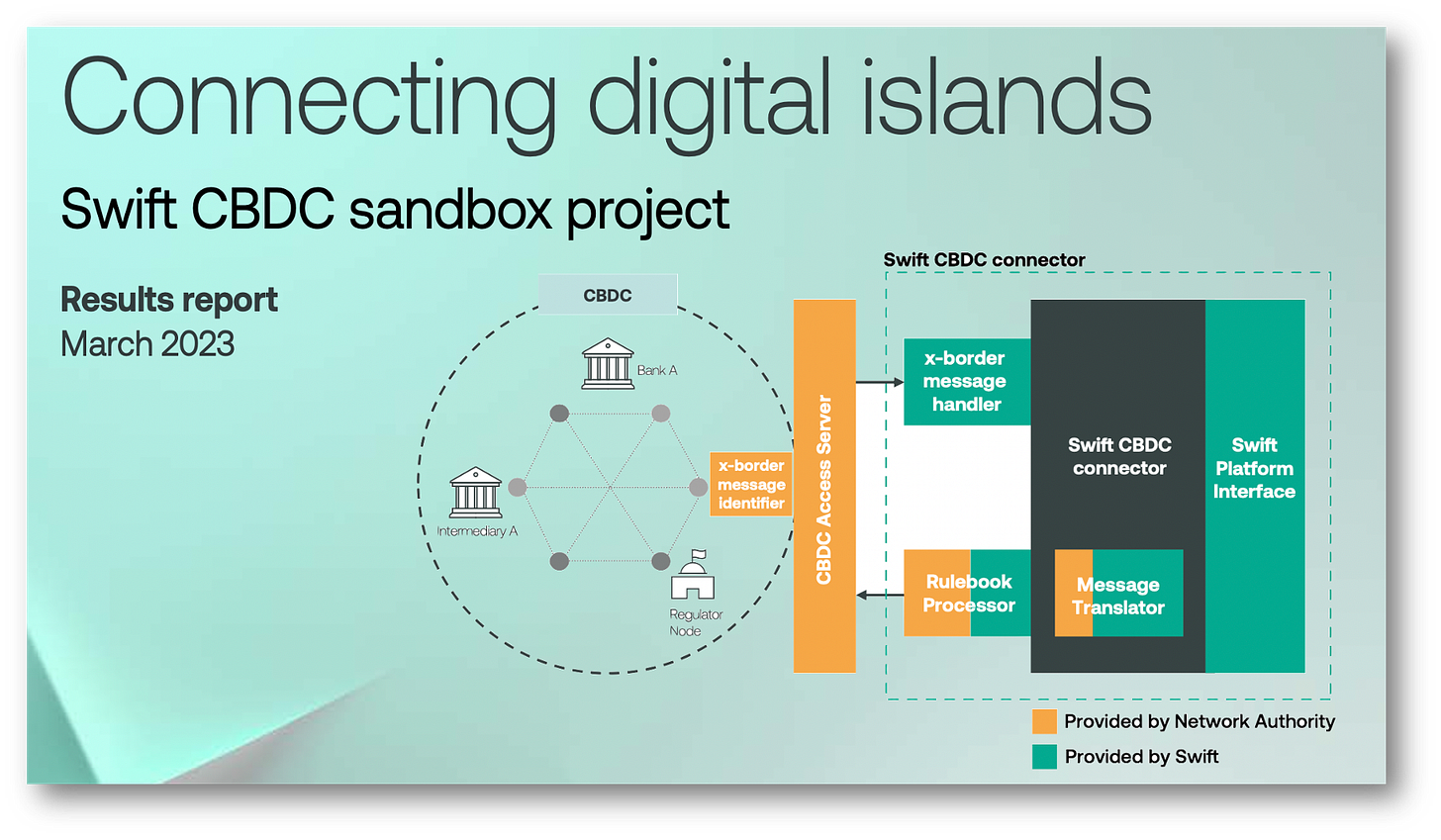

2. SWIFT connects CBDCs

SWIFT innovates a CBDC cross-border interlinking system: Build it, and they will come!

Download: here

SWIFT is responding to the existential CBDC challenge by innovating! It successfully built and tested a CBDC interlink system in a sandbox with 18 collaborating central and commercial banks with stellar results.

The participants saw “clear value and potential,” so the project will continue to Beta development. The goal is to build a production system for instant and frictionless CBDC cross-border payments!

This is great news for EVERYONE who wants cheaper, faster payments!

Fragmentation

SWIFT understands that with the drive toward CBDCs, “fragmentation is a risk.” From SWIFT's perspective, fragmentation is code for CBDCs creating competition they never had before.

For SWIFT “Build it, and they will come” is key to its survival. Given the fragmentation that CBDCs will bring, SWIFT has to provide a CBDC option or risk clients defecting.

SWIFT’s theme of connecting digital islands is dead on! CBDCs are all very different, and the goal of native CBDC-level interoperability is a pipe dream.

SWIFT addresses this by showing how its system can interconnect systems built on Quorum, R3 Corda, and RTGS. The message is clear, whatever CBDC you build, we can connect it!

Interlink CBDC -NOT- Transfer Tokens!

One thing to understand with this solution is that CBDC tokens remain within their jurisdictions. Note the use of the term "interlinking" CBDC rather than transferring.

CBDC tokens aren’t actually transferred, unlike the BIS's m-Bridge, where banks directly hold and transact in CBDC! A key difference!

Technically SWIFT's solution does one thing that no other can; it fits seamlessly into banks' existing systems. This is, without question, the system's greatest strength.

Still, this begs the question, should this legacy framework should be supported or abandoned?

Some will see the preservation of nostro-vostro accounts and escrow as prehistoric artifacts and claim that maintaining this complexity is the system’s greatest weakness. Frankly, I agree! Tokenized money with instant atomic payment shouldn’t be confined to a legacy system from a century ago!

For those who reflexively don’t want SWIFT in our new CBDC world (think China) there will be other options. Multipolarity, or as SWIFT calls it, fragmentation, isn’t going away, but neither is SWIFT.

Payments must become cheaper and faster for us all, and SWIFT's innovations have a big role to play in this future.

Takeaways:

—SWIFT has a role to play in our CBDC future.

—Payments becoming faster and cheaper is good for all!

—The system fitting within existing bank systems is a strength!

—Maintaining archaic systems is also a weakness!

3. USDC shows why we need CBDC!

Stablecoin USDC depegs and shows why CBDCs are not a “solution looking for a problem” but the real source of stability in an unstable world!

USDC’s depegging from its $1.00 value was quite a shock! Circle lost $3 billion in the collapse of Silicon Valley bank. This is roughly 8% of the capital backing USDC which means its value should be $0.92? Let’s hope they can recover far more, I like Circle and am hoping for the best!

The stunning collapse of Silicon Valley Bank is showing why the term “stablecoin” is a misnomer. Circle just announced that it had $3.3 bn stuck in Silicon Valley Bank and its “stablecoin” USDC de-pegged from its $1.00 fix and dropped briefly to $0.87 today.

Let me say from the start that I quite like Circle, the issuer of the world’s second-largest stablecoin USDC. They always positioned themselves as the “good guys” in the stablecoin business. That may be a rather low bar when Tether, the world’s largest stablecoin has yet to publish audited accounts!

I am not gloating at USDCs hardship but do think that this moment requires some introspection.

Not a week goes by when I am not assailed on Twitter or LinkedIn by stablecoin proponents saying:

“There is no need for CBDCs because we have stablecoins!”

My reply: Really?

It would seem that today’s decoupling disproves the notion that CBDC is a “solution looking for a problem.” CBDC's true “stability” through central bank issuance is its greatest feature.

I have written regularly that I support the use of stablecoins, but consider them inferior to CBDC. Today proves why.

In an uncharacteristically short article, I will say look at the graph above and imagine that your business depends on stablecoins.

Need I say more?

Takeaways:

—CBDCs are a superior form of payment to stablecoins. Controversial? I don’t think so.

—Stablecoins will have a role to play in payments, but they do not a substitute for risk-free CBDCs. Today shows why we need both!

—CBDCs are a solution looking for a problem? The problem is clear!

—Never undervalue CBDCs being “risk-free.”

4. China leading in 37 of 44 “critical technologies”

China is leading the world in 37 or 44 “critical technologies” and has a potential monopoly in many.

Download: here

The Australia Strategic Policy Insitute’s (ASPI) “critical technology tracker” delivers a sobering message:

"Western democracies are losing the global technological competition."

Is that blunt enough for you?

“Our research reveals that China has built the foundations to position itself as the world’s leading science and technology superpower, by establishing a sometimes stunning lead in high-impact research across the majority of critical and emerging technology domains."

“China’s global lead extends to 37 out of 44 technologies that ASPI is now tracking, covering a range of crucial technology fields spanning defense, space, robotics, energy, the environment, biotechnology, AI, advanced materials, and key quantum technology areas."

“In the long term, China’s leading research position means that it has set itself up to excel not just in current technological development in almost all sectors, but in future technologies that don’t yet exist.”

Monopoly risk

As though this news wasn’t sobering enough, ASPI also built a metric for “Technology Monopoly Risk.” A red/yellow/green traffic light that seeks to highlight concentrations of technological expertise.

Here too, the news is sobering. Of the 37 areas where China is a global leader, it has a Green or “high risk” of monopoly in 8 areas, and “medium risk” in 29!

What the monopoly index highlights is not just how far ahead the top country is relative to the next closest competitor but how many of the world’s top 10 research institutions are located in the leading country, which would contribute to their monopoly position.

ASPI is correct; these findings should be a wake-up call for democratic nations and suggests that gov’ts should collaborate and work individually to catch China.

ASPI calls for sovereign wealth funds to pour money into research, tech visas, and R&D grants between allies, revitalizing the university sector, tax incentives, and public-private partnerships.

While these are all prudent suggestions, the reader is left with the sense that these solutions will do little in the near or mid-term to counter or catch up with China.

I have been warning readers of this for years!

Takeaways:

—Once again, I state that China innovates, though some will still deny this.

—While this is not “game over,” the West has to play catch-up, a position it is not familiar with.

—Unless the West can match China’s societal emphasis on innovation and technology, I can't see where the tech innovation will come from.

5. China’s world-beating approach to digital. Can the West compete?

“Digital China” is a “whole nation” approach for a world-beating digital future. Can the West compete?

Link to article on Asia Times: Here Another article with complimentary content and no paywall can be found: here

Digital technology represents a strategic opportunity for all nations, rich and poor. In the recent “Two Sessions” meeting, China made it clear that it is willing to change the very foundations of government for a world-beating digital future.

This is monumental! I am not proclaiming that China will rule the digital world, but it's critical to see how it is willing to reinvent itself to succeed in our shared digital future.

The question is can the West compete? The West’s lack of response to new digital challenges like crypto or generative AI doesn't inspire faith.

China's goals are clear:

“By 2025, China will form a nationwide system to achieve its “Digital China” goal, according to the plan. By 2035, China will be among the world’s top countries in terms of its digitalization level.”

China is creating a new government body called the “National Data Bureau” and replacing the Cyberspace Administration to recognize data’s key role in society. It also created data exchanges where data can now be openly traded.

The new entity shows China designating data as a “means of production” is not just talk. They are readying a nation to capitalize on the use of data in the real economy.

The Ministry of Science and Technology is also being refocused and made more powerful due to the US’s chip bans. The goal:

“China should boost its semiconductor sector with a “whole nation” approach,...to achieve technological breakthroughs.”

Time will tell if this effort is successful, but its willingness to change is instructional.

FinTech is also part of the plan, and the Banking and Insurance Regulatory Commission is being revamped and renamed the National Financial Regulatory Administration.

The goal of these changes is to close loopholes created in part due to the greying of boundaries brought by fintech. Change to match a changing world.

The life-altering technology we now possess calls for new regulatory frameworks. China regulators are changing to match technology's expanding societal role and capitalize on this strategic opportunity.

This is what the West is competing against. Where are the West's similar macro-scale changes?

I lived through the 1960s space race in the US. That's what it feels like in China today with digital!

Takeaways:

—China is willing to change to become a tech leader.

—The West must mirror these changes to compete in a new digital era.

— Will the West heed the call?

6. Banks NOT digital ecosystem players

Banks' make-or-break moment is here; they must join in the financial ecosystem movement or be consumed by it!

Download: here

BCG with a great article on banks and financial ecosystems that shows how <27% of the world’s largest banks are making significant investments while the remaining 73% are clueless, with 21% doing nothing at all!

To the victor goes the spoils! With roughly 73% of banks doing little by way of ecosystems, this leaves the door open for BigTech and the likes of Google and Amazon to integrate payments and financial services onto their platforms.

By showing so little interest in ecosystems, banks are abandoning the sector to bigtech, the MASTERS of ecosystems, and positioning themselves to be subservient to them for an eternity! Way to go, banks!

Ecosystems the next disruptor

I think BCB is correct in saying: “Ecosystems are the next step in digital disruption for the financial services sector.” So how do you think this will play out for banks?

To answer that question, some initial figures are already in, as BCG found that: “The 27% of banks with significant ecosystem engagement have higher multiples (10.5 vs. 10.0), a higher price-to-book ratio (1.4 vs. 1.2), and had shareholder returns that grew 2x faster (8.2 vs. 4.2%) than the 21% that had little to no engagement.

So the evidence is already highly suggestive that the banking world is divided into digital performers and “dead bank walking” digital laggards.

Now just to be clear, how BCG defines an ecosystem:

“A business ecosystem is a dynamic group of largely independent economic players that create products or services as part of a shared value proposition."

Just think of major digital platforms to understand ecosystems. Banks can participate in ecosystems in two ways. Either “orchestrate” the ecosystem, which means designing and building it, or join as a “contributor.”

Unsurprisingly only 25% of banks attempted an orchestrator role, 32% were contributors, and 43% shared both roles in some way.

Bigtech gains power

Given how few banks try to be orchestrators, platforms like Alipay, Grab, and Amazon are gaining power relative to banks.

China is the classic example of this, and as I wrote in "Cashless," it gave banks no pleasure to realize that they had to participate on WeChat and Alipay and pay for the privilege!

This same fate awaits banks in the West, where BCG estimates they will lose 40% of a $900bn revenue pool!

Takeaways:

—Banks' digital uptake of digital ecosystems is uninspired!

—Most are predestined to subservience and dependence on bigtech because they will have no digital platform of their own.

—Once again, we must ask, "when will banks understand what’s at stake with digital?"

If you’ve read this far, subscribing is the only logical course of action.

And share on Twitter because:

"The needs of the many outweigh the needs of the few or the one."

My work is entirely supported by reader gratitude, so if you enjoyed this newsletter, please do both of us a favor and subscribe or share it with someone. You can also follow me on Twitter, or Linkedin for more. The best way to ensure you see the stuff I publish is to subscribe to the mailing list here on Substack, which will get you an email notification for everything I post.

Everyone, including platforms that disagree with me, has my permission to republish, use or translate any part of this work or anything else I’ve written (except my books) with credit given to me and this site (richturrin.substack.com) free of charge. For more info on who I am, what I do, and where I’m going, check out richturrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is number 4 on Onalytica's prestigious Top 50 Fintech Influencer list and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon:

Cashless: HERE

Innovation Lab Excellence: HERE

2 words: FU and your digital masters