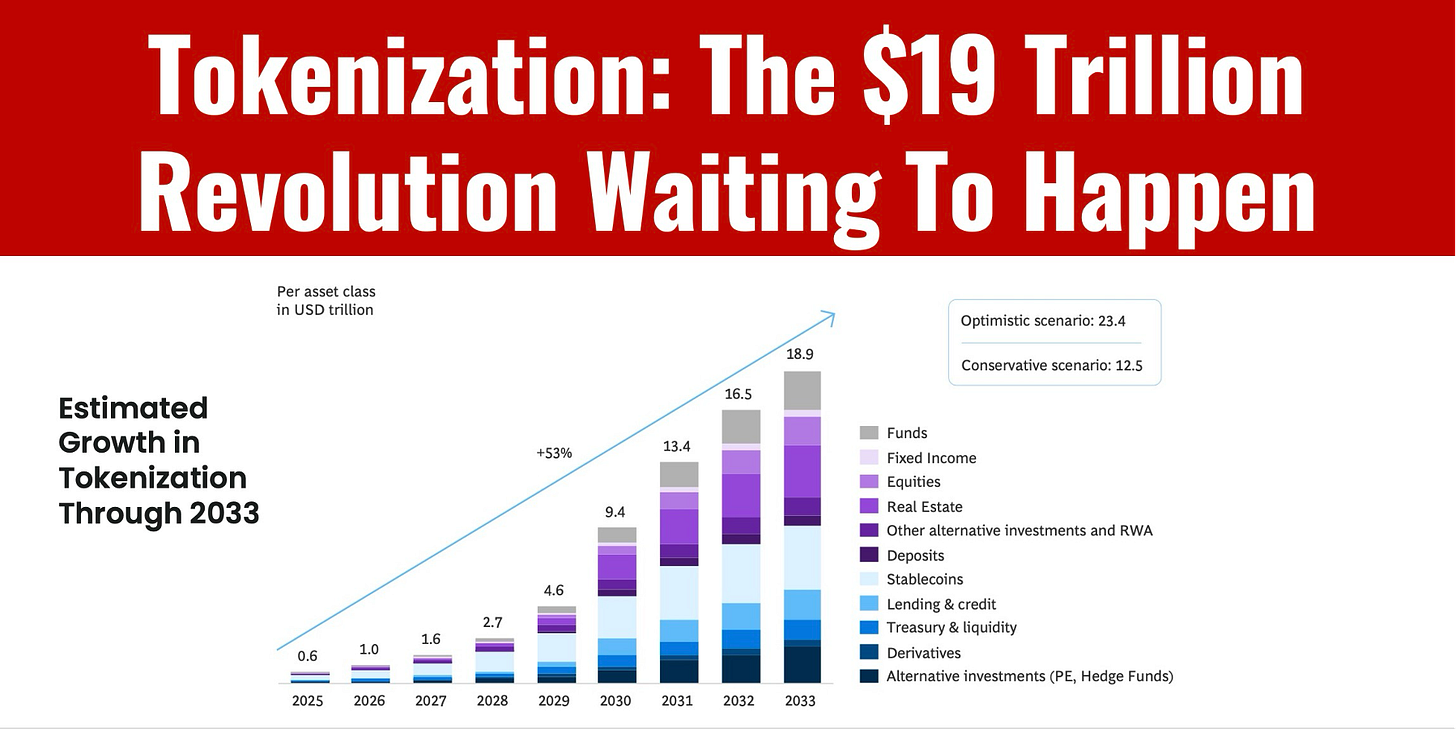

Tokenization: The $19 Trillion Revolution Waiting To Happen

TradFi will not let the tokenization market slip from their grasp.

This is my daily post. I write daily but send my newsletter to your email only on Sundays. Go HERE to see my past newsletters.

HAND CURATED FOR YOU

Boston Consulting and Ripple look at tokenization and see a potential $18.9 trn market at the tipping point.

While I agree with the author’s conclusion that tokenization is at the tipping point, I am growing increasingly frustrated with the absurd exercise of predicting the tokenization market size.

No report on tokenization is complete without taking huge markets like bonds or real estate and multiplying them by some imaginary percent that will become tokenized to yield a number in the trillions.

In reality, all of these estimates, which so far range from $5 to $40 trillion, are meaningless.

Now that I’m done with that rant, let me say that the authors make a great contribution to understanding tokenization by proposing three distinctive phases to tokenized asset adoption (page 7).

This phased approach is one of the better explanations of how tokenization can go from small to $18.9 trillion.

Now, the big question is whether the TradFi world will let this market slip from their grasp to be taken over by crypto? That is never going to happen. The TradFi world will certainly leave the crumbs to crypto, but not much else.

This read was fun but would have been better without the market estimates.

👉Five Use Cases Gaining Traction

🔹 Investment-grade Bonds

The USD 140T global bond market is burdened by high issuance costs, slow settlement, and heavy reliance on intermediaries. Tokenization addresses these frictions head-on—cutting operating costs by 40–60%, enabling near-instant settlement, and reducing systemic risk through smart contract automation.

🔹 Real Estate

With more than USD 300T in global asset value, real estate remains one of the most illiquid and opaque asset classes. Tokenization is taking off with institutional-grade assets—such as commercial real estate, infrastructure, and large-scale property funds—enabling fractional ownership and broader investor access over time.

🔹 Collateral & Liquidity Management

The USD 16T global repo and collateral markets are hindered by fragmented settlement and slow asset mobility. Tokenization enables on-chain collateral pledging, real-time transfers, and smart contract-based margin management.

🔹 Trade Finance & Working Capital

Despite exceeding USD 10T in volume, global trade finance is mired in paperwork and manual reconciliation. Tokenization enables real-time invoice settlement, programmable payments, and access to liquidity for SMEs and large corporations alike.

🔹 Treasury & Cash Management

Most corporations hold significant idle cash in low-yield accounts. Tokenization allows treasurers to deploy cash into money market funds, perform instant FX via stablecoins, and automate intraday liquidity—all while maintaining control and auditability.