The Future of Money is Here: And its US Dollars

Stablecoins are not a takeover of the financial system by crypto, but the opposite.

This is my daily post. I write daily, but send my newsletter to your email only on Sundays. Go HERE to see my past newsletters.

HAND-CURATED FOR YOU

Short take—fast, focused, and straight to the point.

Coinbase declares that the future of money is here, and it’s crypto, but it isn’t valued in Bitcoin, Ethereum, or Dogecoin; but old-fashioned US dollars.

While stablecoins are undoubtedly poised to transform our payment landscape, it is essential to note that 98% of all stablecoins are denominated in dollars, with over 80% of stablecoin transactions occurring outside the US.

While this may change with the launch of Euro or other denominations, what is important to note is that this is not a takeover of the financial system by crypto.

Quite the opposite, crypto is being taken over by US AML/KYC, as under the GENIUS Act, no foreign USD stablecoin that doesn’t comply can be used in the US.

Don’t get me wrong, I congratulate crypto for developing a useful on-chain product with stablecoins, but it remains to be seen if and how banks —the critical link for most users —will adopt them.

If US banks issue them, as Bank of America and others have suggested, crypto may find itself displaced by the very incumbents it has long preached it would defeat.

Will the world welcome a “Made in USA” financial takeover? Here too, there is a big question as it’s not clear that many of the financially excluded in emerging markets will use dollars while their governments preach de-dollarization.

Coinbase Stablecoin Pain Points Fact Checked:

1️⃣ Stablecoins are facilitating faster money movement, updating outdated financial systems.

Nearly 1 in 5 Fortune 500 executives consider on-chain initiatives a key part of their company's strategy, marking a 47% year-over-year increase. Additionally, 81% of crypto-aware SMBs are interested in using stablecoins to address their biggest financial pain points, including fee and transaction processing.

Fact check: Mostly True SMBs in particular hate paying fees to Visa and Mastercard!! If stablecoins can reduce them, companies, both large and small, will rejoice! Yes, our current card-based transfers are outdated, but FedNow and other real-time payment networks are not.

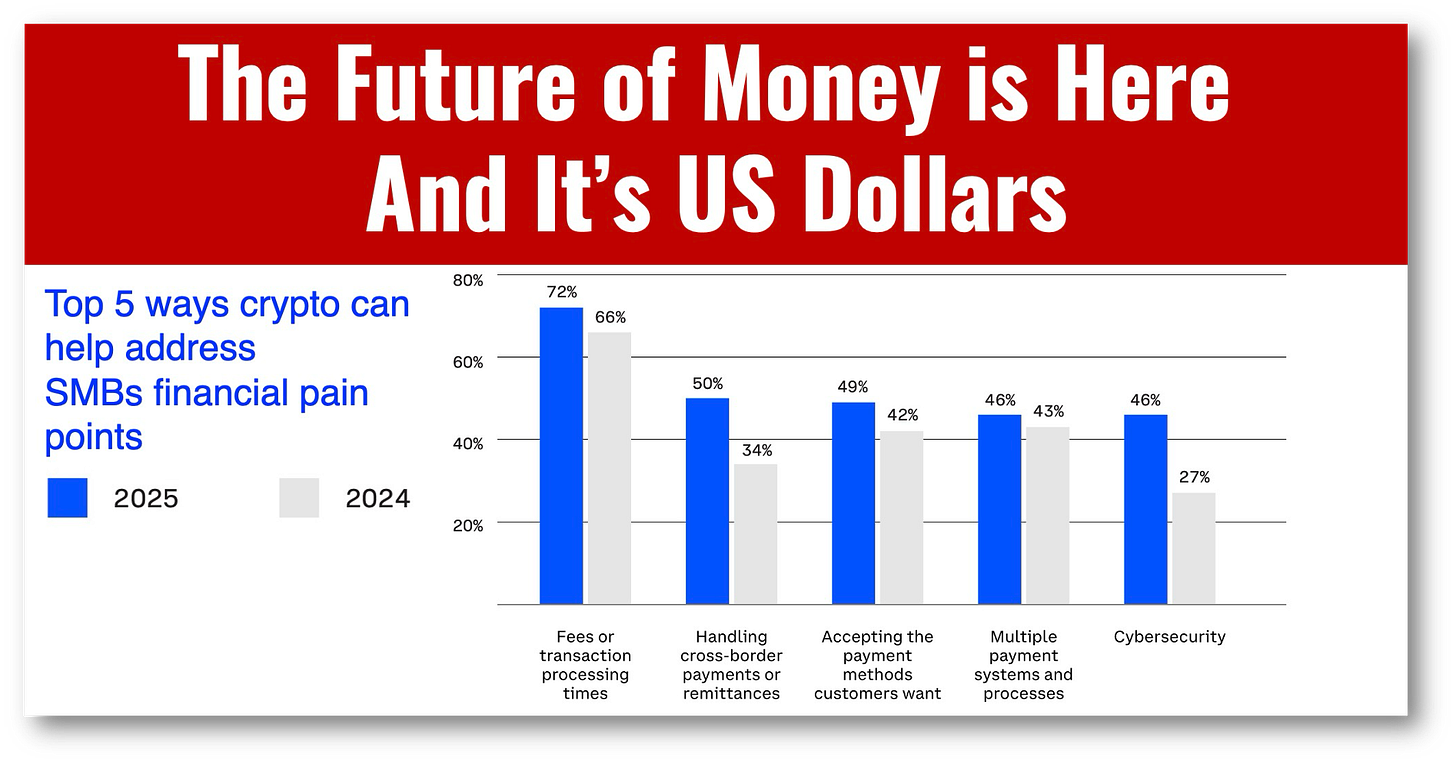

2️⃣ Crypto helps address the top financial pain points facing SMBs.

82% of SMBs say crypto can help solve at least one of the pain points their business faces, up from 68% a year ago. In 2024 the annual stablecoin transfer volume reached $27.6 trillion, surpassing a combined volume of Visa and Mastercard in 2024 by over 7.68% [4], highlighting their realized potential for businesses as a faster, cheaper, and more scalable solution for cross-border payments.

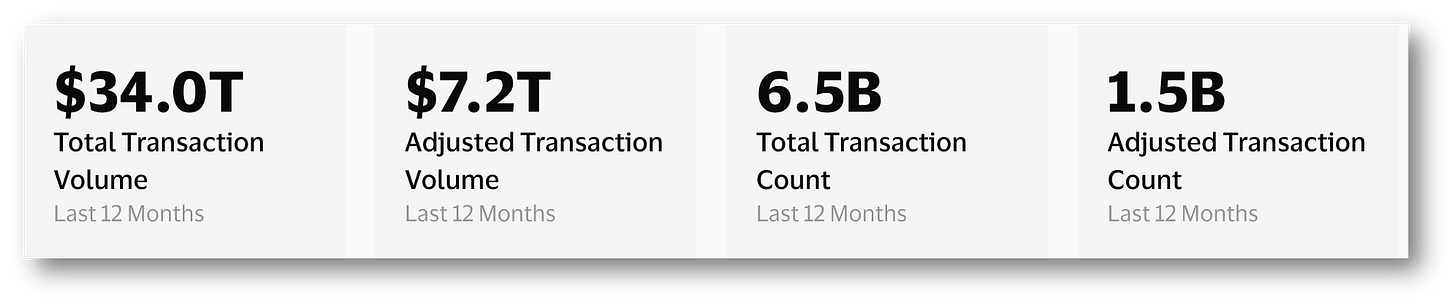

Fact Check: False This whole notion that stablecoin flows are bigger than Visa has been broadly debunked by Visa itself! Visa reports that stablecoin volumes quoted by the crypto press are from inorganic activity from bots and other artificially inflationary practices.

See Visa’s “on-chain analytics” dashboards: HERE

Visa’s adjusted stablecoin volume for the past 12 months shows a nearly 80% lower transaction value than that provided by the crypto industry:

3️⃣ Regulatory clarity is the unlock for crypto’s next chapter.

The GENIUS Act, marking momentous traction for the industry. An overwhelming 9 in 10 Fortune 500 executives agree that clear, consistent U.S. regulation around crypto, blockchain, and on-chain technologies is essential to support ongoing innovation.

Fact check: True. US regulations are required for US dollar stablecoins to leave the gray area of legality. This is key! But is this crypto’s next chapter or the dollars??

🏝️ Short takes are holiday editions! Shorter, yet packing a punch, even if there are more typos!