The Digital Dollar must Die or it will "Undermine the American Way of Life" and High Payment Costs

CBDC is so dangerous to America that the Fed can't even run pilots!

The digital dollar is as dead, as America’s culture warriors claim that it will “undermine the American way of life” if allowed to progress. If that sounds like the culture war at play for votes, it is! Even worse is that among the three new anti-digital dollar bills under consideration, one will prohibit the Fed from running a central bank digital currency (CBDC) pilot. Even learning about CBDC will apparently cause irreversible damage to America!

Interestingly, this love of the “American Way” must also include a love of paying high fees for cash transfers. The release of the McKinsey 2023 Global Payments Report, shows that the US must love paying 2.2% of its GDP to banks for the privilege of making payments!

I am not sure how these obscenely large sums paid to banks fit in with the narrative of American freedom, but they will be forever protected without a more modern and efficient payment system. Dare I say a CBDC that is a “public good” like roads, bridges, and existing Fed payment systems?

1. The Anti-CBDC Bills in Order

On September 20, the U.S. House Financial Services Committee will discuss three bills preventing the U.S. from issuing a digital dollar. They will likely be combined and appear to have the votes for passage.

Let’s take them in order, with the most insane first:

H.R. 3712, the Digital Dollar Pilot Prevention Act (Mooney)

“Requires the Federal Reserve to attain authorization from Congress to establish, carry out, or approve a program intended to test the practicability of issuing a central bank digital currency. This requirement would include test programs partnering with the private sector.”

This is unquestionably the most insane of all the proposals as it strives not just to kill a CBDC but to stop all research and Pilots run by the Fed or those run in conjunction with the private sector. This means that CBDC Projects Hamilton and Cedar already run by the Fed would not be allowed. Future interaction with the Digital Dollar Project or other third parties would also be prohibited.

This is akin to banning books or basic research. If this is incorporated into law, the Fed will not just have its hands tied but will be forced to completely abandon CBDC development. This is so insane I am stunned at the level of ignorance that this demonstrates.

Why doesn’t the US just burn all CBDC literature? All of this for votes in the culture wars? Apparently yes!

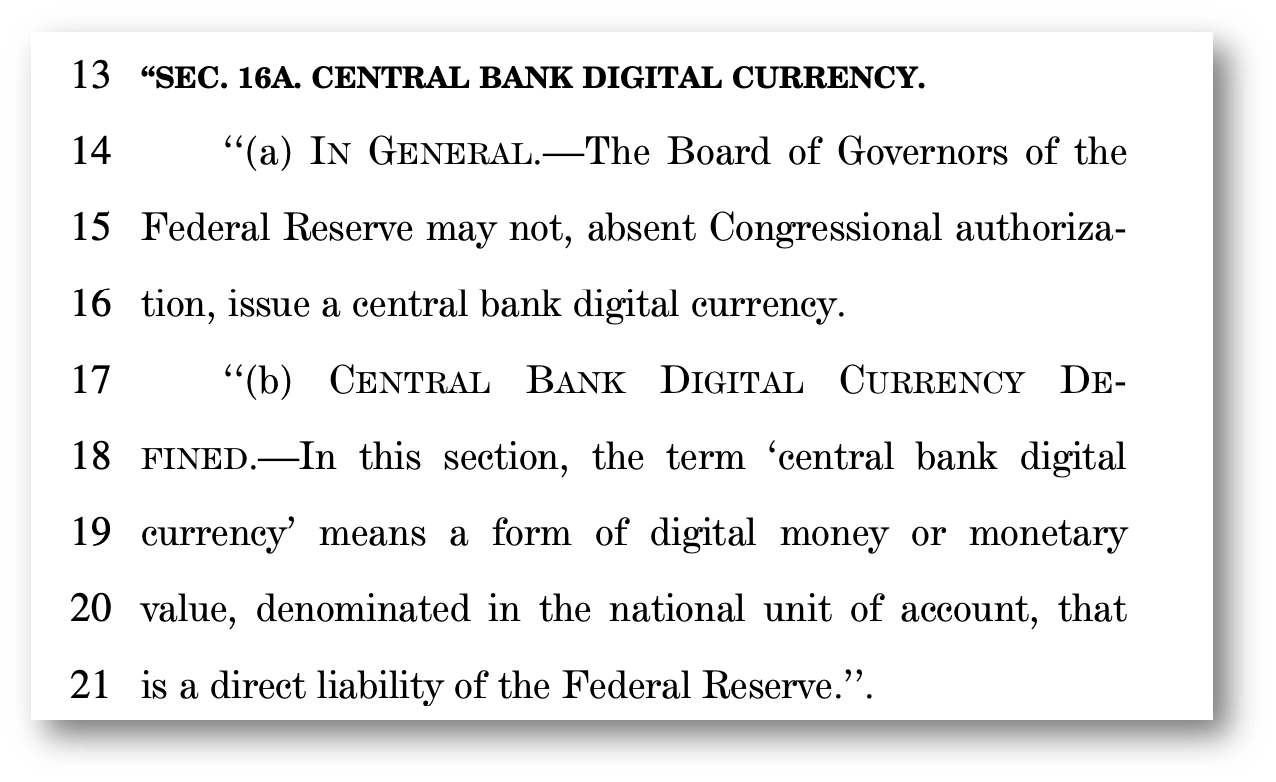

H.R. 3402, the Power of the Mint Act (Auchincloss/Hill)

Prohibits the Board of Governors of the Federal Reserve and the Secretary of the Treasury from issuing a Central Bank Digital Currency without congressional authorization.

This Act is unnecessary! Powell, the chair of the Federal Reserve, made it clear back in March of 2021 that: “We would not proceed with this without support from Congress.” Then again this month, US Federal Reserve vice-chair for supervision Michael Barr made it clear once more that “The Fed will only put a digital dollar into circulation “with clear support from the executive branch and authorizing legislation from Congress.” I think that the Fed gets that it can’t act unilaterally concerning a retail CBDC.

The one thing that makes this Act dangerous is the prohibition of wholesale CBDCs. The Fed technically already has a wholesale CBDC with its real-time gross settlement system, FedWire. I know it isn’t called a CBDC, but technically speaking, it is an account-based CBDC. The Fed doesn’t need authorization if it wants to introduce a tokenized wholesale CBDC as with Project Cedar, as this is within their existing remit. If this bill passes or its language adopted, this technicality would be in jeopardy.

H.R. ____, the CBDC Anti-Surveillance State Act (Emmer)

Prohibits a Federal Reserve Bank from offering products or services directly to individuals, maintaining individual accounts, or issuing a CBDC to individuals. It would also prohibit the Federal Reserve and the Federal Open Market Committee from using a CBDC to implement monetary policy.

Then just in case the Fed changes the name CBDC to something else:

This bill has a loophole, but it is so tight that even crypto can’t fit through:

Crypto and stablecoin fans may think that this is a great loophole that leaves them unaffected. The problem is that neither fully preserves the privacy protection of cash! Crypto’s “pseudo anonymity” is no better than CBDC privacy because they use similar technology. Stablecoins are anything but cash like as they require exchanges to be put into practical use. I’m not sure either will pass the “cash test” in the proposed bill!

2. McKinsey’s 2023 Global Payment Report shows why we need a digital dollar

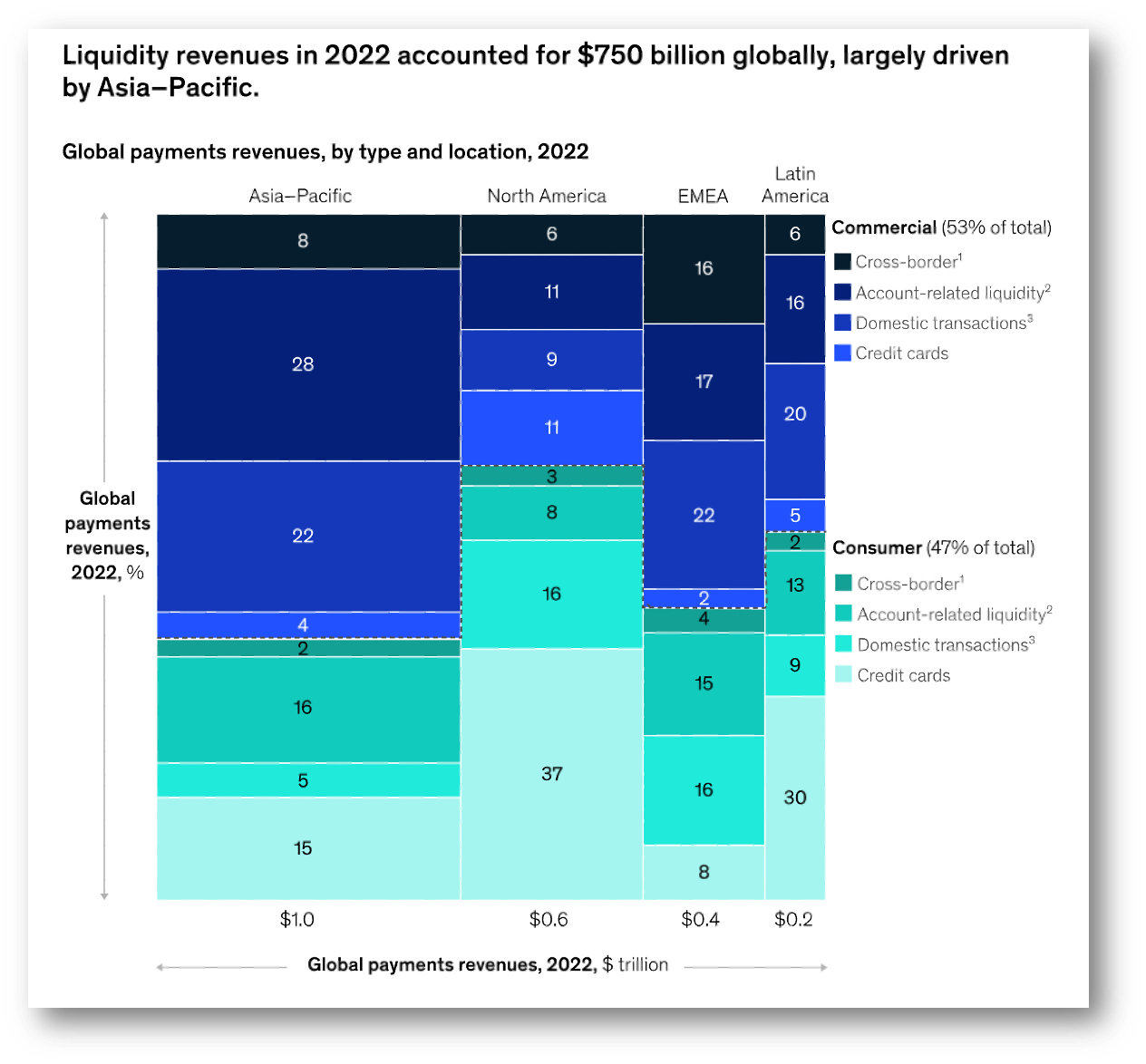

The 2023 Mckinsey Global Payment report shows how expensive payments are and why we need a digital dollar or equivalent modernization of payment techology. The total payment revenue for the North American Market, including the US and Canada, was $0.6 trillion. This is the overall cost to society paid to banks for payment services. A big number for certain, but let’s give it perspective!

Global payment revenues were $2.2 trillion dollars, a staggeringly large sum. This is money that is funneled out of society and rerouted to banks. As an ex-banker I don’t hold a grudge against banks, but how much is too much? Even Fed Governors have stated that there is room for improvement.

Now to better put this US$0.6 trillion figure in perspective, look at the GDP for North America. We see that the US and Canada GDP combined for 2022 are $US 27.6 trillion.

This means that payment revenue of US$0.6tn is a STUNNING 2.2% of total North American GDP! Mckinsey declines to show this number, nor do the senators ever concede that payments are anything less than the world’s most efficient! Interesting?

Now if we look at the breakdown of North American payments, we see that 64% of the total revenue is consumer payments, meaning that consumers pay the equivalent of 1.4% of North American GDP for payment services! Of this amount, credit cards (personal and corporate) amount to 48% or 1.0% of North American GDP!

So let me summarize:

SUMMARY OF NORTH AMERICAN PAYMENT COSTS

Bank payment revenue is 2.2% of GDP

Bank payment revenue from consumers is 1.4% of GDP

Credit card payment revenue is 1.0% of GDP

3. Conclusions

With US $0.6 trillion in payment fees annually, a sum equal roughly comparable to the $0.7 trillion that the US government spends on defense. Do you think we don’t need a digital dollar? Clearly, there is room for improvement!

The US pays more for payments than Medicaide and Income Security. In fact $0.6tn isn’t that far off from the US’s $0.75tn spent on defense.

The US payment system is grossly inefficient and needs modernization. It was once the model of efficiency but became frozen in the past as banks delayed critical modernization to protect fees. Recently implemented FedNow is the best example. With FedNow the US is implementing a payment system that existed in other parts of the world for over a decade. Look to the UK, Singapore, Australia, India, Brazil, and China, among others, for the best examples of where these systems are common.

That the senators loathe CBDC and will likely pass some form of anti-CBDC bill is sad and will push the US payment system back another decade. My only solace is that I look forward to seeing the US push for a CBDC in about another five years to catch up with Europe, the UK, and, of course, China. I look forward to seeing how Washington will sell a digital dollar then.

🚨UPDATE🔥

Since I published this article H.R. 5403 “CBDC Anti-Surveillance State Act” has passed the House Financial Services Committee and is heading for a vote. Will it have the votes to become law? Time will tell, but with culture wars raging, it’s likely.

H.R. 5403, the "CBDC Anti-Surveillance State Act," offered by Majority Whip Tom Emmer (MN-06), prevents the Federal Reserve from issuing a CBDC directly or indirectly to individuals or maintaining accounts on behalf of individuals. It also prohibits the Secretary of the Treasury from directing the Board of Governors of the Federal Reserve System to issue a CBDC and clarifies that a CBDC can only be issued pursuant to congressional authorization.

👊STRAIGHT TALK

So the “good news” is that only Emmer’s bill was passed, and other acts that prohibited CBDC pilots were not combined or added to this bill.

Rep. Stephen Lynch, D-Mass, wins the award for the best quote of the day: “With all due respect, this bill is an act of breathless stupidity.” I couldn’t agree more.

The witch hunt against CBDC is a manifestation of the US's culture wars. It is not based on even the most rudimentary understanding of CBDC technology and is an insult to Fed and Treasury employees who do understand them.

It will set the US back more than a decade, and during this time, the digital euro, sterling, and yuan will all start to out-innovate the US dollar. This is absolutely suicidal for the US, and while this may get politicians a few votes from culture warriors it is selling out the US dollar by dooming it to obsolescence.

Couple this with a default because of inability to agree on debt ceilings and you may as well start cashing out of US dollars and buy RMB. It's sarcastic, I know, but in ten years, people will ask where the digital dollar is. It died with the culture wars.

TAKEAWAYS:

The digital dollar is caught up in culture wars and is as dead as can be!

That these bills seek to prohibit payment system innovation and are seen only in political terms is disappointing.

The US must research the digital dollar and determine whether it works or whether better solutions exist.

That one of the bills seeks to curtail CBDC research condemns the US to follow, not lead, the digital currency revolution.

The US payment system was once the world’s most advanced, now, India, China, Brazil, and others have surpassed the US.

The cost to the US for payments is a stunning 2.2% of GDP, which indicates inefficient systems that need modernization.

Since when does the “American way of life” mean subsidizing banks?

Hey did you enjoy this? You know what to do!

Substack changes these buttons from “Subscribe now” to “pledge your support.” This newsletter is free!

My work is entirely supported by reader gratitude, so if you enjoyed this newsletter, please do both of us a favor and subscribe or share it with someone. You can also follow me on Twitter or Linkedin for more. For more about what I do and my media appearances, check out richturrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is number 4 on Onalytica's prestigious Top 50 Fintech Influencer list and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon:

Cashless: HERE

Innovation Lab Excellence: HERE

The end of the USA as driver of innovation has come.

This obsolete system has slipped into a passive-aggressive self-defence mode.

(Using the term obsolete does not necessarily mean, it was ever anything else than that.)