Tokenized Assets: Just $2 Trillion Market Size According to McKinsey?

No one knows what the tokenized asset market will be worth so they guess.

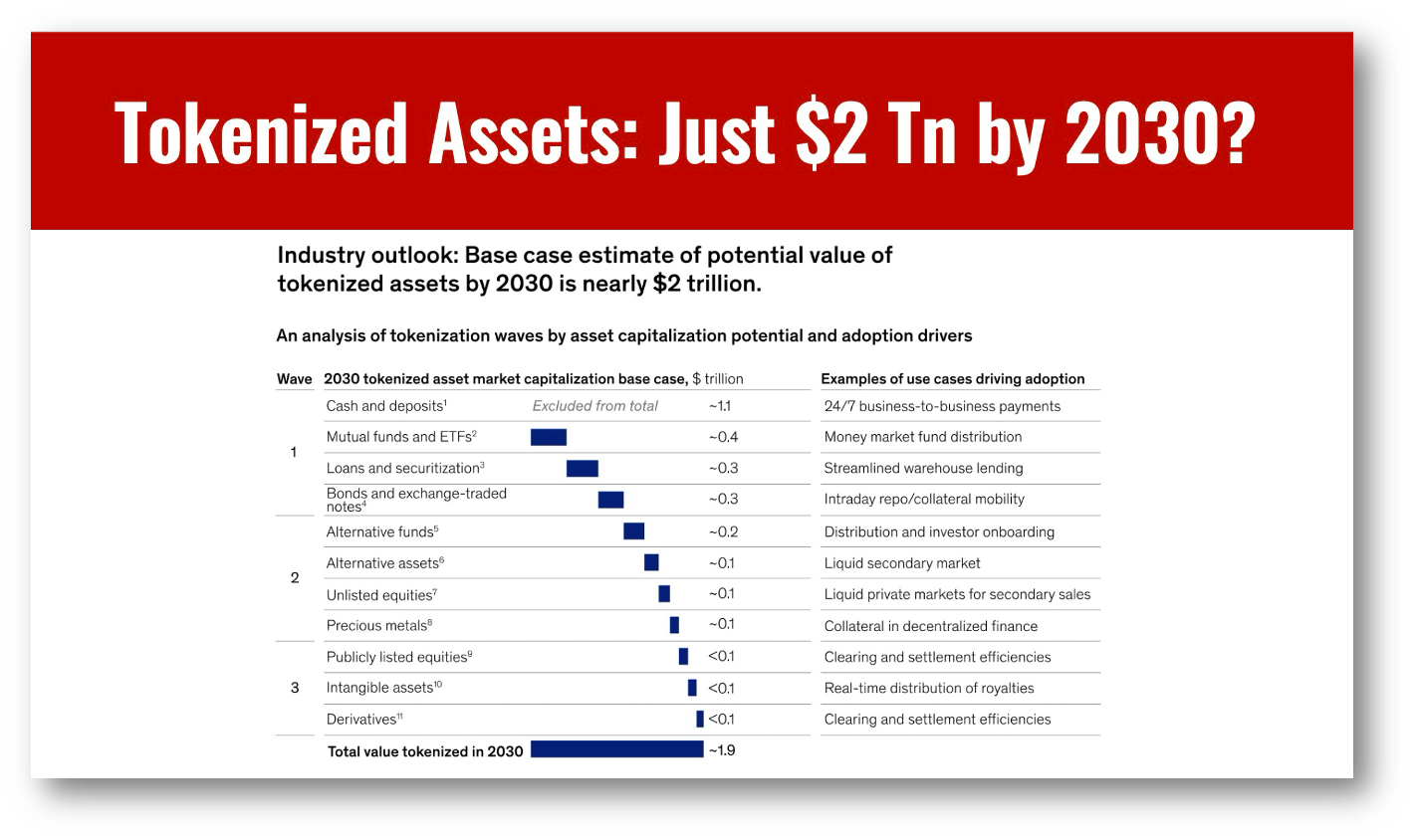

McKinsey estimates that the market cap for tokenizations will be a mere $2 trillion by 2030!

That’s “chicken feed” when you compare it to some of the more absurd market estimates we’ve seen that top $16 trillion!

The reason the numbers diverge is simple, everyone is guessing!

Most estimates of tokenization market size are found by multiplying the very large amount of global assets by some optimistic percentage that will be tokenized.

McKinsey tries to bring some rigor to its estimates by comparison with other disruptive technologies but doesn’t fair much better!

👉TAKEAWAYS

🔹 Tokenization is proceeding slowly and will continue at a slow rate.

🔹 The top opportunities are: cash, bonds, mutual funds, ETFs, loans and securitizations.

🔹 Mckinsey estimates a market size of $2trillion by 2030 with an optimistic and pessimistic scenario of $1 tn and $4tn

🔹 Assets that will likely adopt tokenization more slowly due to compliance issues include: equities, real estate and precious metals.

🔹 Tokenization has a “cold start problem” in that it has to achieve network effects in order to scale.

🔹 Scale will only be achieved when investors capture cost savings, higher liquidity or enhanced compliance.

🔹 Tokenizations exist today, and the tokenized bond market is large but offers little benefit over traditional issuance, and secondary trading remains low.

👊STRAIGHT TALK👊

Mckinsey claims that there will be a “wait and see” until breakthroughs are made in the following areas:

infrastructure: blockchain technology able to support trillions of dollars of transaction volume

integration: blockchains for different applications demonstrating seamless interconnectivity

enablers: widespread availability of tokenized cash (for example, CBDCs, stablecoins, tokenized deposits) for instant settlement of transactions

demand: appetite from buy-side participants to invest at scale in on-chain capital products

regulation: actions that provide certainty and support a fairer, more transparent, and more efficient financial system across jurisdictions, with clarity on data access and security

I think Mckinsey gets it mostly right but is downplaying the savings in settlement and back-office processing that tokenization will bring.

My bet is that a reduction in back-office processing will be a driver for the securities industry to push for tokenization.

No one knows what the tokenization market size will be, but I think that the tech is so good that it will happen faster than McKinsey thinks.

What’s your gut feeling?

Joining our community by subscribing. It will be an exciting journey down the rabbit hole to our future, and you’ll be glad you did!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!