The Year of the Dragon: tough on CBDC and embedded finance, but a golden age for fintech with Asia in the lead!

ARK's "Big Ideas 2024" a great read that sells tech like a used car salesperson!

Artwork of the day: Chinese Dragon, 2002, Ren Yude (detail)

Commonly known as “Wei County Window Flowers,” Wei County Paper-cuts is an art form of colored carved paper formed and mainly popularized in this county in Hebei province adjacent to Beijing.

The main material is white raw rice paper and the techniques of “yin-cutting”, namely, outline-cutting featuring thin, flowing and connecting lines, and the “yang-cutting”, openwork-cutting known for no connections between lines and round cut corners.

Legends suggest paper-cuts might date back to as early as the Ming dynasty (1368-1644 AD).

Happy Year of the Dragon to you all! The dragon represents vigor, strength, and good fortune, among other powerful attributes we hope fintech possesses in this critical new year!

While I’m cautiously optimistic that 2024 (4722 in the ancient Chinese lunar calendar) will be a good year for fintech, it will undoubtedly have to put its dragon game face this year to stave off last year’s funk.

CBDC will have to breathe fire to cut through all the bad press it’s getting from bank lobbying groups who loathe anything that cuts into their payment revenue. Banks will do almost anything, including fudge their research to show that CBDCs will cause catastrophe.

Embedded Finance will need a dragon's “vigor and strength” because while it may be considered the future of finance, Western banks are taking an absurd amount of time to put it to work. It turns out that sclerotic bank culture can slow any great innovative idea!

Will this be fintech’s “golden age?” The jury is out, but one part of the world is on fire! Asia’s fintech will ride this dragon year to even higher heights!

Finally, if you want to read about the future, look at ARK’s Big Idea report. But don’t say you haven’t been warned, as you’ll get burned by ARK’s advice as easily as if you pulled on a dragon’s tail! 🐉

Thanks to all my subscribers for your kind words and encouragement!

Your notes and messages are appreciated more than you know!

If you’re enjoying this newsletter, do me a favor and share it with someone you think will enjoy it!

MYTH BUSTING: No the Digital Euro Won't Reduce The EU's GDP

A Copenhagen Foundation report commissioned by the European Banking Federation makes the false claim that the digital euro will “permanently” reduce the EU’s GDP by anywhere between 0.12 to 0.34%. What is sad is that this bank-sponsored paper joins last year’s paper by the American Bankers Association in attempting to use unrealistic worst case scenari…

Why not share this great article on CBDC with someone!

Click HERE to share!

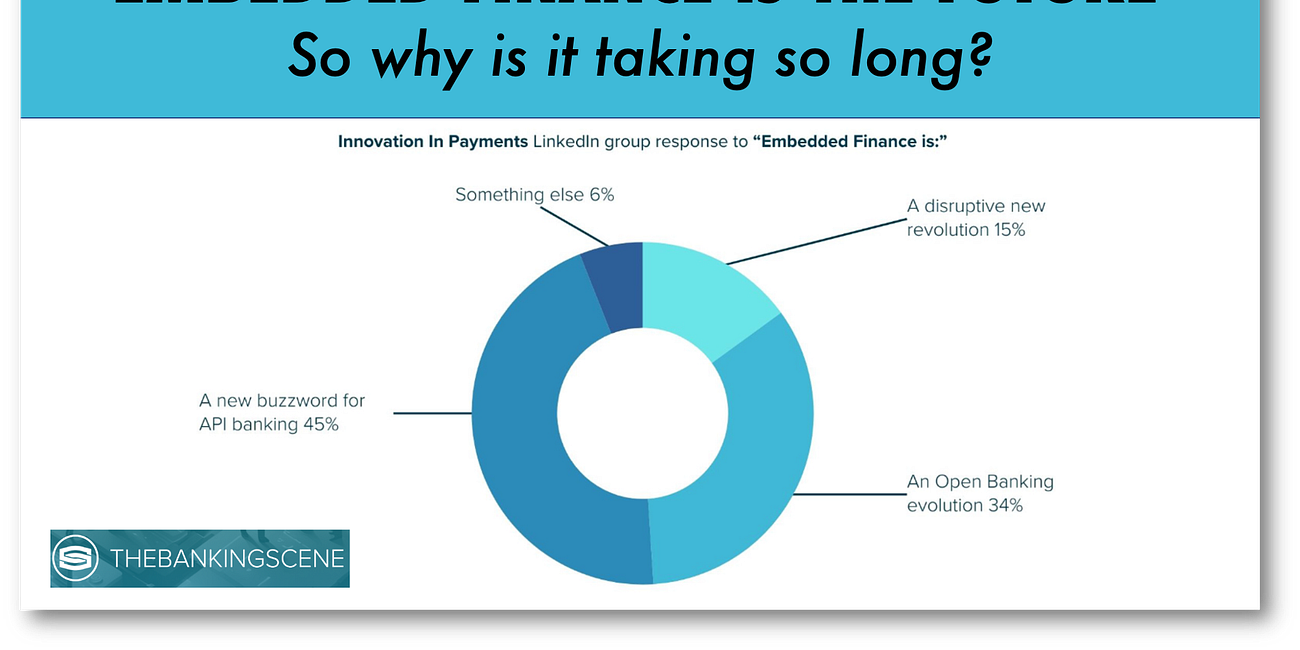

Embedded finance may be the future, but it is a long time coming.

The Banking Scene just ran a great survey and found that the biggest pitfall in the offering of embedded finance wasn’t technology-based but rested squarely on the hesitancy of compliance departments! The survey of Banking Scene members and interviews with industry leaders from OpenPayd, ABN AMRO Bank, Rabobank, and KBC Bank provide a great take on embed…

Want to do us both a favor? Share this with someone you think might like it!

"A golden age of fintech with Asia expected to lead by revenues in 2030."

Great read from Paypers on the Future of Payments. What I like about this report is that the sections are all written by industry professionals who are at the top of their game. Thanks for reading Cashless: Central Bank Digital Currency and China in Perspective! Subscribe for free to receive new posts and support my work.

Hey, you, yeah you!

If you enjoy this newsletter try subscribing!

Your Weekend Fun Read!

ARK Invest’s 12 BIG IDEAS for 2024 is FANTASTIC, but BUYER BEWARE!

ARK’s report is once again a FABULOUS read! It is still visionary in showing how the 12 big ideas are interconnected!

Instead of looking at tech like digital wallets in isolation, ARK distinguishes itself by showing how things like AI, banks and wallets interconnect!

ARK Invest needs little introduction as founder Cathie Wood became the “high priestess” for the high-tech boom. Still, ARK's AUM falling from $30 bn to $9bn speaks volumes about how far it has fallen!

💥WARNING💥

ARK is selling itself and its funds, so this is a sales document! Enjoy their vision of the future, but beware that some of the numbers are as exaggerated as a used car salesperson's.

👉TAKEAWAYS:

A few areas of the report covering fintech that struck me as good, bad, and ugly!

🟢 The Good:

🔹 Digital Wallets: I LOVE ARK’s coverage! They absolutely get the disruptive power of digital wallets and do a fabulous job of showing their importance in our future.

Their take on wallets disrupting banks, disintermediation C2B payments, and closing the financial gap between consumers and merchants are spot on.

🔹 AI: No report like this would be complete without claims that AI will conquer the universe. I liked ARK's coverage but please take the slide headlines with a grain of salt. Claiming that "AI Already Has Boosted Productivity Significantly" based on a few limited cases is absurd.

🟡 The Bad:

🔹 Smart Contracts: Here again, ARK nails it and sees the power of Smart Contracts but, unfortunately, sees smart contracts as the exclusive domain of crypto and decentralized networks.

Interestingly, despite an upsurge of interest in smart contracts run on private DLT networks by banks, ARK seems to ignore the application of smart contracts in this sector on anything but a decentralized network.

I get that ARK loves crypto, but being blind to the use of smart contracts on private networks as used now by the likes of JPM and others would seem misleading.

🔴 The Ugly:

🔹 Bitcoin: ARK’s view is that Bitcoin is going to the moon! This was true last year as it is this year.

Sorry, I don’t buy that, even if I don’t predict or wish for its demise. I congratulate BTC's new ETF and welcome BTC to play with the adults.

Still, ARK wrote one of the most absurd slides ever when it claimed: "Bitcoin Was A Safe Haven During The Regional Banking Collapse."

With crypto markets raw from FTX and other scandals, claiming that BTC was a safe haven because it rose during the limited time period of the collapse of Silicon Valley Bank and others is flat-out absurd.

Thoughts?

Subscribing is free!

The button says pledge, but Substack adds that, not me.

Subscribe! You’ll be glad you did!