The Retail Revolution Won't Happen WithoutFast and Free Instant Payments not Cards with High Fees

We are just scratching the surface of what's possible in retail with better payments

“Payments are delivering the shopping experiences of the future” is undoubtedly true, but what JP Morgan doesn’t dare say is that credit cards with high merchant fees are ill-suited to this purpose.

Look at China for an example. China’s retail revolution was spurred by the explosion of instant payments that has still not hit the West in full.

Embedded finance, social media sales, and small businesses all depend on a payment system that is fit for purpose, without card’s high merchant fees

👉TAKEAWAYS

JPM sees payments inextricably linked to retail but doesn’t dare attack cards and card fees as I do.

Making the purchase experience easy and seamless

Sure, but how can payments be seamless for merchants and consumers without instant settlement? This is requisite not just for convenience but for real-time reconciliation for merchants.

Payments are interconnected to brands, powering every purchase

I respectfully disagree. Payments should be brand agnostic, meaning that any payment should work on any platform. This is where customer choice is key. Even in China users can now pay with either WeChat or Alipay on most platforms after gov’t intervention.

Enhancing loyalty programs with data and open-loop networks

Yes but the data sharing must be consensual with data limits provided by the consumer. Cards still do not offer consumers any control over their data and data brokers regularly abuse card swipe data.

Increasing operational efficiency, decreasing costs and providing data insights

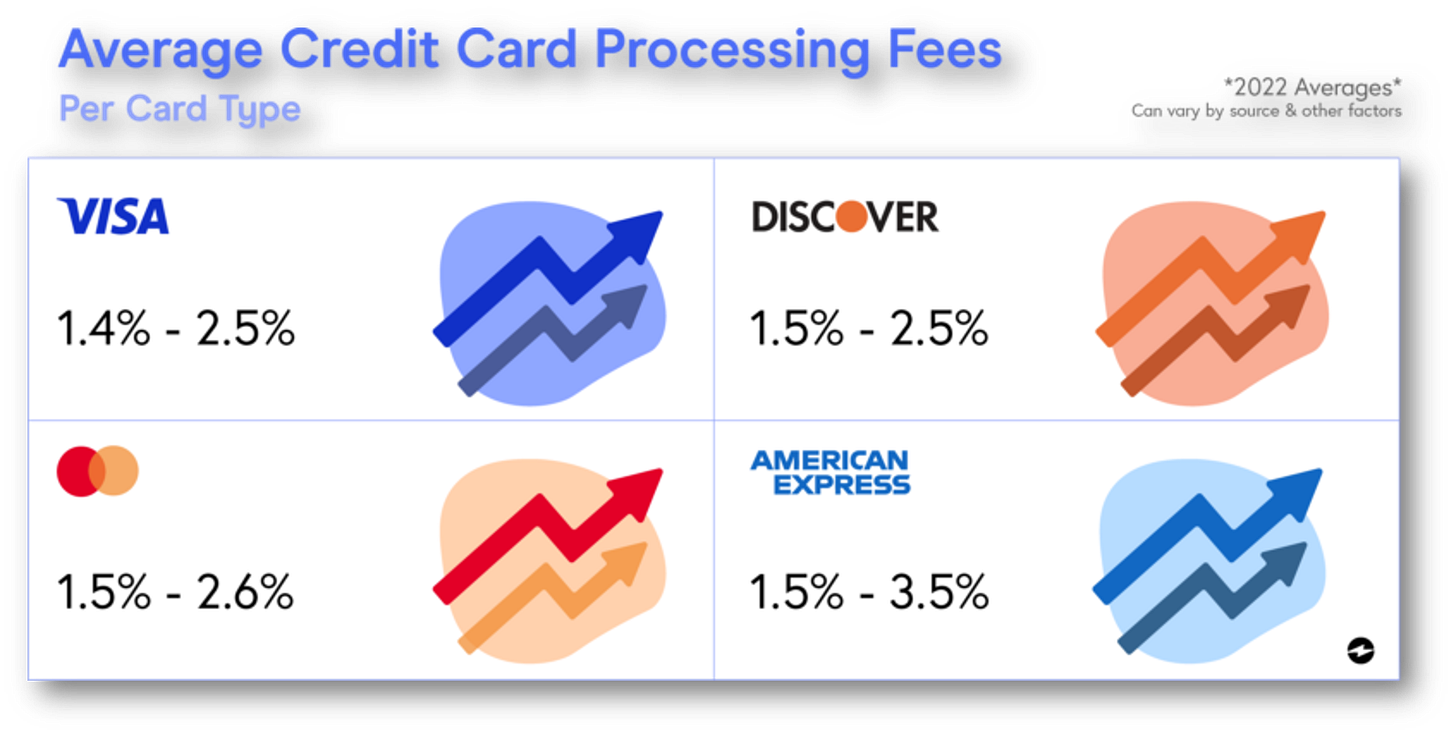

Yes but all of this isn’t going to happen as long as merchants are paying high fees. See the chart below. You can’t have this increase in efficiency if retailers are paying JPM a slice of their revenue.

Helping businesses establish presences in virtual reality

Yes but it is unclear exactly how payment providers can assist with this transition. The best solution is brand agnostic payments that allow the use of any payment.

Supporting emerging ESG opportunities in supply chain

Agree but ESG opportunities are reduced the more money goes to JPM and fees.

2022 average for the US, EU fees are lower but still problematic.

Source: here

👊STRAIGHT TALK👊

The retail revolution requires instant and free or near-free payments, and JP Morgan politely doesn’t discuss this out of fear of disturbing its revenue model.

The irony is that none of the retail “reimagining” that JPM envisions can occur when their clients are paying JPM card services usurious merchant fees. This is where fast and free payments will be required.

The best example of the power of payments is China, where free and immediate payments have been a reality for almost a decade and spurred a revolution that includes everything from social media sales to a robust gig worker economy.

How this revolution can take place with JPM taking a cut of every merchant’s revenue is beyond me.

Subscribing is free!

The button says pledge, but Substack adds that, not me.

Subscribe, you’ll be glad you did!