The CBDC Revolution Arrives, 40 CBDCs in the next six years?

BIS research show 9 out of 10 central banks working on CBDC!

The CBDC revolution is here!

According to recent statistics from the BIS, we’ll have around 40 CBDCs in circulation in six years. So if that isn’t a revolution, what is?

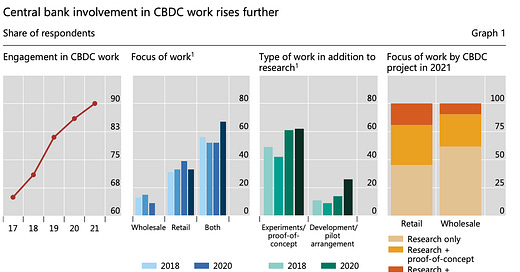

Nine out of 10 central banks worldwide are exploring central bank digital currencies, with two-thirds likely to launch within six years! (Graphs 1 & 6)

All graphs are from the BIS report: “Gaining momentum – Results of the 2021 BIS survey on central bank digital currencies”

Download my highlighted version: here

These figures are from the BIS survey of 81 central banks just published. Once again, the BIS is making it clear that the future is arriving faster than you think.

Two-thirds of the 81 central bank respondents claim that they are “likely or might possibly” launch a CBDC within six years. (Graph 6) In rough numbers, this means around 50 CBDCs if all goes well and 40 if 75% of those in this group fail.

Graph 6

A revolution? You bet it is!

Money is going digital, and there is simply no turning back. The breakthrough prompting this mass migration to CBDC is that money can now be represented as a token or coin.

Tokenization originated with cryptocurrency, and we must -graciously- credit the crypto community for its development. The irony, of course, is that central banks, which generally loathe crypto, are now co-opting crypto technology!

CBDCs are using tokens, a cryptographic form of digital money, to bring payments into a new digital era that allows for the direct transfer of money from one party to another. Banks or credit cards charging fees to act as intermediaries will no longer be required to make a payment.

The survey results prove beyond a doubt that central banks desire modernization. Within advanced economies, central banks’ leading motivation to build a CBDC is to improve domestic payment efficiency. (Graph 3)

Graph 3

But payment is already digital!

For those that say “payment is already digital,” the most common retort I receive from detractors, my response is: "your payments are digital today the way your Blackberry from 2005 is a smartphone."

The reality is that the system of bank transfers and “credit card rails” is so fundamentally flawed with obscene charges and delays that it is no longer tenable. Only elderly and out-of-touch central bank governors think “waiting three days for the check to clear” is acceptable in a digital age. Tokenized digital currency with immediate finality is an elegant and practical solution to transferring money whose time has come.

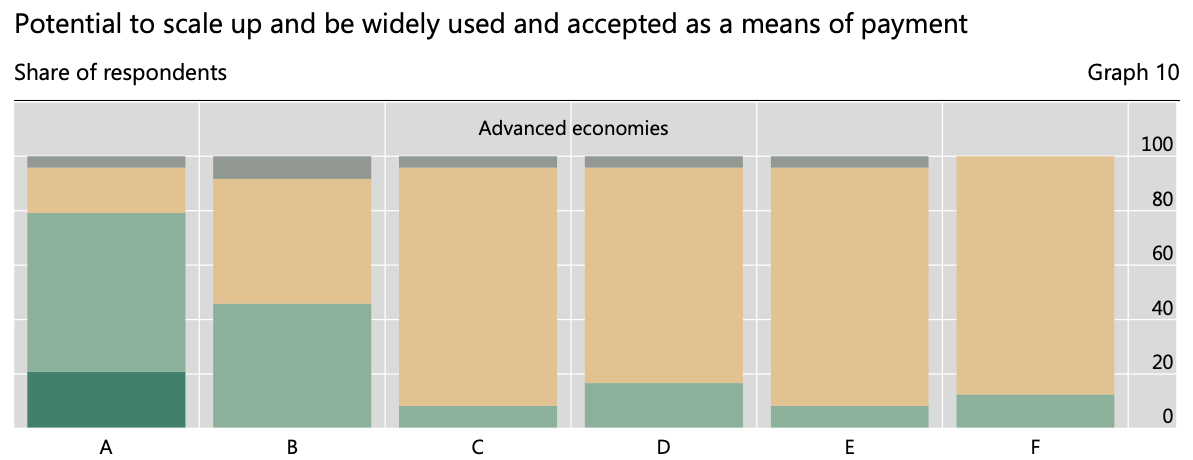

Central banks realize it and feel the threat. A stunning 79% of central banks accelerated their work on CBDC due to crypto and stablecoins. Nevertheless, the danger is real, with 80% of central bank respondents from advanced economies believing that single currency stablecoins have high or some potential to be widely used and accepted as a means of payment. (Graph 10).

Graph 10

Banks will not be disrupted

It is essential for those who claim CBDCs will disrupt banks to understand that accounts and banks will still be with us. A full 70% of central banks are working on two-tiered CBDCs to ensure that the banking system plays an active role, and 76% are working with existing payment systems to ensure interoperability. (Graph 2)

Graph 2

Central bankers are highly protective of their banks; when haven’t they been? They aren't going to destroy them! Fear-mongering over destabilizing bank deposits and rampant government spying is frankly absurd. The ECB has already announced that the digital euro will have privacy on par with credit cards and the existing banking system.

Worst of all, pundits promote the discredited idea that CBDCs entail each citizen having a bank account with the central bank tracking your every cash payment. Most know that this model is unrealistic but use it to stoke fear and promote their fanatical belief in cryptocurrency.

It won’t change anything! Or will it?

Many say that the transition to CBDC will bring few material benefits over the cards we already use. However, China’s experience with free and immediate mobile payment suggests a different outcome.

The chart below shows in scale the volume of mobile payments in China relative to GDP. China’s mobile payment market is roughly four times China’s GDP. For comparison, the US's total use of credit and debit cards was only one-third of the US’s GDP.

Ask yourself, “what are we missing if China’s mobile payment market is so big?”

For those who say, “we’ve got it all,” I respond, “you’re missing far more than you know.”

Within that 4x GDP figure are digital services and products that the US or EU have not yet experienced. Just scroll through the list of services or products available on superapps, WeChat, and Alipay for an example of what you’re missing. The inherent expense of credit card payments is slowing down a world that is far more digital and ready to go far faster than the West’s card-based payment will allow.

CBDCs will bring free and immediate domestic payments that will spur an incredible amount of innovation, just as it did in China. This is the future that CBDCs will bring, and it’s exciting!

We are at the threshold of a new digital currency world; there is no denying its coming.

Learn, understand and plan for its arrival!

CBDCs are coming whether you like it or not!

More of my writing, podcasts, and media appearances here on RichTurrin.com

Contact me https://richturrin.com/contact/

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is an Onalytica Top 100 Fintech Influencer and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my bestselling books on Amazon: