Three big CBDC stories: Digital euro delivers on privacy , Hong Kong goes full speed ahead with e-HKD, and Australia's new pilot reaches out to innovators

Holiday edition

1. The ECB will keep their hands off your CBDC data

2. Hong Kong goes full speed ahead with e-HKD

3. Australia reserve bank’s new CBDC pilot

1. The ECB will keep their hands off your CBDC data

2. Hong Kong goes full speed ahead with e-HKD

Hong Kong is going full speed ahead into the future with a retail CBDC and isn’t looking back!

The BIS announced that its mCBDC pilot has successfully transfered some US$22 million in CBDC. Participants include the BIS Innovation Hub Hong Kong Centre, HKMA, Bank of Thailand, the Digital Currency Institute of the The People's Bank of China and the Central Bank of The UAE

Last week Hong Kong’s central bank the Hong Kong Monetary Authority (HKMA) announced that it was officially going to build a retail CBDC!

This is a bold move for Hong Kong who will eventually use its CBDC to help it in the fight for fintech supremacy with Singapore and for payment efficiency with the world!

Hong Kong will be the world’s leading CBDC exchange

MCBDC the world’s first CBDC exchange platform is in pilot NOW in HK! This week mCBDC announced it had transferred $22mn in cross-border value! Hong Kong wants in on this breakthrough to become the world’s leading CBDC exchange center. With the PBOC’s e-CNY as the first major CBDC in the world this scenario is almost guaranteed.

All bankers are not the same

The most remarkable part of the paper is that the HKMA called for feedback from industry and shockingly the majority of financial institutions supported the retail or rCBDC!

“In total, 75 responses were received (technical whitepaper: 36 responses; policy discussion paper: 39 responses) from stakeholders in various sectors... "

"Overall, the feedback received indicates that respondents are supportive of the e-HKD initiative and believe that rCBDC has the potential to make payments more efficient while supporting the digital economy. This positive sentiment was observed across various sectors.”

Now compare this to the Fed who received some 60+% negative comments on building a digital dollar retail CBDC when they asked for feedback. Unsurprisingly, most of the banking sector was radically opposed!

Why is Hong Kong so different?

My take is that Hong Kong’s financial services sector understands that its future depends on using the most advanced technology in the industry to remain relevant. Without it, they will become an also-ran to neighboring Singapore which just last week beat HK in the world financial center rating. Honk Kong needs an edge and CBDC will most definitely help!

Compare this attitude to the US financial services sector who is mostly concerned about CBDC's impact on domestic profitability. There is no competition and any hit to revenue by CBDC is seen as a threat to be eliminated. Banks and their lobbyists went into high gear to write the Fed and tell them that CBDCs are a bad idea.

Comparing US and Hong Kong shows how bankers in different nations can think very differently about CBDC! Hong Kong shows that all bankers aren't cut from the same cloth.

Hong Kong has a "three rail" plan for CBDC roll-out that is sensible but offers no hard dates.

My bet is they'll have it in trials in 2 years to capture e-CNY business.

Takeaways:

Hong Kong is building a retail CBDC to ensure that it becomes a center for CBDC exchange.

The e-HKD will give Hong Kong something that Singapore does not as the two Asian fintech centers fight it out for dominance.

Hong Kong’s bankers supported a CBDC which shows that not all bankers see CBDC through the same lens.

Watch as e-HKD and e-CNY make Hong Kong the world’s leading CBDC exchange!

3. Australia reserve bank’s new CBDC pilot

Thanks for reading!

If you got this far I’m sure that you want to go down the rabbit hole, so subscribe!

Hey did I mention that subscribing is a great way to say thanks? Every new subscriber helps me get my message out to more people!

More of my writing, podcasts, and media appearances here on RichTurrin.com

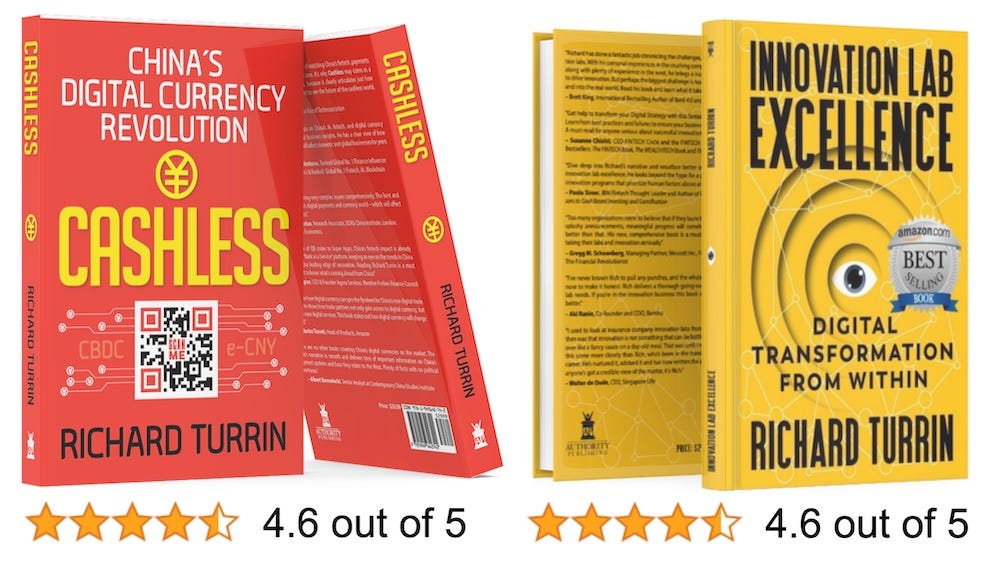

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is number 4 on Onalytica's prestigious Top 50 Fintech Influencer list and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon:

Cashless: (https://amzn.to/3RcC6PB)

Innovation Lab Excellence: (https://amzn.to/3C35Mcr)