The Future Of Payments: Customers And Competition Reign

Keeping customers happy is priority number one!

This is a great read from KPMG on the future of payments. It shows how customers and competition are driving payment modernization worldwide.

Meeting customer expectations is so important that it was cited as the top reason for payment modernization for both banks and retailers.

Without customer pressure, do you think banks would modernize on their own?

The report breaks down payments by looking at financial institutions and retailers, then once again by regional differences.

Once again, APAC is in the lead, with the highest percentage of financial institutions upgrading their payment systems’ digital channels due to stiff competition from “new market players.”

Asia’s digital focus shouldn’t come as a surprise, and it shows new entrants' power to force incumbents to change!

To show how critical competition is, look at the percentage of financial institutions building “customer experience” into their upgrades by region: EU 47%, US 58%, China 66%.

If that doesn’t show the power of competition, nothing does!

Enjoy!

👉TAKEAWAYS

Banks

🔹93% of global Financial Institutions already have payments modernisation programmes underway or have plans to launch one which is in line with other global regions.

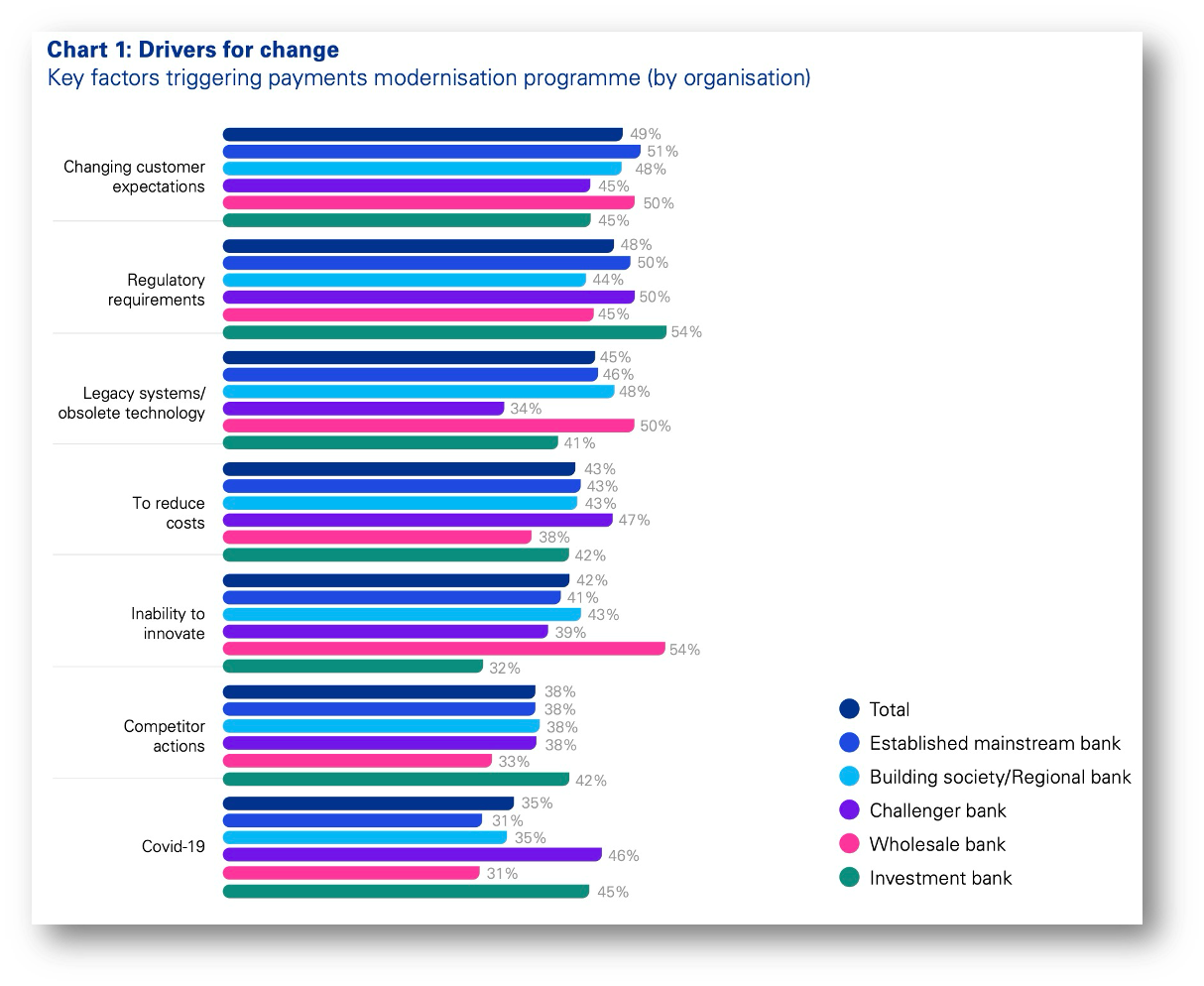

🔹49% of respondents cited that changing customer expectations are the most significant factor which is triggering the payments modernisation programme.

🔹15 months is the average time since the last significant modernisation of payments capabilities. With 33% having completed a programme of such work within the last 6 - 12 months.

Retailers

🔹87% of global Retailers already have payments modernisation programmes underway or have plans to launch one which is in line with other global regions.

🔹58% respondents cited that changing customer expectations is the most significant factor which is triggering the payments modernisation programme.

🔹12 months is the average time since the last significant modernisation of payments capabilities. With 35% having completed a programme of such work within the last 6 - 12 months.

If you enjoyed reading this subscribe or at least restack!

This button will help you “Restack” or post to “X” and others.

Readers like you make my work possible! Please buy me a coffee or consider a paid subscription to support my work. Thank you!

Sponsor Cashless and reach a targeted audience of over 55,000 fintech and CBDC aficionados who would love to know more about what you do!