The Future of Cross Border Payments 2026

The Antidote to Stablecoin Hysteria

This is my daily post. I write daily but send my newsletter to your email only on Sundays. Go HERE to see my past newsletters.

Finextra with a great report from Sibos that I call the antidote to stablecoin hysteria.

The report shows not just the payment methods, but the problems that need to be fixed in our cross-border payment future.

It is an antidote because it will help readers to avoid the stablecoin hype trap, which claims they will solve all problems with cross-border payments.

Of course, with SWIFT as a sponsor of the report, some may say that the report is biased against stablecoins.

I don’t see the bias, but I do see a refreshing pragmatism.

The report does a great job of showing how stablecoins will join a host of other technologies like ISO20022, tokenized bank deposits, and CBDCs in cross-border transfers.

All will vie for a valuable slice of the cross-border and instant payment pie.

Regardless of payment technology, KYC/AML and fraud prevention are still major problems to solve.

We are getting closer to a payment world where blockchain and instant cross-border payments are the norm.

We’re so close.....yet still so far.

👉Key Points:

↳ Agentic AI and GenAI revolutionising cross-border payments;

Advanced AI and machine learning can be leveraged to detect security anomalies in real-time and monitor transactions. GenAI and agentic AI are primed to revolutionise the industry by streamlining every part of the payments process.

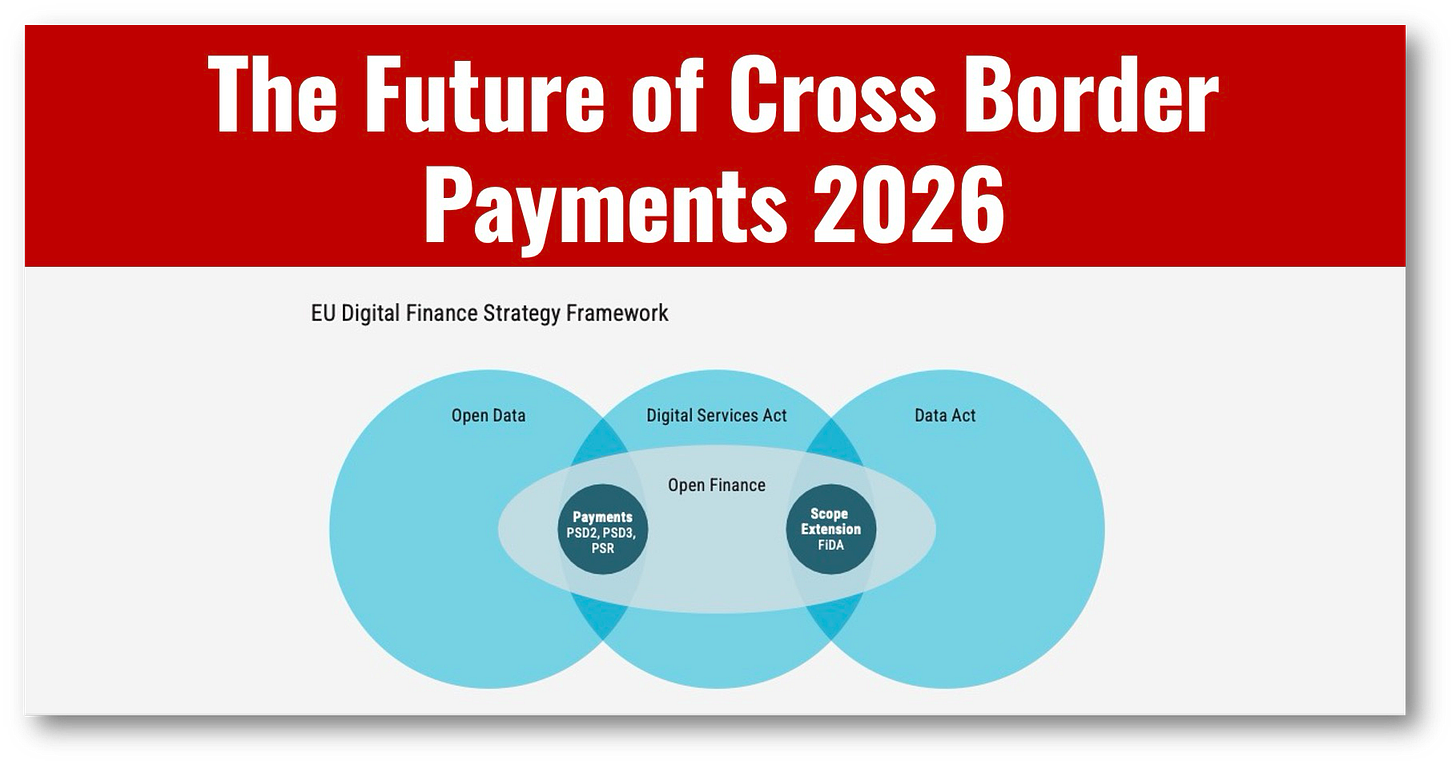

↳ The implications of a post-ISO 20022 migration world;

ISO 20022 migration has changed the game, allowing for increased interoperability, and opening up financial organisations to integrate critical emerging technologies, such as blockchain, AI, and smart contracts.

↳ How banks are future-proofing their cross-border payments

frameworks;

Beyond keeping up with audience expectations, the adoption of instant, cross- border payments is proving to be a future-proofing necessity. From data storage improvements to technological transformation, new innovations are providing a way for organisations across the world to be ready for a digital-first, fast-paced future of payments.

↳ Financial crime and fraud prevention in payments;

In cross-border payments, speed means little without security and trust. As transactions become faster and more digitised, fraud prevention and cybersecurity grow even more critical. Real-time settlement leaves less time to detect and stop illicit activity, and we have seen increasingly sophisticated scams targeting instant payment channels.

↳ The digital transition to cloud native infrastructure;

Cloud-native platforms are fundamentally reshaping cross-border payment architecture by replacing correspondent-heavy chains with multi-rail, API-first approaches. This transformation connects real-time gross settlement systems, automated clearing houses, instant payment networks, and emerging tokenised networks directly, effectively cutting out 60-80% of traditional intermediaries.

↳ Challenges and opportunities in instant payments;

It is no secret that the implementation of instant payments within cross- border transactions has not persisted without its challenges. For some, this has taken the form of enormous infrastructural tasks, whereas others have had to grapple more with data regulation and the challenge of opening-hour logistics.

↳ How rapidly emerging technologies will define the future of cross-border payments.

Emerging technologies do not utilise ISO 20022 per se, but serve as a universal language that can facilitate the interoperability of payment systems and enable the transfer of richer data, leading to new use cases. This helps reduce friction and associated costs, such as universal pre-validation services with verification of payee.

HAND CURATED FOR YOU

🚀 Every week I scan thousands of articles to find only the best and most valuable for you. Subscribe to get my expertly curated news straight to your inbox each week. Free is good but paid is better.