Swiss Pathways For Financial Innovation: Stunning Views For The Brave

You don't have to be Swiss to enjoy the view of fintech innovation from these paths!

This is my daily post. I write daily but send my newsletter to your email only on Sundays. Go HERE to see my past newsletters.

While this report highlights Switzerland’s pathways for financial innovation, it is so well written that everyone should read it. The paths offer stunning views but only for the brave!

The individual chapters are clear not just in explaining the topic but also in explaining what these technologies mean for our future.

The main sections include: AI, Digital Assets, Digital Trust and Quantum-Safe.

I liked them all, but recommend that everyone read the chapter on Digital Trust. This is a “weak link” in all fintech innovation, though the report shows progress with Digital ID in Switzerland and the EU coming soon.

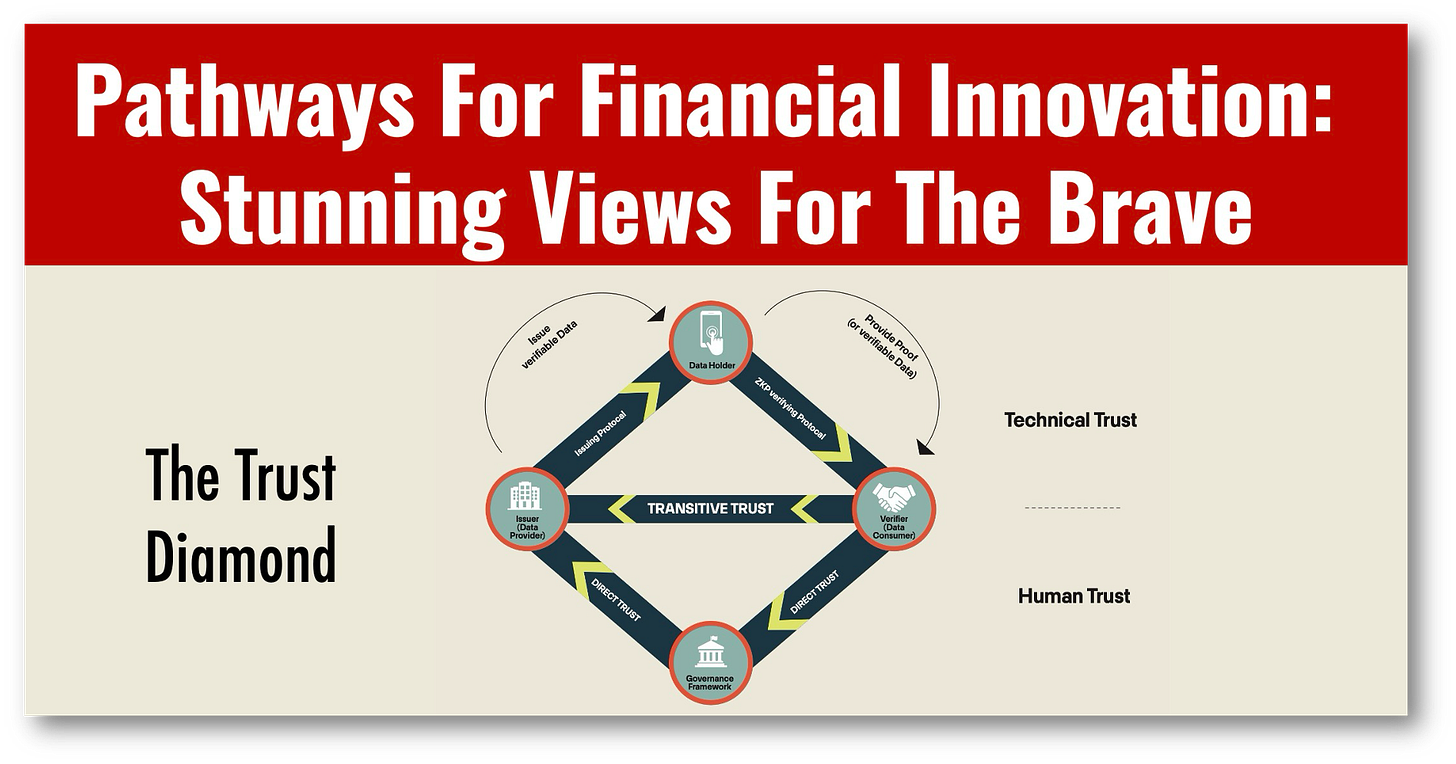

Digital trust is foundational in fintech and has two components: technical trust, which is based on technology, and human trust, which depends on governance rules that determine how players participate in an ecosystem.

It is important to understand that technology alone cannot ensure digital trust, despite crypto fanatics’ assurances that blockchain alone should inspire trust.

For the record, Switzerland knows a bit about digital trust. Remember that in 2020, it was shaken by the Crypto AG scandal. Crypto AG was a company selling encryption technology to 120 governments across the globe, and it turned out to be owned and controlled by the CIA and German intelligence! HERE

Still let's hope that the report is right with its optimistic view: “a “rebirth” is emerging through global trust networks using standardized protocols, verifiable identities, data and privacy-enhancing technologies (e.g., ZKPs) as trust anchors.”

I’m all for a rebirth in digital trust, we need it now!

👉KEY POINTS ON DIGITAL TRUST:

🔹 Don’t trust, verify: Implement trust infrastructures to enable electronic identification and verifiable data exchange ecosystems, fostering users’ autonomy and authentic interactions and transactions in an increasingly digital world while addressing fraud, compliance and removing friction in processes across domains and data silos.

🔹 Empower individuals to manage and control their digital assets and data securely reduces reliance on third-party brokers, ensuring greater security and autonomy.

🔹 Digital identity must not be treated as an isolated identifier but as a foundational trust anchor to enhance customer experiences, streamline operations and improve compliance.

🔹 Wallets combined with advanced, algorithmic user experience (UX) apps allow users to broker digital services under their sovereign control.

🔹 Increased computing power in personal devices enables privacy-preserving, edge-based processing of complex data, simplifying user experiences. Users can consent to share information and revoke access at will.

🔹 Trust-enabled embedded finance relies on three pillars: verifiable open data and data commons, proprietary verifiable data that supports unique services and client-controlled data sharing using sovereign control mechanisms.