The Data Proves The World Is Going Cashless

Small bills are out as small payments increasingly go cashless.

The world is going Cashless, with “Tap, Click and Pay” the new normal!

The BIS analyses the latest payment data and finds that “the use of digital payment methods continues to increase, particularly for small amounts. In tandem, cash withdrawals and the number of small-denomination banknotes in circulation have declined.”

Fast payments are not just a passing fad and “are a prominent driver of the digitalisation of countries’ payment ecosystems.”

But that doesn’t mean that cash is dead. “Consumers continue to use cash to pay at home and abroad: both cross-border card and e-money payments and cross-border cash withdrawals increased sharply in 2022.”

👉TAKEAWAYS:

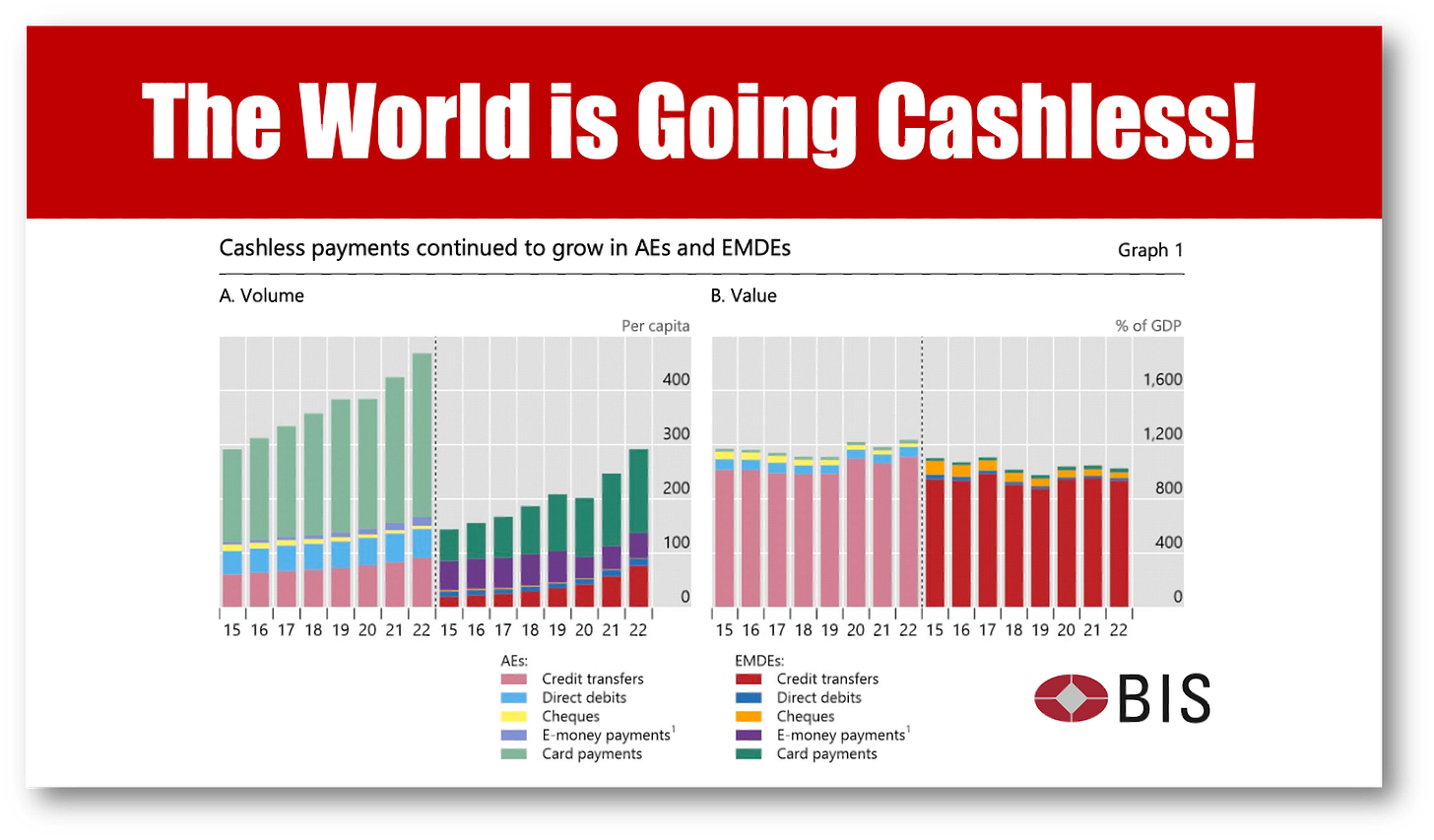

Cashless payments per capita grew +10% (in number) for advanced economies (AEs) and +18% in emerging market and developing economies (EMDEs).

Cashless methods are increasingly used for small payments with the average transaction value of cashless payments declining or stabilising in 2022

Lower average card transaction values are significantly associated with a reduction in cash in circulation and fewer cash payments.

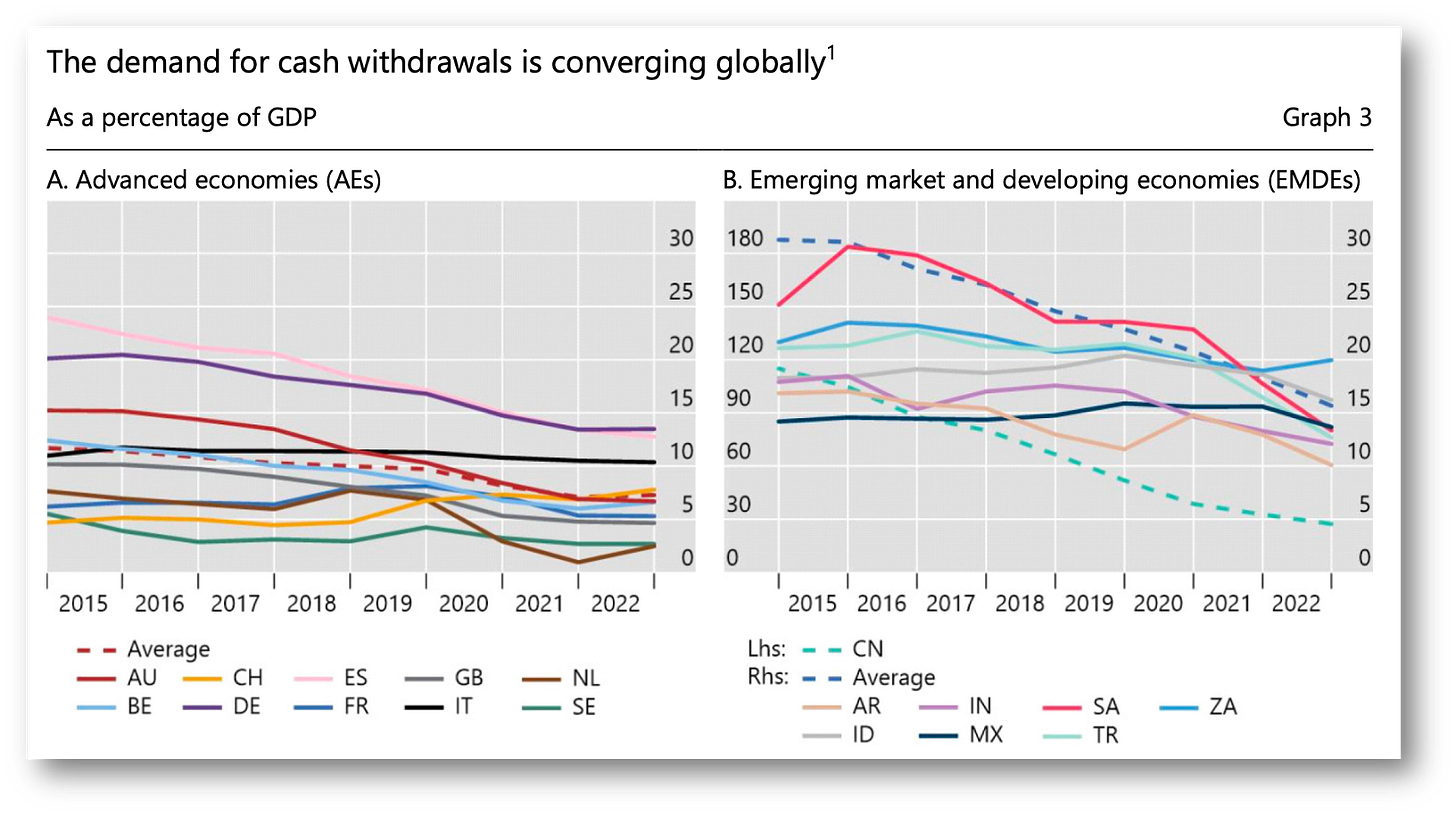

Demand for banknotes and coins declined globally and most strongly in EMDEs. The global trends in cash withdrawals also hint at a decline in the use of cash.

In nearly all jurisdictions, the volume of fast payments increased while demand for small-denomination banknotes declined.

Fast payments are a prominent driver of payment digitalisation.

Fast payments are mainly used for domestic payments, but they also have the potential to improve cross-border payments.

The share of fast payments in total cashless payments continued to grow in 2022. In terms of number of transactions, this share was largest in India (76%), Argentina (49%), Mexico (39%) and Brazil (28%). In terms of payments per capita, it was highest in Korea (154), followed by Brazil (112) and Sweden (88)

In 2022, the number of cross-border cash withdrawals and card and e-money payments surged in all countries.

👊STRAIGHT TALK👊

The data is in, and the trend is clear: the world is going “Cashless!”

This doesn’t mean that cash is dead and interestingly, while cashless payments are increasingly displacing the use of small bills, larger bills are still in demand and being used as a “store of value.”

So that wad of cash you stashed somewhere in your house for a rainy day isn’t going away, nor should it.

This news will be met with two opposing reactions. Proponents of going cashless, like your humble author, will say “I told you so, it’s simply easier and far more convenient.”

Opponents will claim in shrill and unequivocal terms that this is another step into dystopia. There is no escaping the polarization this topic engenders.

The reality is that people are voting with their wallets and don’t care much for debate.

The vast majority find the low cost of payment and ease of “tap, click, and pay” provided by fast payment systems simply irresistible!

Thoughts?

A big thank you to all my subscribers! I appreciate your notes telling me how much you enjoy reading the Cashless newsletter.

Join them by subscribing! You’ll be glad you did!