THE TOP 20 BANKS LEADING IN AI AND WHY IT MATTERS LESS THAN YOU THINK

AI is the future and mastery is no joke.

The AI race is so young that, for now, I don’t believe it really matters much who is leading. This is a 500-lap race, and we’re on lap 2!

Still, in a few years, it will be obvious that bank leadership in AI is more than a beauty contest. It directly indicates how future-proof the bank will be and sets winners apart from losers.

The “Evident AI Index” benchmarks banks and shows who the leaders are:

The Top 20 Banks

The full list from Evident Insights, Evident AI Index can be found: here

The “leadership report” used in my Takeaway section: here

👉TAKEAWAYS:

In the “Leadership Report” Evident Insights summarizes its findings.

My comments, often sarcastic, follow each of the nine boxes:

Banks are future-proofing themselves with AI and its clear that banks that are advanced in AI are also leading in stock performance. While it is also true that the leaders are also large banks, that alone isn’t enough. Massive institutions like Deutsche Bank (#29) and NAB (#35) are big but are nearer the bottom of the 50 institutions examined.

AI is too new to proclaim a winner in the AI race. While it’s fair to say that larger banks with deeper pockets will likely win the race, there is no guarantee.

We’re likely to see smaller, more aggressive banks working with upstart AI companies, launching some of the AI services that will be the big award winners.

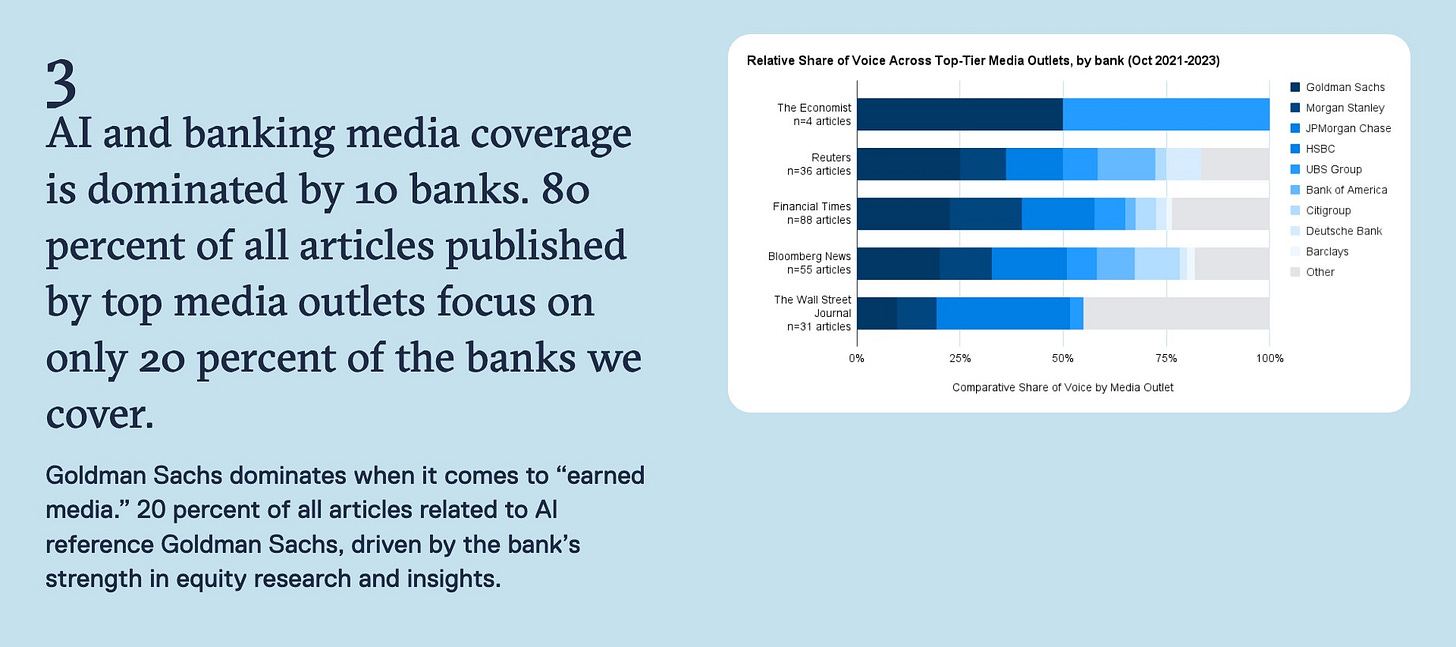

The reality of media coverage is that smaller banks simply don’t get in the media. This strengthens the case I made above! Even if a mid-tier bank does great work in AI, you won’t hear about it. Case in point: my former employer, Intesa-Sanpaolo, in Italy. They don’t make the press but are working hard on AI with good success.

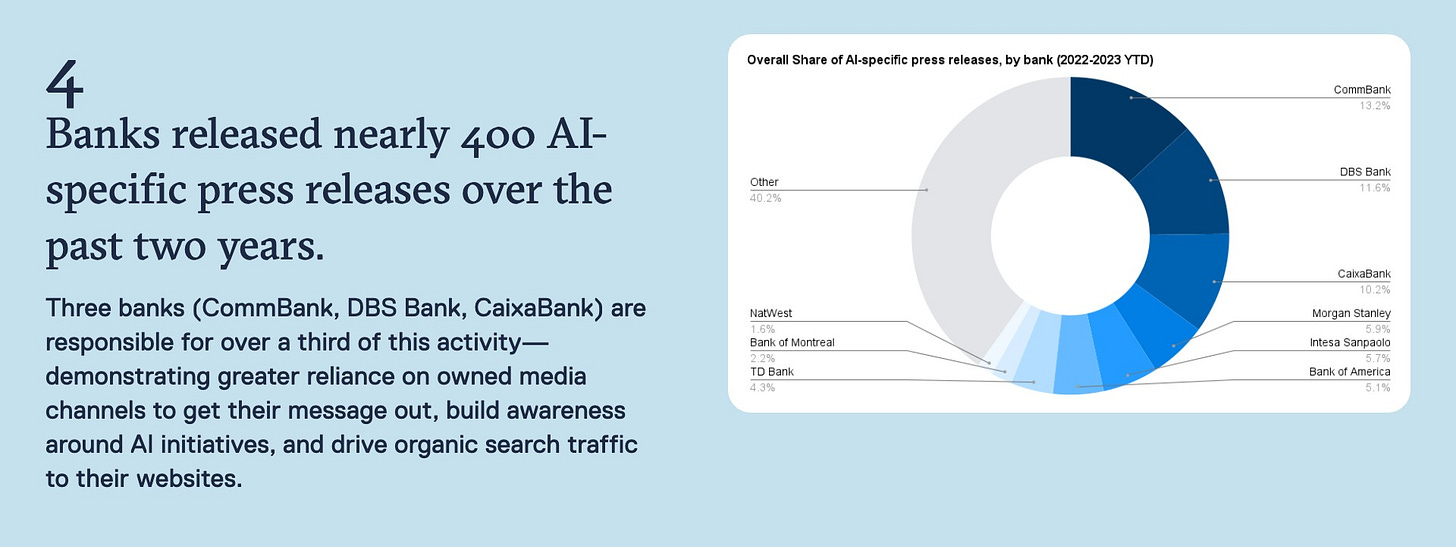

Bank press releases on AI are the equivalent of showing off. None of these banks have enough real success with AI to make a big deal of it. That said, they do understand “innovation theater.” They signal to the world through press releases that they are being innovative and hope this somehow lifts their stock price or, at a minimum, the perception that they are innovative!

Well, isn’t that amusing! Glad to see LinkedIn included in the research! That the percentage of AI posts increased isn’t a surprise. The entire world has gone AI mad, and I think if you were to survey AI in media, you’d see a similar doubling of the amount of AI content. My own writing about AI on Linkedin has easily doubled. I would call this a societal macro trend more than banks’ love of AI.

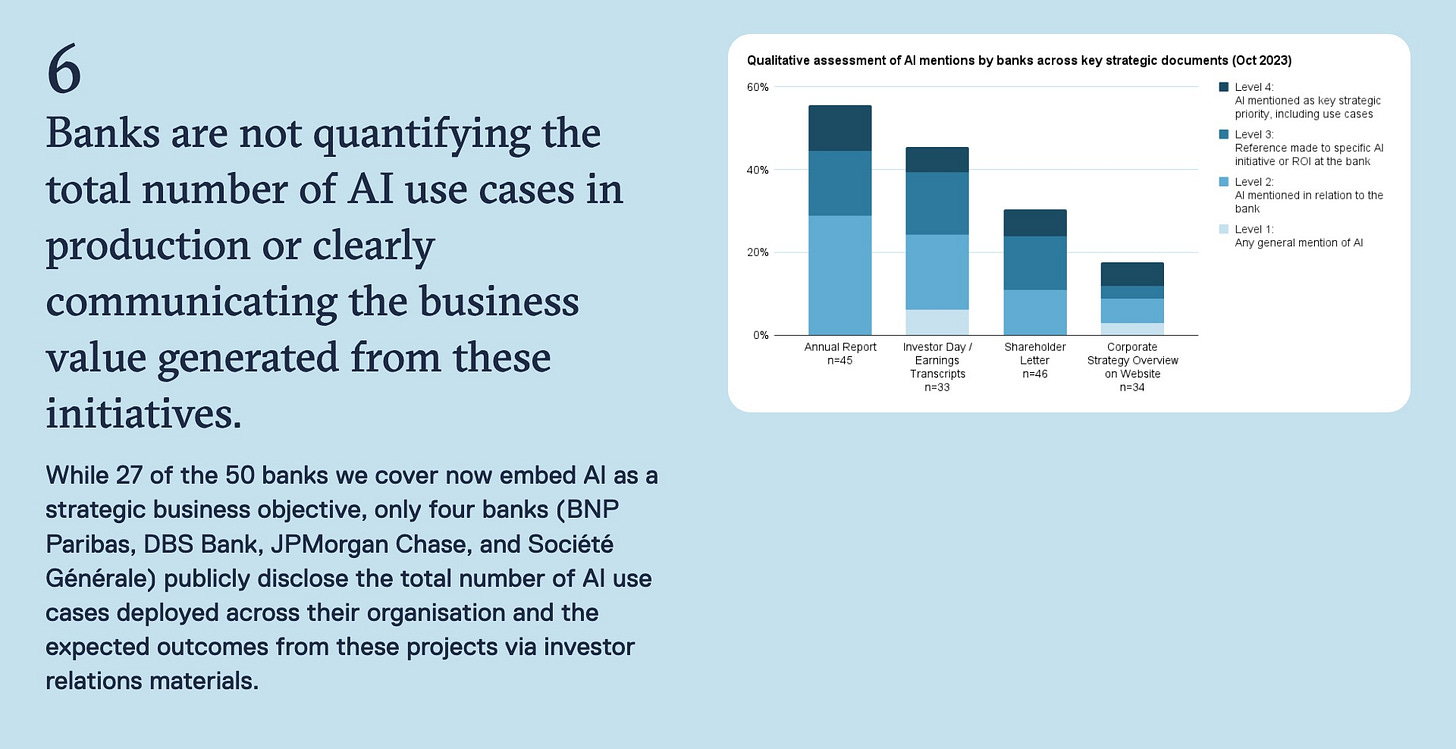

Banks aren’t quantifying anything because their efforts with AI are so new that there is literally nothing to show! Kudos to the four banks, DBS, JPM, Paribas, and SocGen that do list their user cases, but for everyone else, there likely isn’t that much to list. Even worse, listing use cases is potentially dangerous. Remember, innovation requires failure, and investors won’t like reading that half of the AI use cases failed!

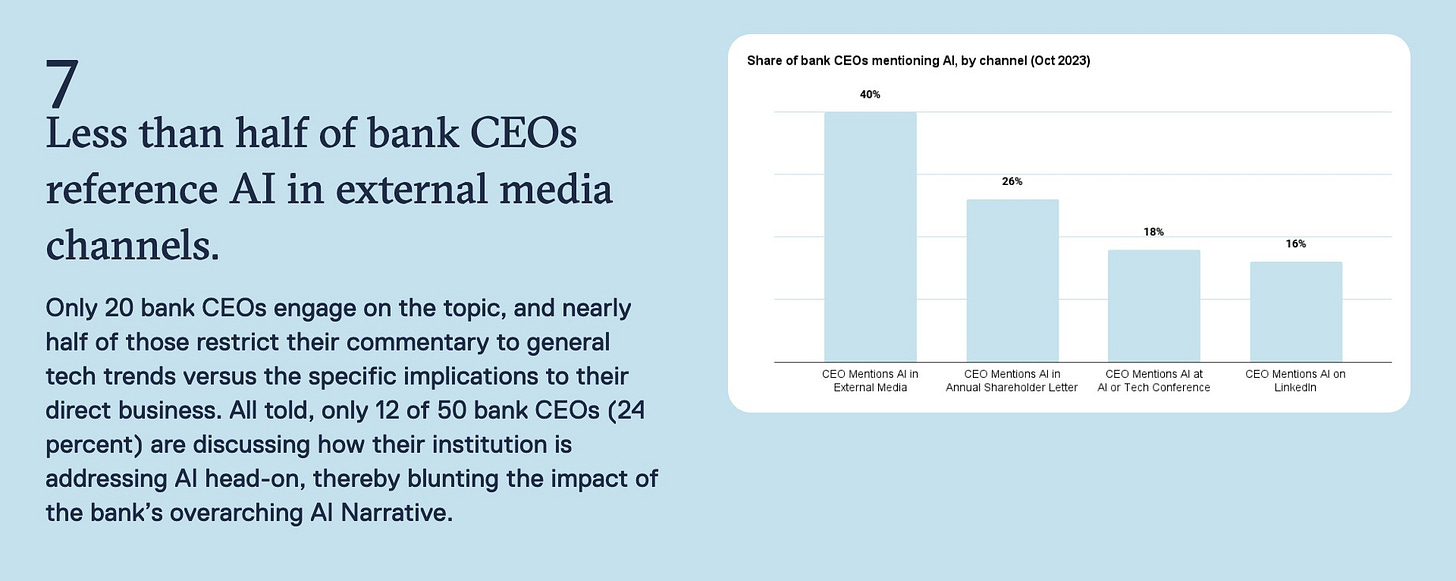

So, 15 of 50 bank CEOs discuss how their institutions deal with AI. This makes perfect sense since, in my view, 35 of the 50 barely know what AI is! While at IBM, I had the pleasure of meeting regularly with bank C-suite members, and I learned one thing. Keep it simple when discussing tech. Aside from the CTO or CIO, most in the C-suite are Luddites. So it shouldn’t surprise that CEOs don’t talk about AI!

What is amazing to me is that CEOs are now recommended to take to LinkedIn to get their message out. A few brief years ago, they all would have laughed at writing a post (we all know that they are written for them) on LinkedIn, but now it is recommended practice! Can you see the CEO’s face when his media department comes in with a schedule of LinkedIn posts? Oh, how the times have changed!

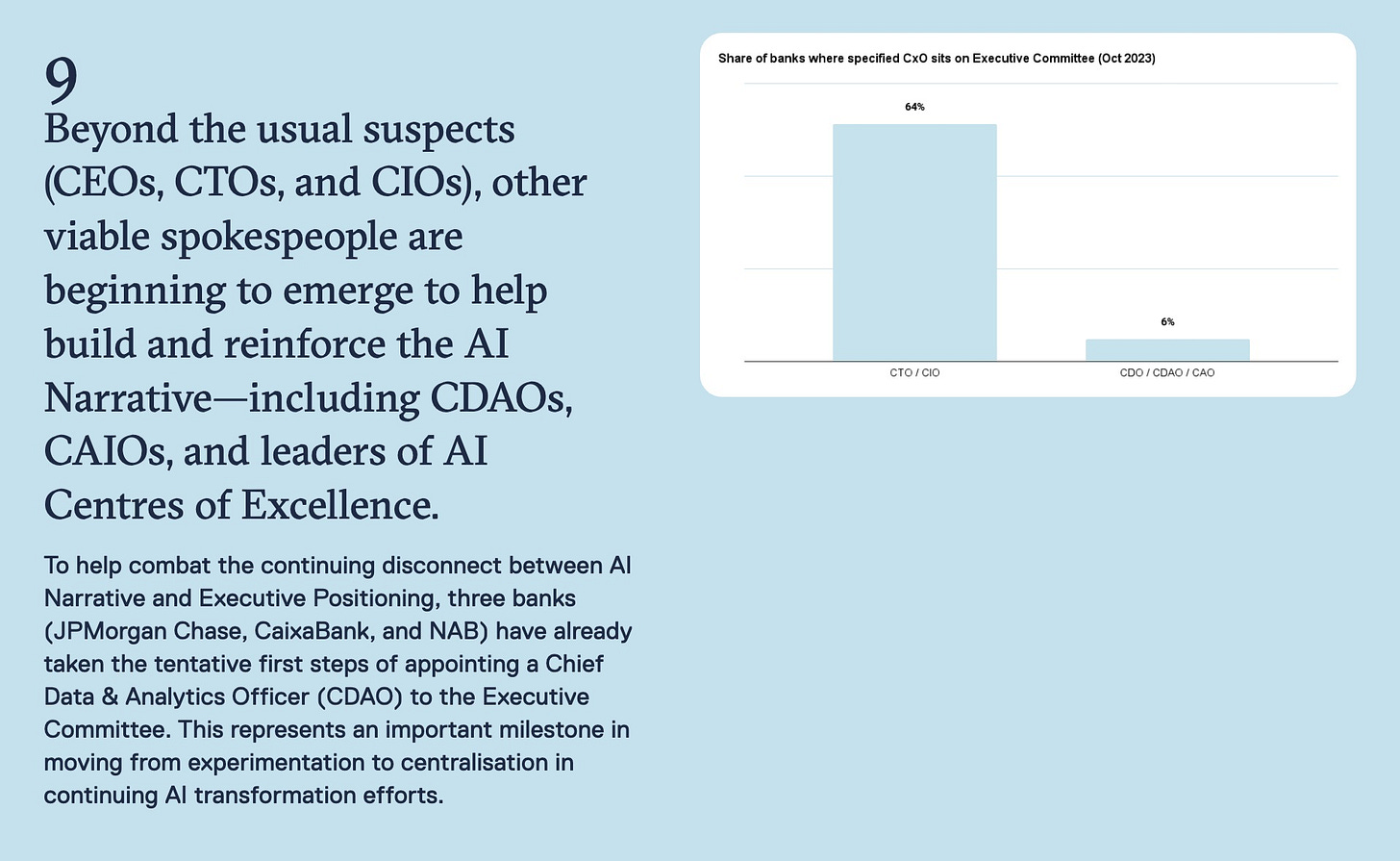

Love the concept of a CAIO or CDAO. These are disciplines worthy of C-level promotions. At the very least CEOs should want these positions filled as any failure of an AI, and you know there will be spectacular failures can be blamed on another C-suite member! I know that is harsh, but some of the AI failures we will witness in coming years will be epic!

👊STRAIGHT TALK👊

Tonight, a very brief straight talk. No bank has yet cracked AI use, and the expectation that they will in the near future is frankly absurd.

We are way too early in the “AI race” to predict or show the exact impact of AI on banks or their balance sheets. The race is long, and it is unfair to rule banks in or out of contention. All may be winners, and I would watch smaller banks very carefully!

Our latest AI tech will take YEARS to make it into production on a scale that would impact a bank. In fact, the best analysis of this was from S&P Global, who claimed that AI will be an “incremental game changer.” My article on this is in my special edition newsletter on banking AI. (below)

In closing, here’s what S&P said in its analysis, which I believe to be true and does a lot to cool the AI hype:

🔷 “It remains to be seen to what extent banks that successfully deploy AI strategies materially outperform those that are AI laggards.”

🔷 “It remains to be seen at what speed and to what extent, it makes business sense for banks to invest in transformational AI strategies.”

🔷 “Notable changes due to the application of generative AI in banking are unlikely to be immediate.”

🔷 "The bulk of banks' near-term use cases will likely focus on offering incremental innovation (i.e., small efficiency gains and other improvements across business units)."