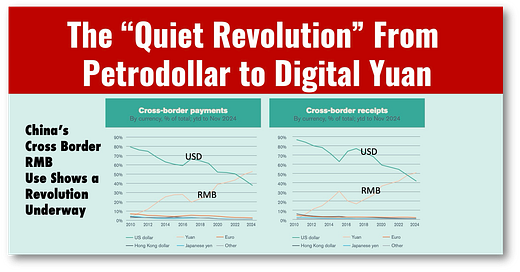

The "Quiet Revolution" From Petrodollar to Digital Yuan

President Trump's 100% tariffs acknowledge de-dollarization as a challenge

A quiet revolution is going on that is barely acknowledged or even mocked, and that is the challenge to US dollar dominance from the RMB.

This is a great read from Diana Choyleva, founder of Enodo Economics, who looks at the changing role of the RMB and the new digital RMB.

While no one, including the author or the Chinese government, is calling for the "death of the dollar," the reality is that the dollar is facing challenges, and President Trump seems to agree.

His most recent of repeated declarations that BRICS nations could face 100% tariffs from the United States doesn't seem an idle threat: "if they want to play games with the dollar." "If any trading gets through, it'll be 100% tariff, at least."

Enjoying this article? Do us both a favor and subscribe!

Trump's declarations acknowledge that change is in the air for the dollar at a level that has attracted presidential attention.

It is unclear what this means in the long term for the expanding market for alternative currencies, including the RMB.

What is clear is that technological advances are giving rise to central bank digital currencies, like the digital yuan, which fundamentally change the nature of money.

Meanwhile, US sanctions and the perception that the dollar is no longer a safe haven fuel the desire for change among a group far more diverse than America's sworn enemies.

The petro-yuan is technically already here, as RMB has been used for oil purchases, but it has a long way to go.

Meanwhile, as part of the "quiet revolution," China continues increasing its exports to the Gulf, including pipelines and infrastructure to entire Lenovo computer factories.

This provides a ready answer to the age-old question, " What will they do with the RMB if they get it?"

I was delighted to contribute to the publication:

"With the digital RMB and blockchain-based trade systems, China will do for trade what Alibaba did with mobile payment and e-commerce sales in China.” from my book "Cashless: China's Digital Currency Revolution

Three Potential Scenarios in 5 years:

1️⃣ Managed Evolution (Most Likely): Gradual expansion of yuan settlement and investment while maintaining core Petrodollar architecture.

2️⃣ External Shock (Second-Most Likely): Sudden changes forced by geopolitical conflict, major political upheaval in key countries, technological breakthroughs, or market disruption. Depending on the nature of the shock, this scenario could lead to either a dramatic decline of the Petrodollar system or its reinforcement as nations seek the safety of established dollar markets and the U.S. security umbrella.

3️⃣ Rapid Shift East (Least Likely): A decisive strategic pivot by Saudi Arabia and other Gulf states toward deeper integration with Chinese systems.