The Future of Fintech: Asia and Payments Rule!

Lack of funding continues to constrain fintech growth

The World Economic Forum surveys global fintech and likes what it sees, citing “strength and resilience” for the industry, and downplays the lack of funding that impacts 66% of those surveyed.

The WEF is intentionally downplaying funding constraints to put a happy face on the industry while ignoring the more interesting story in their survey.

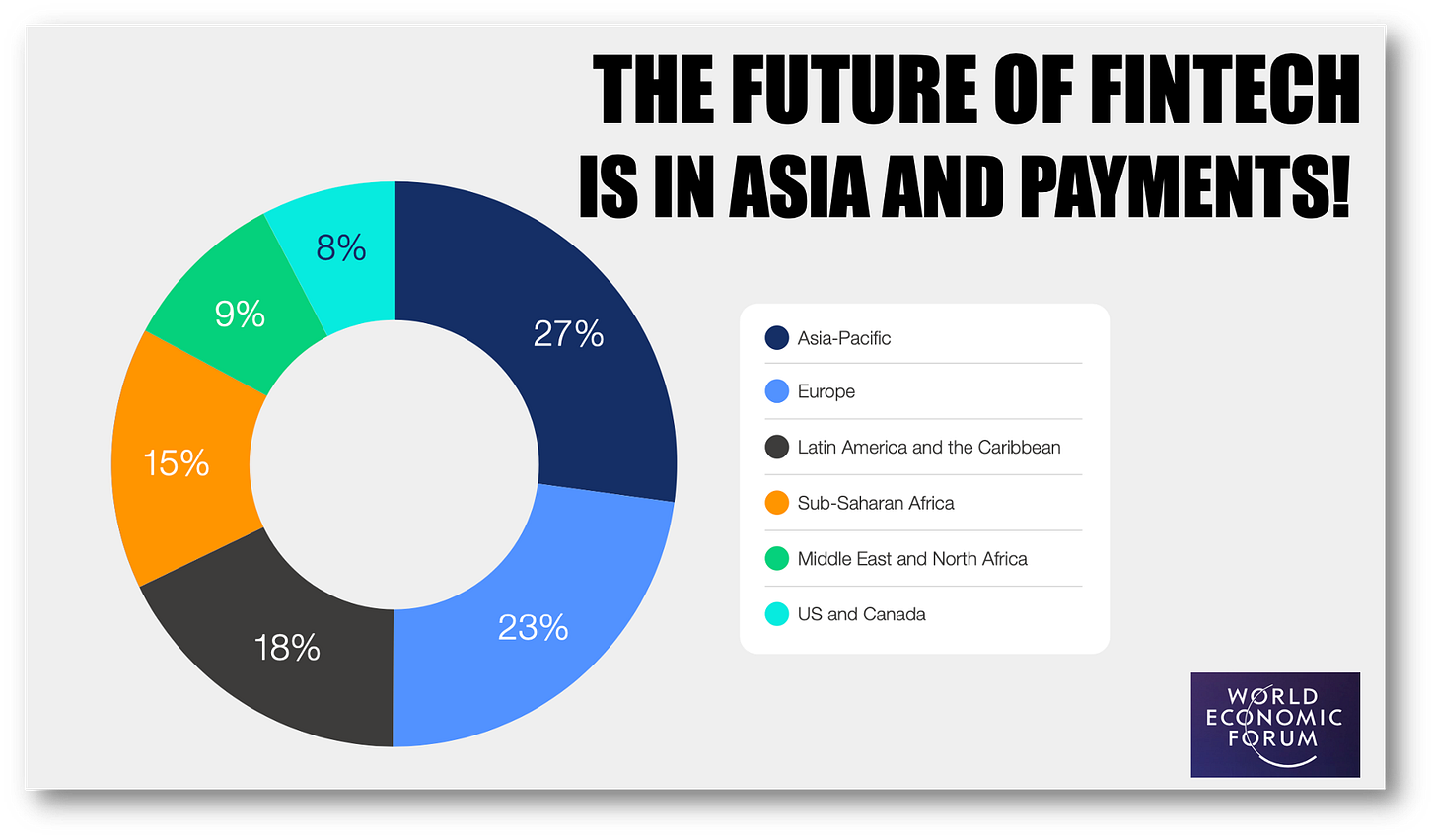

The real story in this survey is that the world’s largest concentration of fintechs is in APAC (27%) and that 30% of all fintechs are in payments!

The real headline should be Asia and Payments are the stars of the fintech show!

👉TAKEAWAYS

Customer growth rates averaging above 50% across industry verticals and global regions.

Consumer demand is the main driver of growth, with over half (51%) of all surveyed fintechs citing it as a major factor supporting their growth.

Fintechs cite macroeconomic factors (56%) and the funding environment (40%) as two of the top three hindering factors for growth.

FUNDING: only 34% regard their fundraising environment as supporting growth.

Most fintechs reflect favorably on their regulatory environment, with 63% rating it as adequate.

A total of 38% of surveyed fintechs also cite the regulatory environment as a major supporting factor for their operations and growth.

Fintechs are expanding the provision of financial services and products to underserved segments for both developed and emerging economies.

Look at how 50% of the fintech market is payments and loans. These are two sides of the same coin in my view. To see how they are inseparable, look to WeChat and Alipay.

👊STRAIGHT TALK👊

Asia and payments rule! From my biased view of the world, that’s the real headline in this story!

Payments and lending comprise 57% of all fintechs, and given how closely they two are related, it’s fair to simplify and say “payments rule.”

And why shouldn’t they? Fintech’s greatest gift to society may be to help everyone have access to immediate and free (or near free) payments!

APAC also wins the competition for the number of fintechs with 27% of the global total. But what was a shocker is that Europe comes in with a close second with 23% and the US with a mere 8%.

So 50% of the world’s fintechs are in the EU and APAC and the US is an also-ran. I think this shows just how hard it is to challenge US incumbents.

Funding remains a problem and the WEF isn’t wrong in focusing on fintech’s resilience, but it should be more honest in admitting that funding is a real problem.

Thoughts?

Subscribing is free!

The button says pledge, but Substack adds that, not me.

Don’t be afraid to click!

1

Share