The BIS Wants Bank Volunteers To Test a Tokenized Cross-Border Transfer Future

Project Agora shows how tokenization will disrupt cross-border transfers.

The BIS and the IIF are inviting private sector banks to participate in Project Agora, to explore how tokenization can enhance wholesale cross-border payments.

First, understand this: Project Agora is big.

Seven major central banks support it, five of which are reserve currencies: Banque de France (representing the Eurosystem), Bank of Japan, Bank of Korea, Bank of Mexico, Swiss National Bank, Bank of England, and the Federal Reserve Bank of New York.

Agora will test a multi-currency unified ledger for cross-border payments to improve the existing financial market infrastructure.

What is very interesting is that Agora will use both tokenized central bank digital currency and commercial bank money.

What Agora signifies more than anything else is how tokens have gone mainstream.

👉TAKEAWAYS

🔹 Applicants need to be commercial banks with access to their central banks. And the BIS channels “UPI” by stating that this is a “public-private” partnership! Good for BIS!

🔹 What we don’t know is whether Project Agora’s “unified ledger” is blockchain-based or not; in fact, details on the transfer system are almost non-existent. (If I missed something please tell me in the comments.)

🔹 What is clear is that the BIS must have built some serious tech to support this effort! We know this because the BIS says it wants to go beyond POC.

🔹 “Project Agorá aims to go beyond proof-of-concept. is not just demonstrating the art of the possible. It seeks to prepare a groundwork prototype that will be key for developing a future financial market infrastructure.”

🔹 Perhaps the funniest line however was this: “This project should not be confused with individual efforts by central banks to provide a digital version of cash aimed at the general public.

The unified ledger comprises its data and execution environments as well as the rules, standards and governance applying to those environments. The data environment contains money, assets and information (internal or external to the ledger). Each of these includes partitions (denoted by dashed lines) delineating ownership and/or access by the relevant entities. Operations involving one or more of these elements are carried out in the execution environment, either directly by users or through smart contracts. The lock indicates that some operations may be performed on confidential encrypted data.

👊STRAIGHT TALK👊

If you take away nothing else from this article, understand that if seven central banks, five of which are reserve currencies, buy into the concept of tokenization, it is, by definition, mainstream.

So please don’t think of tokenization as the domain of crypto bros; it’s come for mainstream finance and isn’t going away.

Given all the support it has, the BIS will likely get a prototype out of Agora. About three years later, I predict a unified ledger running for wholesale cross-border transfers.

That doesn’t mean that the entire financial system will be switched over, but that the long process of switching will begin in earnest.

The unified ledger is not “one ledger to rule them all.” It stands apart from the ledgers of central banks or commercial banks and interacts with them but does not control their actions.

The BIS’s Agora is big, and with the dollar, sterling, yen, franc, and euro behind it, I expect it to be disruptive.

Thoughts?

LEARN MORE:

⏵An earlier article from the BIS with more about the Unified Ledger concept: HERE

⏵The BIS’s concept of a “unified ledger” is clearly a subset of Citibank’s “Regulated Liability Network” (RLN). RLN envisions an even broader mix of assets.

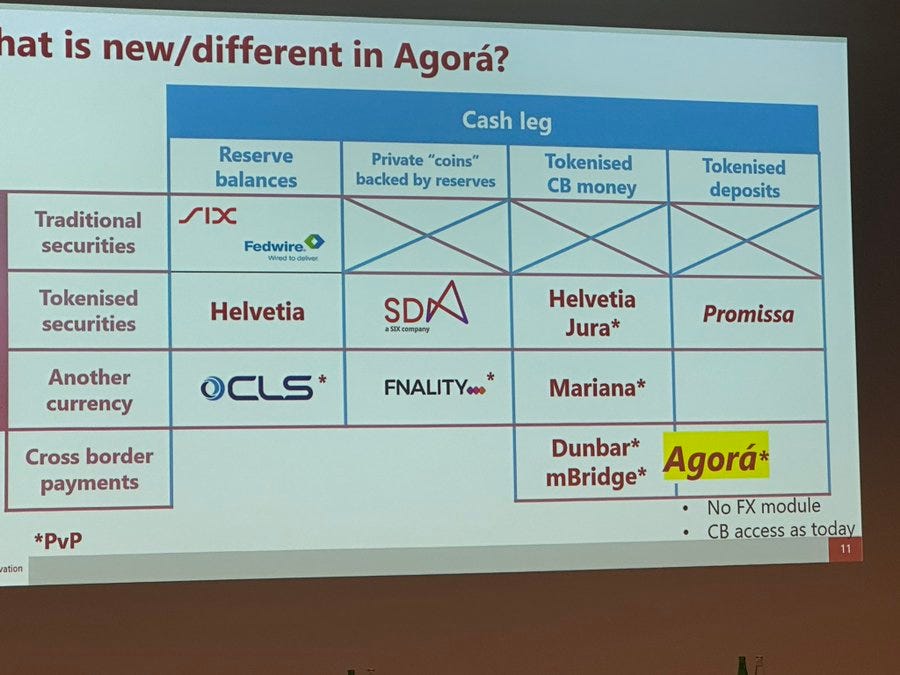

⏵Follow up: There is confusion between the BIS Project mBridge and Project Agora

This slide from the BIS Innovation Conference, based on Josh Lipsky’s tweet on the subject, makes it a bit clearer.

The two major distinctions are:

MBridge does not anticipate the use of tokenized deposits but CBDC only;

Agora uses US dollar assets while mBridge does not.