The Long Finance Global Financial Centers index is a fun read with more than a few surprises.

It might not be surprising that New York and London took the first and second spots, but Singapore beat Hong Kong by a single point for the second year in a row!

Now, for many of you, this may be irrelevant, but in this part of the world, that single point is enough to make Singapore jubilant and Hong Kong thirsty for revenge.

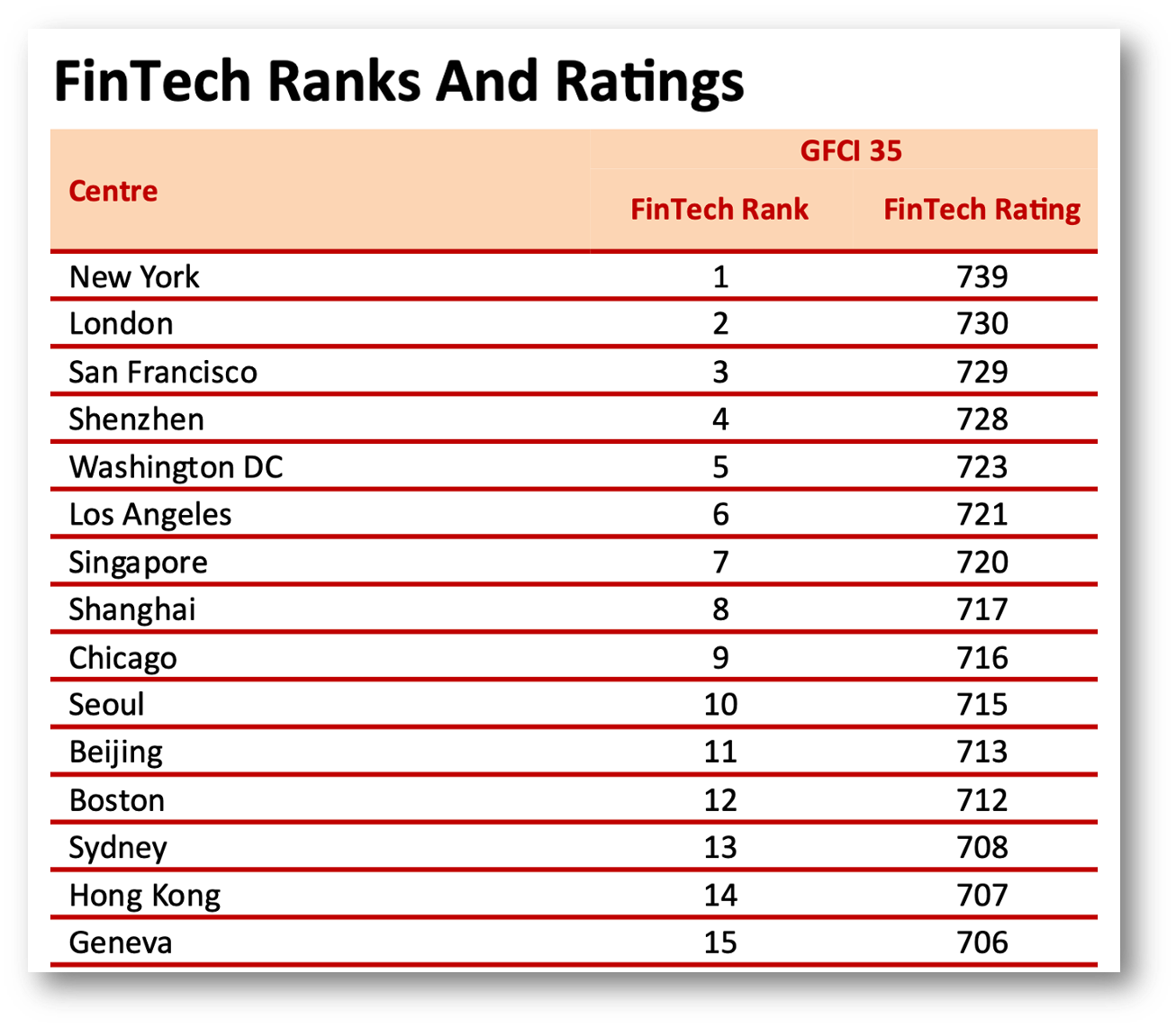

The report also ranks Fintech capitals, and here, the rivalry is a huge win for Singapore in 7th place and Hong Kong in 15th. Check out Shenzhen’s 4th place!

No matter what you think of these ratings, understand that Hong Kong's stock market is worth about $5 trillion, which is more than 12 times the value of Singapore's stock market at $400 billion!

These numbers matter because predictions of Hong Kong’s demise as a financial center seem premature!

👉TAKEAWAYS

🔹 Worldwide: New York leads the index, with London second, ahead of Singapore in third place, which has maintained its slight lead over Hong Kong in fourth position.

🔹Western Europe: London continues to lead in the region in second place globally, with six Western European centres featuring in the top 20

🔹Asia/Pacific: Singapore continues to lead in the region, one rating point ahead of Hong Kong. Shanghai and Seoul also feature in the world top 10, at sixth and tenth, respectively.

🔹Eastern Europe & Central Asia: Astana remains in the lead position in the region. with Tallinn overtaking Prague to rank second.

🔹Middle East & Africa: Dubai and Abu Dhabi continue to take first and second places in the region.

🔹Fintech: New York retains its leading position in the Fintech ranking, followed by London, then San Francisco. Shenzhen maintains its fourth place in the table and Washington DC moved ahead to fifth place overtaking Singapore.

👊STRAIGHT TALK👊

There isn’t a day that goes by when I don’t read about Hong Kong’s death as a financial center.

The headlines are brutal:

”It pains me to say Hong Kong is over”

“Can Hong Kong remain a global financial centre?”

“Hong Kong is dubbed 'a relic' of an international financial center.”

The roots of these headlines were born in the tough times Hong Kong endured during COVID-19, the protests, and new legislation that is challenging Hong Kong’s sense of self.

Still, it’s hard to see how Hong Kong is a “relic” with capital markets 12 times the size of Singapore’s, a IPO market that is roughly 6 times larger, and larger foreign exchange volumes.

Hong Kong also has another thing going for it, as the gateway to China it is uniquely positioned to service the world’s second-largest economy.

So is Hong Kong dead?

Not a chance.

Thoughts?