Terra Burns $3bn, China's Slowdown, Crypto's Shadow Finance System, The China-US Tech War is Lose-Lose

Terra founder Do Kwon's $78 million in back taxes! Not in it for the money?

This week:

1. Terra Burns $3bn and $78 mn in back taxes

2. China’s Slowdown and Shanghai readies for opening

3. World Bank “Fintech and the Future”

4. The Shadow Financial System: Banks and Bitcoin

5. China-US Lose-Lose Tech War

6. Inequality rising

1. Terra Burns $3bn its founder owes $78 mn in back taxes

Terra BURNS $3 billion in reserves supporting failed “stablecoin,” Singapore police involved, while South Korea is calling for an investigation and claims founder Do Kuan owes $78 million for tax evasion. Oh, this is going to be amusing!

Just when you thought the Terra story couldn’t get any worse, it does! Terra burned through $3 billion in Bitcoin in a "last ditch" effort to save the UST coin.

1️⃣ A tweet by “Luna Foundation Guard” the entity responsible for Terra’s reserves confirms that they have only 313 Bitcoin remaining of a total of 80,394 which meant that $2.9 billion was spent on “saving” Terra. We do not know where the money went!

2️⃣ Reserves will NOT BE returned to the remaining Terra holders! One plan that met with community support was for roughly $200 million in reserves to be used to cash out small users. Instead, Terra and disgraced founder Do Kuan will use the remaining reserves to restart a new Terra network. This is in direct conflict with calls from Binance’s CEO CZ and Vitalek Buterin to refund small users. The Ponzi continues!

3️⃣ The voting on the new Terra is as you’d expect controversial and shows governance issues. Non-binding voting on the Terra platform shows 90% don’t want the “new Terra” and want reserves used to reimburse smaller holders. The vote that matters of course is not in the hands of users but instead in the hands of “validators” who control large voting blocks! Even among validators, Terra’s insiders, there is dissent. Of course the little guy, or small investor is destined to lose once again!

4️⃣ A police report has been filed in Singapore, where Terra founder Do Kuan and the non-profit corporation holding reserve assets resides. Recent reports claim that the police are not investigating, but I can’t see Singapore ignoring this. as they’ve been proactive against crypto fraud.

5️⃣ South Korea tax authorities are however not pleased and are coming after Do Kwon seeking significant amounts of back taxes. This certainly will not go away!

6️⃣ We still do not know where the money went. A Bitcoin tracking company tracked Bitcoin transfers to exchanges but once converted to another crypto or cash, it is untraceable. A complete accounting is required and none has been provided.

I expect founder Do Kuan’s life will change considerably in the coming months, while he may be the cult leader who founded a new version of Terra I’m not sure he will be able to savor the victory of a second chance for long.

Singapore has zero-tolerance for financial fraud and even less for this fraud in the crypto world, Korea is after him for tax evasion and fraud and he still has the US SEC chasing him for selling to US citizens.

I was going to say “I hope he has good lawyers”, but Terra’s entire legal team resigned this week!

2. China’s Slowdown and Shanghai readies for opening

This is day 52 of lockdown and it looks as though Shanghai will reopen this week. Fingers crossed as its boring as hell! Still, the financial cost to China is massive and data out this week showed the impact.

1) Retail sales are down 11% YoY if my household is any example we can all understand why! My wife and I marvel at how much we’ve saved during lockdown. All of those in varying stages of lockdown are unable to purchase anything but necessary food supplies. Shanghai is 3.8% of China GDP so an important retail market as is Beijing which has also been hit.

2) Industrial production is also down almost 3%, which shows not just the impact of Shanghai but the slow-down in logistics systems across the nation. A knock-on effect to lockdown.

Pg. 3) Supply chains are impacted, and imports into China have been delayed by several weeks. These figures don’t show that perishable products like my favorite imported Australian yogurt have all but stopped importing for fear that shipments will expire. This part of covid is the most painful for me!

4) I know many of you both in and out of China have strong opinions on China's covid policies, so I'm not going to go there in depth. What is clear is what is at stake. A recent report showed that if China opens 1.55mn deaths, mostly among those 60+ and swamped ICUs, would ensue. So there is a real price to be paid for opening even with the far less deadly omicron.

5) So should companies pull out? Some are, and a neighbor announced that she was going to Vietnam to work with clothing manufacturers there in a few months. Still, the numbers for foreign investment into Vietnam and SE Asia don’t show a boom in capital migration. You simply can’t move all of these factories because of well-established supply lines, even if slow, unique to China.

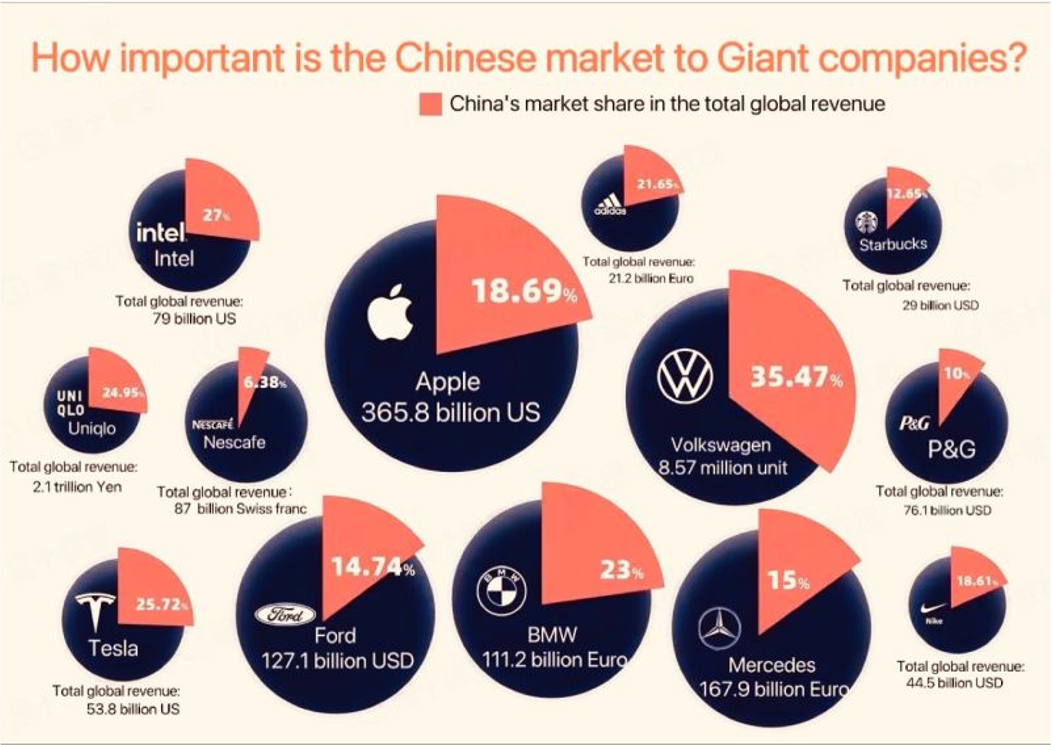

6) Pulling out of China isn’t an option for many multinationals who are dependent on sales in the world’s second-largest economy. "Pull-out" or "decouple" make good sound bites but are bad for business.

Covid cases in China are falling, and the end is near, but no one knows how fast China can rebound. Pent-up retail demand certainly exists. I know about this firsthand and can’t wait for retail therapy! Still, cars and house purchases for 2 months can’t immediately be recovered.

While there is always the “China is doomed” camp who claim China can’t recover, there is ample reason to be hopeful given government stimulus measures. I think that “betting against China” is always a dangerous position to take.

3. World Bank “Fintech and the Future”

🔥 MUST READ 🔥 The World Bank goes “all in” with an 8-section report on Fintech and the Future!

This massive read is so big I can’t put it up on Linkedin! It is over 500 pages and really should be considered a book. The full report can be downloaded: Here

To give you a feel for the gravity of this document, here are the eight sections: 1) Overview, 2) Market Participants, 3) Market Structure, 4) Regulation, 5) Consumer Protection, 6) Payments, 7) SMEs, and 8) Digital Money. Below are sections 1 & 8.

How to tackle this document. Download the entire report and have a look at the section headings but PLEASE LOOK at the graphs. They are simply stunning!

Here’s why this document matters. The World Bank wrote this for “policymakers" particularly those in “emerging market and developing economies” (EMDEs) so the WB presents a very candid discussion about what can go wrong with fintech.

Frankly, I find that refreshing. While I believe in fintech’s ability to make life better, it often makes new sets of problems that are all too often ignored.

We saw this in full view this past week with the collapse of the crypto market. Risks were ignored. But it isn't just crypto, look at China’s P2P lending market for how bad things can get in an EMDE.

Enjoy this document. It is thorough and pulls no punches.

Fintech isn't always rainbows and unicorns.

4. The Shadow Financial System: Banks and Bitcoin

Banking, Bitcoin, and crypto exchanges form a “shadow financial system” that needs regulation before it blows up.

Talk about timing! Given last week's crypto carnage, the BIS couldn’t have planned this if it tried! My highlighted copy HERE

Maybe the BIS did plan the crypto crash? I say this because I want to see if tomorrow, on Twitter or Reddit, the crypto community’s conspiracy theorists will blame the BIS for causing last week’s crash! 🤣

So let’s start with the obvious from the BIS:

Regulations: “should focus on ensuring a more level playing field with regard to financial services provided by established financial institutions and intermediaries in the emerging crypto shadow financial system by introducing more stringent regulatory and supervisory oversight for the latter.”

According to the BIS the “shadow financial system” is primarily driven by crypto exchanges. What comes next should not be a surprise, they are a mess.

“Regulatory and supervisory oversight of crypto exchanges – encompassing consumer protection, market integrity, trading, disclosure, prudential and addressing anti-money laundering (AML), combatting the financing of terrorism (CFT) – remains patchy at best.”

It's not just the BIS saying this. Last week the SEC accused exchanges of regularly front-running clients!

While last week’s crypto blow-out had no impact on the traditional financial system, assuming that this will always be the case is a grave error.

Reinforcing the oversight of exchanges would seem not just prudent but an urgent action for regulators. This means regulations on exchanges that mirror traditional securities houses.

For crypto believers, this will only make the crypto “decentralization illusion” even more complete!

Crypto users relying on exchanges have the illusion of decentralization rather than true decentralization because exchanges centralize their activities for gov't authorities.

So to all those using crypto exchanges preaching decentralization the BIS has a stark message:

“Our findings, however, suggest that the footprint of the current generation of cryptocurrencies does not mark a sharp departure from the existing financial ecosystem.”

Brace for impact. More regulations are coming and last week proved to every regulator on the planet why they are needed.

The crypto world will respond with, "we're decentralized and don't need them."

The battle lines are drawn!

5. China-US Lose-Lose Tech War

We are fast approaching a “Lose-Lose Tech War” that will cost not just the US and China, but the whole planet.

The original article “The Lose-Lose Tech War” can be found HERE on “Project Syndicate.” It is syndicated and can be found on other news sites without a paywall by searching for the title on google. Also available HERE

The tech rivalry between China and the US is becoming so bitter that both countries are losing. The rhetoric is so bad in the US that hate crimes against Asian Americans were up 339% in 2021.

We are now reaching the point where we risk the world’s two greatest nations derailing each other's progress. When Chinese professors in the US are leaving, and a younger generation isn’t arriving to fuel innovation, there's a problem for both nations.

Let’s face it there are a lot of problems that need to be solved right now from food security, global warming, and yes, the ongoing pandemic.

Find someplace to cooperate:

“The United States and China need to find discrete areas where they can pursue cooperation and reverse the rot in their relationship.” (quotes indicate text from the article)

It takes two to tango and both the US and China need attitude adjustment:

🔹On the American side,

“Too many political leaders and commentators believe that an economic decoupling from China will cripple its ability to catch up, let alone surpass, the US as the world’s leading economy. The dynamism that China has exhibited for the past four decades suggests otherwise.”

“In some races, [China] has already become No. 1. In others, on current trajectories, it will overtake the US within the next decade.”

🔹On the Chinese side,

“There are many who believe that the country is now capable of going it alone. They think China has already learned all that it needed to learn from the West and the wider world. Homegrown innovations, in their view, combined with the strength of China’s governing structures, will be enough to sustain the country’s upward trajectory.“

“Chinese who think this way should recall their country’s own history. It was a refusal to learn from the outside world, …… that helped to bring about the country’s long decline from its position as the world’s wealthiest and most advanced society.”

The Huawei ZTE barriers won’t be eliminated in the US, nor will Facebook and Google suddenly find China open. IP battles will continue to rage in the background. They won’t end and are a historical feature of developing nations, including the young US, not an aberration.

The US must compete, as it did during the space-race, but now it also needs to find ways to cooperate.

"The world’s most pressing problems are global, not national. They will require not just competition but also cooperation."

6. Inequality rising

Inequality will be the most important topic of our times because the rich really are getting richer while the poor get poorer. Social stability hangs in the balance.

The Paper can be downloaded HERE

Tonight’s paper is a kind of “public service announcement." Inequality was already growing, and Covid gave it a boost. The BIS says it best:

“Inequality has been on the rise since the 1980s. Segmentation, polarisation, and impediments to social mobility have become more prominent in many different societies over the last 40 years.”

Don’t think this applies to you? Think again. Social stability declines with inequality and take one look at riots in Sri Lanka and Iran (happening now) show that this summer will likely be a violent one.

So here is the paper’s conclusion in short: Inequality makes recessions deeper, ensures that those hit hardest by the recession can’t get out of their dire straits, and makes both fiscal and monetary policy less effective anti-recession tools.

Why this matters. All of our fintech products, including CBDCs have to be seen as tools for reversing inequality to be relevant.

That is their "raison d'ê·tre."

Thanks for reading

Be in control of your future, subscribe!

More of my writing, podcasts, and media appearances here on RichTurrin.com

Contact me: https://richturrin.com/contact/

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is an Onalytica Top 100 Fintech Influencer and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon: